Recover Suspended Prosper Account With the Help of DoNotPay

Prosper Marketplace Inc. offers online peer-to-peer lending services. The company allows borrowers to make loan requests and gives investors on the platform the option to choose to invest in the loan based on many factors.

Many reasons could have you suspended from Prosper's platform. When this happens, you should know the right procedure to follow to unsuspend your account. Read along to know what to do about your and how DoNotPay can help.

What Is Prosper?

Prosper was founded in 2005 as the first peer-to-peer lending marketplace in the United States. Since then, the company has provided more than $20 billion in loans to more than 1 million people. The organization has enabled people to invest in each other socially and financially. Prosper has been a trailblazing company. After a few challenges down the road, the company has positioned itself as one of the two leading players in the p2p lending industry.

However, some users report having that need resolving.

Qualifications to Become an Investor in Prosper

Investing in Prosper is not for everyone. Interested investors have to meet a set of requirements before they can open an account:

- Candidates must be at least 18 years of age and have a valid Social Security Number and a savings or checking account.

- Applicants must be a resident of an eligible state.

- Specific states such as Nevada, Missouri, New Hampshire, Idaho, Alaska, Washington, and Virginia require applicants to have at least $70,000 annual gross income and a net worth of $70,000. Investors in California have their specific requirements.

For more information, visit the Prosper Help section of the company's website.

How Prosper Works

Investing in Prosper is not a complicated process. It starts with the application for a loan. If the borrower meets all requirements, the loan is added to the platform for investors. Prosper has two separate platforms: the fractional loan and the whole loan platforms. The entire loan platform is preserved for large investors, who must finance loans as a whole.

On the other hand, in the fractional loan platform, investors can invest in small fractions of the loan. It takes 30-45 days for investors to see payments reflected in their accounts. The borrower makes principal and interest payments every month over the life of the loan.

Making an Investment in Prosper

Prosper uses an easy system that allows investors to invest their money quickly. All investors have to do is:

- From Featured Listings on Prosper's home page, select Browse Listings

- A list of all available loans will appear, making the loan selection process easy.

Prosper Automated Loans

Not all investors have the time to log in to the platform at a particular time every other day to invest. To make the investors' work easy, Prosper has several automated loan options:

- Automated Quik Invest

- NSRPlatform

- The Prosper API

- PeerCube

- Lending Robot

Prosper Loan Grades and Credit Scores

Prosper loans are categorized under seven loan grades, also known as Prosper Ratings. Prosper ratings are AA, A, B, C, D, E, and HR. AA loans have the lowest risk, while HR loans have the highest risk. One outstanding factor about Prosper loans is that the borrowers are ranked by the loan grade and the Prosper Score. The Prosper Score ranges from 1 to 11. The scores are developed by Prosper's internal system using the past payment behavior of the borrowers.

Risks of Investing With Prosper

Prosper offers a great return on investment. So, most people ask, "What are the risks of investing with Prosper?" As it turns out, investing in Prosper comes with its own set of risks, such as:

- The borrower may default. Because no securities are attached to the loan, the investor risks incurring significant losses if the borrower refuses to pay. Prosper has an average default rate of 3-4%.

- Poor investor loan diversification. Most new investors often fall into this trap. New investors are advised to focus more on the $25 minimum investment.

- Liquidity risk. While Prosper has a secondary market for buying and selling loans, any investment on the platform should be considered liquid.

- Bankruptcy. Prosper has two entities. Prosper Marketplace Inc is tasked with running the platform and overseeing administrative functions. Prosper Funding LLC, on the other hand, holds all loans. The two-part structure is designed to offer bankruptcy protection in that if the company were to go bankrupt, creditors cannot claim the loans because they are held in a separate entity.

- Risk of interest rates. Prosper loan terms are usually three to four years. At this time, the interest rates could significantly go up. Investors rely on Prosper to price the loans with an interest rate that takes into account the risks.

Why Can Your Prosper Account be Suspended?

You can get your Prosper account suspended for violating Prosper's Terms of Services. The following are notable examples of Prosper's Terms of Use:

- Copying, distributing, republishing, or posting any Content on Prosper's Site without written Consent from Prosper is prohibited.

- You can only use the Content on the Site for lawful purposes. The following are examples of unlawful use of the Site's material:

- Hacking into Prosper's systems

- Misusing passwords

- Children under 18 years are prohibited from using the Site

- Prosper's Termination Policy

- Prosper may terminate or suspend your access to the Site at any time and without cause or warning.

Unsuspend Your Prosper Account With DoNotPay

You may not have the time to draft an appeal letter yourself to get your Prosper account unsuspended. Nevertheless, the good news is that DoNotPay can help you with the process.

DoNotPay does not promise that you will get your account unbanned, but we will increase the chance of having your account restored by putting pressure on Prosper to look into your appeal without delay.

All you have to do is:

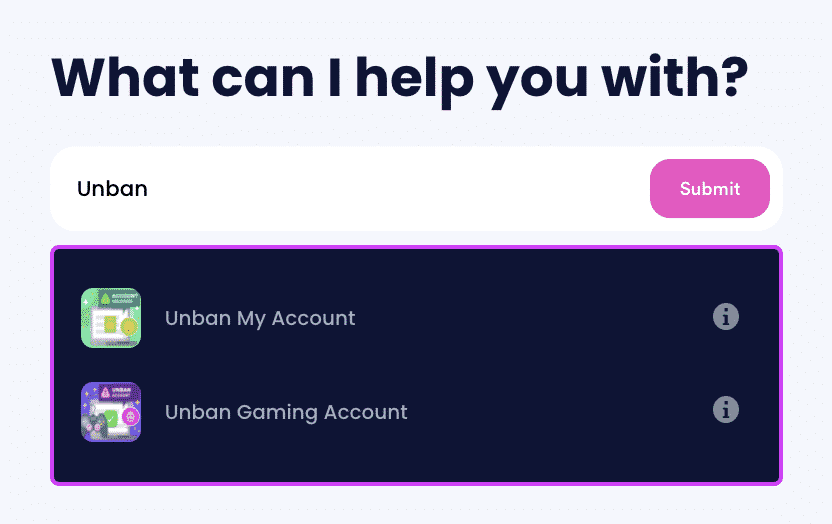

- Log in to your DoNotPay account and locate the Unban My Account product.

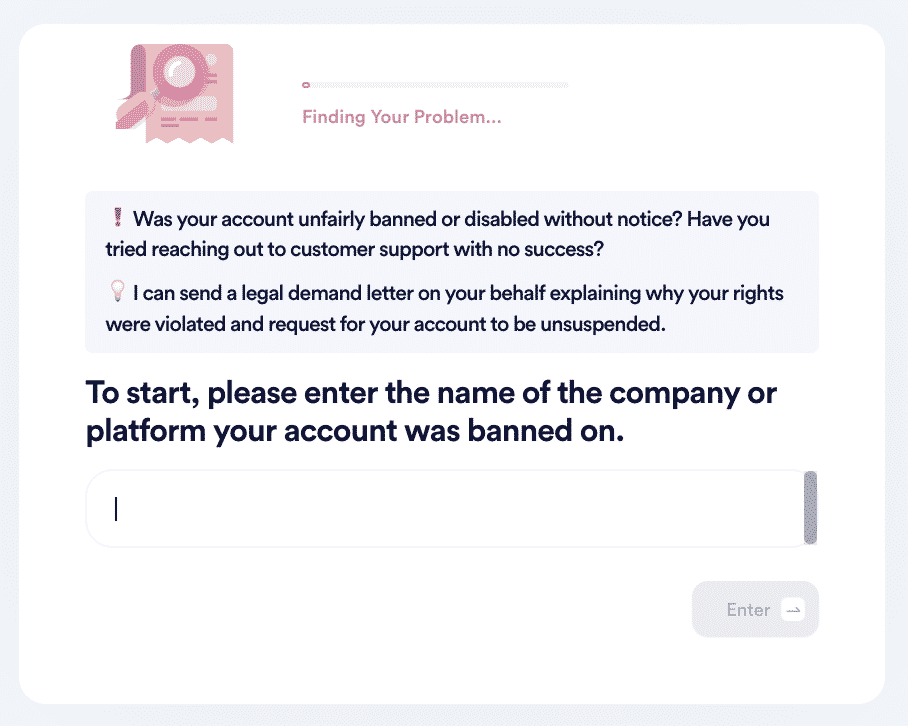

- Answer a few questions related to your banned account.

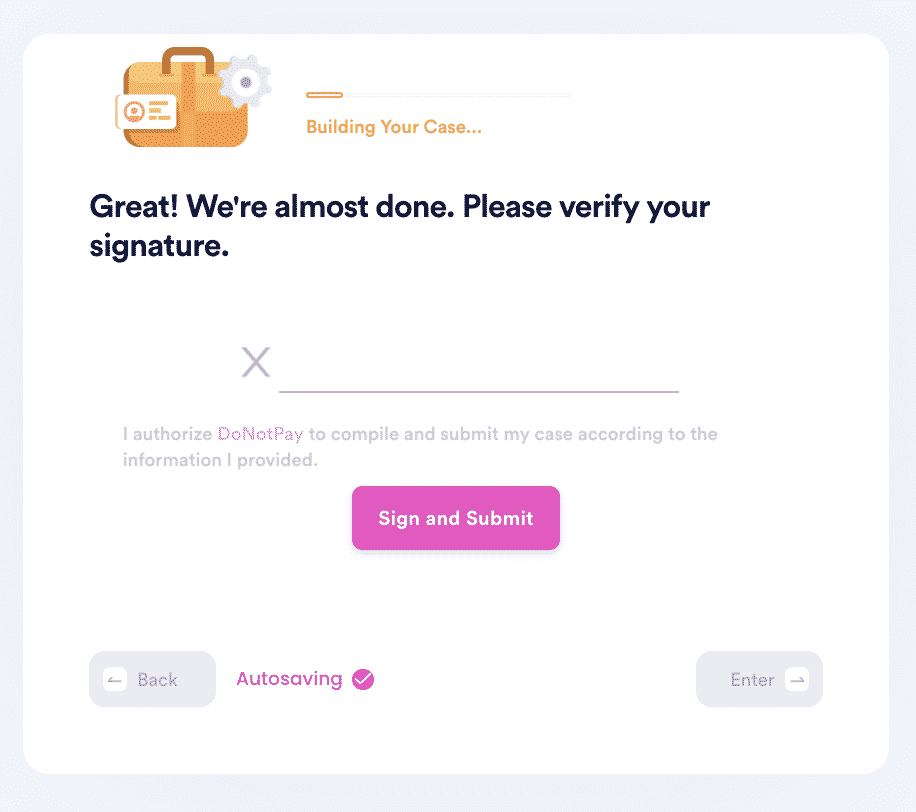

- Click on the Sign and Submit button.

DoNotPay will generate a customized appeal letter in less than five minutes and send it directly to the company. There will be a two-week deadline for the company to respond.

DoNotPay Can Appeal Account Suspensions Across Multiple Platforms

You can also use DoNotPay to get unbanned from many other platforms, such as:

| Steam | Amazon | |

| Omegle | ||

| Playstation | ||

| Uber | YouTube | Tinder |

| TikTok | Xbox One |

What Other Services Can DoNotPay Offer

DoNotPay can help you with many other services, including without limitation:

- Paying bills

- Suspended accounts

- Discovering and applying for scholarships

- DMV appointments

- Appeal suspension

- Filing a complaint

- Missing money issues

- Get your account unbanned

- Reduction of property taxes

- Free trials

- Small claims court

Sign up with DoNotPay today to get started.

By

By