Everything to Know About a Chime Virtual Card

Shopping online can be convenient as well as fun. It saves you the hassle of going out to the store and gives you the option of having all your essentials delivered right to your door. While online shopping can be therapeutic, anytime you head online to make a purchase, you are entering potentially dangerous territory. Entering your credit card information on any website, even secure ones, can cost you a lot of money in the long run.

Getting a virtual credit card, such as a can help save you money by eliminating ongoing monthly payments. It can also help to prevent identity theft issues since virtual cards aren't connected to any of your personal banking accounts. There's a lot to know about the - so read on to learn about virtual cards, and why you should consider using DoNotPay for all your online free trial needs.

Why Should You Consider Getting a Virtual Credit Card?

A virtual credit card can help protect your privacy online. generate a 16-digit number that you can use on a variety of online platforms, such as getting free trials for the latest streaming platform that you want to try. Since they aren't tied to your bank account or personal information, you don't have to worry about enduring recurring charges every month, should you forget to cancel.

The Benefits of a Virtual Credit Card

Here are a few other reasons why you should consider getting a virtual credit card:

- You can use them for free trials and not get charged when the free trial expires.

- Using virtual credit cards reduces the risk of identity theft since they aren't tied to your bank account.

- help to protect your privacy online.

- Virtual credit cards reduce your chances of getting burned by a scam or malicious website.

Drawbacks of a Virtual Credit Card

Although the benefits of using a virtual credit card outweigh the downfalls, there are some issues that you should be aware of when using a virtual credit card:

- If you make a purchase using a virtual card and need to make a return, it could be a challenge for the merchant to process that return, since virtual credit cards expire after a short period of time.

- You can't withdraw money using a virtual credit card.

- If a merchant needs to verify your account, you could run into problems - for example, if you need to make a rental car reservation. Virtual cards aren't easily verifiable, since they are different from your actual credit card.

These are just a few things to be aware of if you do decide that a virtual credit card is right for you.

Does Chime Offer a Virtual Credit Card?

is a financial technology company that partners with regional banks in order to provide members with various banking solutions. Online banking through Chime offers a variety of benefits, including, according to the Chime website, no hidden fees, fee-free overdraft, and getting access to your paycheck up to 2 days early.

Because Chime is a technology company, and not technically a bank, they do not actually offer bespoke virtual credit cards. However, many banks do offer virtual credit cards, so it might be possible to get a virtual credit card through your current bank and manage it with the help of Chime.

| Chime Card types | Monthly Fees | Maintenance fees | Offers |

| Checking Account and Visa® Debit Card | No | No | Comes with a debit card |

| Chime Credit Builder Secured Visa® Credit Card | No | No | -No credit check to apply

-No minimum security deposit required |

| High Yield Chime Savings Account | No | No | -0.50% Annual Percentage Yield (APY)

-Set money aside with Automatic-Savings features. And never pay a fee |

How to Get a Virtual Card on Your Own

If you want to get a virtual credit card on your own, you can reach out directly to your bank to see if they offer that option to members. Here's how to ask your bank for a virtual credit card:

- Contact your bank via phone or email. Explain to the representative that you want a virtual credit card, and ask what you need to do in order to get one.

- The representative will ask you account verification questions and explain the process for getting your own virtual card.

- You might have to wait a while or submit a formal request to get a virtual credit card through your bank, so be patient at this stage.

Use DoNotPay to Easily Generate a Virtual Credit Card

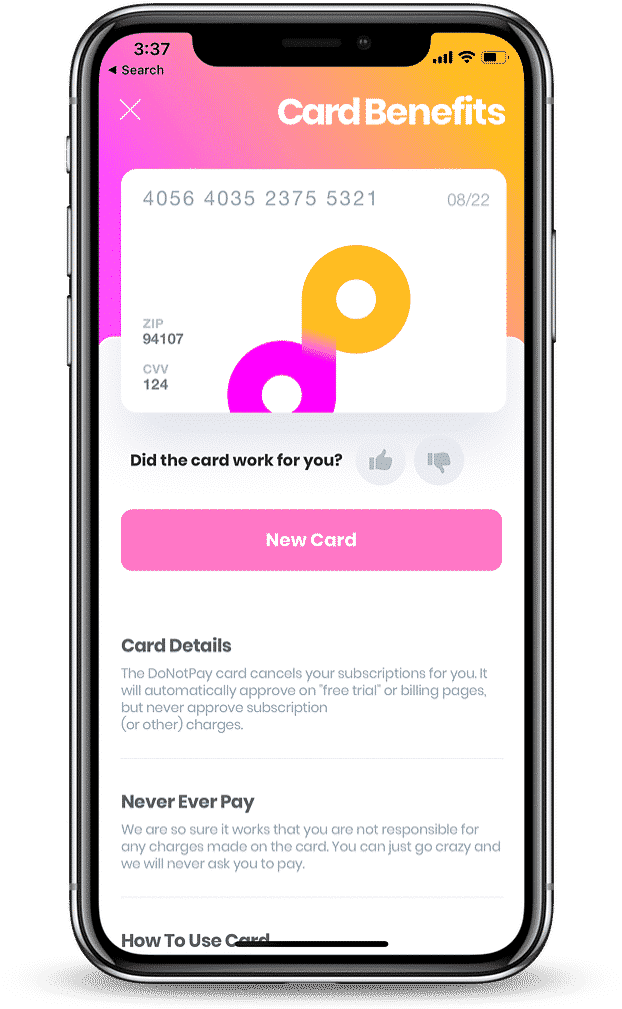

The best way to get the benefits of a virtual credit card is to go through DoNotPay. With a DoNotPay virtual credit card, you can set up all kinds of free trials online without fear of being charged at a later date. DoNotPay's virtual cards can bypass authentication, allowing you to enjoy the benefits of free trials without the fear of getting hit with an expensive recurring charge. Each card gets deactivated once it is used, making it easy to have any subscriptions canceled after you enjoy the initial free trial period.

How Else Can DoNotPay Help You?

DoNotPay is the fast, easy, successful solution for all your virtual credit card questions. Here are a few other ways DoNotPay can help you:

- Get an instant approval virtual credit card.

- Free virtual credit card no deposit.

- Help you deal with credit card issues and issue virtual credit cards

- Get compensation for delayed and canceled flights

- Cancel any subscription or membership

By

By