All You Should Know Before Applying for the UC Berkeley Financial Aid

Getting into UC Berkeley is a dream come true for many, but hefty tuition fees may be a real challenge. The good news is that, despite high costs, the university awards more than $750,000 of financial aid to its students per year.

If you are thinking about enrolling in a program offered by this institution, we can help you find out more about getting student support. Get familiar with all the UC Berkeley financial aid terms and learn how to appeal the rejected application or a low offer by !

What Types of Financial Aid Does Berkeley Provide?

UC Berkeley has a wide financial aid offer categorized into four groups:

- Grants

- Loans

- Scholarships

- Work-study support

Check out the table below for more information on each category:

| Type of Aid | Explanation | Available Programs |

| Grants | Financial help that doesn’t need to be repaid. It’s a need-based type of support that comes from federal, state, or college funds |

|

| Loans | College financial aid that usually must be repaid unless you get loan forgiveness benefits. It’s available for most students and features favorable repayment plans |

|

| Scholarships | A special type of financial support that is awarded to students mostly based on their academic success, but they can also be given based on personal income or financial circumstances. It doesn’t need to be repaid |

|

| Work-study aid | An opportunity to get a part-time job to earn for college financing |

|

Who Qualifies for Receiving the UC Berkeley Financial Aid?

To apply for any of the four available types of college financial aid from Berkeley, you must meet certain requirements provided by the institution. You qualify for the support if you:

- Reside in the U.S. or belong to one of the following categories of eligible non-citizens:

- U.S. permanent residents

- Conditional permanent residents

- Indefinite parole

- Asylum granted

- Humanitarian parole

- Refugees

- Citizens of the Republic of Palau, the Federated States of Micronesia, or the Republic of the Marshall Islands

- Possess a valid Social Security Number

- Have:

- A high-school degree

- A General Education Development

- Are a regular student of a particular degree within UC Berkeley

- Maintain a solid academic success (depending on the particular year of studies)

- Pay all your previous student loan debts

- Are a Selective Service registree—only for male persons between the ages of 18 and 25

- Have no drug convictions or offense records

Some types of aid may have slightly different or modified eligibility criteria. For the most accurate info, visit the official website of the university and check if there are any specific updates. Application deadlines and other additional financial aid information are also available on the institution’s web page.

How To Apply for the Financial Aid for UC Berkeley

Once you confirm that you meet all the initial requirements, you must file a California Dream Act Application or a Free Application for Federal Student Aid (FAFSA). These are the forms that UC Berkeley uses to collect information about your income and financial situation and decide if you are eligible for the support.

After submitting the form to the Federal Student Aid online, by mail, or via the myStudentAid app, a Student Aid Report (SAR) is sent to your email or home address. It contains all the details you disclosed in your FAFSA and serves to help you check the information provided and detect potential errors.

If your application gets accepted, the financial aid amount will be disbursed ten days before the school year starts. Should UC Berkeley reject your FAFSA application or offer an amount that doesn’t cover your expenses, you can submit an appeal letter to the institution. In the letter, you should:

- Describe the financial issues you are having

- Inform the institution about the better offers you got from other colleges

- State the amount that would cover all the college-related costs

Not happy with the solutions offered by UC Berkeley? Discover other guides from our learning base explaining how you can get more support money on various colleges, such as:

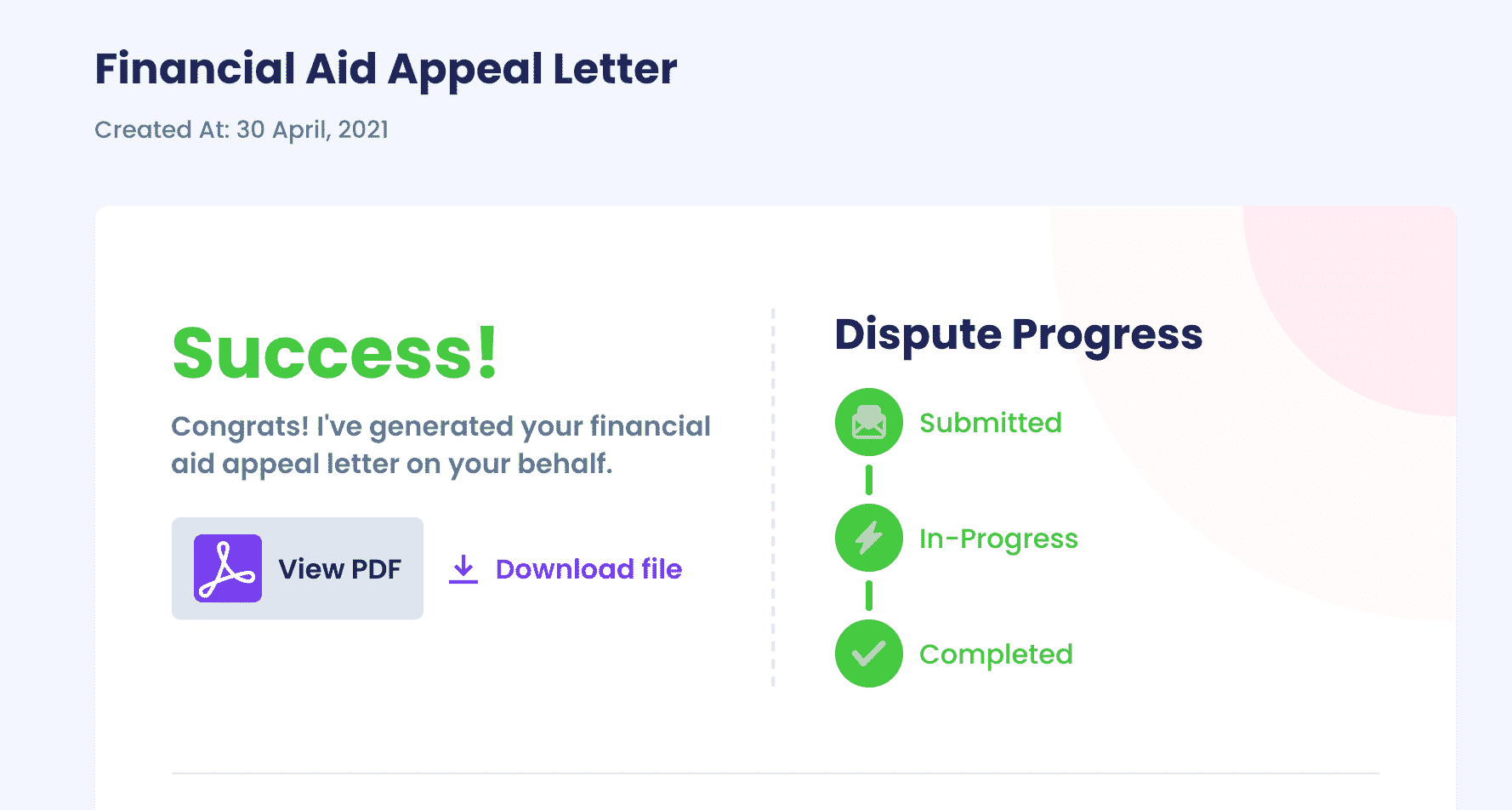

Get a Better Offer by Appealing the College’s Decision With DoNotPay

Writing appeal letters can take too much time, especially if you want to submit one to each college you are considering. Use DoNotPay and create an unlimited number of personalized claims based on your tax, income, and other financial info in only a few clicks!

The procedure can’t be simpler. Make sure to:

- in your preferred web browser

- Choose the Appeal for More Financial Aid option

- Tell us which college you want to attend and enter the names of the universities that offer higher support amounts

- Answer a few brief questions about your finances and household

As soon as we process the disclosed details, we will generate a fully customized appeal letter for you! The best part is that you don’t need to do anything else—we will mail the claim to the financial aid office of the college or graduate school you choose.

Only the Sky Is the Limit for DoNotPay

DoNotPay has an insane number of features that keeps growing. Our platform can help you:

- Request refunds and get your money back fast and easy

- Create documents crafted to suit your needs

- Reduce property taxes and apply for tax exemptions

- Claim any money you might have under your name

- Cancel any service or subscription

- Appeal parking tickets in any city

- Demand compensation from airlines without the hassle

- File insurance claims the easy way

Say Goodbye to Spam Mail With DoNotPay

DoNotPay has designed a feature that will put a stop to the flood of junk and spam mail into your inbox! We can help you join a class action against a spammer or take any person or company that’s wronged you to small claims court!

Need a virtual credit card number or a fake phone number to protect yourself from scammers? We’ve got you covered! We can help you fight text spam or even assist you in sending mail without any chance of error.

Our users’ safety is our number one concern, so we’ve developed a feature that will protect you from cyber stalking or harassment!