What You Can Do When the Bank Closes Your Account

The largest benefit of having a safe and stable bank account is that you can always rely on it when you need it. However, when the bank closes your account, all that security is abruptly taken away. There are a number of reasons that the bank may close your account, and they may not even be required to notify you. While having a bank close your account may be frustrating and have serious financial implications, there are some options available.

In the article below, we'll dive into the reasons that a , as well as what actions you may be able to take to recover your account or preemptively close your accounts easily before the bank can lock you out with the help of DoNotPay.

Reasons That a Bank May Close Your Account

A bank is a private institution, and though the government heavily regulates them, they have a lot of freedom in internal policies regarding account holders. While many banks will notify you if anything out of the ordinary happens with your account, not all will be so kind. There are many reasons that a , and what options you have available largely depends on why they've closed your account.

| Inactivity | If you have an account you hardly ever use, your bank may decide to close it for low activity. In most cases, this means little to no activity over at least a 3-year period, and the bank will typically attempt to contact you once they've made the decision to close up your account. In cases where you've moved and forgotten to close your old accounts, you may potentially miss out on any funds in the account if the bank can't contact you. This money goes to the state's unclaimed property division in many areas. |

| Suspicious Activity | A bank may close an account if they deem the current or recent activity in it particularly suspicious. "Suspicious" is a highly subjective criteria depending on bank policies and could include high-risk investments, sudden increases in spending, suspected identity theft, illegal or untraceable purchases or transfers.

In most of these cases, the bank will simply suspend the account, though you could easily end up with a closed account for any of these reasons due to internal bank policy. |

| Delinquency | If you have a balance below the minimum or even negative for too long, your bank can close the account. This can be particularly common with direct deposits and recurring bill payments, making it easy for some people to neglect to keep tabs on their accounts. Any overdraft fees or bounced check fees can also contribute to an overall negative balance and lead to the bank unexpectedly pulling the plug on your account. |

What Can You Do When the Bank Closes Your Account?

While your best course of action to deal with a closed bank account will vary depending on why the bank has closed your account and your bank's policies, in most circumstances, you should follow these steps after a bank has closed your account if you're unhappy with the account being closed.

- Contact your bank to see if you can get the most current statements of the account and an explanation on why it was closed.

- Reroute all direct deposits, recurring payments, or outstanding checks to another account.

- Compile all paperwork and records that you have regarding the recent history of the account.

- If you decide that you want the account open again after reviewing all information, contact the bank for the next steps or alternative accounts you can create if you decide that you want the account open again.

- If you feel like the bank isn't being fair in its practices, you can place a complaint with The Office of the Comptroller of the Currency.

Managing Your Bank Accounts to Prevent Account Closures

With direct deposits, recurring subscriptions, and electronic fund transfers these days, it sometimes feels like your account and its balance have a mind of their own. It can be much tougher to maintain touch with your account balances without constantly checking your account than it was when you could just balance your checkbook weekly. While the people adding and taking money from your account have machine-like precision, you're left to your own devices to keep up.

Luckily, this is where DoNotPay can simplify things by giving your own automated ally. As the world's first robotic lawyer, DoNotPay is amazing at filing complex forms and dealing with highly bureaucratic institutions like banks. DoNotPay can help you manage accounts and recurring payments, but most unexpected account closures are because an account that should've been closed already was just forgotten about. With DoNotPay, you can close accounts safely and conveniently with the click of a button, preventing the bank from getting in between you and your funds.

How to Close a Bank Account Properly and Transfer Funds Before the Bank Closes It Yourself With DoNotPay

If you hardly use an account anymore or think it's possible that the bank may close your account, it's always better to close it on your terms first. This allows you to prepare for the account being terminated and preemptively change any recurring deposits or payments from the account.

How to Quickly Close a Bank Account with DoNotPay:

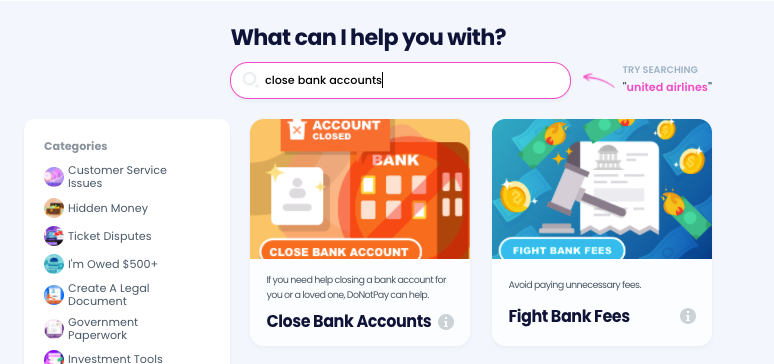

If you want to easily close a bank account before it can sit idle until the bank closes it but don't know where to start, DoNotPay has you covered. Create your own cancellation letter in 6 easy steps:

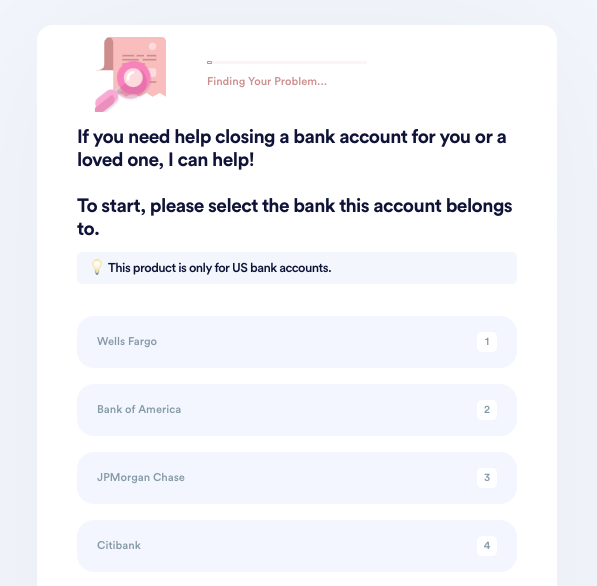

- Go to the Close Bank Accounts product on DoNotPay.

- Select which bank the account was opened under, and enter the account type, account number, and your local branch location.

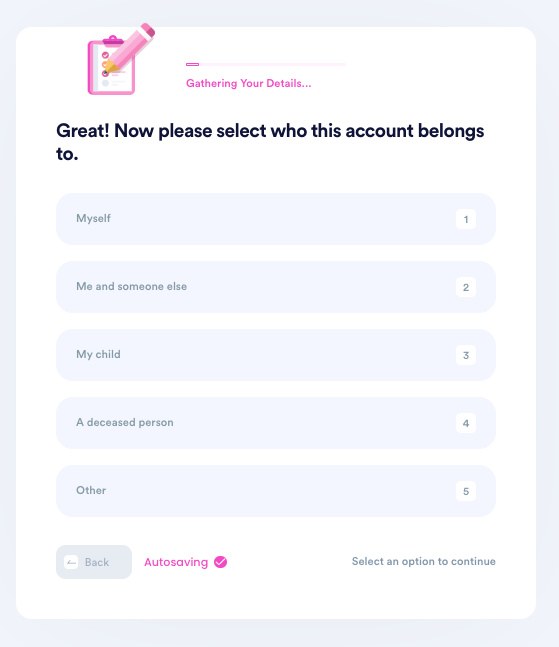

- Indicate who this account belongs to. If the owner or co-owner has passed away, upload a death certificate or other formal evidence. If you are not the original account owner, upload evidence of your relationship to the owner.

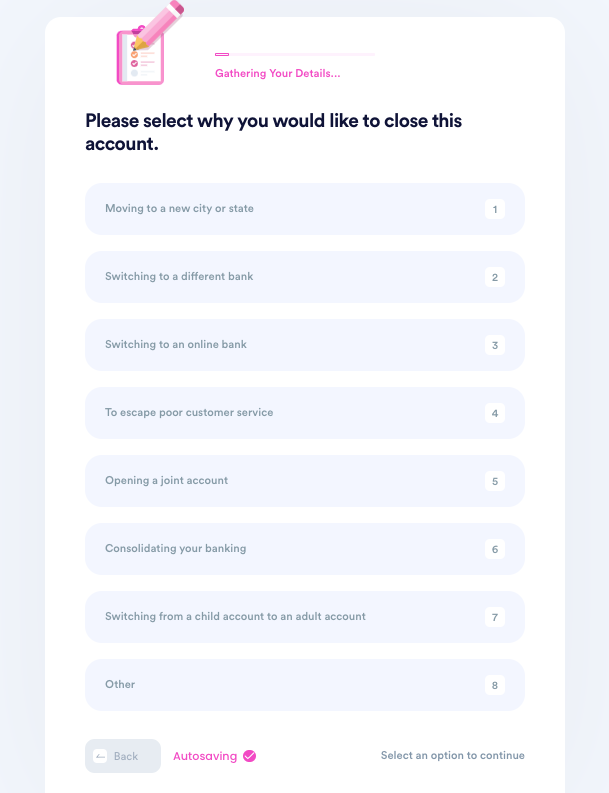

- Tell us why you need to close this account.

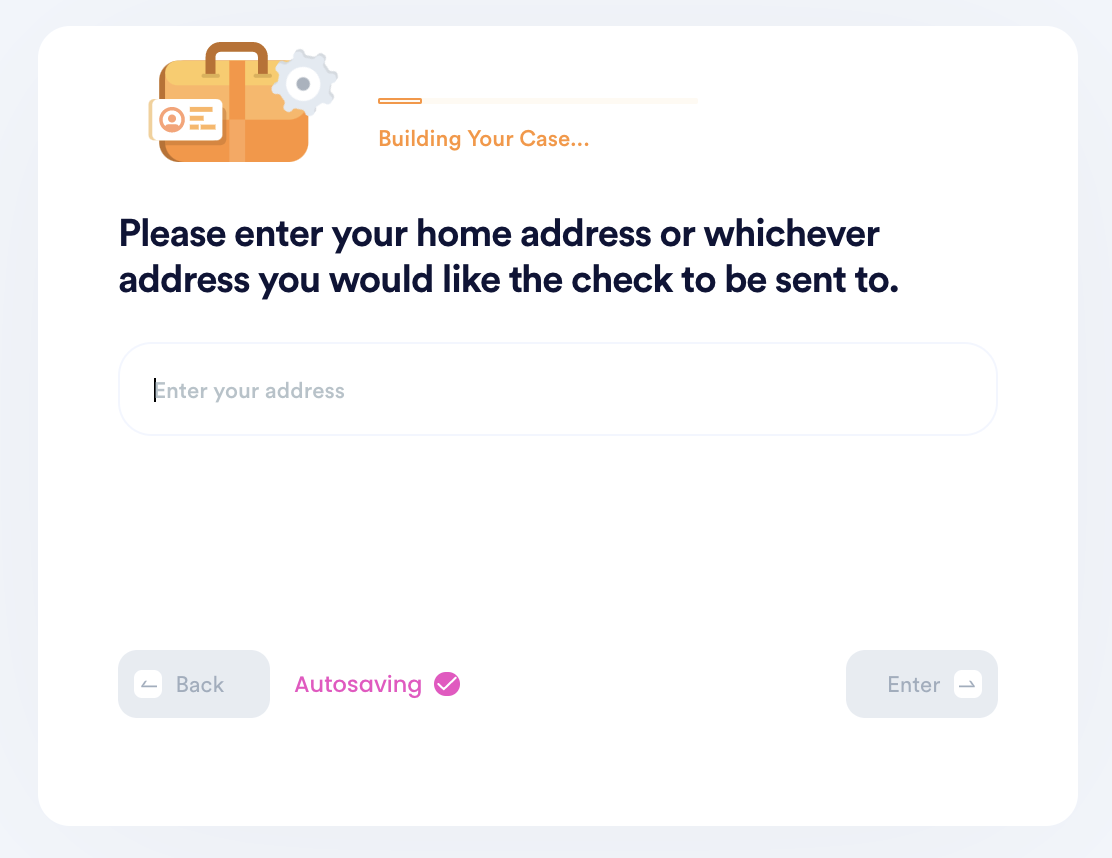

- Enter your contact information, including email, phone number, and the address you want any remaining funds to be sent to.

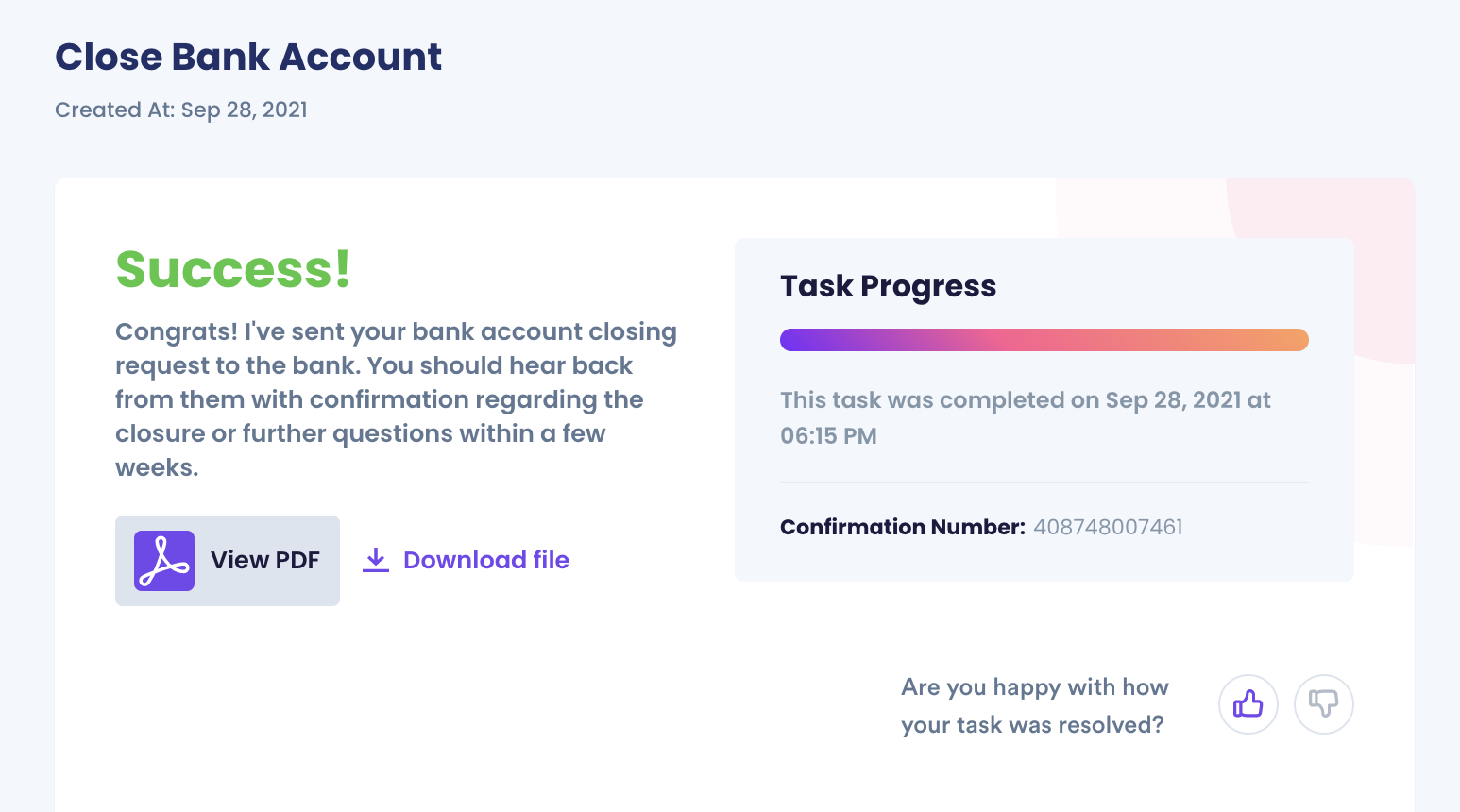

- Submit your task! DoNotPay will mail the request letter on your behalf. You should hear back from the bank with confirmation or a request for more information within a few weeks.

Why You Should Use DoNotPay When You Need to Close a Bank Account

Closing a bank account is a lot more complicated for you than it is for the bank. Drafting a letter of your intention to close your account, rerouting payments and deposits, and coordinating with bank staff can get extremely complicated and time-consuming, but with DoNotPay it's simple. With just a few clicks and a little information, DoNotPay will draft a letter and mail it to your bank to ensure that your account is closed when you want it to be, not when the bank wants it.

DoNotPay doesn't just help with closing bank accounts, though, they can help with all sorts of financial needs, such as:

- Paying recurring medical bills

- Managing bank accounts of loved ones after their death

- Utility bill payment

- Credit card management

- Cancel subscriptions or recurring payments

- Relocating or closing a current bank account

- and more!

What Else Can DoNotPay Help You Get Done?

DoNotPay isn't just for helping to manage your wallet, though, and pretty much any complex process is much easier to navigate with a AI Consumer Champion on your side. A few simple clicks could help you get so much done, including

- File lawsuits in small claims court

- Submit insurance claims

- Register trademarks

- Have documents notarized

- Reduce your property taxes

DoNotPay gives you the power of automation so that you don't waste your precious time filling out forms endlessly. To see what else DoNotPay can enable you to accomplish, visit today.

By

By