How to Close a Chase Bank Account the Easy Way

Chase Bank has a poor reputation with the Better Business Bureau (BBB) and other consumer advocate groups. If Chase is mistreating you, you want to right away. And the DoNotPay App can help.

This article explains how to with DoNotPay. But you can also use the app to close any bank account. Use it to close your Capital One accounts, US Bank accounts, and PNC accounts, too.

DoNotPay can help you manage your paperwork, such as allowing you to:

- Close bank accounts if someone has passed away

- Write a cancellation letter to a bank

- Close a time deposit account

The DoNotPay App is always the fastest and easiest way to cancel a Chase bank account, so let's start there.

How to Close a Chase Bank Account Using DoNotPay

It’s straightforward to close your Chase Bank Account using DoNotPay’s services. Just follow these simple steps:

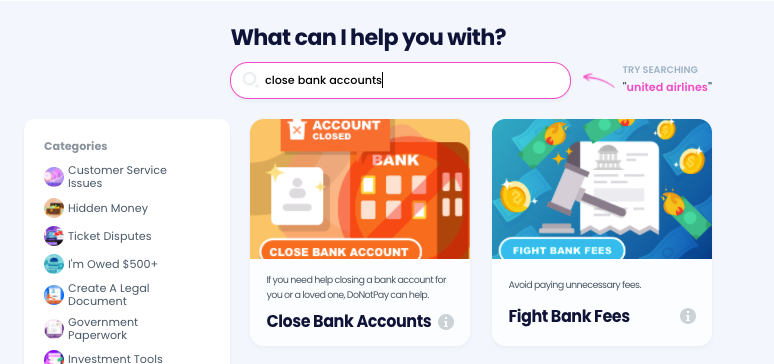

- Go to the Close Bank Accounts product on DoNotPay.

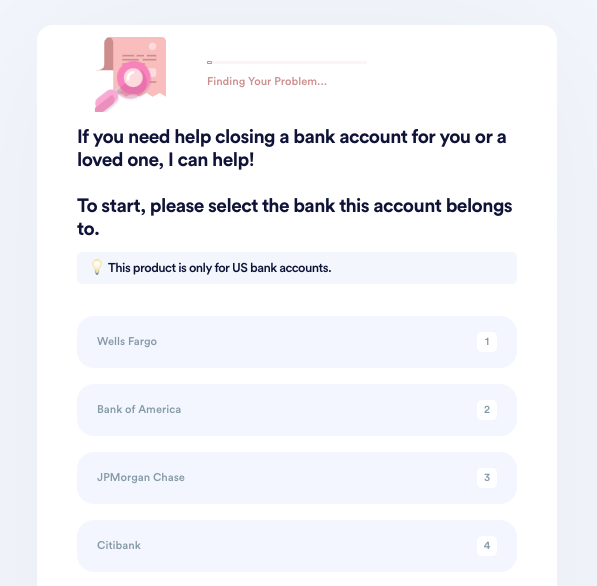

- Select which bank the account was opened under, and enter the account type, account number, and your local branch location.

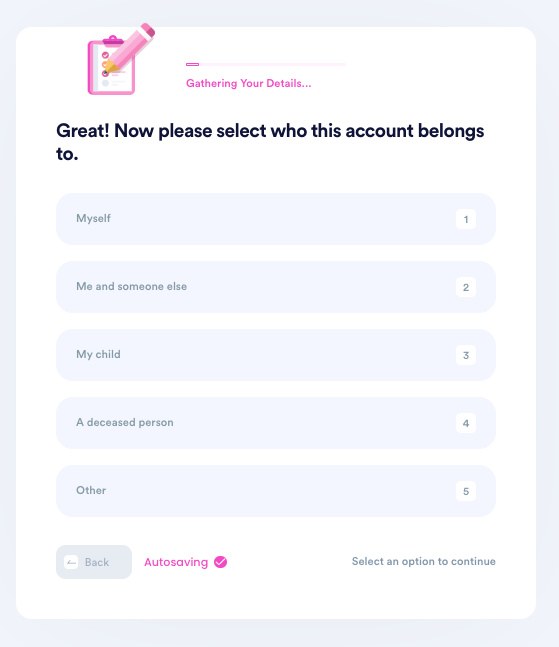

- Indicate who this account belongs to. If the owner or co-owner has passed away, upload a death certificate or other formal evidence. If you are not the original account owner, upload evidence of your relationship to the owner.

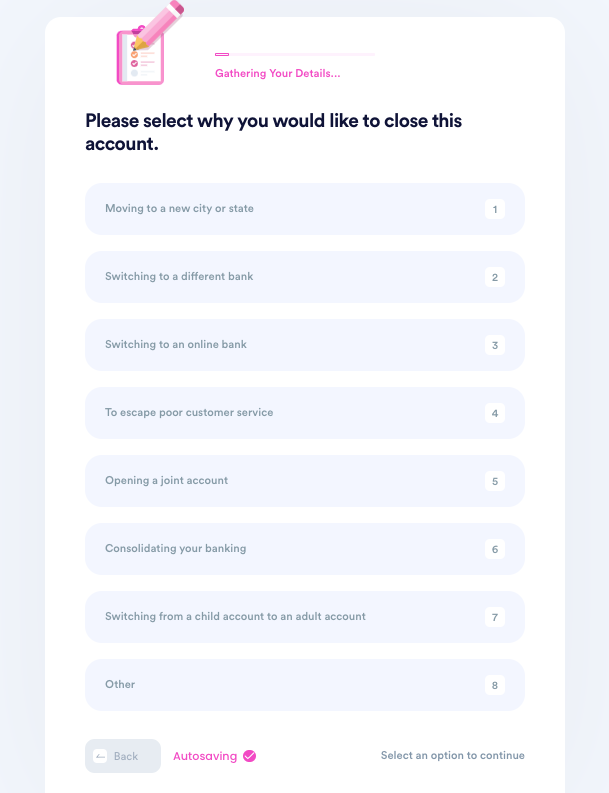

- Tell us why you need to close this account.

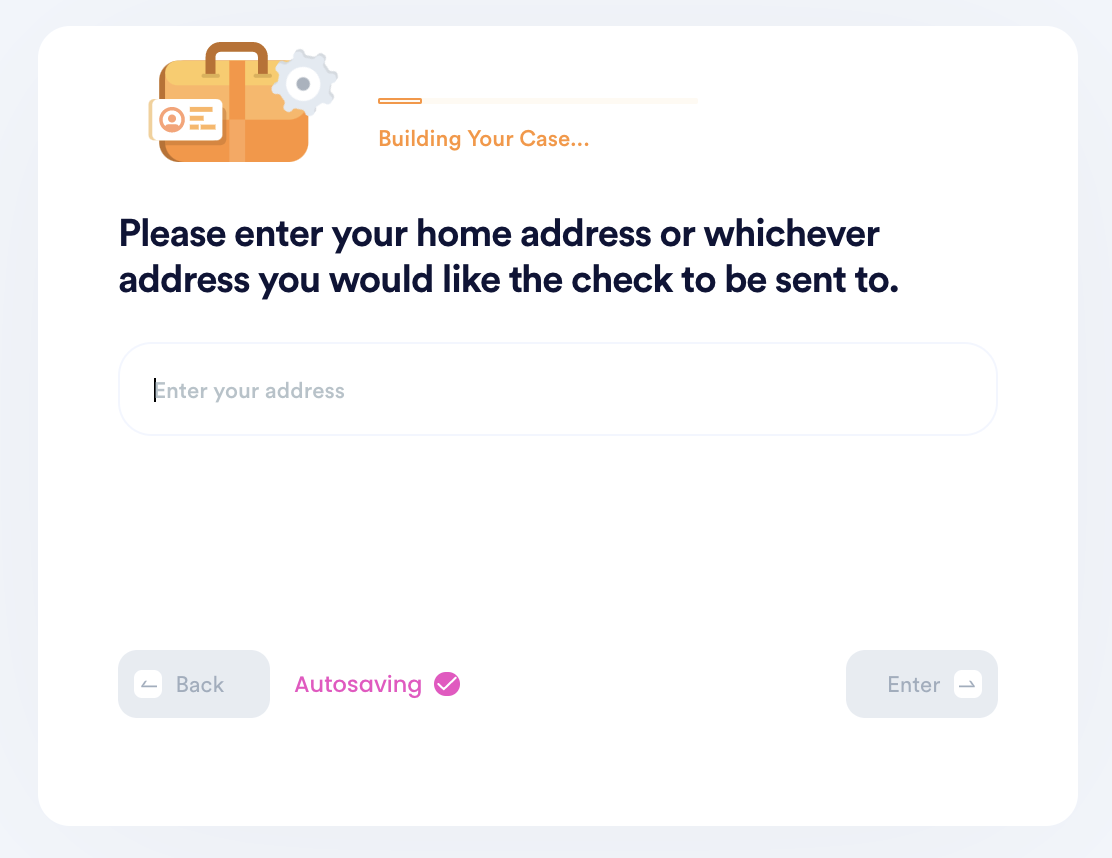

- Enter your contact information, including email, phone number, and the address you want any remaining funds to be sent to.

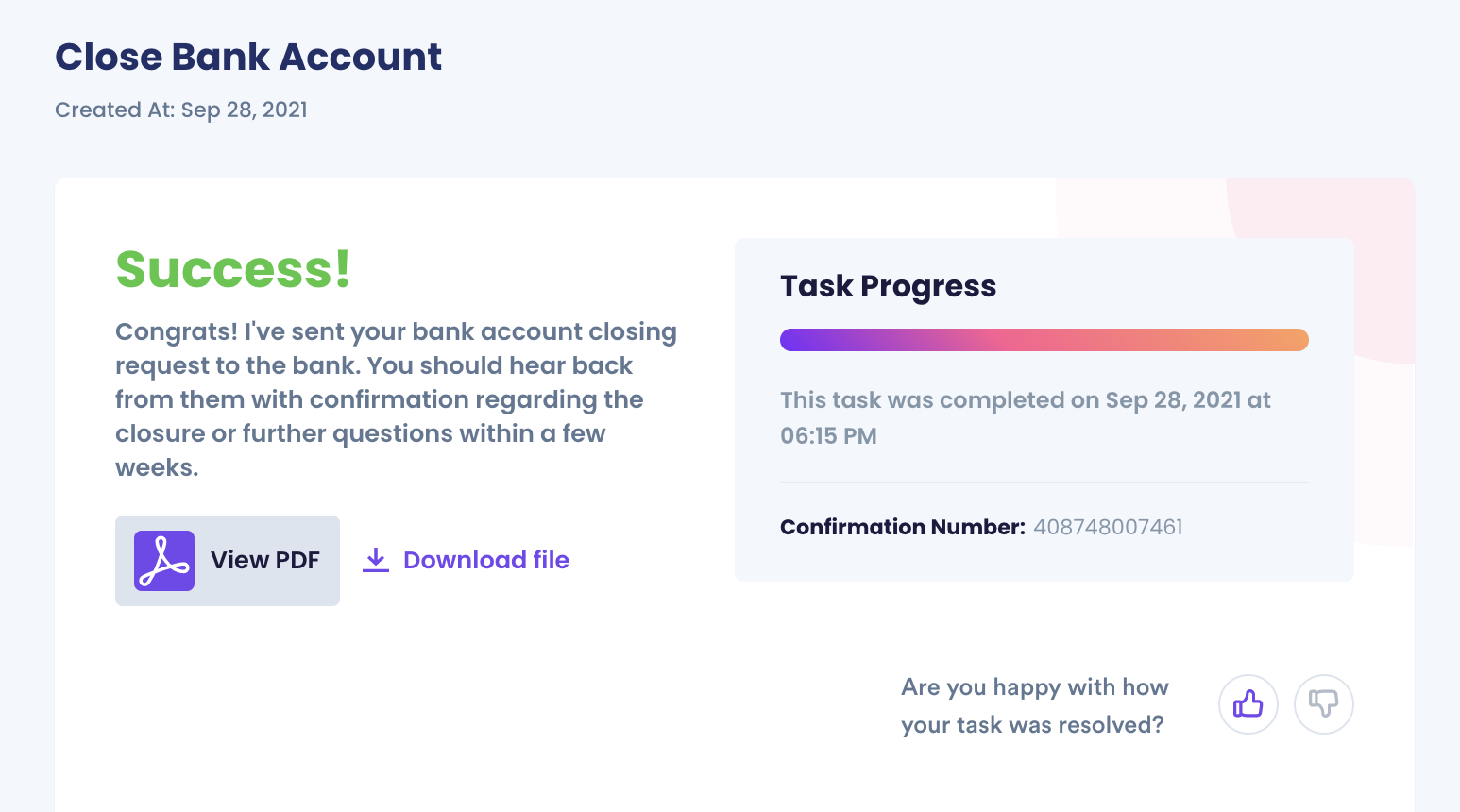

- Submit your task! DoNotPay will mail the request letter on your behalf. You should hear back from the bank with confirmation or a request for more information within a few weeks.

It only takes a few minutes to successfully close a Chase account using DoNotPay. Of course, you can always try to handle it yourself. It takes much longer, and if you're not an attorney, there's a chance you might miss an important detail on the paperwork.

Your Options for Closing a Chase Bank Account

When it comes to closing your Chase Bank account, you have the following options:

| Going to the branch office and closing the account in person. | You may have to wait in line for a while before getting attended to by the teller or bank manager. |

| Closing the account by mail. | If you choose this method, it takes several weeks before your account is closed. There is a possibility that your letter of request might get lost or ignored. |

| Getting help from DoNotPay to close the account. | This method is the fastest and stress-free way to close your Chase bank account. |

The following sections outline the steps you need to take to close your Chase Bank account.

How to Close the Account in Person

- Use Chase's branch locator tool online to get started.

- Double-check the office hours before you go. Banking hours have been odd since COVID-19.

- Bring your ID and account number.

- If you're closing an account for a deceased family member, you'll need a certified copy of the death certificate, too.

How to Close the Account by Mail

To close a bank account with a letter:

- Begin with your name, address, and account numbers.

- Illustrate the reason you're closing the account

- Date and sign the letter

- Include contact information, including a mailing address

Be sure to keep a copy of this letter and a record that you mailed it. Otherwise, Chase might claim the letter is lost. You won't know that for a few weeks, though.

Will Closing Your Chase Bank Account Affect Your Credit Score?

If your Chase checking or Chase savings account is in good standing, it will not affect your credit score. However, your credit score might be impacted if you accidentally overdraft an account or write a series of bad checks from your Chase checking account. Your credit score could be affected if Chase closes your account with a negative balance, too.

But that's not all! Whether you're relocating and need to close a Bank of America account or need help paying all your utility bills on time, DoNotPay can help. There are hundreds of issues the DoNotPay App can manage on your behalf.

What Else Does DoNotPay Handle?

DoNotPay is the world's first AI Consumer Champion. If you feel like a big company is treating you poorly, DoNotPay can help. Think of it like having an attorney in your back pocket.

In addition to canceling your accounts with Chase bank, you can use DoNotPay to:

- Cancel timeshare contracts

- Pay utility bills

- Order marriage, birth and death certificates

- Get your pets licensed

- Stop junk mail from coming to your home

Stand up to big banks with DoNotPay. Try it today.