How to Cancel Your Churchill Home Insurance Hassle-Free

There is a time when you feel that your insurance company or the insurance cover you have doesn't meet your needs, or you might have gotten a cheaper home insurance policy elsewhere. The best next step is to cancel your insurance to avoid wasting your hard-earned money.

However, cancelling insurance isn't easy, especially if your subscription hasn't yet expired or you're past the cooling-off period –the logistics of dealing with big companies tend to be complicated, which could lead you to give up and end up losing money. But, that shouldn't be the case, and that's why DoNotPay is here to help out.

This article looks at how to easily with DoNotPay. But let's look at several things first.

Churchill Insurance Overview

Based in Bromley, London, Churchill Insurance is a British insurance company founded in 1989 as one of the country's first direct-to-customer car insurance companies. A family-owned and operated insurance agency, Churchill insurance diligently serves individuals and businesses, meeting their needs at favourable prices.

It has since expanded to offer other insurance products, including home insurance, workers compensation, commercial property insurance, bonds, farm and ranch owners insurance, business owners' policy, and commercial auto insurance.

Churchill's Home Insurance Cancellation Policy

might not be that hectic. However, you must be aware of several terms and conditions of their cancellation policy to smooth out the process.

Like most insurance companies, Churchill will charge a fee to cancel your insurance. You'll need to pay a £53 cancellation fee and an additional amount for the period you've been covered.

Cancelling Before the Cooling-off Period

However, you can get a full refund without charges if you cancel your policy before it's automatically subscribed. But, you'll still have to pay the £53 cancellation fee.

Cancelling During or After the Cooling-off Period

Suppose you cancel your Churchill insurance policy during or after your 14-day cooling-off period. In that case, you'll get a refund less the amount for the time you've been covered –Churchill will deduct some amount from the refund to cover the insurance period that's already rolled over.

NB: You'll still have to pay the £53 cancellation fee in both scenarios.

Cancelling Optional Extras

Churchill also offers extra policies like breakdown cover and assistance covers. Cancelling your breakdown cover within the 14-day cooling-off period guarantees you a full refund, less the amount you've been covered and a £10 administration fee.

But, not every optional extra charges cancellation fees. For instance, you can cancel your assistance or car hire insurance free of charge.

Cancelling After You Make a Claim

As is standard in insurance, Churchill doesn't offer refunds on your insurance policies if you've already made a claim or someone else has made a claim against you. But, you'll still have to pay the necessary cancellation fees and complete your policy payment even after you cancel.

Best Insurance Alternatives to Churchill Insurance in the UK

Some of the best alternatives to Churchill Insurance include:

- & General

- RSA Insurance, and

- Direct Line.

Here's How to Cancel Churchill's Home Insurance by Yourself

To cancel a Churchill insurance on your own:

- Contact (call or text) customer service. You'll be connected to an agent.

- Provide the agent with your policy number and any other details they'd want to confirm your identity.

- Request a policy cancellation and any recurring payments. Remember to state whether you want to cancel immediately or later.

- You'll likely be asked the reason for cancelling. Give one to complete the process.

- Request an email to confirm that the process has been completed.

You can also cancel your policy online by visiting and following the prompts for the cancellation process. Don't hesitate to use the virtual assistant for immediate help if you are stuck.

| Ways to Cancel Churchill Home Insurance | |

| Phone | 0345 603 3551 |

| Online | Contact form |

Churchill will refund the remaining part of your policy or premium minus the administration or cancellation fee, depending on the type of cover you have.

Cancelling Churchill Home Insurance Using DoNotPay

Cancelling insurance by yourself can be hectic –the process takes time. Here's how to easily cancel your in 3 single steps:

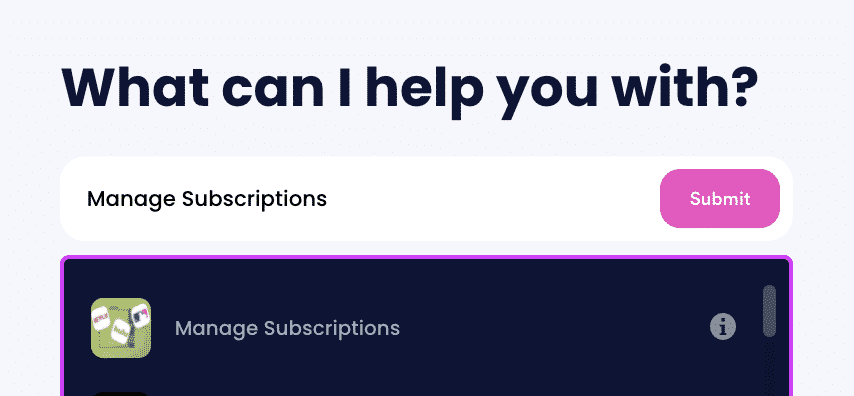

- Log-in to DoNotPay and search for the Manage Subscriptions product.

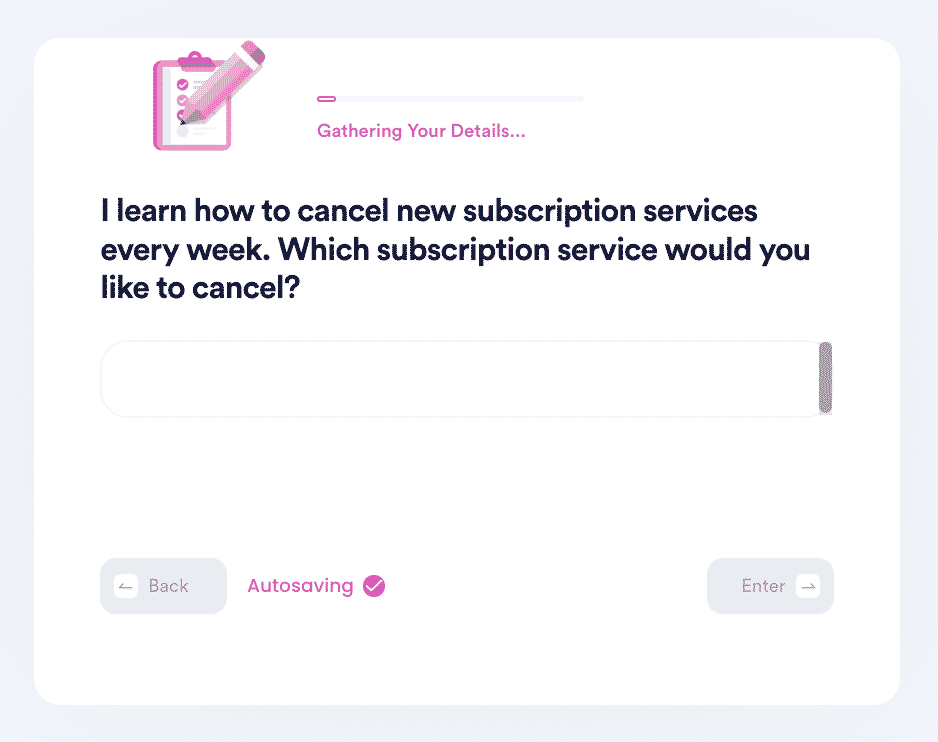

- Provide the name of the subscription service you want to cancel.

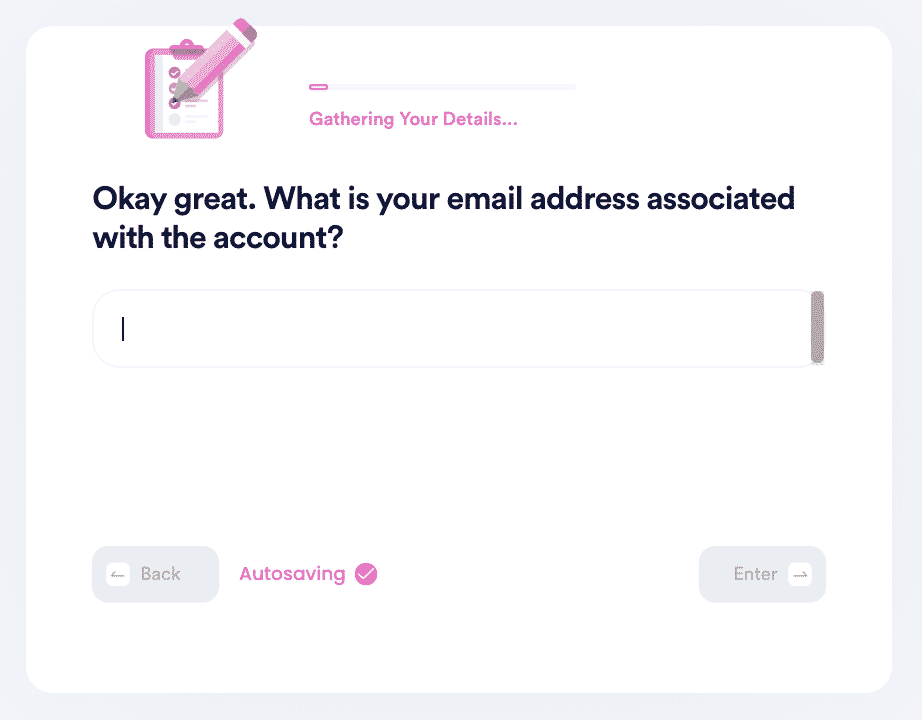

- Provide your account details such as email address and username.

That's all you need to do. DoNotPay will work on cancelling your insurance and notify you once it's been cancelled.

You Can Do So Much More With DoNotPay

The world of DoNotPay is unlimited. We're all about making your life easier by providing hassle-free solutions to life's most problems. Apart from helping you cancel home insurance, DoNotPay can also help cancel the following subscriptions:

- BT Sport

- Planet Fitness

- CVS CarePass

- RAC membership

- NOW TV

- Virgin Media

- Vodafone Contract

- Just Eat order

- Admiral renewal

- AA membership

- Xbox Live

- Sky

- Beer52

What Else Can I Do With DoNotPay?

DoNotPay can also help you:

- Negotiate your hotel bill

- Lower your bills

- Reach customer service faster

- Avoid unwanted charges on your credit card

- File charges in small claims court

- Get free trials

- Get burner phones

DoNotPay is easy and convenient. Please don't hesitate to sign up today and enjoy unlimited solutions.

By

By