All You Need To Know About the Walden University Financial Aid Program

Despite its 100% acceptance rate and more than 50,000 enrolled students, Walden University doesn’t have the best reputation, and one of the reasons is its financial aid program. Are you applying to Walden University, but you’re unsure if the tuition costs, which can reach $25,000, are worth it?

Learn how the Walden University financial aid program works, how to apply for it, and how to if the school offers little or no relief!

The Basics of the Walden University Financial Aid Program

38% of all Walden University students received financial aid in the academic year 2020/2021, averaging $3,900 per person. The University disburses the following types of aid:

- Federal grants

- Loans

- Limited-time savings

- Tuition discounts

Walden University Financial Aid—Federal Grants

Check out which federal grants you can qualify for at Walden University, including their amounts and duration:

| Student Category | Grant | Amount and Duration |

| Undergraduate | Federal Pell Grants | Up to $6,495 for a maximum of 12 semesters |

| Federal Supplemental Educational Opportunity Grants (FSEOG) | Up to $4,000 for a maximum of 12 semesters | |

| Iraq and Afghanistan Service Grants | Up to $5,983 for a maximum of 12 semesters | |

| Graduate | Teacher Education Assistance for College and Higher Education (TEACH) Grants (MAT program only) | Up to $4,000 per year for a maximum of two years |

Loans at Walden University

If you still have substantial student contributions left even after receiving grants, you can opt for the following loans at Walden University:

| Student Category | Loan | Does the Loan Require a Credit Check? | Does the Loan Require a Co-Signer? |

| Undergraduate | Federal Direct Subsidized Loan | No | No |

| Federal Direct Unsubsidized Loan | No | No | |

| Federal Direct Parent PLUS Loan | Yes | Depends on the credit check result | |

| Graduate | Federal Graduate Direct Unsubsidized Loan | No | No |

| Federal Direct Graduate PLUS Loan | Yes | Depends on the credit check result |

If you opt for a private loan, the University requires you to submit a Private Education Loan

Applicant Self-Certification form to your lender.

Walden University Financial Aid—Limited-Time Savings

Walden University offers grants to students who apply for select study programs by a specified deadline. The grants can go up to $4,000, depending on the program you choose. You can check out available offers on the school’s Limited-Time Savings page.

Tuition Discounts at Walden University

Check out all tuition discounts you can qualify for at Walden University:

| Tuition Discount | Who Is Eligible? |

| 15% |

|

| 20% |

|

| 25% |

|

| 50% |

|

How To Apply for Walden University Financial Aid

To apply for Walden University financial aid, complete your FAFSA and include the school code, which is 025042.

The University has no application deadlines but requires that continuing students submit their FAFSA a minimum of 30 days before the end of the ongoing academic year to secure aid for the following one.

If you’re having trouble with the application process, contact the Walden University Financial Aid Office by:

- Calling 800-925-3368 and following further prompts to reach the Financial Aid Office

- Sending an email with all of your questions to finaid@mail.waldenu.edu

What Can I Do if Walden University Rejects My Financial Aid Application?

If Walden University rejects your financial aid application, the following course of action depends on your student status:

- Continuing students should file a Satisfactory Academic Progress (SAP) Appeal through myWalden portal

- Prospective students can write a financial aid appeal letter and explain why they need more aid

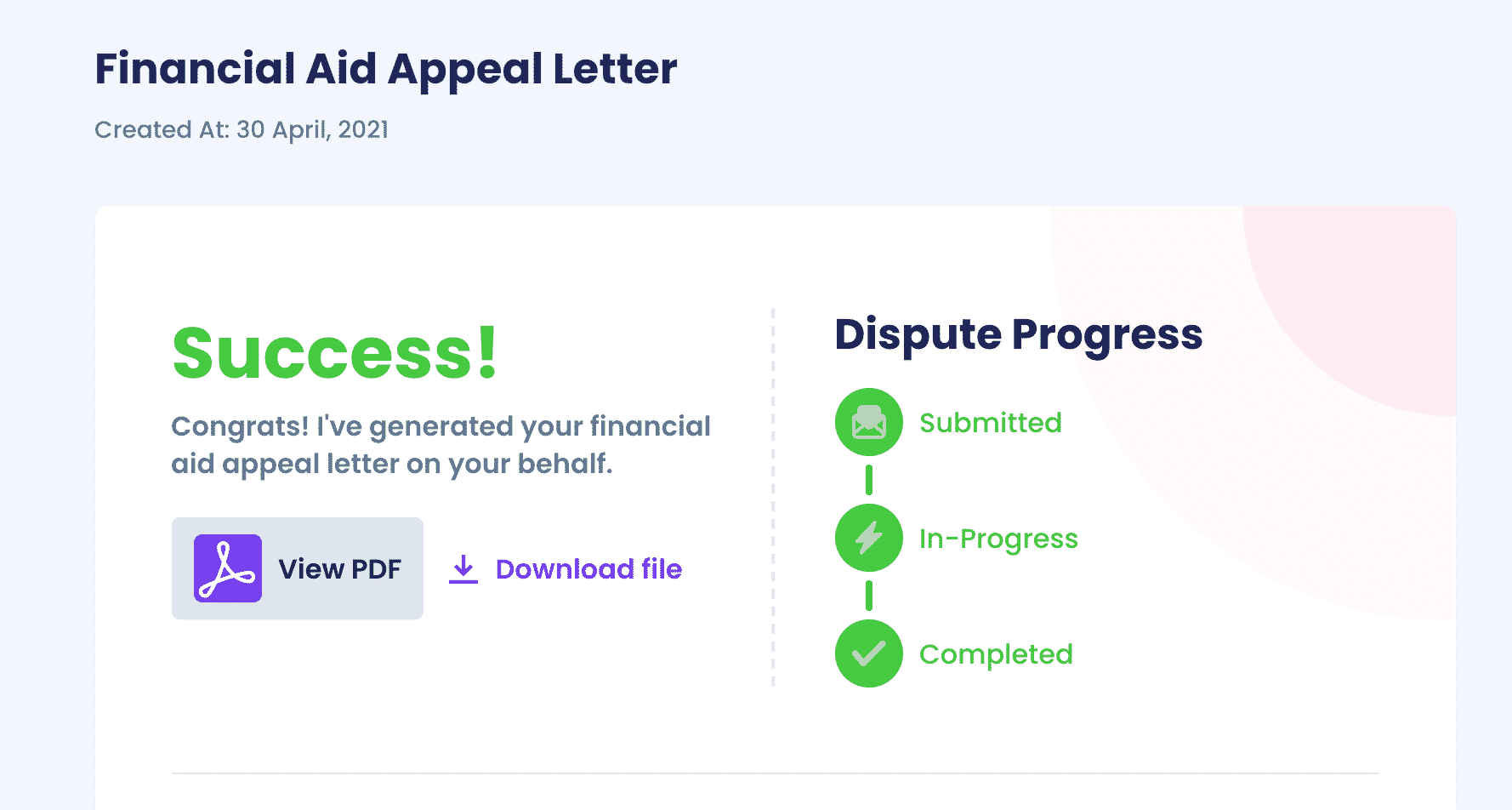

The goal of the appeal letter is to convince the financial advisors at Walden University to reconsider your application. Filing an appeal can be an aggravating and time-consuming process, and that’s why DoNotPay developed a product that can help you get a persuasive letter in a matter of moments!

DoNotPay Can Write and Send an Appeal Letter to Walden University in a Flash!

Sending your appeal as soon as possible is crucial for reaching the best outcome. For that reason, DoNotPay created a way to speed up the process!

To get started:

- Search for Appeal for More Financial Aid

- Explain what circumstances led to an increase in your financial need

Sit back and let DoNotPay generate your letter and send it directly to Walden University or to your email so that you can print it out and submit it yourself.

Alternatives to Walden University

If Walden University didn’t meet your expectations, DoNotPay can help you explore other options, regardless of whether you’re looking for:

- Undergraduate or graduate schools

- Private or public schools

- Full-time or part-time enrollment

We wrote about plenty of schools and their financial aid programs. You can find some of them in this table and pick an option that suits your budget best:

DoNotPay Turns Your Everyday Hurdles Into a Piece of Cake

Did you receive a faulty or damaged item? Why not return it with your virtual assistant? We can also help you get a late delivery refund and jump the queue if the customer service phone keeps ringing to no avail. The list of handy DoNotPay features that make your everyday life easier goes on.

By subscribing to our platform, you won’t have to worry about your tedious neighbors or parking tickets. We can do it all!

Want To Save Money on Lawyers? Use DoNotPay

Most people spend big bucks on expensive lawyers to overcome their bureaucratic obstacles. Don’t waste your money on unnecessary fees—use DoNotPay and take care of any matter in a few easy clicks! Check out some of the issues the world’s first AI Consumer Champion can help you with:

- Suing any company or person in small claims court

- Appealing parking tickets anywhere

- File insurance claims effortlessly

- Report any stalking or sexual harassment

- Reducing property taxes

- Drawing up tailor-made documents

- Creating POA agreements fast and easy

- Generating perfect

- Sending a DMCA takedown notice in case your work was stolen

- Putting an end to text and mail spam

By

By