Should I Close My Bank Account Prior to Filing Bankruptcy?

There are specific rules that need to be followed when you are planning to file for bankruptcy. Read on to learn if is a good idea.

Bankruptcy can be a painful subject. You feel like you are giving up. In reality, you are giving yourself a fresh start to building your credit and getting rid of the old debt that you cannot afford to pay. In these trying times, there is no shame in filing for bankruptcy, but it will go a lot smoother if you know the rules of bankruptcy in advance. If the courts see any activities that they believe go against the rules in divulging all of your assets and liabilities, your bankruptcy can be denied.

When preparing to file for bankruptcy, it is often recommended that you close your bank account and open a new one somewhere else.

The bankruptcy trustee will be looking at your bank balance when you file and before your discharge is finalized. They will be looking for evidence that you may be hiding money or assets from your assigned trustee. You should not close retirement accounts as those are usually exempt from your bankruptcy discharge.

If you are concerned about protecting accounts that are exempt from bankruptcy actions, DoNotPay can help.

Your Bank Account and Bankruptcy

There are good reasons to close your bank account before filing for bankruptcy.

When your bankruptcy begins, the administrator who is appointed by the courts will look at your bank balance. It is their job to pay off what bills can be paid from whatever you have. Any money that comes in after that first look, will be applied to your creditors.

When the courts notify the banks and your creditors that you have filed for bankruptcy, things can change quickly.

There is always a chance that when you begin bankruptcy proceedings you run the risk of having your bank account locked. This is most common when you have a bank account that is attached to a mortgage or car loan, credit cards, etc. This bank account will be impossible to close, and any chance you have of keeping your home or your car is dependent on this account remaining open.

You can learn a lot about bank accounts and when you visit DoNotPay.

Other bank accounts that are in good standing should be closed before you file. You can open a new account during the process of your bankruptcy as long as you report it to the courts. Any and all accounts, whether debts or credits, must be reported.

Can a Bank Refuse to Close My Account?

A bank can refuse to close your account in a few situations. Your bank can refuse to close your account if you have:

- An overdraft in your account balance

- Owe property or money for another type of loan with them.

- Owe fees or any other money to the bank.

- If you are trying to close the account of a relative who has died without a will unless you have appropriate documentation.

If your bank is refusing to close your account, you can learn more DoNotPay

What Happens to My Money if I Close My Bank Account?

Money that belongs to you cannot be held from you when you close your bank account.

Barring any fines or fees due to the bank, you will receive your money back from the bank. If you are able to close your account in person, you will not have to wait for your funds. If you close your account by another method, you will receive your money in the form of a check mailed to your home.

How to Close My Bank Account

There are several different ways to close your bank account

Close Your Account in Person

You can choose to close your account in person all you have to do is:

- Go to your local bank branch.

- Stand in line.

- Tell the teller you want to close your bank account.

- Teller stares at her screen while checking your account.

- Teller calls the manager for a second opinion.

- The manager checks your account.

- The manager approves you closing your account.

- You receive your funds and sign off on closing your account.

Close Your Account By Mail

If for some reason you want to close your account by mail you can:

- Write a letter to your bank requesting to close your bank account.

- Print out your letter and put it in an envelope.

- Stamp the envelope.

- Go to the post office and mail your letter to the bank.

- Wait for the bank to approve your request.

- Wait for your check to arrive in the mail.

Close Your Account Over the Phone

You can also choose to close your account by phone by:

- Call your bank's customer service line.

- Enter your account number and PIN

- Listen to balance and activity.

- Wait for the menu to give you options.

- Request a live customer service agent.

- Argue with the recorded voice telling them you want to speak to a human.

- Wait on hold and hope the system sends you to the right person.

- An agent comes on the line and asks you to verify your identity.

- Tell the agent that you want to close your account.

- Wait while the agent looks over your account.

- Wait while the agent summons the manager to double-check your account.

- Repeat to the manager that you want to close your account.

- Manager approves account closure.

- Confirm your mailing address and other information.

- Wait for your check to come in the mail.

Close Your Account Online

If you can’t go to your bank you can close your account online:

- Open your online banking access.

- Log in to your account.

- Double-check your password and enter login information again.

- Search the site for a link to close your account.

- Wait for confirmation that the account is eligible to be closed.

- Confirm your mailing address.

- Wait for the check to arrive in the mail.

Next Steps if I Can't Close My Bank Account on my own

If you are unable to close your bank account on your own, consider getting help from DoNotPay.

If you are unable to close your account in person, your choices are limited as to how to get it closed. An easy option is to go to DoNotPay and get help.

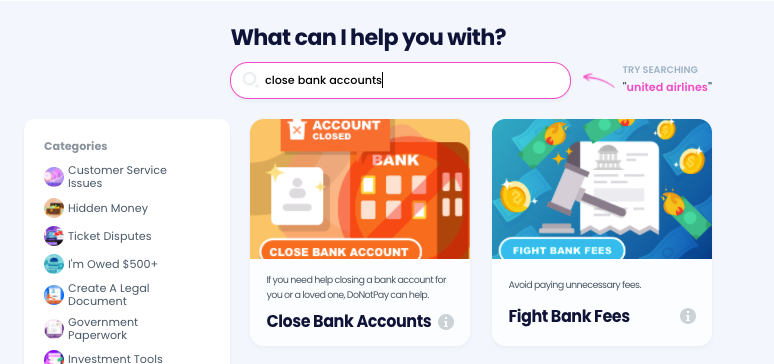

Close Your Bank Account With DoNotPay

Close your account the easy way with

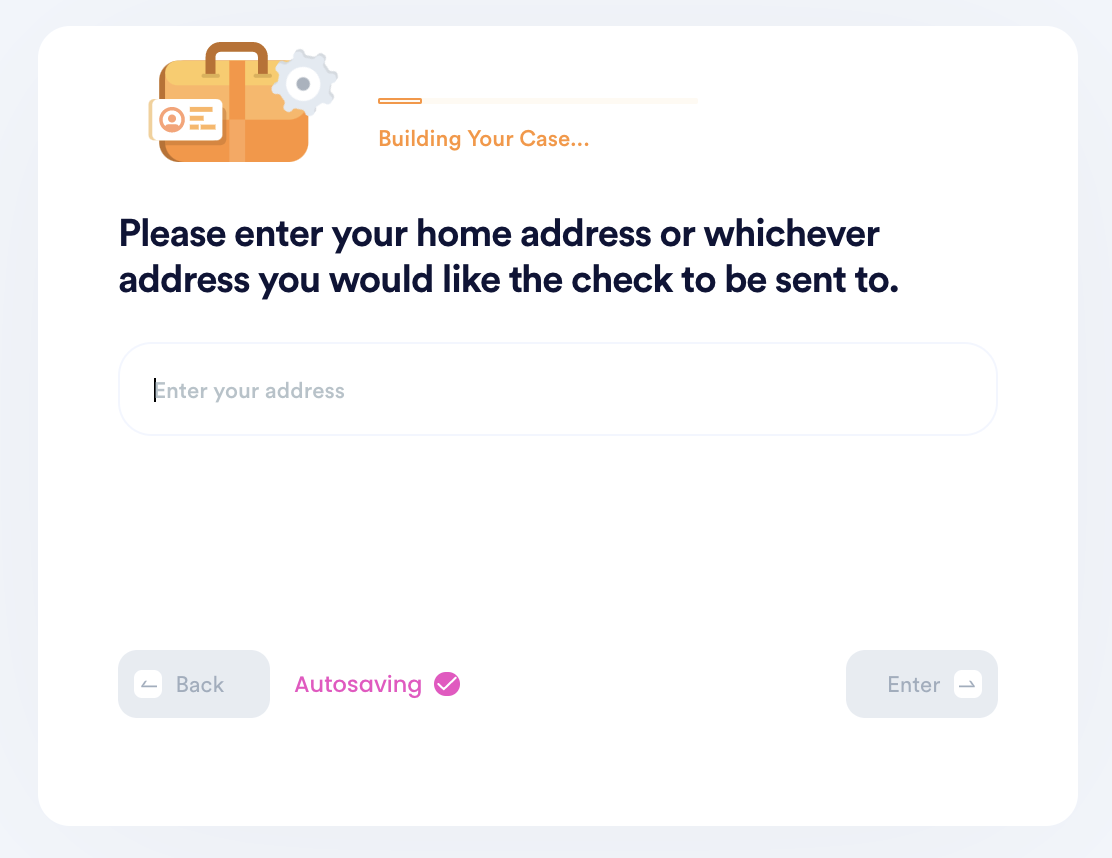

If you want to Quickly/Easily Close your Bank Account but don't know where to start, DoNotPay has you covered. Create your own cancellation letter in 6 easy steps:

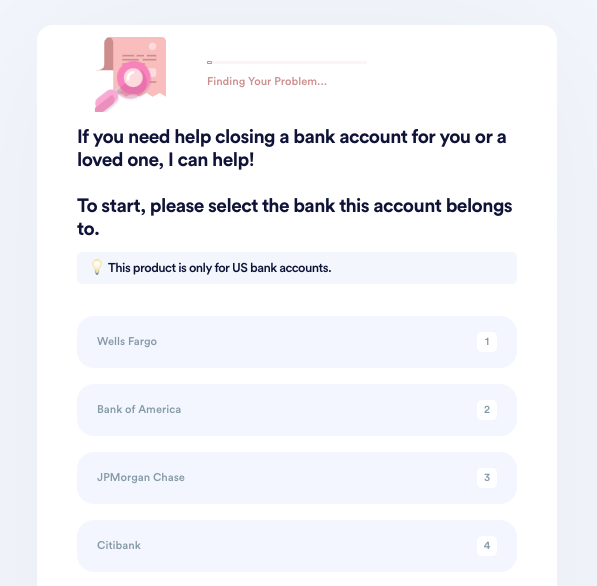

- Go to the Close Bank Accounts product on DoNotPay.

- Select which bank the account was opened under, and enter the account type, account number, and your local branch location.

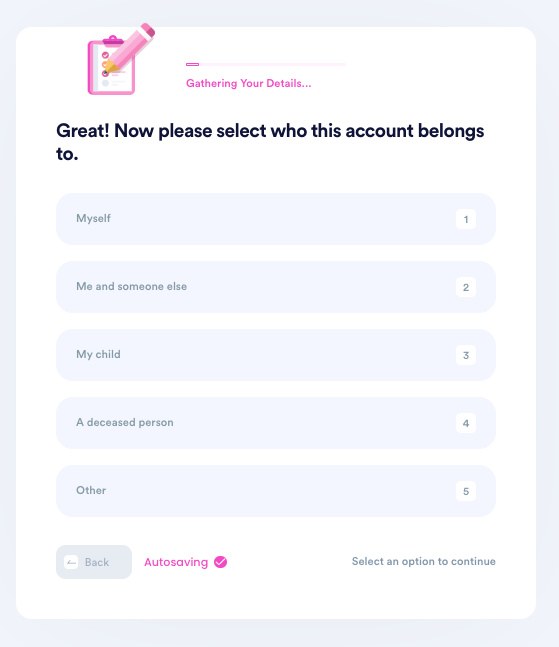

- Indicate who this account belongs to. If the owner or co-owner has passed away, upload a death certificate or other formal evidence. If you are not the original account owner, upload evidence of your relationship with the owner.

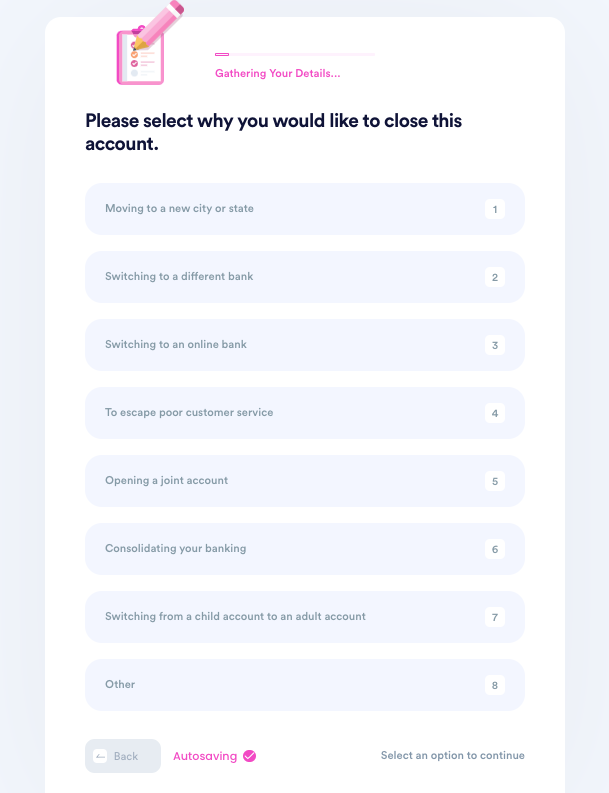

- Tell us why you need to close this account.

- Enter your contact information, including email, phone number, and the address you want any remaining funds to be sent to.

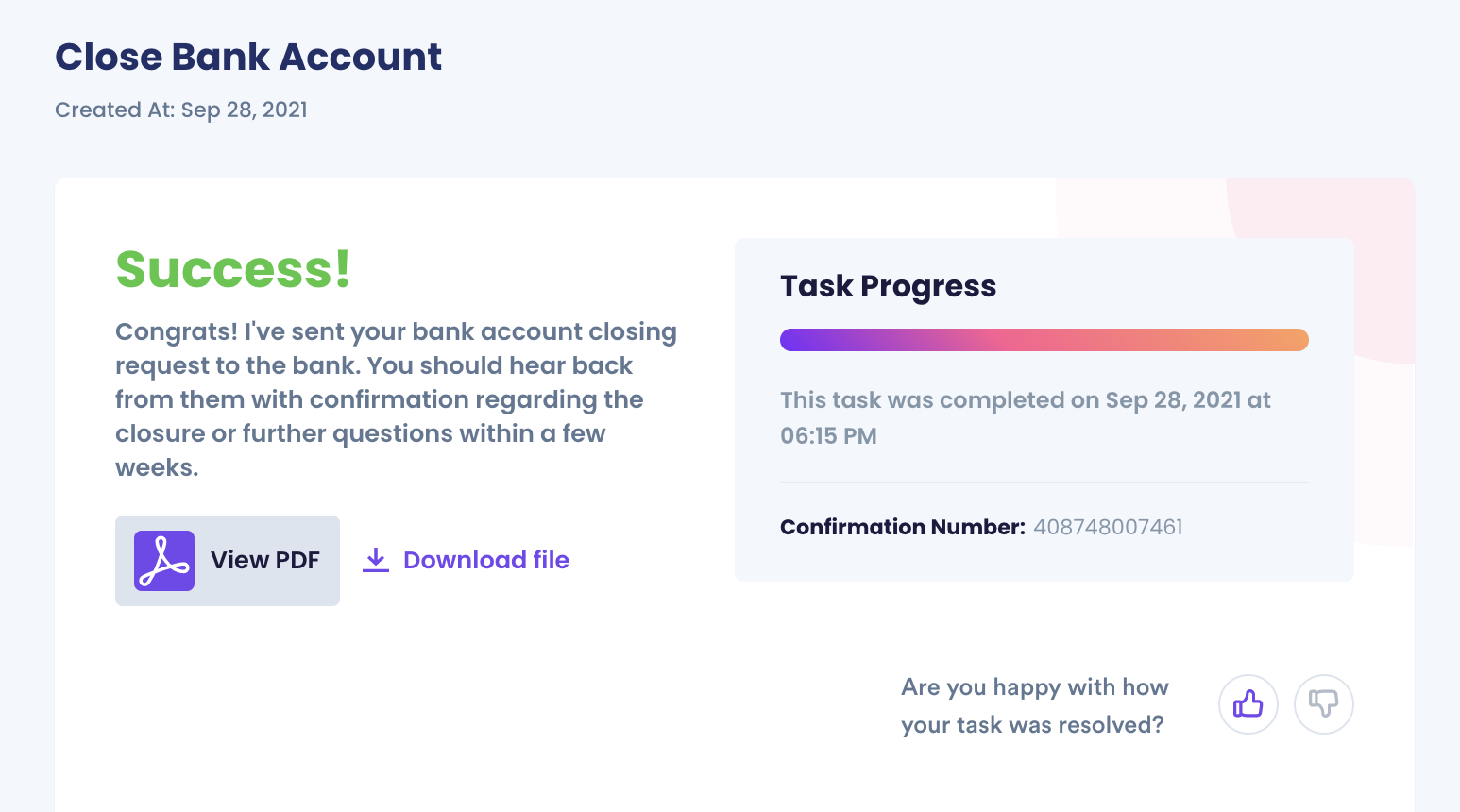

- Submit your task! DoNotPay will mail the request letter on your behalf. You should hear back from the bank with confirmation or a request for more information within a few weeks.

Why Use DoNotPay to Close Your Bank Account Before Bankruptcy

When you need to close your bank account, DoNotPay is always your most convenient and trustworthy option.

| Fast | DoNotPay will get your bank account closure started with a click of a button. |

| Easy | Just answer a few questions about your account, your mailing address, and the reason you are closing your account. |

| Successful | DoNotPay will generate a request letter for your bank and mail it to you. You should receive a check with the balance from your account in a timely fashion. |

DoNotPay Offers Help With a Variety of Services

DoNotPay doesn't just offer help with your bank account. There are a number of services available in many different areas.

Some of the other services that DoNotPay can help you with include but are not limited to:

- Small Claims Court

- Parking tickets

- Reduce property taxes

- Help with bills

- Relief from Payday Loans

DoNotPay has solutions for all of your financial needs.

By

By