A Guide to Closing a Bank Account After Death With No Will

Have you ever tried to close the bank account of someone who passed away? We all go through emotional times when a loved one dies. But the stress seems unbearable when you try .

Closing a bank account for a deceased person that didn’t leave a will is a lengthy process. You will need a notarized letter of instruction to close their account. Remember, banks are pretty strict with their requirements. So, there's no way you can skip any of the steps. If you need help with closing a deceased person’s bank account with no stress, DoNotPay can help.

What Happens to Bank Accounts if a Person Passes, but There Is No Will?

If a person passes away but does not leave a will, the state appoints an executor to . The executor can access the money with authority from the state. And then distribute it to the deceased loved ones.

What happens if the deceased named no beneficiary in the account? If so, a relative must seek authorization from the probate court to close the account.

How to Get a Grant of Probate

No matter the amount of money in the bank account, the bank always wants a probate letter. A grant document from the judge makes you the sole executor of the estate. With that, you have the right to close the deceased person’s bank account. Meanwhile, the state's laws decide who gets the money.

To get a probate letter, follow these steps:

- Apply to the probate registry.

- Fill out the appropriate forms.

- Settle any outstanding taxes.

- Attend the interview at the probate registry's office.

- Swear under oath to verify your identity.

This process can be long and stressful even if you know each action to take. So what do you do? Contact a reliable agency like DoNotPay to file the request for you. DoNotPay will request the probate grant on your behalf to make the process simpler.

Which Documents are Needed to Close the Bank Account?

Documents to present to the bank or probate court must show your relationship to the owner. These are:

- Valid ID

- Certificate of death

- Deceased name

- Deceased account number

- Social security number

How Do You Close the Bank Account of an Estate?

If you have court paperwork, how do you close a bank account of an estate? Your relationship to the deceased determines your line of action. The following factors affect the steps you take to close the bank account:

| Parties to the account | If you're a joint owner, in many situations, you also own the account. Therefore, you can close it. |

| Beneficiaries or POD | If a bank account owner dies without a will, the funds go to the beneficiary or POD named in the account. But the situation becomes complicated when the deceased has no beneficiary.

So, what does the POD need to close a bank account? You will need to do the following:

|

| Power of Attorney | Power of attorney ceases when the owner dies. That means you cannot access or close their bank account. All the power of attorney needs is a confirmation by a probate judge as executor of the estate. To close the account, you must provide the following documents to the bank:

|

How to Close the Bank Account Using DoNotPay

Not everyone can endure the tiring steps of accessing money from a deceased person’s bank account. If you want to close their bank account but don't know where to start, DoNotPay has you covered.

Create your own cancellation letter in 6 easy steps:

- Go to the Close Bank Accounts product on DoNotPay.

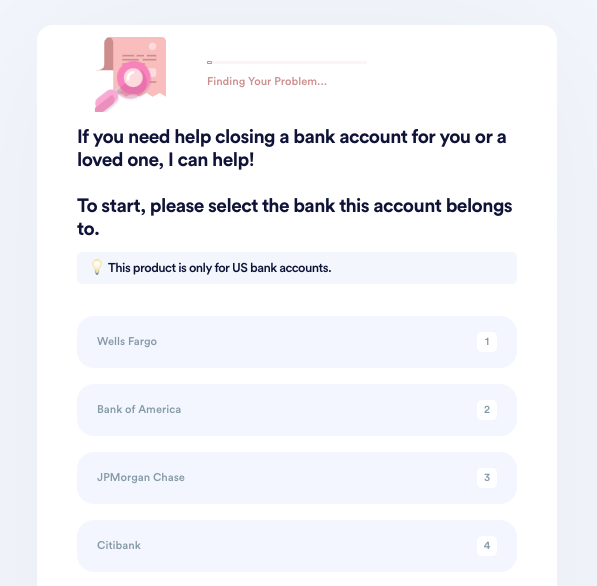

- Select which bank the account was opened under, and enter the account type, account number, and your local branch location.

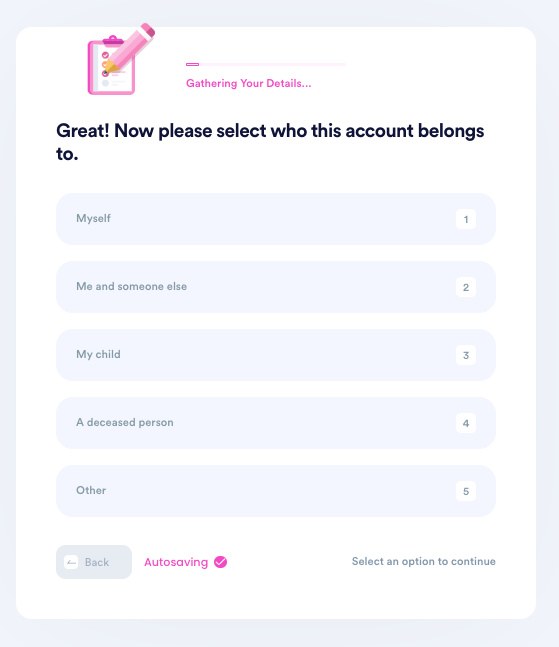

- Indicate who this account belongs to. If the owner or co-owner has passed away, upload a death certificate or other formal evidence. If you are not the original account owner, upload evidence of your relationship to the owner.

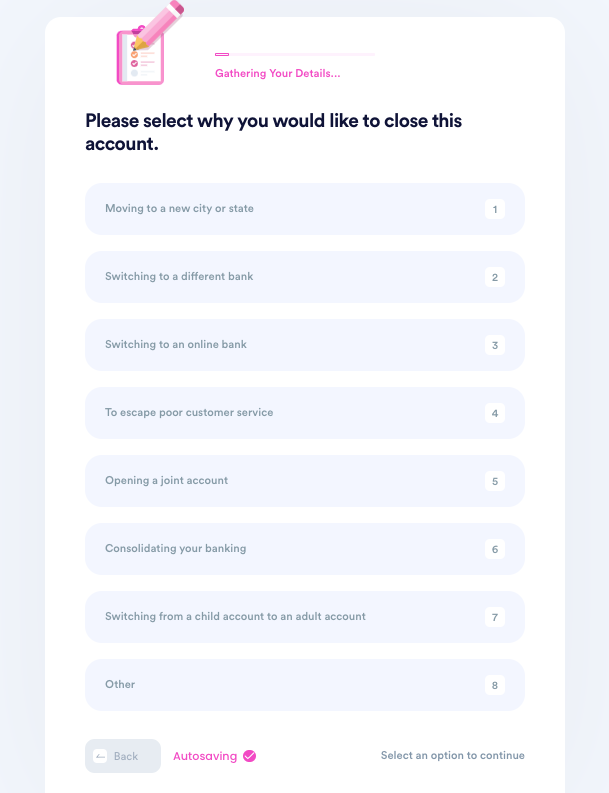

- Tell us why you need to close this account.

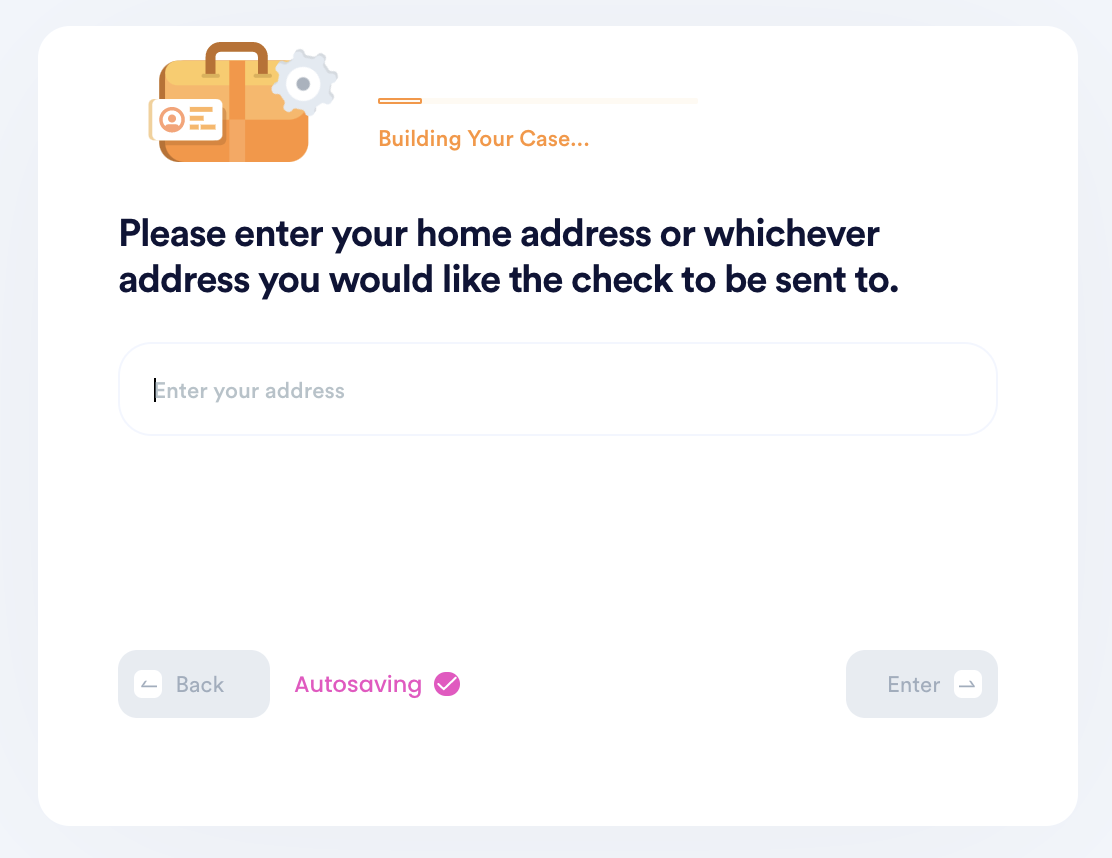

- Enter your contact information, including email, phone number, and the address you want any remaining funds to be sent to.

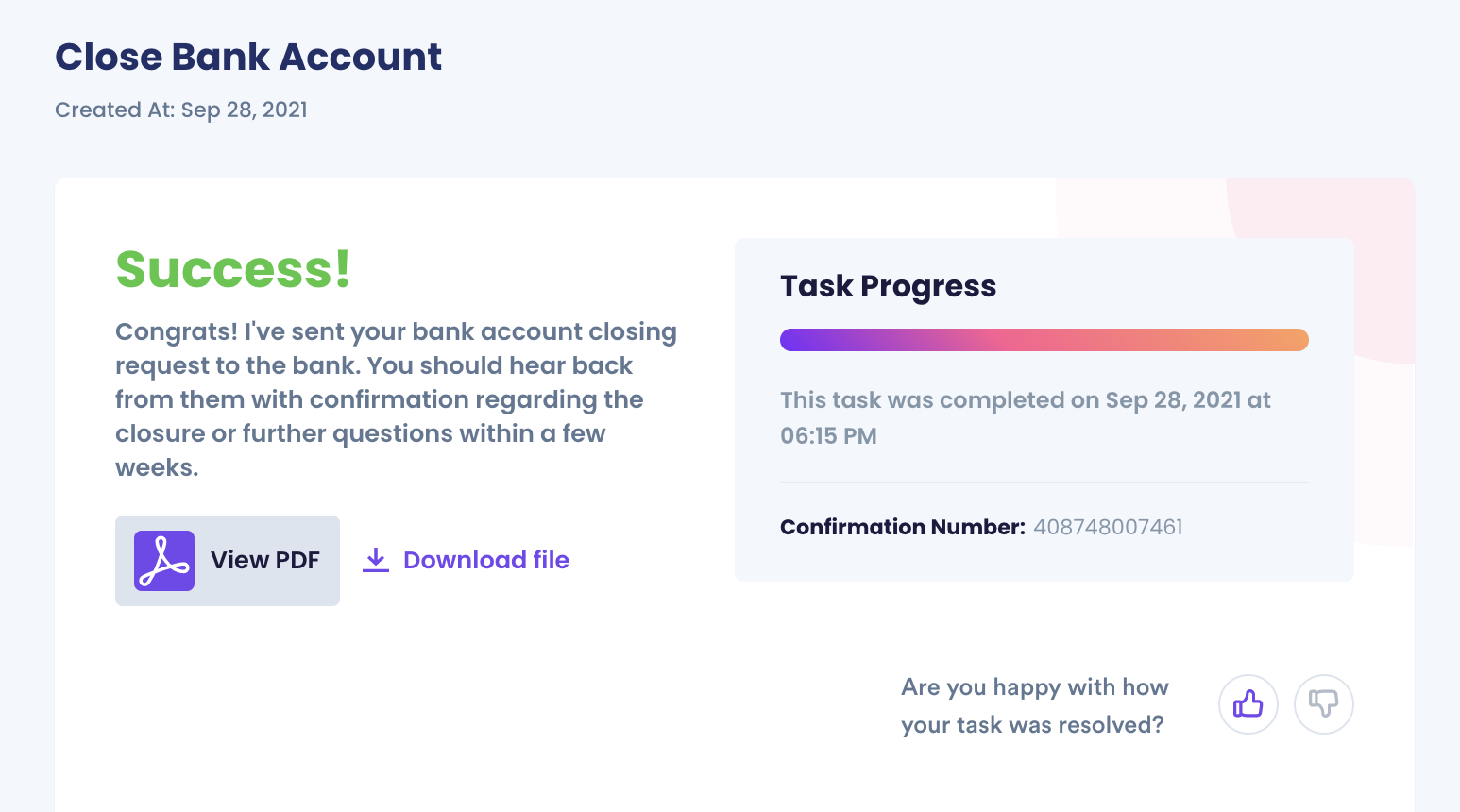

- Submit your task! DoNotPay will mail the request letter on your behalf. You should hear back from the bank with confirmation or a request for more information within a few weeks.

If you want to close the bank account of someone who passed away but didn’t leave a will, you're not alone. Many people lose hope or get discouraged when the bank’s demands become unbearable. Fortunately, DoNotPay is available to help.

We understand the stress you may go through if you want to close a deceased person’s bank account. But we can make your path shorter. DoNotPay is fast and reliable at helping you with closing a bank account.

Sign up now to get started with DoNotPay bank account closing services. They can provide you with assistance when it comes to:

- Closing a bank account such as Bank of America, Chase Bank, or PNC Bank.

- Closing your bank account without hurting your credit.

- Closing a time deposit account.

- A bank closing your account.

By

By