All You Need to Know About the Mastercard Virtual Card

By requiring a credit card for a free trial, a subscription service knows that it's more likely to get you to pay for at least one month because you'll forget to cancel it. If you shop online, you might find a transaction that's higher than it should be due to higher fees. What's the solution? How can you protect your credit card and still get the things that you want?

You might have heard about a , but you don't understand exactly what that is or how it works. If you tried to research it online or called Mastercard, the answer might seem a little confusing.

DoNotPay has you covered. You can use DoNotPay to create a virtual credit card and to learn more about a Mastercard virtual card, so you can buy with confidence.

What Is a Virtual Credit Card?

A virtual credit card is a set of randomly generated numbers that represent your real credit card number that you can give to a merchant in the place of the actual one. Depending on the app or company that generates the virtual credit card, you should be able to set a limit on the amount of the charges.

If you need a virtual credit card for a specific business or company, you should be able to generate one of those, too. All of these features are created to help you protect your actual credit card info from hidden charges or unauthorized purchases. While you can usually recoup the losses on a credit card, it can be a hassle when you need to get your bank involved.

How Does a Virtual Credit Card Work?

An app that offers virtual credit cards gives you a set of numbers that represent your real credit card number, expiration date, and security code that you can provide to a vendor who gets paid without ever seeing your real information. This helps keep anyone from stealing your info or coining your credit card.

- You can create a virtual credit card that can only be used for a single-use at the vendor you specify. This ensures no further charges.

- Virtual cards work by making it more convenient for you to shop online and try free trials without worrying about problems that might arise from someone having your actual credit card information.

Drawbacks of Using a Virtual Card

Before you commit to using a virtual card, you need to know that there are some drawbacks and decide if you still want to proceed. There are two drawbacks that come up most often in connection with virtual cards, and these are:

- If you plan to use a virtual card on your phone to shop in person, you might find that not every store is set up to use this form of payment. Of course, more and more stores are beginning to invest in the technology.

- When you use a virtual card to get cash, many of them charge you a significant fee for the service. This includes sending cash through an app or online service.

Benefits of Virtual Credit Cards

Even though there are some drawbacks, virtual credit cards offer many benefits for you to enjoy. Of course, how important the individual benefits are to you depends on how you plan to use the card.

Here are four benefits to consider:

- If you use a mobile app to generate a virtual credit card, you always have it with you and know exactly where it is.

- Virtual credit cards mask your real credit card, protecting it and keeping it safe from fraud or theft.

- Use a virtual credit card for a free trial, and you don't need to worry about canceling to avoid further charges.

- No one can steal or clone your virtual credit card because it isn't the real information.

Are Mastercard Virtual Credit Cards Free?

There are many banks and credit companies that issue , so it depends on whom you bank with whether there's a fee or not. You should contact the financial institution to check for fees.

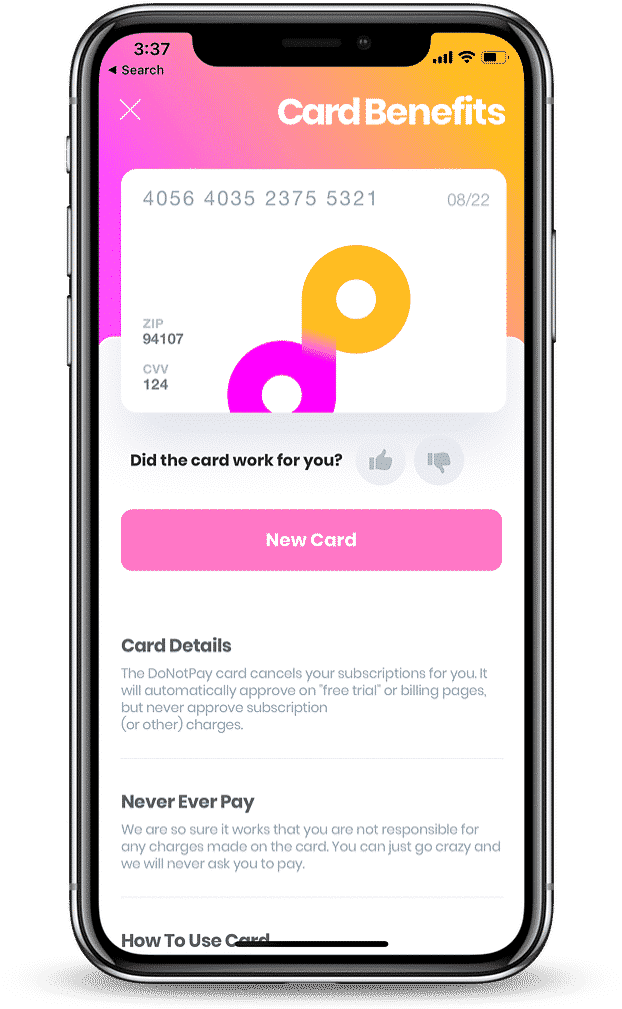

What Is the DoNotPay Free Trial Card?

Designed specifically to use for a free trial of a service or subscription program, the DoNotPay virtual card allows you to sign up and avoid worrying about future charges. This virtual card is only good for authorizing a free trial.

Where Can You Use DoNotPay's Free Trial Card?

After you discover more information about a Mastercard virtual credit card and the DoNotPay free trial card, you'll be ready to start using the card offered by the DoNotPay app. The good news is that you can use the DoNotPay virtual card to start almost any free trial that you're interested in trying. Some of the most common ones that people try are:

| HBO | Tidal | Adobe After Effects |

| CBS All Access | Starz | Spotify |

| Showtime | Hulu | Chegg |

| Netflix | Amazon Prime | Twitch Prime |

What Else Can DoNotPay Do?

After you use the DoNotPay app to generate a virtual credit card, it's time to see what other options the app offers for you. DoNotPay strives to offer a variety of services that you might need now or at some point in the future. Check these out to get started:

- Get an appointment with the DMV faster

- Fight parking tickets in any city

- Send Demand Letters To people and companies in small claims court

Allow the DoNotPay app to create a virtual credit card for you to use today!

By

By