Get Acquainted With Harvard’s Financial Aid Program

Harvard is the oldest and one of the most prestigious universities in the United States. Is this Ivy League school out of your reach because of its sky-high costs, including tuition and other attendance fees, that sum up to a scary amount of $85,060?

Learn how the Harvard financial aid program works and how to if its offer doesn’t work for you!

The Basics of the Harvard Financial Aid Program

Harvard University decides about financial aid cases individually and strives to create programs that don’t require loans. The most important factors the University considers while creating your financial aid package are:

- Your family income and assets

- Outside awards

- Changes in your financial circumstances

If you have any questions regarding the application process, you can contact the Harvard Financial Aid Office by:

- Calling 617-495-1581

- Sending an email to faoinfo@fas.harvard.edu

- Visiting the office located at 86 Brattle Street, Cambridge, Massachusetts

What Are the Available Types of Harvard Financial Aid?

Harvard offers the following types of financial aid:

- Scholarships and grants

- Loans

- Work-study

Harvard Scholarships and Grants

Harvard scholarships are funded by:

- Harvard endowment funds

- Gifts from alumni

- General tuition revenues

- Federal and state grants

The University offers the following federal and state grants:

- Supplemental Educational Opportunity Grant (SEOG)

- Federal Pell Grant

- Gilbert Grant (for Massachusetts residents)

Harvard also accepts outside awards, such as:

- Secondary school awards

- Civic organization awards

- Awards from parental employers and other corporations

- National Merit Scholarship Programs

- The G.I. Bill

- Reserve Officers’ Training Corps (ROTC)

You can use the following resources to search for outside scholarships and awards:

- College Board

- Fastweb!

- Scholarships.com

- CollegeScholarships.org

- UNIGO

- GoodCall Scholarship Directory

- Scholarship Search by SallieMae

Harvard Financial Aid—Loans

You can opt for federal or private loans to cover your student or family contribution.

Harvard offers the following ones:

- Federal Direct Subsidized Stafford Loan

- Federal Direct Unsubsidized Stafford Loan

- The Harvard Loan

Keep in mind that you will have to do your own research for private student and parent loans.

The Harvard Work-Study Program

You can register for a work-study job by completing a referral card or search for jobs using the Harvard Student Employment Office (SEO) database.

You can work up to:

- 20 hours per week if you’re an undergraduate student

- 40 hours per week if you’re a graduate student

- 40 hours per week during breaks, such as spring break, reading period, etc.

Harvard students can work both on- and off-campus.

How To Apply for Harvard Financial Aid

Your financial aid application process depends on your student status:

- Prospective students—They need to submit a CSS Profile and IDOC Packet when applying for Harvard financial aid. U.S. citizens and permanent residents will also need to include the FAFSA form with their application

- Current students—The aid renewal application deadline is May 1. If you submit your renewal request on time, you will receive a reply from Harvard by July 1. If you applied for financial aid the previous year, the University will send you instructions for the renewal process

What Is the Deadline To Submit a Financial Aid Application to Harvard?

You can submit your FAFSA as early as September 17. The University’s financial aid application deadlines are:

| Restrictive Early Action | Regular Decision | Transfer Applicants |

| November 1 | February 1 | March 1 |

What Can I Do if Harvard Rejects My Application or Doesn’t Offer Enough Financial Aid?

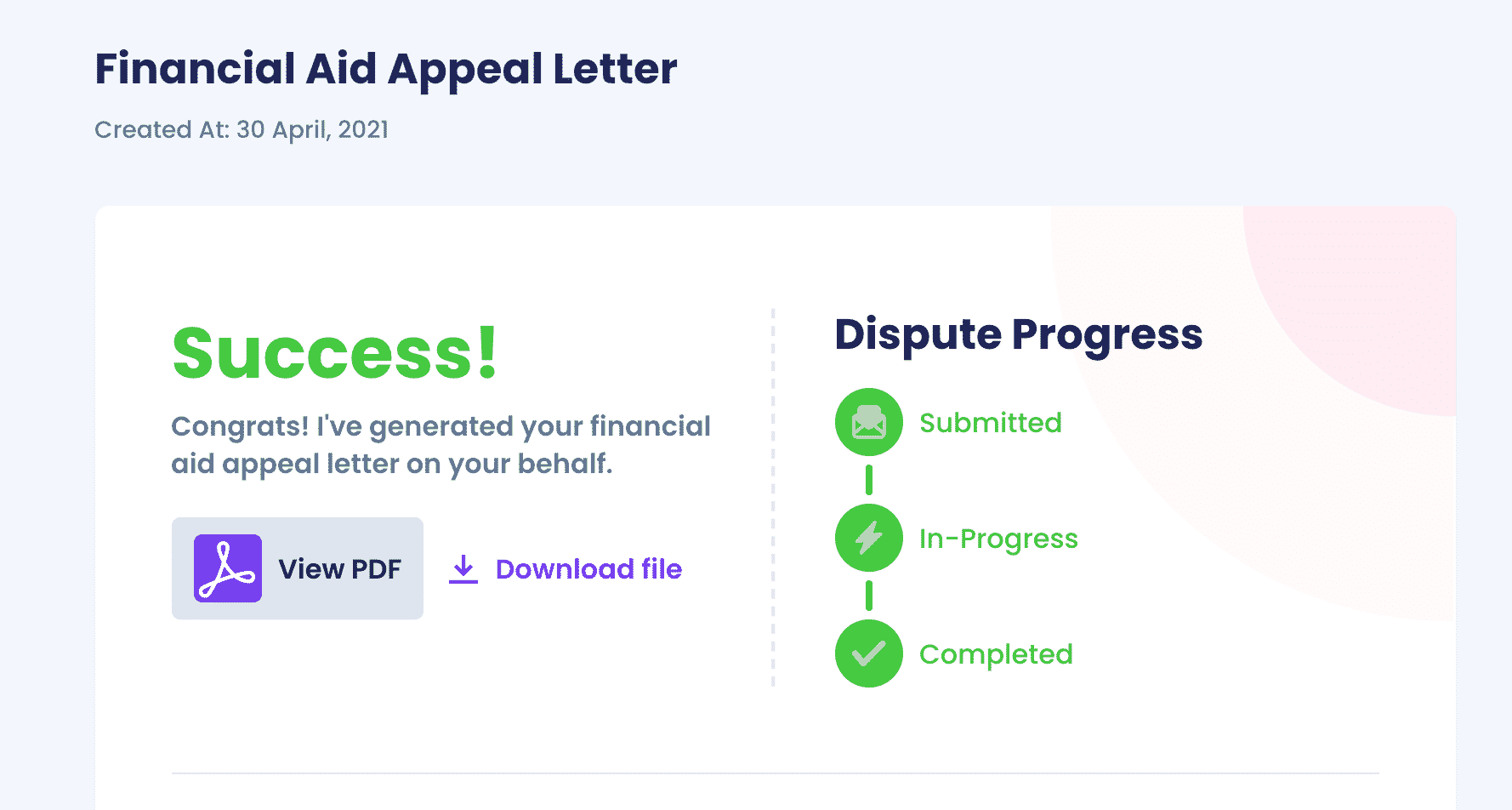

If you received your Student Aid Report (SAR) and found out that Harvard rejected your application or didn’t offer enough financial aid, you can appeal the University’s decision by completing a reconsideration form and enclosing an appeal letter with it.

Forget about the tiresome process of writing your own appeal letter—use our nifty tool to generate a tailor-made one and get more aid from Harvard in no time!

DoNotPay Can Generate a Custom Financial Aid Appeal Letter That You Can Send to Harvard

Generate your financial aid appeal letter for Harvard in three simple steps:

- Enter Appeal for More Financial Aid in the search bar

- Answer a few questions about your financial aid application and include offers from other schools you applied for, changes that occurred to your family’s financial situation, etc.

After you complete all the steps, the feature will prompt you to use it to send the letter directly to Harvard. If you click on No, we will send it to your email.

Leave Your Options Open—Use Our Guides To Explore Other Universities’ Financial Aid Programs

Our learning center can help you make the right choice. The universities whose financial aid programs we wrote about include:

Become a Financial Aid Expert With Our Guides

Use our guides to find out:

- What financial aid for college is

- How much financial aid you can get

- Who qualifies for financial aid for college

- How long you can get financial aid

- How to get financial aid for graduate schools

DoNotPay Turns Your Everyday Hurdles Into a Piece of Cake

Did you receive a faulty or damaged item? Why not return it with your virtual assistant? We can also help you get a late delivery refund and jump the queue if the customer service phone keeps ringing to no avail. The list of handy DoNotPay features that make your everyday life easier goes on.

By subscribing to our platform, you won’t have to worry about your tedious neighbors or parking tickets. We can do it all!

Want To Save Money on Lawyers? Use DoNotPay

Most people spend big bucks on expensive lawyers to overcome their bureaucratic obstacles. Don’t waste your money on unnecessary fees—use DoNotPay and take care of any matter in a few easy clicks! Check out some of the issues the world’s first AI Consumer Champion can help you with:

- Suing any company or person in small claims court

- Appealing parking tickets anywhere

- File insurance claims effortlessly

- Report any stalking or sexual harassment

- Reducing property taxes

- Drawing up tailor-made documents

- Creating POA agreements fast and easy

- Generating perfect

- Sending a DMCA takedown notice in case your work was stolen

- Putting an end to text and mail spam