All You Need to Know About T-Mobile’s Virtual Card

Most subscription services come with a free trial to test the waters. But they have a catch. You must provide your credit card details before you enjoy the service. For most customers, this is a red flag in some cases, such as if you have a , you can earn some money back.

According to McKinsey, more than 80% of Americans pay for their stuff digitally. Why wouldn't they? Businesses make it easy for customers to pay this way. These guys bank on you enjoying the free trial that you forget to cancel. You automatically find yourself in a paid tier facing unnecessary charges. Well, now, you can enjoy the free trial without getting charged even if you forget to cancel it.

What Is a T-Mobile Virtual Card?

A is a free card that allows you to enjoy promotions, credits, deals, redemptions, and reimbursements from the carrier. This virtual card is used when a customer trades in their devices, buys a new device, transfers their carrier to T-Mobile, and new home internet activation.

| Offer | T-Mobile Tuesdays |

| Card or App | App |

| Points to collect | No |

| Commitment | No |

| Freebies | Yes |

| Perks | Yes |

| When | Weekly - every Tuesday |

Benefits of Using a Virtual Card

A brings with it a ton of benefits that you wouldn't get from your standard credit card. Whether you are a seasoned entrepreneur, start-up, or use T-Mobile services for personal use, the benefits of a VCC include:

- Added security – the VCC number is unique and enables you to pre-set and match the actual amount to the bill you are paying. Since the VCC isn't a physical card, you don't have to worry about vices such as credit card theft, fraud, and identity theft.

- Convenience – eliminate time wastage and physical movement as you pay your bills. Better still, forget about the archaic and annoying paperwork and procedures. Pay your bills conveniently in your comfort.

- Cashbacks and rebates – you can receive cash back or other promotional deals every time you use a VCC to pay bills. This also encourages customers to adopt this tech.

- Low-cost transactions – every virtual transaction costs way less than the standard credit card transactions.

- Spending limits – the VCC number is tied to a unique transaction. In most cases, the card expires when you pay that bill. So, even if you want to continue shopping, you can't since the VCC doesn't have any more funds to do so.

- Peace of mind and heart – when you combine these benefits, you get peace of mind. You can rest assured that your transactions are secure and your money even more so.

Drawbacks of Using a Virtual Card

Like any other fantastic revolutionary technology, the T-Mobile virtual card has its flies in the ointment. Although the VCC tech isn't common in many businesses, the challenges you'll meet along the way include:

- Lack of accommodation - not all businesses and merchants are ready to switch to VCC. Not all have the technology and capabilities to adapt the tech despite its potential.

- Employee training – if you are a business owner and thinking about adopting VCC in your business, you must invest in training your staff on the ins and outs of the tech. This might end up costing your profits.

- Number mismatch – in some instances, you might be required to show proof of credit card ownership, significantly to curb CC fraud. A VCC isn't a physical card, and the number doesn't match that of your physical CC. Merchants unaware of this fact might see it as an act of fraud.

- Unideal for recurring payments – to create a VCC, you must use a virtual credit card generator to develop the unique VCC number tied to that specific bill. You might forget to generate another VCC number or lack time to do so making it an unideal payment mode for vital recurring bills such as gas, power, phone, or internet.

Where Can You Get a Virtual Credit Card?

If you feel convinced, and you should be, that getting a VCC is the right move, that's fantastic. You'll be delighted to know getting the VCC is faster than you think.

The main sources of VCCs include:

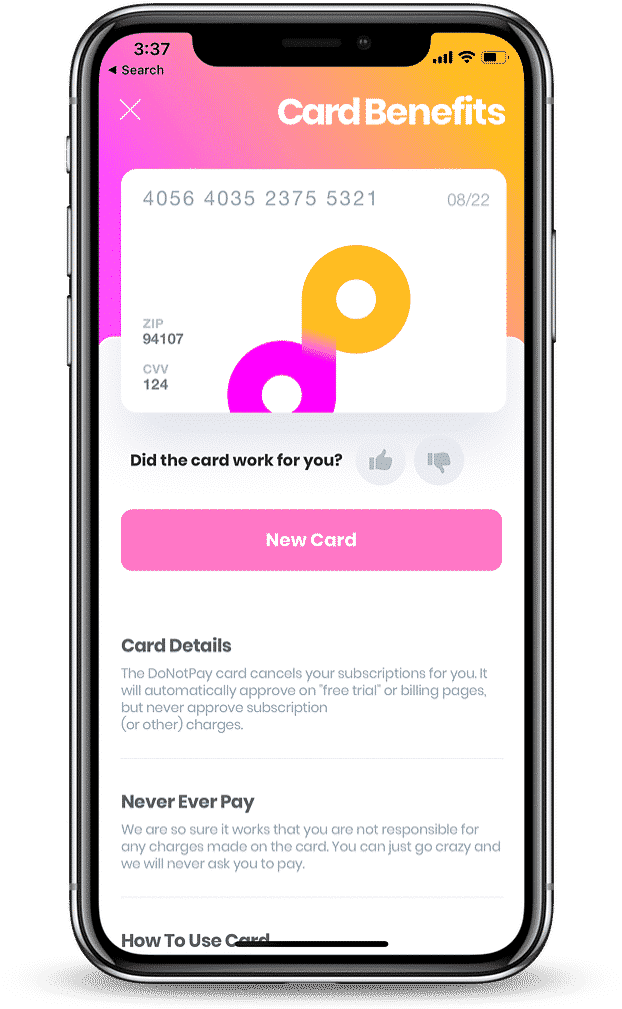

DoNotPay - This is your safest and sure best of getting a VCC for any free trial without worrying about automatic renewals or forgetting to cancel the subscription. However, you should know the DNP free trial card doesn't hold actual money and isn't connected to your real bank account. It's therefore unideal for making online purchases, but best for:

- Free virtual credit card with no deposit

- Improved security on your money and credentials

- An approval virtual credit card

- A virtual credit card with a U.S. billing address

For a VCC that'll enable you to make online transactions, you can consider:

What Is the DoNotPay Free Trial Card?

Joining your free trial service has never been this fantastic.

Now, DoNotPay's free trial card is a VCC like other VCCs and physical credit cards, but with a twist. The standard CC uses a single-use token that enables a business to charge you per transaction.

DoNotPay's free trial card uses a virtual credit card generator to develop a random and unique credit card number, expiration date, and card verification value (CVV). When you use the VCC, the merchant's payment system will translate these three elements as valid and your transaction will be successful.

You might purchase your stuff from a malicious website or fraudulent merchant without knowing. The random credit card number is single-use that's tied to a single transaction, single merchant, or limited spending amount. So, even when the fraudulent merchant attempts to make an unauthorized purchase or the website steals the credit card number, it's completely useless!

Here comes the twist. You don't have to link your real account or credentials to the VCC. Our generator will create a random email address to use when subscribing to any free trial! There's nowhere your accurate personal info will appear or connect in any subscriptions.

And if that's not bananas enough, it's free and keeps your email free of spam emails!

So, what we are saying is, after maneuvering to DoNotPay from your web browser and choosing the Virtual Card option, we will;

- Generate a random card number for you

- Automatically approve free trials and billing pages

- Halt and disapproving auto-renewals or any additional charges

- Cancel subscriptions for you

Where Can I Use DoNotPay's Free Trial Card?

VCCs such as the T-Mobile virtual card have gained popularity among consumers and merchants. As more businesses digitize their payment systems, it's only logical you get the ultimate VCC. You can use DoNotPay free trial card for:

- Free trials

- Hotel reservations

- Over the phone transactions

- Card not present transactions

Having said that, you'll be happy to know you can use to pay for numerous services, including:

- Adventures in Odyssey

- Grammarly

- Xfinity Wi-Fi

- Tinder Gold

- Showtime

- Netflix

- Hulu

- Spotify

- Twitch Prime

- Chegg

- Amazon Prime

So, why then, pray to tell wouldn't you consider a DoNotPay VCC when you won't have to worry about canceling a free trial or unwanted charges?

What Else Can DoNotPay Do?

Now you know all about a T-Mobile Virtual Card and the VCC from DoNotPay. You now know why you should be getting yours very soon. Our information sharing and helping don't end there. We have tons of resources to help you with:

- Getting out of traffic tickets

- Schedule your appointment with the DMV

- Bring action to numerous parties in small claims court

- Physical and virtual credit card issues

- Tips on getting compensation for delayed and canceled flights

- Cancel multiple subscriptions and memberships

- Catapult your contact with any customer support agents

- Fight parking tickets

- Valuable info about bills

By

By