How Much Does It Cost to Close a Bank Account?

There are many valid reasons for ending a long or short-standing relationship with your bank, and the process of closing an account is not hard; it's almost similar to opening one. Although it doesn't affect your credit score, closing your account correctly and getting confirmation for closure can help you prevent future problems.

You may also wonder if your bank will to close your account and how to avoid any fees. Read the terms and conditions to learn about any charges. In this guide, we'll discuss how to avoid additional charges while closing an account by yourself or using DoNotPay.

Why Do Banks Charge to Close a Bank Account

Essentially, most banks do not charge to close an account, and you can open or close any whenever you want. But if you send a letter to close it soon after opening it, there may be some fees to pay.

These charges are put in place for three main reasons:

- To prevent you from abusing the privileges of opening and closing bank accounts.

- To compensate for the time spent collecting personal information, explaining rules, and printing out paperwork to finalize the account setup.

- To deter you from closing the account early so they can secure a new, long-term client.

How Much Does It Cost to Close a Bank Account?

In addition to early account closure fees, if your bank reopens an inactive account due to persistent automatic transactions. So, ensure to deactivate all automatic transactions and wait for a month or two before writing the letter for bank account closure to the bank manager to ensure that the account is inactive.

Early Account Closure Fee

Some banks have early account closure fees if you don't keep them open for the minimum period. The period varies from one bank to the other, ranging from 60, 90, or 180 days and more.

| Here are some early account closure fees from top banks | |

| BB&T | charges $24 for an account younger than 90 days. |

| M&T | charges $50 for closing within 180 days. |

| Regional Bank | charges $25, within 180 days. |

| KeyBank | charges $25 for closing within 180 days. |

| U.S.Bank | charges $25, within 180 days. |

| PNC Bank | charges $25 for closing within 120 days. |

| SunTrust | charges $25 for closing within 180 days. |

| Santander | charges $25 for closing within 90 days of opening. |

Overdraft/NSF Fee

NSF refers to when a checking account does not have sufficient funds to cover a transaction. NSF checks may result in an NSF fee that ranges between $27 and $35. Overdraft fees occur when the banks accept transactions that overdraw the account.

To avoid NSF and overdraft fees, budget yourself well, monitor your account progressively, and eliminate automatic transactions that can draw from your account after you've withdrawn your money.

Stop Payment Fee

Ensure to write the correct number for your new bank account when making a check or wire transfer. If you make a mistake, you may have to pay stop payment charges. Most banks will charge you between $15 to $35 for each stop payment order.

Monthly Maintenance Fee

Some banks charge monthly upkeep fees. If you're moving to a new bank, make sure you have enough balance in your old account to cater to the monthly maintenance fees. The amount charged depends on your bank and account type.

ACH Transfer Fee

When moving money to your new bank account, you'll make an ACH transfer. This process takes one or two business days and costs about $0.29, but this can vary depending on a number of factors, including the size of the transaction, the size of the bank, and any hidden charges.

Wire Transfer Fee

If you move your money through a wire transfer, you may incur a wire transaction fee. The charges typically range from $25 to $30 for bank transfers within the US and $45 to $50 for transfers outside the US. However, this also varies from one bank to another and depends on the amount.

How long does it take to close a bank account?

The process of closing an account shouldn't take long, but, as discussed above, the time to prepare should take about two months. The bank can close your account within a day or two if you've met all criteria.

How to Quickly/Easily Close a Bank Account with DoNotPay

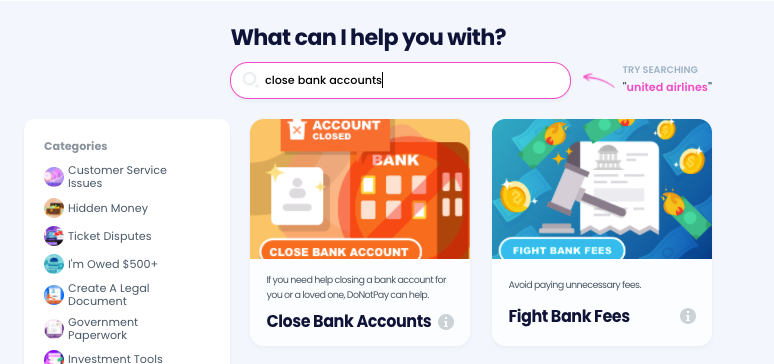

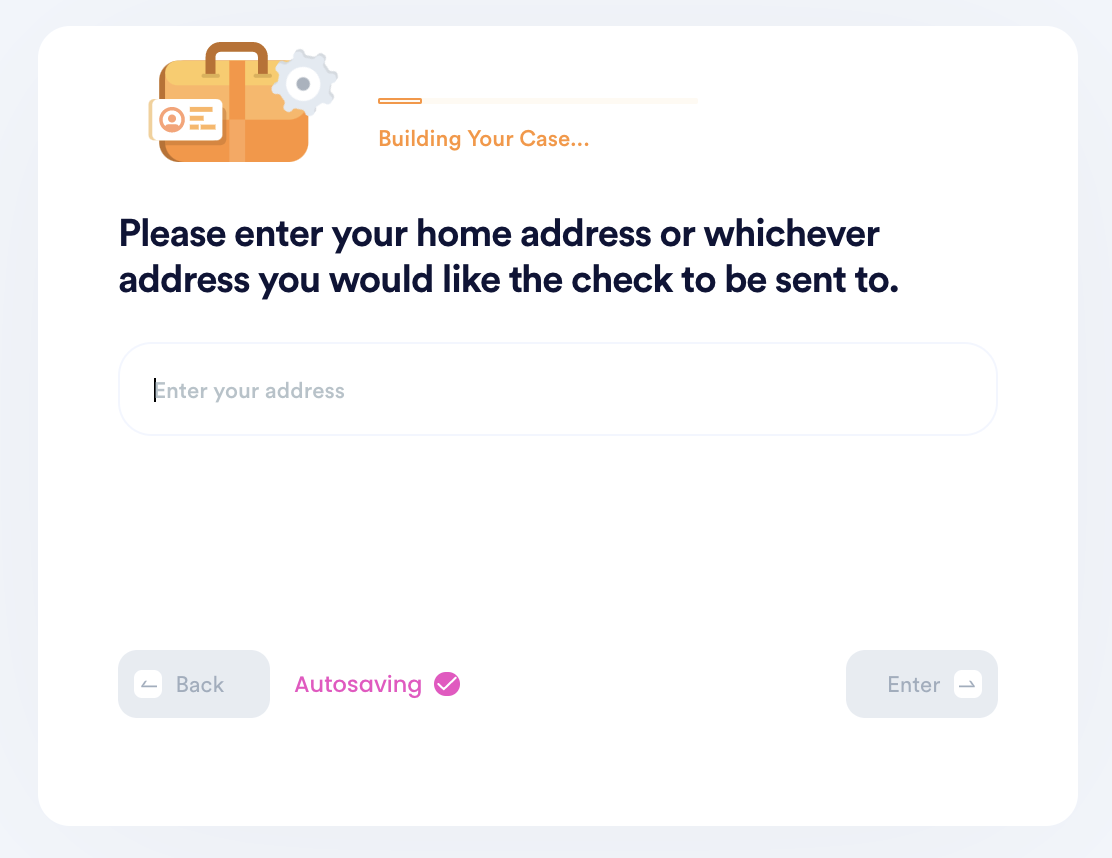

If you want to Quickly/Easily Close a Bank Account but don't know where to start, DoNotPay has you covered. Create your own cancellation letter in 6 easy steps:

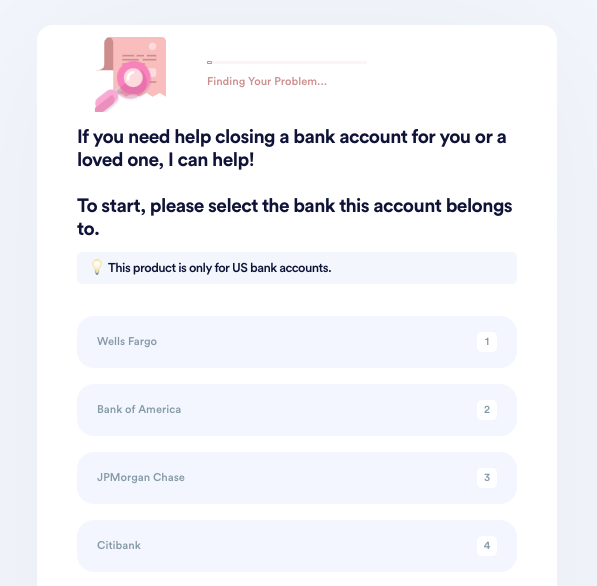

- Go to the Close Bank Accounts product on DoNotPay.

- Select which bank the account was opened under, and enter the account type, account number, and your local branch location.

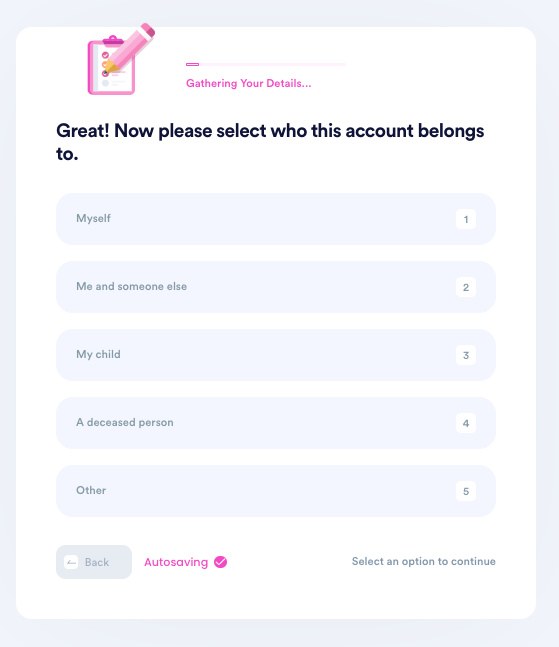

- Indicate who this account belongs to. If the owner or co-owner has passed away, upload a death certificate or other formal evidence. If you are not the original account owner, upload evidence of your relationship with the owner.

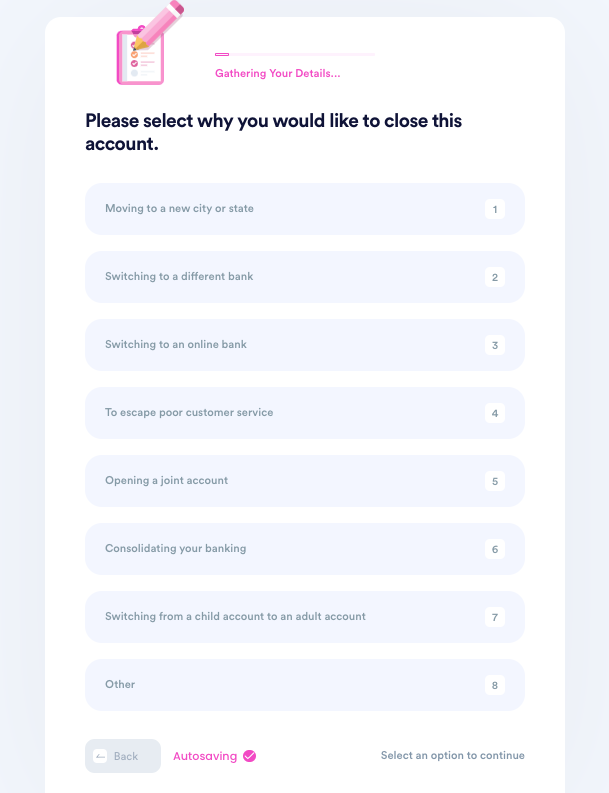

- Tell us why you need to close this account.

- Enter your contact information, including email, phone number, and the address you want any remaining funds to be sent to.

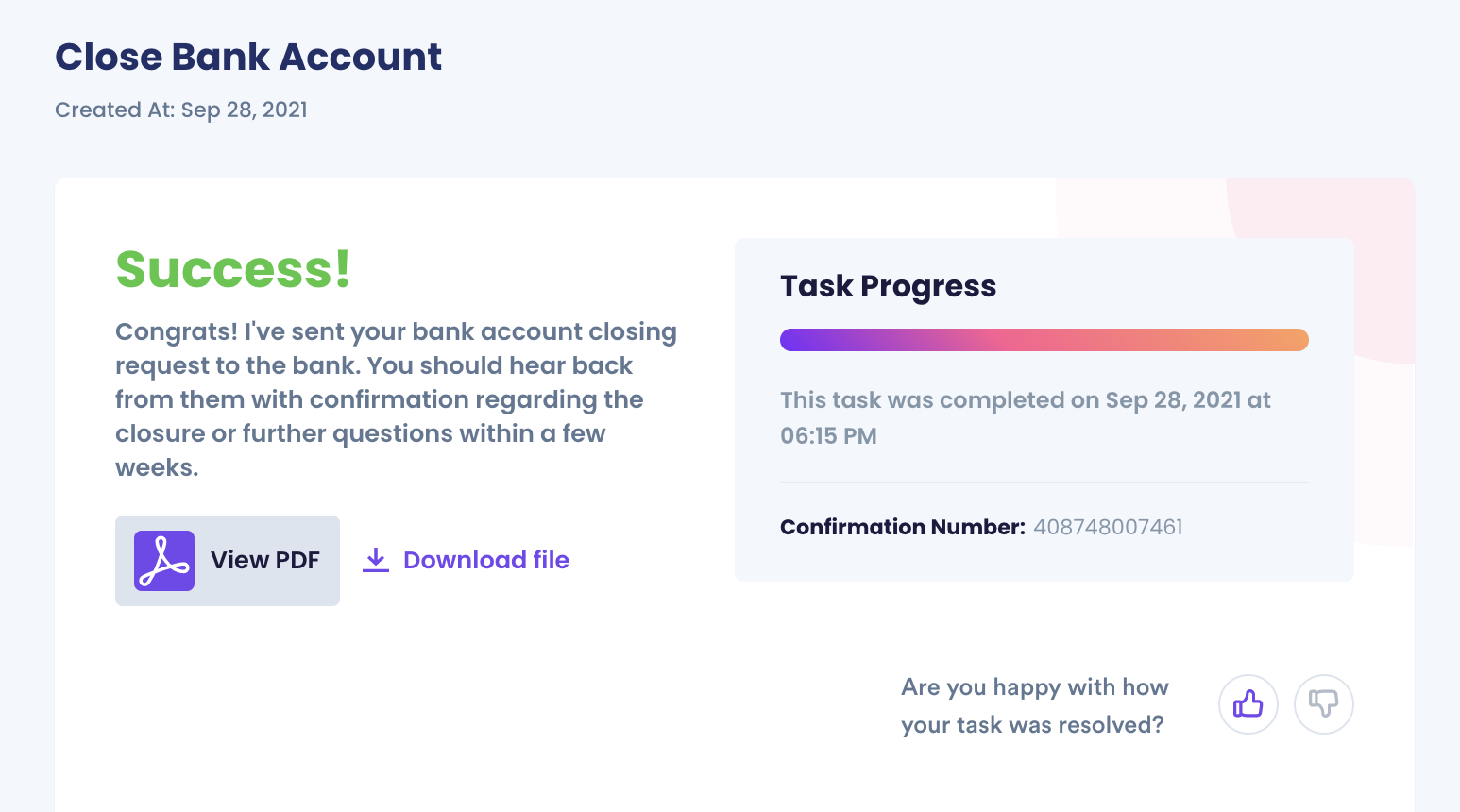

- Submit your task! DoNotPay will mail the request letter on your behalf. You should hear back from the bank with confirmation or a request for more information within a few weeks.

Why Use DoNotPay to Close Your Bank Account?

DoNotPay is a popular and upcoming product that helps many customers solve issues easily. To avoid unnecessary bank account closure fees, you can use DoNotPay.

In addition, DoNotPay is:

- Fast—You don't have to spend hours trying to close your bank account.

- Easy—You don't have to struggle with filling out tedious forms or keeping track of all the steps involved during the process of closing your account.

- Successful—You can rest assured knowing we'll maneuver carefully through all steps to reduce your costs and to avoid any future problems.

What Else Can DoNotPay Do?

DoNotPay is a versatile product designed to solve many problems. Visit some of our guides below to find out what more DoNotPay can do for you:

- https://donotpay.com/learn/small-claims-court/

- https://donotpay.com/learn/gift-card-cash-back/

- https://donotpay.com/learn/credit-cards/

Register for the DoNotPay account closing platform to start your account closing process today and save time and money.