The Essential Steps to Getting UCLA Financial Aid

The University of California, Los Angeles (UCLA) is ranked as the best-value university in the U.S. Approximately 55% of UCLA undergraduates get financial aid in some capacity.

If you’d like to know how the UCLA financial aid works, make sure you read this comprehensive guide and find out how much financial aid you can get.

if you need our help with appealing a rejected financial aid application. We can even help you find out how long you can get support!

Types of Financial Aid Offered at UCLA

At UCLA, financial aid is available for:

- Undergraduate students

- Graduate students

Undergraduate Students

Types of financial aid for undergraduate students include:

- Grants—Gift aid from the federal government, state, or university. Students don’t have to repay them, and they are given based on the students’ financial need

- Scholarships (full or partial)—They don’t have to be repaid and are divided into three categories:

- Merit-based

- Need-based

- Non-need-based

- Federal Work-Study (FWS)—Program for students who demonstrate financial need. Work-Study funding is limited, and eligible students are selected based on financial need and timely application submission

- Loans—Financial aid that allows students and parents to borrow money from state governments, the federal government, or private lenders. There are eight loan options at UCLA:

- Federal Direct Subsidized Loans

- Federal Direct Unsubsidized Loans

- University Loans

- Federal Perkins Loans

- California DREAM ACT Loan Program

- Federal Direct Parent PLUS Loans

- Private Loans

- Corbett Disclosure Statement

You can find all available UCLA undergraduate grant programs in the table below:

| Types of Grants | Available Programs |

| Federal grants |

|

| State grants |

|

| University grants |

|

Graduate Students

Graduate students may apply for:

- Aid

- Teaching & Research Assistantships

- Fellowships & Grants

- Teach Grant

- Work-Study

- Loans

- Federal Direct Unsubsidized Loans

- Federal Direct PLUS Loans

- Private Loans

- California DREAM Act Loan Program

- Corbett Disclosure Statement

How To Apply for UCLA Financial Aid

If you are a U.S. citizen or a permanent resident, you must complete a Free Application for Federal Student Aid (FAFSA) to apply for financial aid. If you qualify for a non-resident tuition waiver under AB-540, you must fill out the Dream Act Application.

To be eligible for federal, state, or university grants, students must be U.S. citizens or permanent residents. UCLA can’t provide support to international students with these visa types:

- F-1 or F-2 Student

- G Series, H Series

- J-1 or J-2 Exchange Visitor

International students may be eligible for scholarships, fellowships, and loans. To apply for a scholarship, create a profile in UCLA’s Scholarship Portal. If you are a graduate student and want to apply for a fellowship, use UCLA’s Graduate & Postdoctoral Extramural Support (GRAPES) Database.

Students who want to enroll in summer sessions can also apply for financial aid.

What if the UCLA Financial Aid Office Rejects My Application?

UCLA’s Financial Aid Office may reject your application for numerous reasons. One of the most common ones are:

- Changed family income

- Changed cost of education

To ask for more support, you can send an appeal letter to UCLA’s Financial Aid Office. The deadline is three weeks before the end of the academic year.

The University will review your appeal in 10–15 business days. During summer, the evaluation may take longer. If it gets approved, you will get a notification on MyUCLA, and if it gets denied, you will receive an email explaining the reasons for the rejection.

You can always call the UCLA Financial Aid Office at 310-206-0400 or send a message via Message Center to inquire about your application.

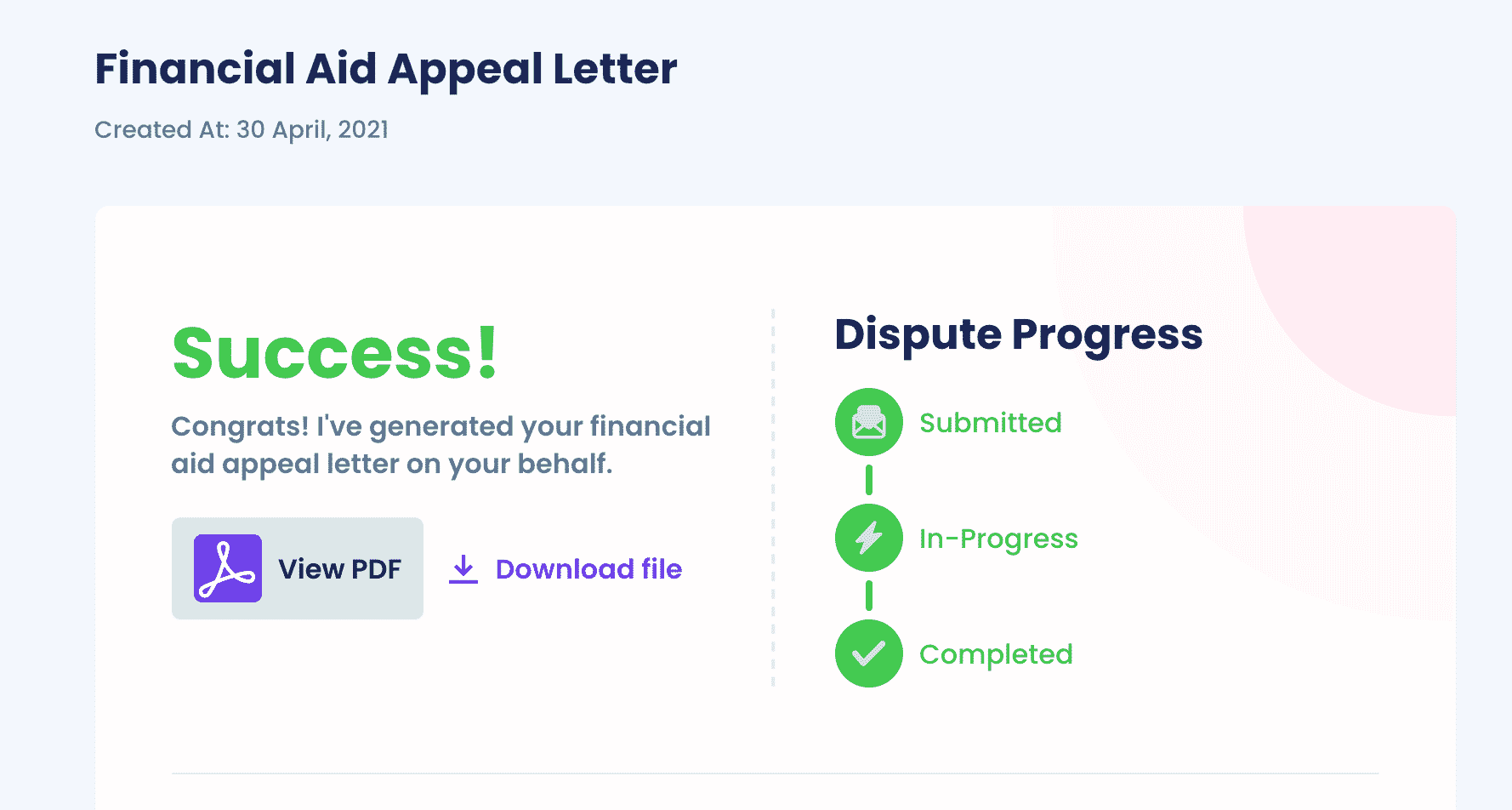

Appeal the University’s Decision With DoNotPay and Get a Better Offer!

Writing an appeal letter is a process that few people have time for. If you don’t know how to write an appeal, are too busy, or don’t have the will to do it yourself, sign up for DoNotPay! Our app will save you the hassle and help you appeal the decision of UCLA’s Financial Aid Office quickly and easily and get you more aid!

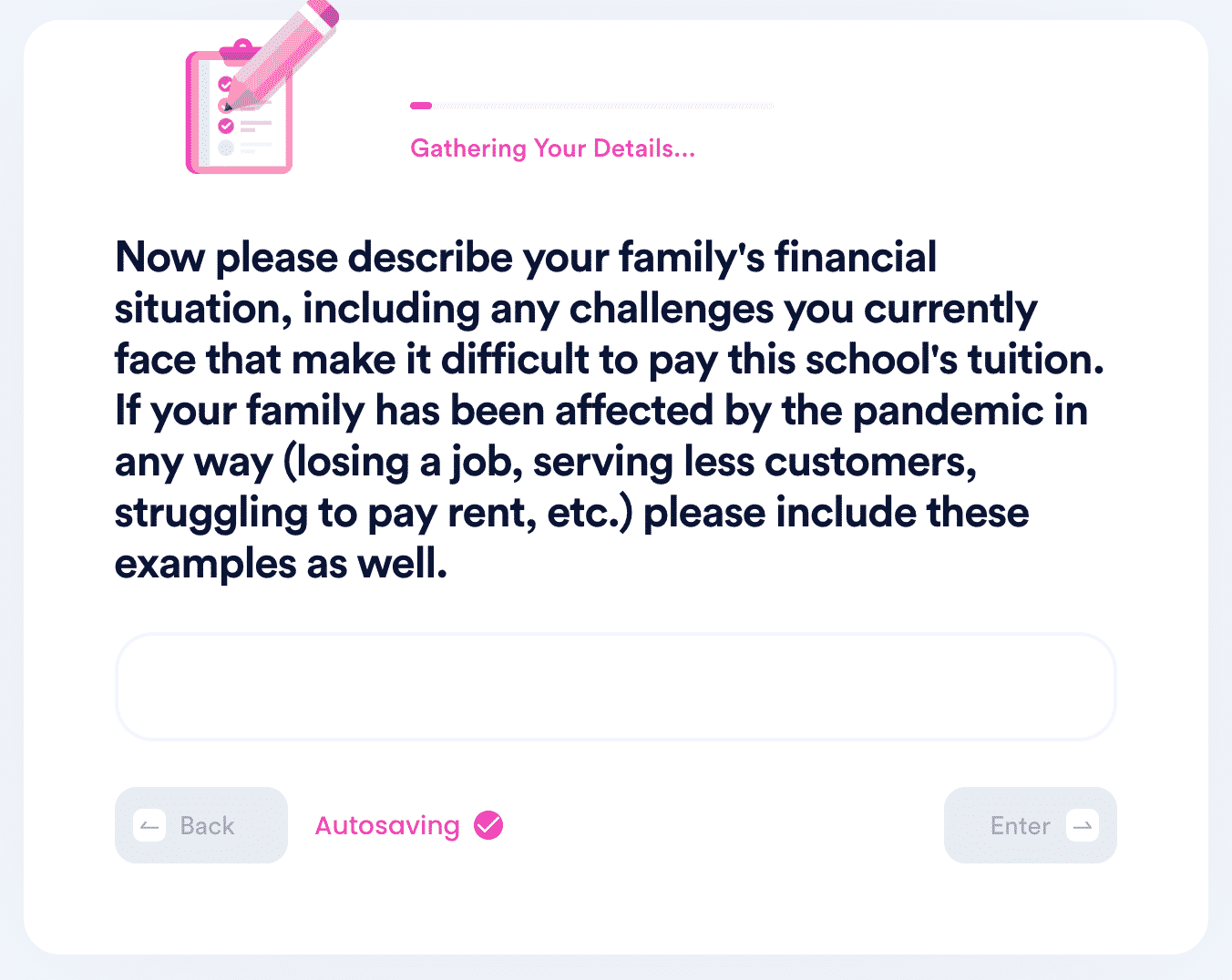

All you have to do is follow four simple steps:

- Search for the Apply for More Financial Aid feature

- Enter the name of the university

- Answer a few brief questions from our chatbot

After you complete all the steps, our app will generate a customized appeal request letter that will reach the UCLA Financial Aid Office in minutes.

Wondering if you can get financial aid as a grad school student? We can help you find out!

Examine the aid packages offered by some of the most prestigious institutions in the United States:

DoNotPay Is the AI Consumer Champion You Need!

Dealing with the law and understanding protocols is difficult if you’re not used to doing it on a daily basis. That’s why DoNotPay comes to the rescue!

Assisting you in drafting documents, creating a neighbor complaint letter, and suing companies in small claims court is what we do best.

That’s not all! With us, you can tackle any task head-on, no matter how big or small, including:

- Fighting workplace discrimination

- Filing for crime victim compensation

- Getting a document notarized online

- Reducing property taxes

- Taking the perfect passport photo

Deal With Companies Hassle-Free

If you love to shop and you want to make the experience as easy and enjoyable as possible, you’re in the right place! DoNotPay provides you with various features that allow you to accomplish just that.

You don’t have to struggle trying to reach customer support or figuring out how to claim a warranty or file an insurance claim by yourself. You can cancel any subscription, sign up for free trials, and discover how to use every last penny from your gift cards in minutes!

In case you made a purchase, but your package is missing, don’t fret! Finding your missing parcel is only a few clicks away.

By

By