How to Get Your Bank of America Account Back Using DoNotPay

Bank of America can for various reasons. When the bank freezes your account, you can access your account, but the bank prevents you from carrying out particular transactions. In other words, you can monitor what takes place in your account, including receiving your paycheck, but you cannot withdraw or transfer from the bank if your account is suspended.

All is not lost, as you can unfreeze your account by writing an appeal letter to the bank to unban your account. Unfortunately, your request might be ignored or lost in a pile of emails the customer support receives daily. DoNotPay can help you write a demand letter to the company and pressure them to attend to your request.

Why Is Your Bank of America Account Banned?

Your for the following reasons:

- Suspicious or illegal activity

- Creditor's debt

- Government's debt

Suspicious or Illegal Activity

Bank of America has the right to freeze your account if they detect that you are conducting illegal activity with your account. The company will routinely monitor suspicious activity like money laundering, where large sums of money are deposited into your account.

- If the company suspects terrorist financing from your account, they are bound to suspend your account.

- Your account will be frozen if you write bad checks. In other words, you might take it as usual to cash in a check without having enough money in your account, but the bank will consider it a fraud.

- Unusual bank deposits can cause your account to be suspended even if the deposits were legitimate. For instance, if you win big at a casino, you should inform the bank before depositing to avoid suspicion.

Creditor's Debt

If you have a debt that you haven't settled, your creditor might request Bank of America to freeze your account until you settle your debt. The creditor has to seek approval from a court before they take action to have your account frozen. The creditor will get a judgment against you and send it to the bank, where it is kept on file.

If you have a loan account and a bank account at Bank of America, a creditor can access your account and settle your dodged loan without seeking a judgment against you. If you want to secure a loan, you have to provide your full bank details implying the lender can access your bank account even when you default.

Unpaid Debt to the Government

If you haven't cleared your student loan or settled government debt, your bank will be frozen. In such an event, the Internal Revenue Service (IRS) issues a tax levy for all your unpaid taxes, which will only be raised once you pay your tax in full.

The government will treat your unpaid student loan differently. It will seize your tax refund or garnish a percentage of your monthly income. Take note that your taxes and wages will be pursued without a judgment from the court.

It is important to note that when your bank account is suspended because of debt or suspicious activity, the funds in your account should remain intact. The laws of your residential state determine the income limit to be taken from your account.

For example, creditors are not supposed to withdraw child support, social security, and worker's compensation in some states. You should file a lawsuit of exception within ten days after your account is frozen if it happens.

How to Avoid Getting Banned From Bank of America?

Prevention is better than cure, and thus you can follow these tips to safeguard your account:

- Pay your taxes promptly. Your account will not be frozen if you settle your federal and state taxes promptly.

- Pay your creditor's debt without fail. Settling your debt as per the agreement is the best way to prevent creditors from moving to court to have your account frozen.

- Avoid any illegal activity that might put your account at risk. Such activities include fraud, terrorist financing, money laundering, and more.

Learn What You Should Do After You Get Bank of America Ban

Before your Bank of America account is frozen, you receive a notification from either the organization that wants your account to be frozen or the bank itself. Once you receive the notification, you need to contact the bank and know the steps to rescue it.

| Bank of America Contact Information | |

| Phone | 1-315-724-4022 |

| Available Hours | Monday to Friday 8 AM - 9 PM ET

Saturday 8 AM - 8 PM ET Sunday 8 AM - 5 PM ET |

| Website | Customer Support |

Ignoring your frozen bank account can worsen the situation by causing a drop in your credit score and increasing your bank fees.

Learn How to Get Your Bank of America Account Back on Your Own

If your bank account was frozen for a legitimate reason, you can file an appeal. Proceed to the bank with proof. A proof will show that your account was suspended wrongly. You can be lucky, and thus the bank will unsuspend your account and give you full access to it.

If the bank account was frozen because of unpaid debt, you should get the creditor's attorney information from the bank as soon as possible. It would be best to come up with a payment plan; otherwise, your account will remain suspended.

Making a follow-up to unban your bank account can be an uphill task, even if you provide evidence that shows that it was banned wrongly. Your request might be ignored, meaning that your account will remain inactive and functionless. You don't have to worry since DoNotPay has a perfect solution to your problem through its Appeal My Banned Account product.

Learn How to Get Your Bank of America Account Back Using DoNotPay

You can get your Bank of America account unbanned easily with DoNotPay.

All you need to do is:

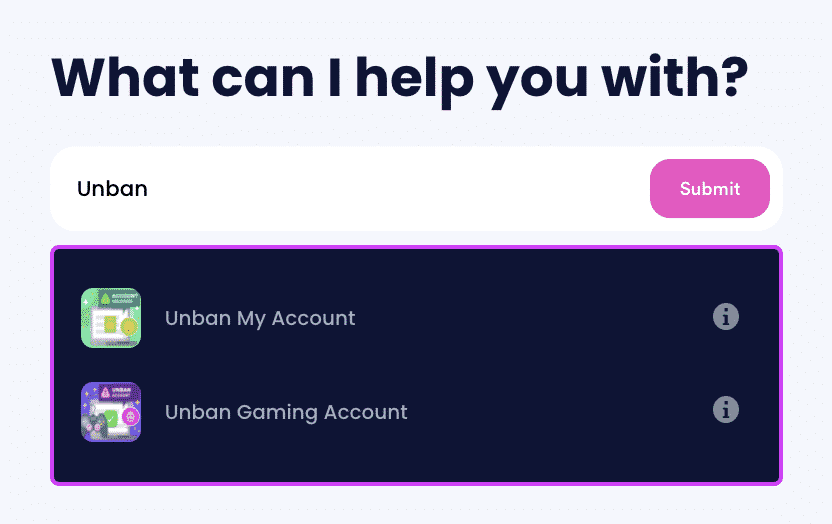

- Log in to your DoNotPay account and locate the Unban My Account product.

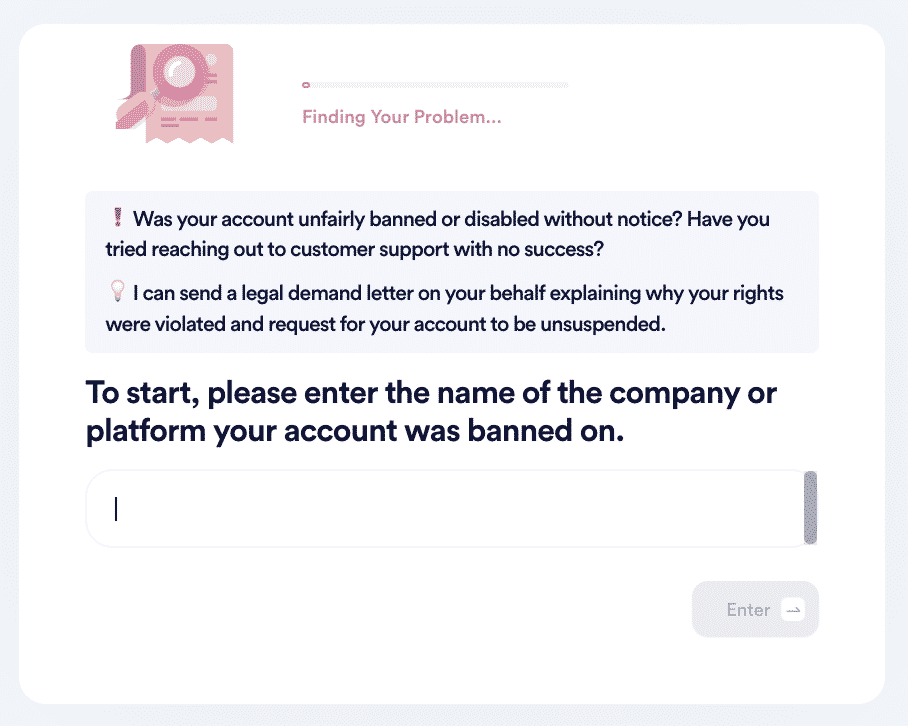

- Answer a few questions related to your banned account.

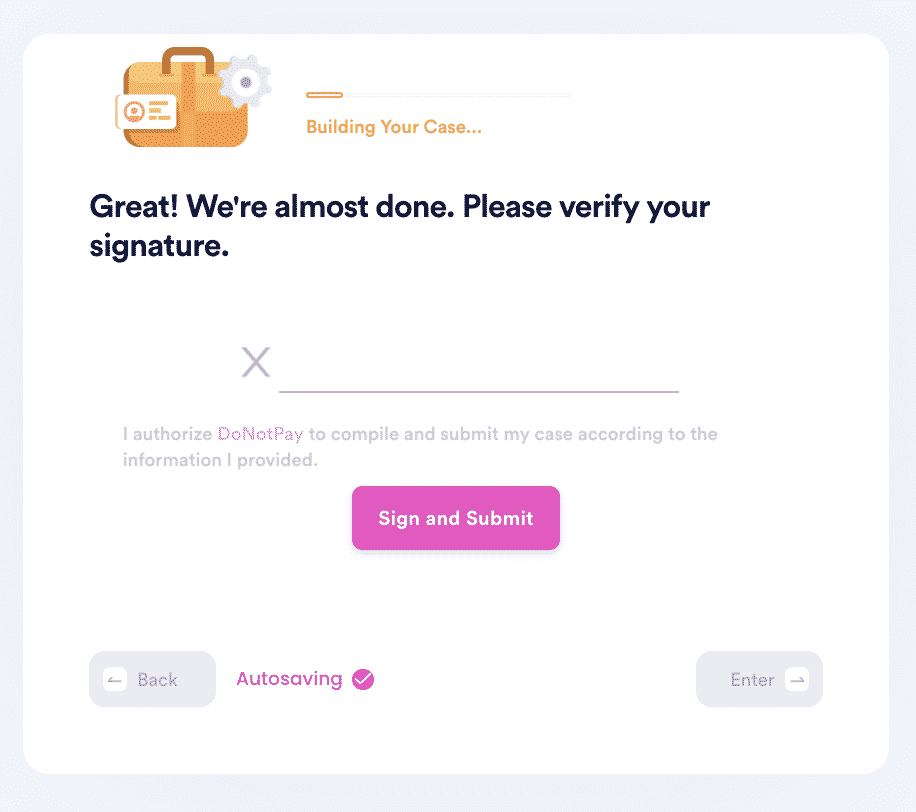

- Click on the Sign and Submit button.

What Other Problems Can DoNotPay Solve

DoNotPay is the best remedy to unban different accounts:

DoNotPay is the best hub to . Sign up today and let us guide you on how to do it!

By

By