Are Scholarships and Grants Taxable?

Before considering student loans, you should explore scholarships and grants available for you. These are financial aid options that can help you finance your education with ease and graduate without any liabilities. But are scholarships and grants taxable?

The IRS aims to minimize the tax burden on scholarship recipients, but there are times when you are required to report taxes on such assets. Because nobody likes unpaid tax surprises, we have prepared this guide to help you understand the impact scholarships and grants may have on your tax liabilities.

What Is the Difference Between Scholarships and Grants?

The terms are usually used interchangeably, but there is a slight difference. Scholarships are normally awarded based on merit. This means you may receive a scholarship based on your achievements in different areas, such as academic performance, athletic skills, or other talents. Grants are awarded based on financial need. As gift aids, scholarships and grants don’t have to be paid back.

If you need more financial aid to finance your education, you can find and apply for more scholarships and grants. To streamline your search, consider looking for scholarships targeting specific groups, such as:

- High school seniors

- Disabled students

- Minorities

- Moms

- First-generation college students

- Grad school students

- International students

- Veterans

- Women

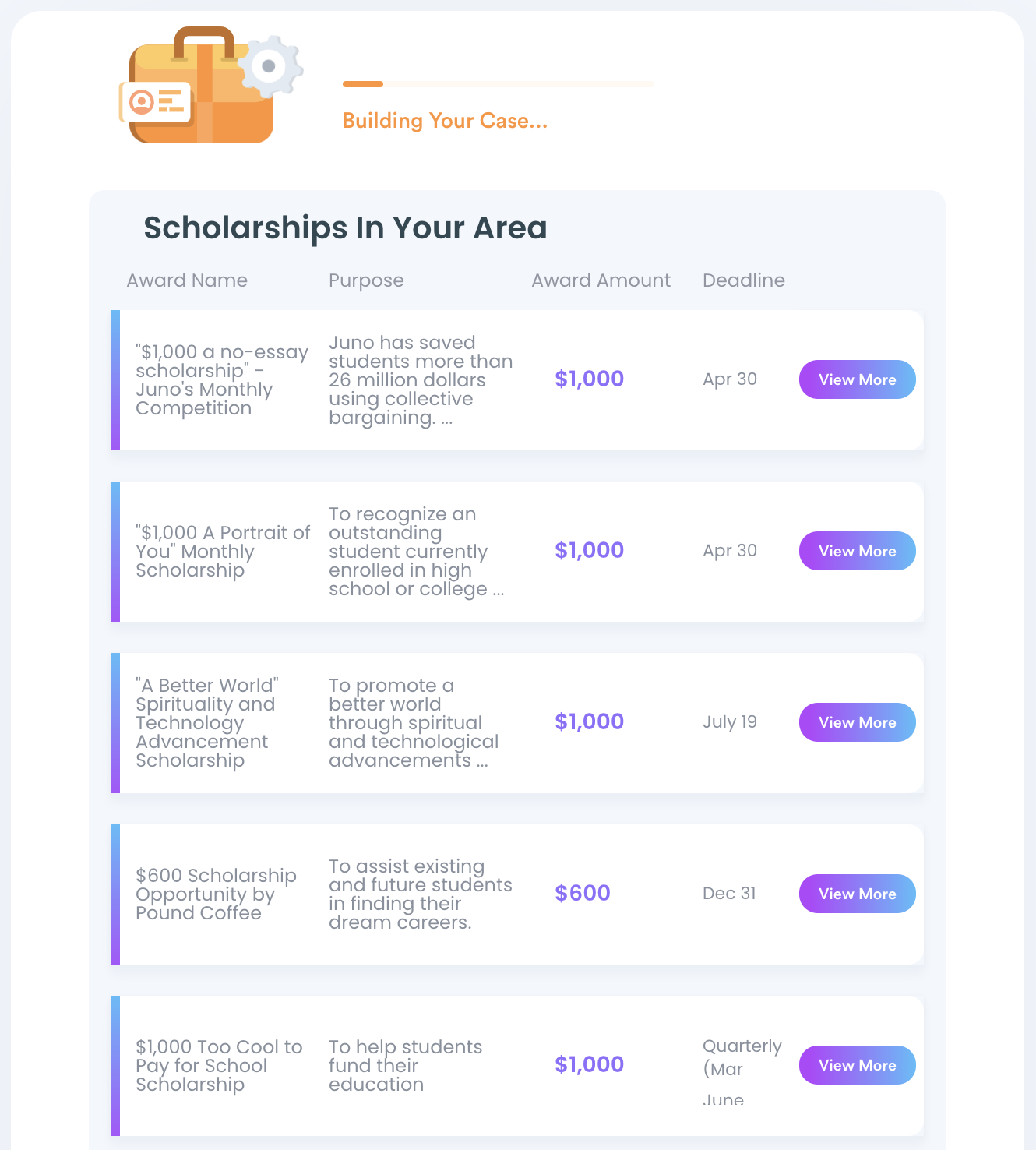

The process can take days, but the trick is knowing where to look. If you , you will get a list of all the scholarships and grants you are eligible for in less than five minutes.

The IRS Rules for Scholarship Funds

Considering that scholarships are gift aids, you may have a lot of questions on how they affect your tax responsibilities. Are college scholarships taxable income? Generally, the answer is no, but in some cases, scholarships can be counted as taxable income.

According to the IRS rules for scholarship funds, scholarships don’t qualify as taxable income if you are:

- Pursuing a degree

- Using the money to pay for what IRS considers to be a qualified education expense

- Enrolled in an eligible institution

Check out the table below for clarifications:

| IRS Rule for Scholarship Funds | Description |

|---|---|

| Eligible degrees | An associate, bachelor’s, or a higher degree |

| Qualified education expense | Basic expenses that are directly related to your education, such as enrollment tuition and fees or other course-related expenses, like books, supplies, and equipment |

| Eligible institution | An institution that has the regular faculties and curriculum with the primary role of offering formal education |

When Is a Scholarship Taxable?

Here are the scenarios when a scholarship is taxable:

- The student has extra funds after paying for the qualified education expenses—the extra money is treated as taxable income

- Recipients use the funds to pay for incidental expenses. Did you pay for room and board with a scholarship or grant? That amount is taxable, including other optional expenses

- The student receives compensation for the services they are required to offer, such as teaching or researching, as a condition of receiving your scholarship

Note that compensation under the following programs is tax exempted:

- The Armed Forces Health Professions Scholarship and Financial Assistance Program

- The National Health Service Corps Scholarship Program

- A comprehensive work-study program

How To Report Scholarship Income

You don’t have to shy away from scholarships that award you more than you need for your qualified expenses. All you have to do is report your taxable income. In such cases, your scholarship provider may issue you with a W-2 form that shows the taxable amount. You can get the form at your school.

To report your income, you should use the appropriate IRS 1040 tax return form. Check the taxable amount on your W-2 form and complete the tax return form by filling the figure under the wages and salaries space.

If you can’t find the taxable amount on the W-2 form, you can enter the figure on the dotted line near the wage box and write “SCH”. You can also use the help of a tax professional to ensure you file the correct amount.

Discover and Apply for Scholarships and Grants Using DoNotPay

There are many scholarships that you can take advantage of today. The challenge is finding the ones you are best suited for in a limited time. You can also miss application deadlines if you are not up to date with new offers.

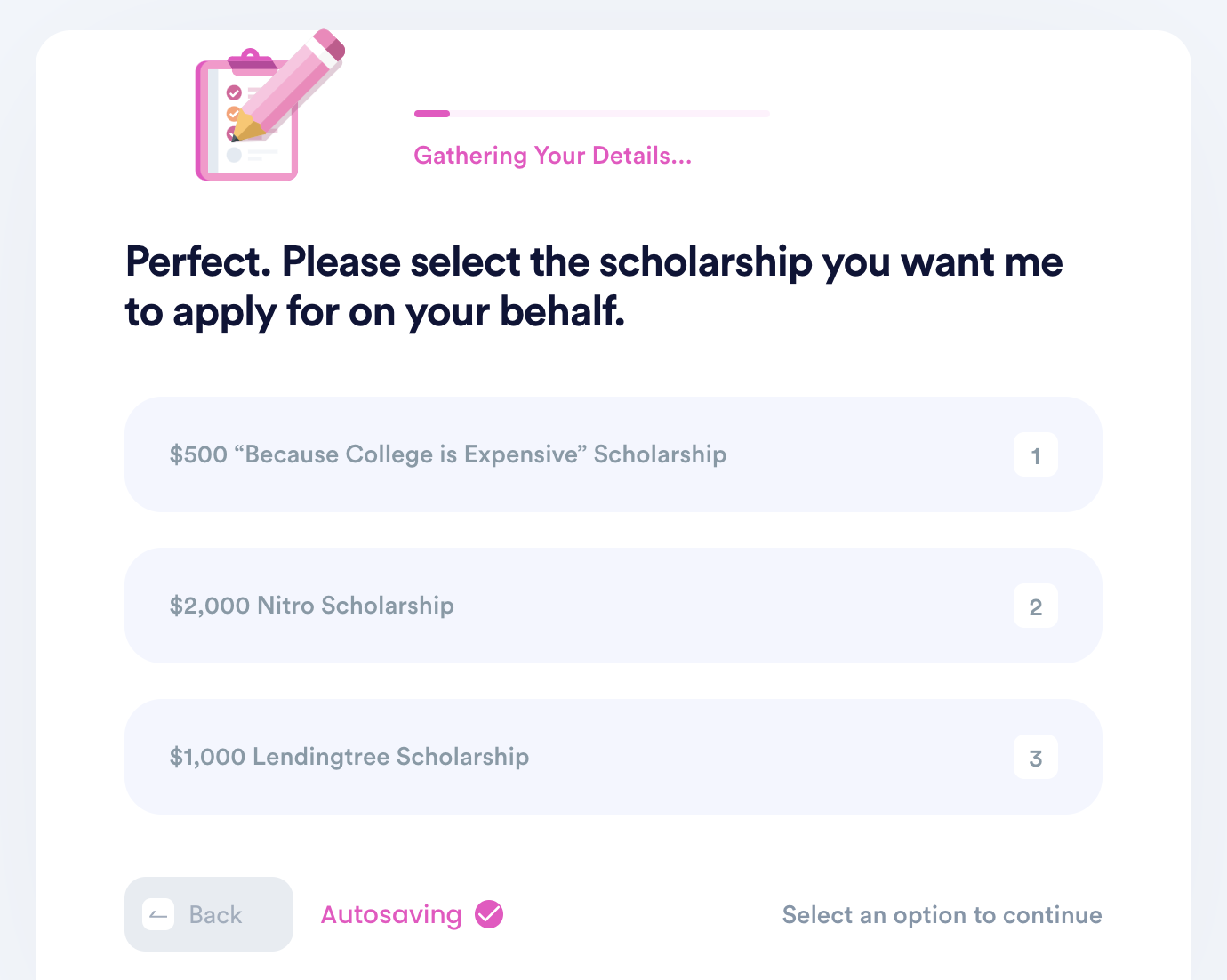

Don’t miss out on amazing opportunities to fund your education for any reason. DoNotPay can help you find and apply for scholarships in less than five minutes. All you need to do is:

- Search the term Scholarships and click on the Apply for Scholarships product

- Enter the required information

DoNotPay will use the information you provide to generate a personalized list of scholarships that you qualify for. We can also submit the applications for the no-essay scholarships on your behalf immediately.

If you have any questions on other scholarship topics, like recommendation letters and scholarship essays, DoNotPay has the resources to help you.

Explore DoNotPay’s Product Range

Are you looking for additional assistance from our app? We’re happy to inform you that DoNotPay provides you with a number of useful tools that you can use to complete mundane tasks in the blink of an eye! Sign up for our app and let us help you get:

- Free trials with no hidden charges

- Complaint letters to send to your noisy neighbors

- Copyright protection

- Personalized documents

- Tourist visas for any country

- Virtual credit cards

- College fee waivers

- Gift card cash back in any U.S. state

- Late, lost, or damaged delivery refunds

- Passport photos at home

- Sweepstake or giveaway entries

DoNotPay Resolves Your Financial Issues in a Few Taps

You don’t have to struggle to figure out how to resolve financial problems yourself when you have our app at your disposal. In only a few clicks, you’ll be able to discover any unclaimed money under your name, submit insurance and warranty claims, or request compensation for delayed flights.

But that is not all! Lowering your utility bills, appealing parking tickets, or canceling memberships and subscriptions is also something you can do in no time and with minimum effort if you use DoNotPay! Work smarter, not harder!