A Complete Guide to Dartmouth Financial Aid

It’s no secret that Ivy League schools aren’t for everyone’s budget. The tuition for Dartmouth can go up to $60,000 a year, which may seem like an unreachable amount. Don’t let this stop you from going after the college of your dreams since Dartmouth financial aid might cover your expenses. This is your shot at making Dartmouth a possible goal, but you first need to know how financial aid programs work.

Our guide is here to answer all your questions about applying for financial aid at Dartmouth and appealing the university’s decision if necessary.

Eligibility Criteria for Financial Aid at Dartmouth

An eligible candidate for financial aid needs to meet the following criteria:

- Be a U.S. citizen or an eligible non-citizen

- Have a high-school diploma or a recognized equivalent

- Be enrolled or accepted as a regular student

- Have a valid Social Security number

- Keep satisfactory academic progress in college

- Demonstrate financial need (for most of the programs)

Financial need-wise, you will be eligible for a scholarship that covers full tuition if your family’s total income is $125,000 or less and you possess typical assets. This aid doesn’t include loans.

Available Types of the Dartmouth College Financial Aid

Dartmouth has a need-based financial aid program. They offer aid according to students’ financial situation.

The types of aid you can get from the school are the following:

| Type of Aid | Details |

| Grants and scholarships

(don’t need to be repaid) |

|

| Work-Study programs

(student employment) |

|

| Loans

(must be repaid, with interest) |

|

| Veterans’ benefits |

|

To get an estimate of how much financial aid you can get, use Dartmouth’s Net Price Calculator. This won’t show your precise aid package—it will only give you an estimated cost for attending college and the potential funds you can get. You will need to submit the following info:

- Your parents' Federal Income Tax Returns

- Your parents' W2 forms

- Asset information for students and parents such as investing, savings, and other

How To Apply for the Dartmouth Financial Aid

Your application for financial aid at Dartmouth will consist of these steps:

- File the FAFSA (Free Application for Federal Student Aid) form and use the Dartmouth code 002573

- Complete the CSS Profile and use the Dartmouth code 3351

- File necessary documents to IDOC

Note that U.S. citizens and permanent residents only need to file the FAFSA for federal financial aid, loans, and grants. The CSS Profile and IDOC are required if you wish to apply for Dartmouth scholarship funds and loans.

What Is the Deadline for Dartmouth Financial Aid Application?

Missing the deadline can be one of the worst nightmares, so we have prepared a useful table that will help you apply for financial aid on time:

| The Type of Application Form | Early Decision Deadline | Regular Decision Deadline | Deadline for Transfer Students |

| FAFSA | November 1 | February 1 | March 1 |

| CSS Profile | November 1 | February 1 | March 1 |

| IDOC | November 1 | February 1 | March 1 |

How To Contact Dartmouth Financial Aid Office

For any questions, refer to the Financial Aid Office. Dartmouth has closed its doors for in-person consultations due to the pandemic. You can, however, get in touch in the following ways:

- Send an email to financial.aid@dartmouth.edu

- Call the office at (800) 443-3605 or (603) 646-2451

- Join the virtual meeting in Zoom (every Tuesday, 9 a.m.–11 a.m. and Thursday, 2 p.m.–4 p.m.)

The Financial Aid Office staff will be at your service on weekdays, 9:00 a.m.–12 a.m. and 1 p.m.–4 p.m.

How To Check Your Application Status for Dartmouth Financial Aid

After you apply for financial aid, you can keep an eye on the updates through the Dartmouth information system. View your application status by doing the following:

- Go to the Dartmouth College Student Information System (DartHub) page

- Log in with your NetID and password

If you can’t find your NetID, email the school at help@dartmouth.edu.

What’s My Next Step if I Get Rejected or Receive an Offer With Insufficient Funds?

Did Dartmouth refuse your application or offer a small amount? Don’t give up because you can appeal the university’s decision. To start the procedure, contact the Financial Aid Office.

You will also need to write an appeal letter to every college you applied for financial aid. The letter needs to contain your reasons for the appeal and what makes you qualified for getting more financial aid. Sounds tiring? It is, but you can and avoid this mundane task.

Submitting an Appeal Has Never Been Easier Thanks to DoNotPay!

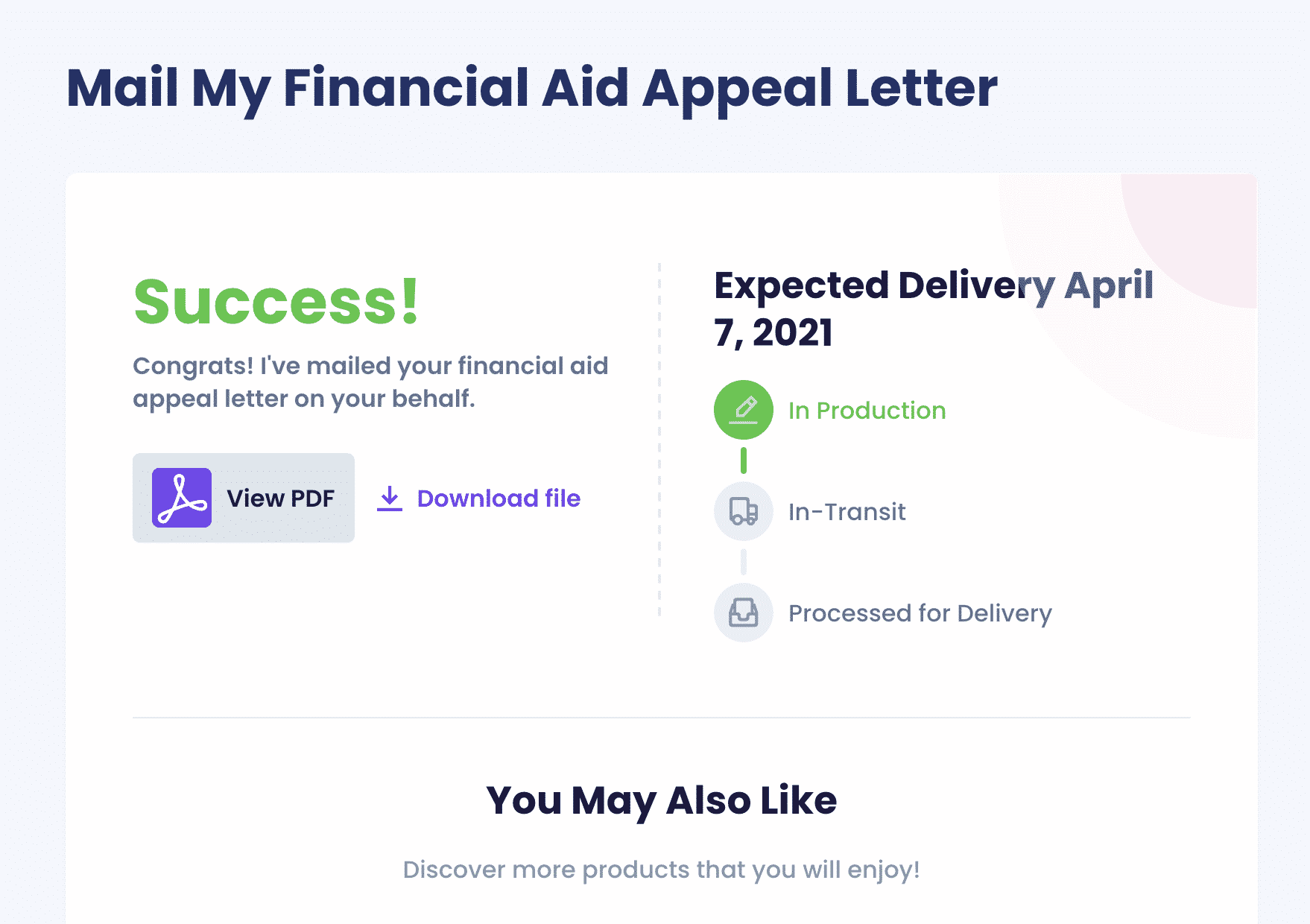

Do you want to make sure that your appeal letter is top-notch? Our nifty app can create the perfect appeal letter!

All you need to do is:

- Click on Appeal for More Financial Aid

- Answer the chatbot’s questions about the appeal

We will generate a customized appeal letter in a few minutes and send it to Dartmouth or any other college or university in your stead.

If you need help with financial aid for graduate school or you’re not sure how many years you can get aid, browse our learning center to get the answers you need!

Stay open to other possibilities by reviewing how financial aid works in other schools:

DoNotPay Is an App for Everyone

Whether you need help with drafting paperwork, searching through government databases, or managing your bills, DoNotPay has a feature that’ll make your life easier. The number of features keeps growing, and you can check out a table showcasing some of them:

| Solving Issues | Saving Money | Protecting Privacy |

|

|

|

Get More Done With Our Do-It-All Platform

DoNotPay can take care of any daily hurdle you come across. For a small yearly subscription fee, you get access to various features that you’ll find handy on a daily basis. Besides everyday chores, signing up for DoNotPay will help get you:

- Free raffle tickets

- Chargebacks and refunds from various companies

- Practice tests for almost any exam

- Professional power of attorney documents

The list could go on for days. You can even get in touch with an inmate or fight for discrimination at your workplace!