Chase Freedom Extended Warranty Explained

Chase Freedom Unlimited is one of Chase credit cards. The extended warranty protection covers your purchases with this card. This perk adds another year to the U.S. manufacturer warranty, which is usually three years. Learn more about the Chase Freedom Extended warranty and how to claim it with our help!

Chase Freedom Unlimited Extended Warranty Coverage

Chase Freedom extended warranty protects the cardholder as well as the recipients of gifts the cardholder bought. The coverage amount is up to $10,000 per one claim and no more than $50,000 for one account.

Check out what items Chase Freedom extended warranty covers:

| Chase Freedom Extended Warranty Covers | Chase Freedom Extended Warranty Doesn’t Cover |

|

|

How Can I File a Chase Extended Warranty Claim?

Chase offers a few ways to file an extended warranty claim:

| Can You Claim Your Warranty With | Yes/No |

| DoNotPay | Yes |

| Yes | |

| Phone | Yes |

| Letter | No |

| Online Form | Yes |

| In Person | No |

| Chase Website | No |

File a Chase Freedom Extended Warranty Claim Over the Phone

To file a warranty claim over the phone, call 1-800-874-7702 as soon as you notice a failure of your purchased item, and no later than 90 days, or Chase could deny your claim.

Here’s what you need to do once you call:

- Explain why you want to submit a warranty claim

- Answer the benefit administrator’s questions and follow their instructions

- Complete and sign the form and return it together with the requested documentation

You have 120 days after the item failure to submit the claim form.

File a Chase Freedom Extended Warranty Claim Using an Online Form

You have an option to submit your claim online. Here’s how to do it:

- Visit Card Benefit Services

- Sign in or register

- Click on File a Claim

- Type in your credit card number and hit Continue

- Select the product you want to claim from the drop-down menu

- Tap on Next

- Click I am filing a claim while registering a product if your product is not yet registered

- Enter the date when you purchased the item

- Choose Product failed within manufacturer terms

- Answer a few questions and confirm your digital signature

- Upload the documents required for your claim

- Enter your name, email, and address

- Follow the prompts and submit the claim

What Documentation Do I Need To Provide?

Whether you’re submitting the Chase Freedom Extended warranty online or over the phone, you may need to prepare certain documents, such as:

- Filled-out and signed claim form

- Your Chase credit card statement

- Copy of the itemized sales receipt

- Copy of the original manufacturer’s written U.S. warranty

- Any other documents that the Benefit Administrator requires you to submit

DoNotPay Helps You Submit a Chase Credit Card Extended Warranty

If filing a warranty claim on your own is too much to handle, we’ll jump in! DoNotPay can guide you through the whole process and submit your Chase Freedom extended warranty claim in no time! Here’s all you need to do:

- Access DoNotPay in a

- Choose our Claim Warranty feature

- Select Warranty on a Purchased Item

- Enter Chase Freedom and answer a few questions about the purchased item

- Hit Submit

DoNotPay will submit the extended warranty claim letter to Chase on your behalf. You can expect Chase to reach out to you directly soon after the claim reaches them.

We can streamline submission procedures for other warranty claims, such as car, home, or extended warranties for used cars.

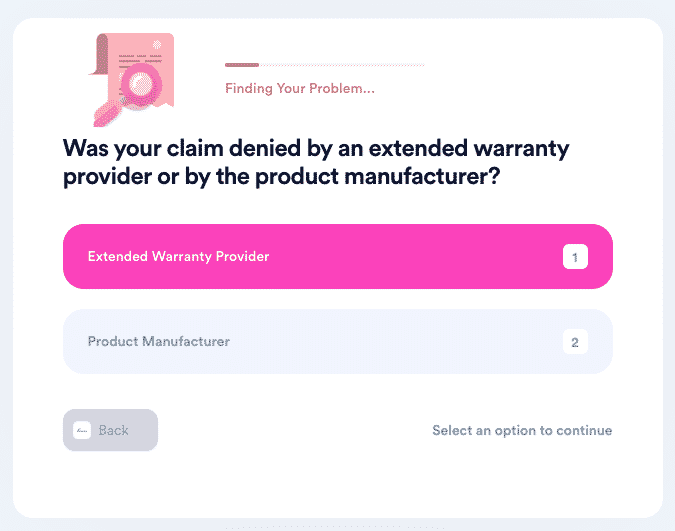

Did Chase Reject Your Warranty Claim? Use DoNotPay To Appeal It!

If Chase or any other company denies your warranty claim, there is something you can do! DoNotPay will assist you in appealing your Chase Freedom Extended warranty claim or any other troublesome claim. Here’s how to do it:

- Open DoNotPay in a

- Find the Claim Warranty feature

- Choose Appeal a Denied Warranty Claim

- Answer a few questions about your original claim

- Click on Submit

We can take it from here! DoNotPay will build your case and send your appeal letter to Chase. Even if you don’t provide us with too many details, DoNotPay can rely on the implied warranty laws.

Free Yourself From Annoying Tasks With DoNotPay

From now on, dealing with warranties will be a piece of cake! DoNotPay is your go-to whether you need home warranty reviews, the best home warranty in America, or help to handle a dealer refusing to cancel your extended warranty.

Lean on DoNotPay for all kinds of tasks, not only warranty-related ones. Visit DoNotPay in your , and learn how to:

- Waive college application fees

- Start free trials safely

- Manage unpaid bills

- Find any unclaimed money under your name

- Stop spam emails

- Protect yourself from stalking and harassment

- Appeal speeding tickets

- Cancel your subscriptions or memberships

- Dispute traffic tickets

- Demand a refund from any company

- Schedule a DMV appointment quickly

- Skip the call waiting when getting in touch with customer service reps

- Protect your work from copyright infringement

- Submit a claim for any warranty

- Overturn parking tickets

- File small claims lawsuits against people or companies

- Get in touch with loved ones in prison

- Sign up for services without phone verification

- Apply for clinical trials near you

- Get back at robocalls

- Free yourself from spam text messages

- Resolve credit card problems

- Request a refund and compensation for a delayed or canceled flight

By

By