What Is the Difference Between a Chargeback and a Refund?

The terms chargeback and refund may seem like they can be used interchangeably. You should refrain from that, though, because they don’t refer to the same thing. We’ll explain their differences, as well as how to request them, with one common goal in mind—to get your money back ASAP!

What Is a Refund?

A refund is simply the amount of money returned to you by a seller. You ask the seller directly for a refund. A refund differs from a chargeback in that it is solely between the merchant and you. The bank is not involved in any capacity.

How Do Refunds Work?

The steps starting from purchasing an item or service to requesting a refund usually go the following way:

- You buy a service or product

- The product is not delivered, you are not satisfied, or you are overcharged

- You contact the seller directly via phone, email, or through a refund request form on their website

- You may have to return the product to the seller

- The seller gives you your money back

If the company doesn’t have a ready refund request form on their website or you can’t be bothered with contacting their customer support, DoNotPay can help you request a refund!

What Are Double Refunds?

A double refund can come about in two ways.

- You request a refund from the seller and start a chargeback process with your bank at the same time

- You asked the seller for a refund, and before they get back to you, you contact your bank

In both cases, the company or the bank may not be aware of the other initiated action. So a bank could start the chargeback dispute even though you have already received your money back.

This just makes things all the more complicated. With DoNotPay, you can be sure that both fronts are covered without worrying about a double refund.

Is a Chargeback the Same as a Refund?

A chargeback is an amount of money returned to you—the customer—on your credit or debit card once you filed a chargeback claim to your bank. It’s also known as “payment dispute” or “transactional reversal.” The purpose of a chargeback is to protect you and give you your money back when a company refuses to issue a refund.

Which Situations Call for a Chargeback?

Here are some instances when you should file a chargeback claim:

- Somebody illegally used your card to purchase something

- The merchant declined to issue a refund

- You were charged multiple times for the same item or service

- The goods you ordered were never delivered

- You don’t recognize a charge

- Your bank made a mistake and charged you

- You were charged more than the agreed price

- The company you purchased something from went out of business

What Does the Chargeback Process Look Like?

Before requesting a chargeback, you should know how it works. These are the steps in the chargeback process:

- You file a chargeback claim

- Your bank investigates your case and contacts the company or the company’s bank

- The company reviews your request and contacts your bank

- Your bank makes the final decision and informs you

- Hopefully, you get your money back, unless your request is denied (e.g., because you filed a chargeback claim late or you didn’t contact the merchant first)

This cycle and back-and-forth may last up to 90 days.

When Can I Claim a Chargeback?

The exact timeframe when consumers can file a chargeback claim varies according to a specific situation, but there are some time limits that banks impose on their clients.

According to the Fair Credit Billing Act, you can request a chargeback with your bank within 60 days of the purchase. This applies to all transactions over $50.

If you have a Visa, MasterCard, or American Express card, you may have 120 days from the payment date to request a chargeback. We advise you to check with your card issuer whether you can file a chargeback claim for your purchase.

How To Request a Chargeback Through Your Bank

Now that you are up to speed about the ins and outs of chargebacks, let’s see how you can request them via your bank. Here’s what you can do:

- Contact your bank by:

- Phone

- The bank’s website

- Submit a chargeback claim through your bank’s app on your phone

Building your case is crucial in chargeback issues. Be sure to include as many documents as you can, such as the contract, receipts, invoices, terms and conditions, pictures of damaged goods, and correspondence with the merchant.

This can be a tedious and confusing process, seeing as every bank and every case is different, and you might have to contact different departments to be told what to do next.

You still want to know more about chargebacks or have some questions unanswered? Check out our detailed chargeback rundown.

Requesting a Refund vs. Requesting a Chargeback

You should contact the merchant first and ask for a refund before you initiate a chargeback with your bank. Even if you ask for a chargeback right away, the bank may ask you to check with the merchant to see if they are willing to give you a refund.

A chargeback claim should be your last resort because it is an arduous process.

Apart from the merchant and you, now a third party is involved. A chargeback is also more harmful to the merchant. They have to pay additional chargeback fees, and too many chargebacks may result in the bank closing their accounts.

If the merchant refuses to give you your money back, then you should contact your bank and request a chargeback.

Refunds vs. Chargebacks—The Breakdown

Let’s take a look at the main differences between a chargeback and a refund.

| Refund | Chargeback |

| Dealt with between the seller and the customer | Dealt with between the customer and their bank, then the seller is involved |

| Usually doesn’t last long | Usually lasts longer |

| The seller doesn’t have to pay extra fees | The seller pays extra fees to the bank |

| Refund limits are not controlled by banks | Banks determine the chargeback limit |

Request a Refund or a Chargeback With DoNotPay in a Few Quick Steps

If you’re dying for a quicker and stress-free way, we’ve got you covered! Follow the instructions below to request a chargeback or a refund with DoNotPay’s assistance.

- Go to DoNotPay in your

- Tap on File a Chargeback

- Fill in your bank information

- Answer a couple of questions to build your case

- Confirm your details

Now you’re all set! DoNotPay will create a dispute letter on your behalf and forward it to your bank. We can also send it to the merchant or company, so you can rest assured that you covered all the bases.

Check out how we made consumers’ lives easier by dealing with chargebacks from different companies, such as:

You may also want to know if you can go to jail for chargebacks or whether you can get the Paypal chargeback protection.

DoNotPay Brings More Answers and Solutions!

DoNotPay has already covered requesting a refund or chargeback from myriads of companies.

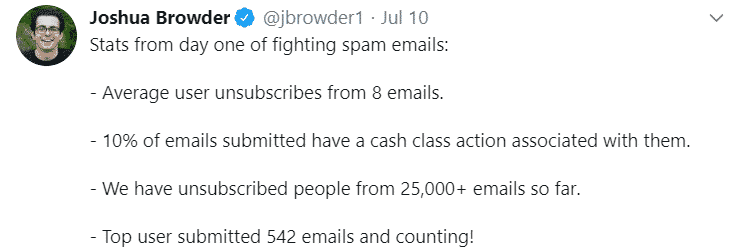

Besides learning the difference between a chargeback and a refund, you may also be curious about the differences between junk email and spam email.

If you create a DoNotPay account on , we can clarify many other doubts for you. Rely on DoNotPay when you need help:

- Putting a stop to text-message spam

- Handling any unpaid bills

- Contesting your speeding tickets

- Scheduling a DMV appointment

- Fighting your parking tickets

- Dealing with robocalls

- Locating and applying for clinical trials near you

- Disputing your traffic tickets

- Getting refunds from companies

- Canceling your subscriptions or memberships

- Signing up for a free trial risk-free

- Protecting your work against copyright infringement

- Solving your credit card problems

- Getting in touch with your incarcerated loved ones

- Stopping spam emails for good

- Cutting in line for a talk with customer support on the phone

- Safeguarding from harassment and stalking

- Suing people or companies in small claims court

- Getting refunds and compensation for delayed or canceled flights

- Signing up for services without phone verification

- Finding any unclaimed funds under your name

By

By