How to Close a Bank Account the Easy Way

The average person has more than three bank accounts, which means that they have several different monthly statements as well as several different bank fees per month. In order to lower these fees and save money, one of the best things is to close your bank account. However, this isn't always easy to get done.

Different banks have different requirements in order to . These requirements can be as complicated and arbitrary as "you must wait six months between closing and reopening an account", or as simple as needing to open another account first. This guide will walk you through the basic steps of how to close your bank account like a pro.

DoNotPay can help you save time and aggravation by making bank account closures quick and easy.

Reasons to Close a Bank Account

There are many reasons why you would want to close your bank account, with the most obvious being that it's just taking up space. Some other reasons to close a bank account are

- You have an account that has been inactive for a long period of time;

- Your bank is charging you excessive fees for something, such as low balance fees or stops payment fees;

- You want to switch banks, but your new bank doesn't allow you to transfer existing accounts without closing the old one first;

- You are using multiple bank accounts to split up different types of transactions but don't need all accounts anymore.

How Do I Close a Bank Account?

There are three ways to close a bank account. You can call the bank and ask them to close your account over the phone. You can write a letter to the bank, asking for them to close your account. You can go into the bank and ask them to close your account in person.

| Close Your Bank Account by Phone | To close your bank account by phone, simply call the number on the back of your bank card. A representative should be able to help you get everything set up over the phone. Some banks require you to make a request in writing before they agree to let you close your account, while others will do it right away even without written notice. |

| Close Your Bank Account by Mail | If you do not want to go into the bank, then writing a letter is another option for closing your account. However, you must send this letter to the right department or person at your bank. You can find their address online through customer service, via an internet search, or through your bank's website. Let them know that you would like to close the account and ask if there is anything else you will need to do, such as transfer money to another account first or wait a certain period of time before opening a new account at their institution. |

| Close Your Bank Account in Person | If you want to keep things extra simple, then closing your account in person is probably the best option. If you have a checking or savings account, you can go to your bank and ask a representative to close these accounts for you. However, if you have a credit card with them as well, then it is always better to close this card on its own first before closing the account. |

How Long Does It Take To Close a Bank Account?

It varies from bank to bank. Some banks allow you to , while others can take several days or even weeks to get it closed. There is no set timeline for how long it takes for an account to close, because every person and situation is different. The best way that you can ensure that your account will close as quickly as possible is by making the request in writing and including any supporting documents such as the following:

- Driver’s license

- Copy of your passport

- Bank statement (that shows your account number)

- Account card

What Do I Do if I'm Getting Pushback From My Bank?

If you are trying to close a credit card or any other type of account, you may run into some pushback after explaining your reasoning. Banks do not always want to close accounts because they want to reduce the amount of money that they owe in taxes because their customer base has dropped. They also don’t like it when a customer for so many years closes their account. However, they have to abide by your request if you are the account owner. If they continue to give you a hard time, then ask for their manager or someone else higher up on the food chain.

What Are the Consequences of Closing My Bank Account?

There are a few different consequences of closing your bank account. If you have shared accounts, such as a joint checking or savings account with someone else, then both of you must agree to close the account before it can be done. This is because these types of accounts require both parties' consent before they can be closed completely.

If you have a credit card with your bank, then canceling this can hurt your credit score in the short term because it shows up on your credit report. Canceling any type of account may also affect other lines of credit or loans that you have with this bank, such as a mortgage or auto loan. If you are closing your account to move to another financial institution so that you can take advantage of their savings accounts or credit cards instead, then make sure that you open a new account elsewhere before closing the old one.

Is There an Easier Way to Close a Bank Account?

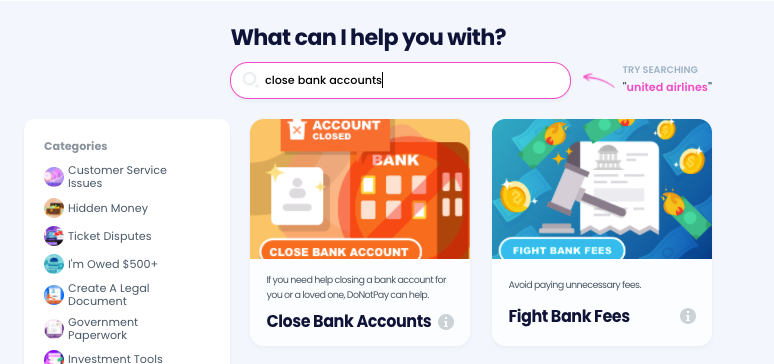

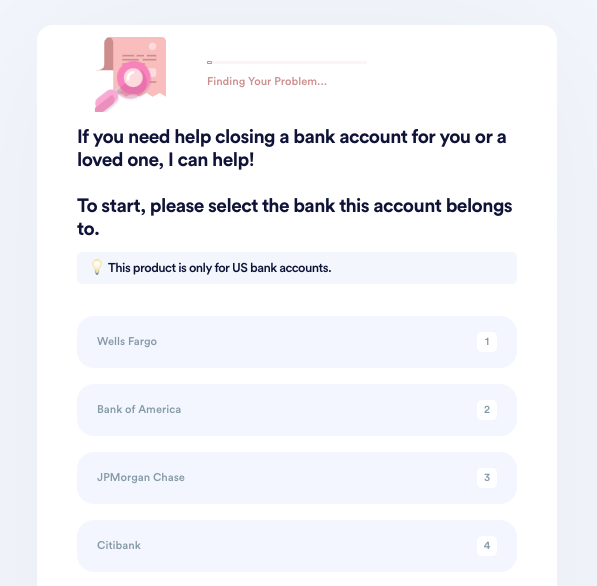

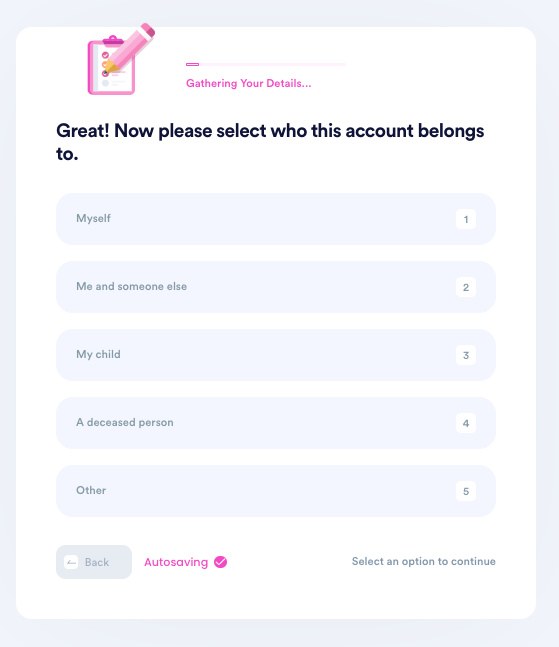

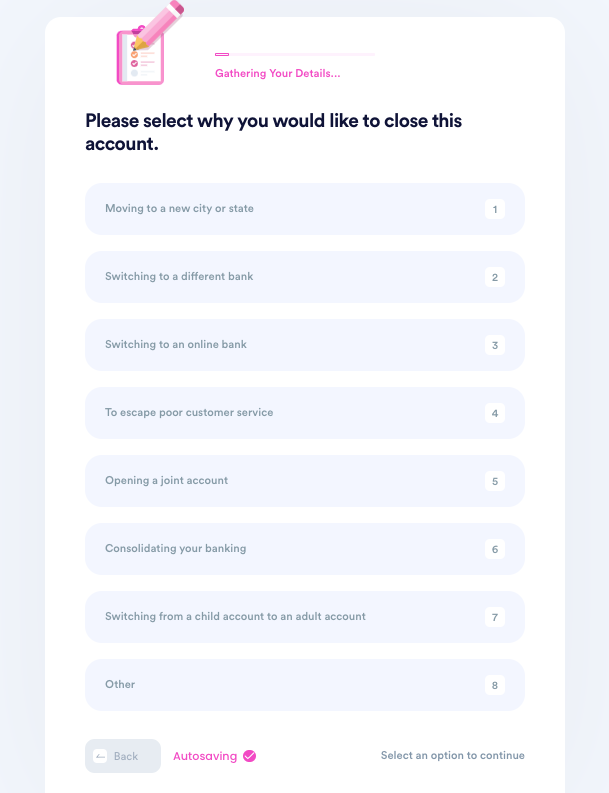

If you need help closing a bank account for yourself or a loved one but don't have the time to do so, simply use DoNotPay! We have you covered in 6 easy steps, all you have to do is:

- Go to the Close Bank Accounts product on DoNotPay.

- Select which bank the account was opened under, and enter the account type, account number, and your local branch location.

- Indicate who this account belongs to. If the owner or co-owner has passed away, upload a death certificate or other formal evidence. If you are not the original account owner, upload evidence of your relationship with the owner.

- Tell us why you need to close this account.

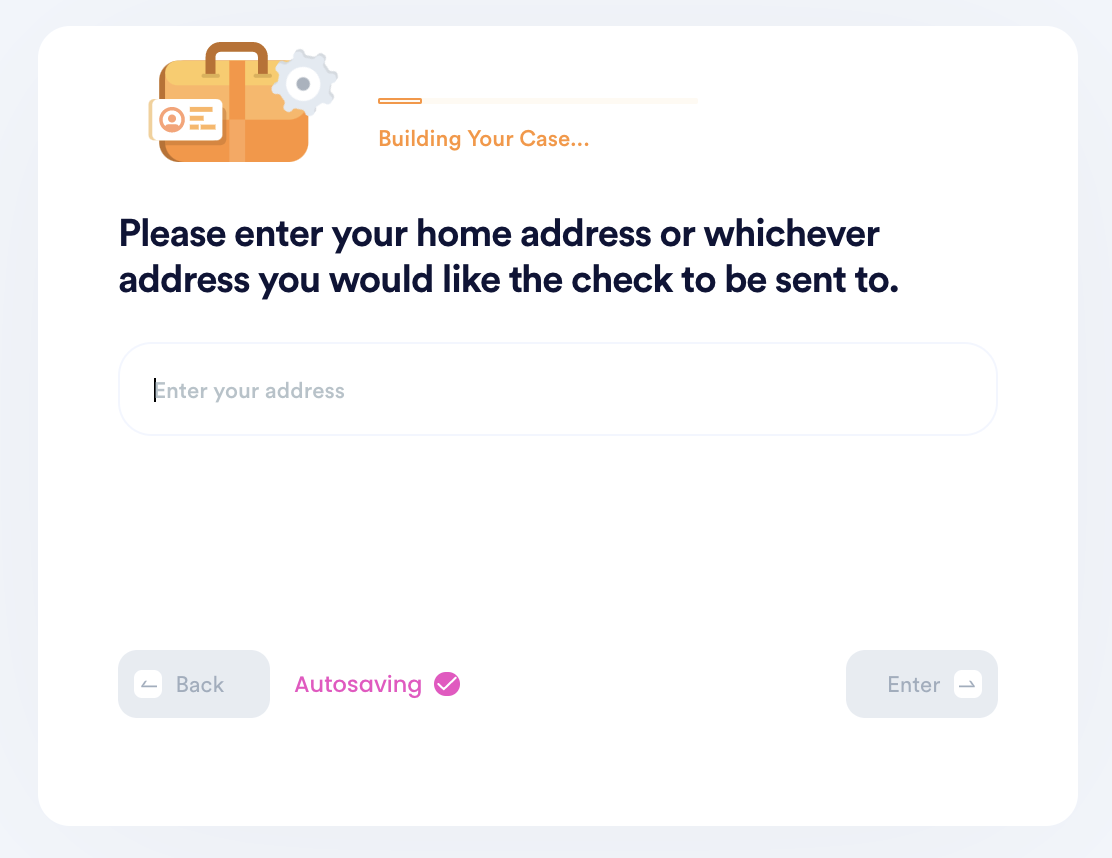

- Enter your contact information, including email, phone number, and the address you want any remaining funds to be sent to.

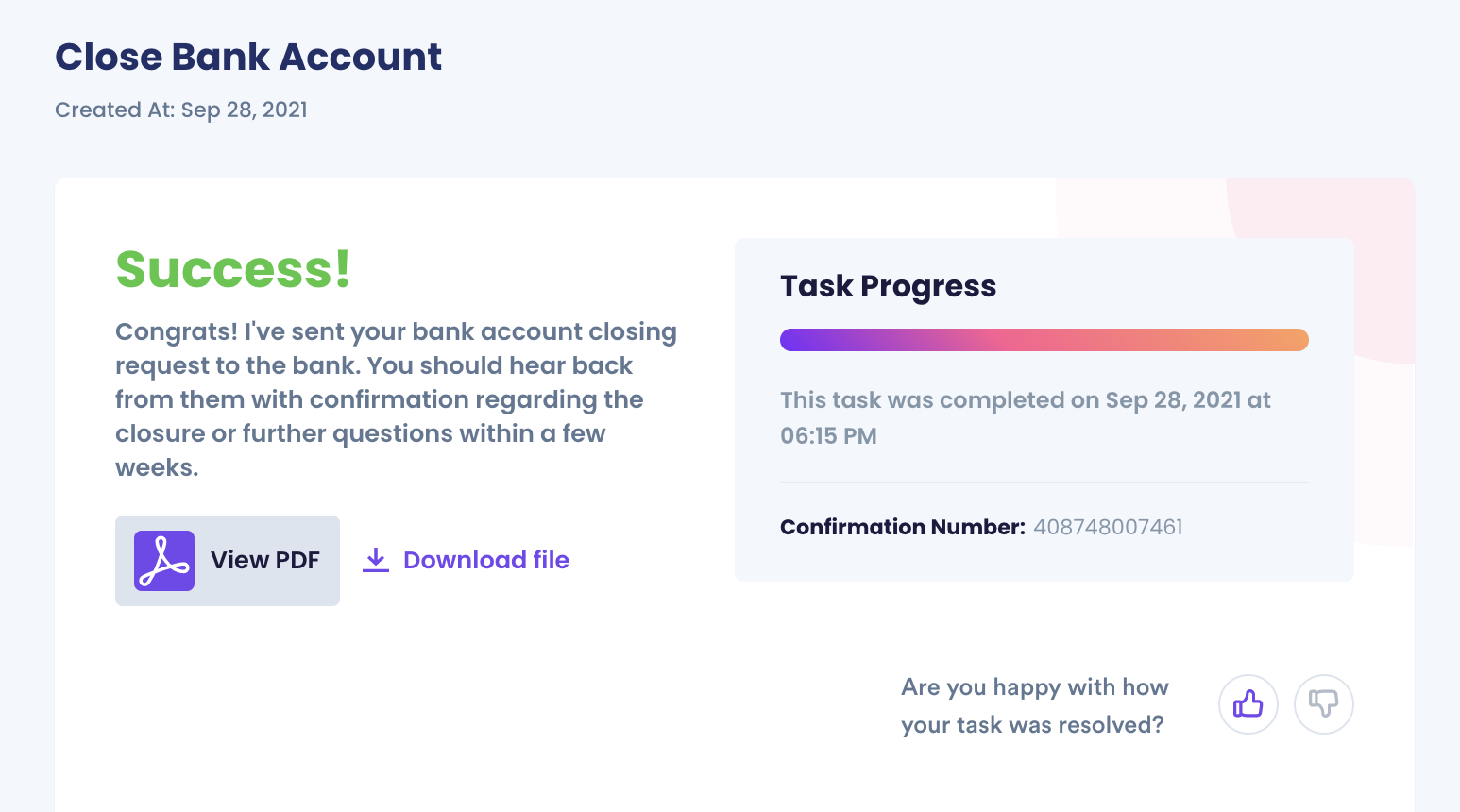

- Submit your task! DoNotPay will mail the request letter on your behalf. You should hear back from the bank with confirmation or a request for more information within a few weeks.

Why Use DoNotPay to Close a Bank Account?

DoNotPay makes closing a bank account simple by guiding you through the cancellation process. This makes it easier for you to get the job done and move on with your life.

You don't have to spend hours trying to figure out some complicated issue. They will do the legwork for you by drawing information from banks all around the country so that you can get exactly what you need in a timely manner.

What Else Can DoNotPay Do?

DoNotPay can help with a wide range of automated tasks besides closing a bank account:

- Request refunds from popular services such as Uber Eats, VRBO, or Zelle.

- Appeal a parking ticket in any city.

- Find financial aid and request application fee waivers for college.

- Compare and apply for virtual credit cards.

- Appeal account bans on services throughout the internet.

So, if you need assistance with closing a bank account (or any other tasks) DoNotPay has you covered. Get started today!

By

By