Learn Everything About the UCSD Financial Aid Program and Reduce Your Tuition Costs

With its fast-paced three-semester-per-year program, the University of California, San Diego (UCSD) is a place where you learn faster than in any other school. Still, the tuition—ranging from $33,195 for California residents to $62,949 for non-residents—can be too much for students to handle.

Are you not sure about whether you want to apply for UCSD? Use this guide to find out how UCSD’s financial aid program works, how it can take some pressure off your budget, and how to if you receive a negative response!

What Types of Financial Aid Does UCSD Offer?

UCSD offers numerous types of financial aid, such as:

- Grants

- Loans

- Scholarships

- Work-study

The amount of financial aid you will get from UCSD depends on your financial needs, which is the difference between the tuition and attendance costs and your or your family’s ability to pay.

UCSD Grants

UCSD offers and distributes the following grants:

- Federal Pell Grant

- Cal Grant

- University of California Grants:

- Federal Supplemental Educational Opportunity Grant (FSEOG)

- Opportunity Grant (OG)

- Grant-in-Aid (GIA)

- Blue and Gold Opportunity Grant

- Summer Aid

UCSD offers additional benefits to veteran families, such as college fee waivers and more.

UCSD Financial Aid—Loans

Check out this table to see which loaning options are available at UCSD:

| Federal Loans | UC Loans | Private Loans |

|

| Any private loan programs you or your family opt for to fill any leftover financial gap after receiving every other type of financial aid |

Scholarships at UCSD

UCSD divides scholarships by student status:

- Entering first-year students

- Entering transfer students

- Continuing undergraduates

- Enrolled transfer students

Check out these documents listing all scholarships that are:

- Available for undocumented students and minorities

- Open for all students, regardless of immigration status

Scholarships available at but not offered by UCSD include:

- Hope Scholars Program for former foster youth (formerly Guardian Scholars)

- Middle Class Scholarship

- National Competitive Scholarships

- Outside Agency Scholarships

- Reserve Officer Training Corps (ROTC) Funds

- The San Diego Foundation

- Private and Foundation Scholarships

UCSD also offers undergraduate research scholarships during summer and additional financial aid for students applying for exchange and study-abroad programs.

UCSD’s Work-Study Program

You can participate in UCSD’s work-study program by:

- Searching for jobs using Handshake—the UCSD database of:

- Off-campus jobs

- On-campus jobs

- Internships

- Volunteering opportunities

- Visiting the UCSD Career Center page

- Asking your employer at your part-time campus job to keep the job as a work-study employee

- Consulting the Career Center about creating a new job on or off-campus

UCSD offers work-study awards valued from $600 to $2,800, depending on your job title and work hours.

When and How To Apply for UCSD’s Financial Aid Program

To apply for financial aid from UCSD:

- Complete your FAFSA and DREAM Act applications

- Submit your forms before March 2 for priority financial aid

- Complete the required tasks and submit additional documents by May 1 if you’re a continuing student or June 15 if you’re an entering student

After you complete all of the steps, it’s time to wait for UCSD’s Student Aid Report (SAR).

If you have any additional questions, you can always contact the UCSD Financial Aid Office by calling (858) 534-4480 or sending an email at finaid@ucsd.edu.

What Can I Do if UCSD Rejects My Application or Offers Little Financial Aid?

If you’re dissatisfied with UCSD’s decision regarding your application, you can appeal it by writing a financial aid appeal letter. It should explain why the University should reconsider your application and list the better offers you got from other schools to kick it up a notch and get you more financial aid.

Write Your Financial Aid Appeal Letter to UCSD the Simple Way—With DoNotPay!

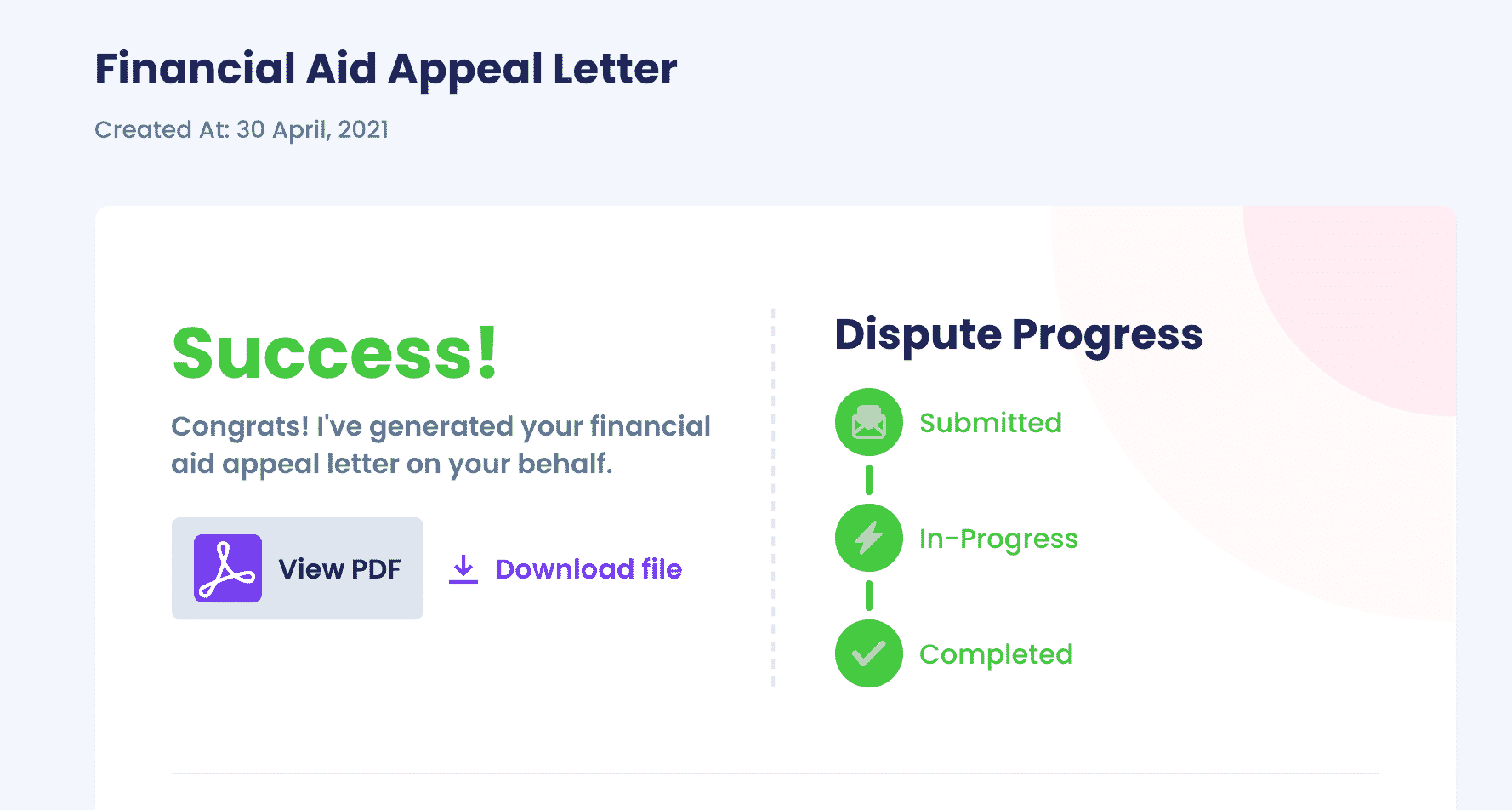

Writing and mailing a financial aid appeal letter to UCSD has never been easier with our nifty tool!

The process takes two minutes if you follow these steps:

- Search for Appeal for More Financial Aid

- Answer a few questions regarding your financial aid application and UCSD’s reply

Upon completing the final step, we will generate your custom financial aid appeal letter, and you can choose whether you want us to mail it to UCSD or send it to you via email.

We Offer More Guides on Financial Aid Programs From Other Universities for You To Check Out

You should be aware of all the options at your disposal in case you receive a negative response from UCSD. We hand-picked some of them for you:

Our Guides Can Answer All of Your Financial-Aid-Related Questions

Wondering if you can get financial aid for graduate schools? Our learning center answers specific questions like that but also helps you understand the basics of financial aid, such as:

- What is financial aid for college?

- Who qualifies for financial aid for college?

- How many years can you get financial aid?

- How much financial aid can I get?

- When should you apply for financial aid?

DoNotPay Turns Your Everyday Hurdles Into a Piece of Cake

Did you receive a faulty or damaged item? Why not return it with your virtual assistant? We can also help you get a late delivery refund and jump the queue if the customer service phone keeps ringing to no avail. The list of handy DoNotPay features that make your everyday life easier goes on.

By subscribing to our platform, you won’t have to worry about your tedious neighbors or parking tickets. We can do it all!

Want To Save Money on Lawyers? Use DoNotPay

Most people spend big bucks on expensive lawyers to overcome their bureaucratic obstacles. Don’t waste your money on unnecessary fees—use DoNotPay and take care of any matter in a few easy clicks! Check out some of the issues the world’s first AI Consumer Champion can help you with:

- Suing any company or person in small claims court

- Appealing parking tickets anywhere

- File insurance claims effortlessly

- Report any stalking or sexual harassment

- Reducing property taxes

- Drawing up tailor-made documents

- Creating POA agreements fast and easy

- Generating perfect

- Sending a DMCA takedown notice in case your work was stolen

- Putting an end to text and mail spam

Frequently Asked Questions

How Much Does UCSD Tuition Cost?

UCSD tuition varies on several different factors. Without scholarships or financial aid, the least amount of expenses a family would need adds up to $18,480 for the 2023-2024 academic year.

For out-of-state students who plan to live on campus and require all the expenses on offer, tuition adds up to $72,165 for the 2023-2024 academic year. These numbers are based on expenses required to study during three of four quarters. It’s important to consider that these fees are not fixed and are expected to increase each year.

What Does A UCSD Academic Year Consist Of?

The UCSD academic year consists of four terms known as quarters. UCSD operates in Spring, Summer, Fall, and Winter quarters. The Spring and Fall Quarters are the university’s businest quarters, whereas the quietest quarter is during the Summer.

How Do I Determine How Much UCSD Financial Aid I Can Get?

The university recommends visiting the Federal Student Aid Estimator to find out how much financial aid you might qualify for. With this site, you answer a series of questions and get results in around 10 minutes. This is considered a “quote” or “estimate” of your financial situation for upcoming quarters, and the site is free to use for students and parents.

What Are UCSD’s Financial Aid Office Hours?

UCSD’s Financial Aid and Scholarships Office is open Monday, Wednesday, and Friday from 8:00 A.M. to 4:30 P.M. local time. The office accepts both in-person and video appointments.

Contact the office by dialing (858) 534-4480 or writing an email to finaid@ucsd.edu. Airbnb publishes an annual Business Complaints Report to document what kinds of company complaints they receive and their resolutions.

Where Do I Find UCSD’s Financial Aid Office On Campus?

The financial aid office can be found on the 3rd floor of the UCSD Student Services Center, also known as the “north wing”. The office is located on the corner of Rupertus Way and Myers Drive. Additional directions and details can be found on this page.

What Is The UCSD Financial Aid Award Letter?

After you apply and qualify for financial aid, UCSD will mail a letter to your address. This is the Financial Aid Award Letter, outlining the financial support that the university is willing to give you specifically.

How Much UC San Diego Financial Aid Does The Average Student Get?

According to College Confidential, the average financial aid package for full-time undergraduate students is over $28,000 per year. Students in the class of 2023 with financial aid graduated with an average of around $19,000 in debt.

What Percent Of UCSD Students Receive Financial Aid?

According to multiple sources outside of the university, around 60% of first-year students received financial aid for the 2021-2022 academic year. This aid mostly consisted of grants and scholarships.

Where Can I See Which UCSD Loans I Have?

When you have financial aid from UCSD in the form of loans, you can check the details of your loans at www.studentaid.gov. After logging in to the website, click on your name, followed by “My Aid”, and then “Loan Breakdown”. You’ll be directed to a page that shows details of each of your active loans. You’ll also be able to see consolidated and paid-off loans on this page.

By

By