What to Do When You Need to File Credit One Bank Complaints

People often get very frustrated and confused when they cannot figure out where they need to go to file a complaint against a company. Obviously, the first thing we hope for is that you won't have to file the complaint at all. If you are filing a complaint, it means that something has gone wrong in the course of doing business with that company. That is unfortunate and not ideal, but there are ways of fixing the issue. However, if you discover that you need to file and don't know how to do it, you need to have DoNotPay step in to help you.

What Do You Do When You Need To Make A Credit One Bank Complaint?

Those who find themselves in a position where they need to file a complaint against need to know that they have options. First, they should know about the customer service phone number that they can dial to speak with an account representative who may be able to help. The instructions for doing that are as follows:

- Dial 1-877-825-3242 and press one to select English

- When prompted, enter your 16 digit account number to let the representative know which account they need to look at

This is the most straightforward way you can speak to someone from Credit One Bank about your complaint. At present, Credit One Bank does NOT offer a live chat option even though this is increasingly more common for banks (and all companies) to offer. If you wish to speak with someone from the company, you will have to use the method above at this time.

For quick reference, see the table below:

| Ways to Contact Credit One Bank Customer Support | |

| Phone Number | 1-877-825-3242 (toll-free, TDD/TTY) |

Credit One Bank P.O. Box 98873 Las Vegas, NV 89193-8873

Credit One Bank Payment Services P.O. Box 60500 City of Industry, CA 91716-0500 | |

| Social Media Platforms |

What Are Some Common Complaints?

People call the customer service line for all kinds of different reasons. If they are making a complaint, it is often because some aspect of their account is not functioning the way it ought to. When this happens, they may feel the need to give the company a call and let them know what is going on. They want them to fix the problem, and they no longer want to deal with the frustrations. Here are a few of the common issues people run into:

- Their card is not working

- They don't think their credit limit is high enough

- They are charged a late fee that they do not think they owe

- They are being called repeatedly by Credit One Bank demanding payment

Whatever the complaint may be, you need to call often if you want to be heard on this matter. They will not stop until that is the case. It means that the bank has to staff their customer service line to operate long hours because they know that they could get calls at any time. It is often the case that the people who staff those lines can actually help the people they speak with, but you should know that it is possible that they may not have a solution for you in every situation. Be prepared to make your case, but also be prepared to not always get the answers back that you want to hear.

Can You File A Claim Against Credit One Bank In Court?

It may be possible to file a claim in small claims court against Credit One Bank if you feel that they have acted in bad faith or if you believe that their business practices are unlawful. You might have a fighting chance of winning the case when you bring it before a judge who knows the law and how these companies should treat their customers. You should use DoNotPay to help get your case filed.

Here's how to start a small claims lawsuit against Credit One Bank with DoNotPay:

- Log-in to DoNotPay and select the Complaint Letters product.

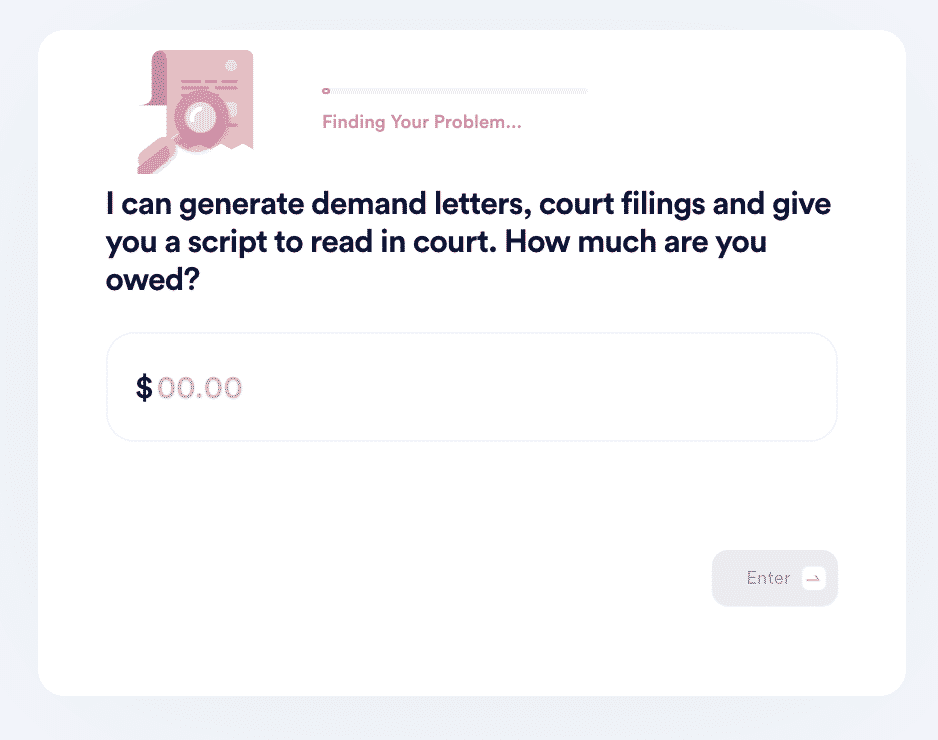

- Tell us how much you are owed by the company, if applicable.

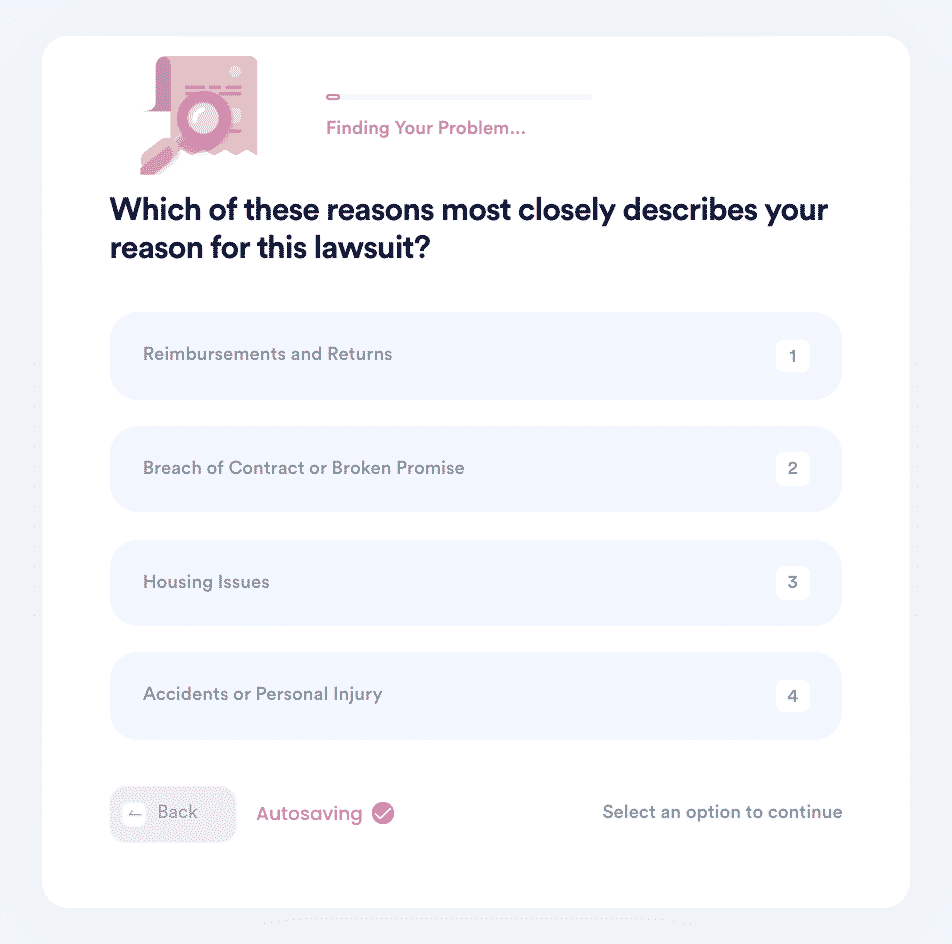

- Select the reason for your lawsuit.

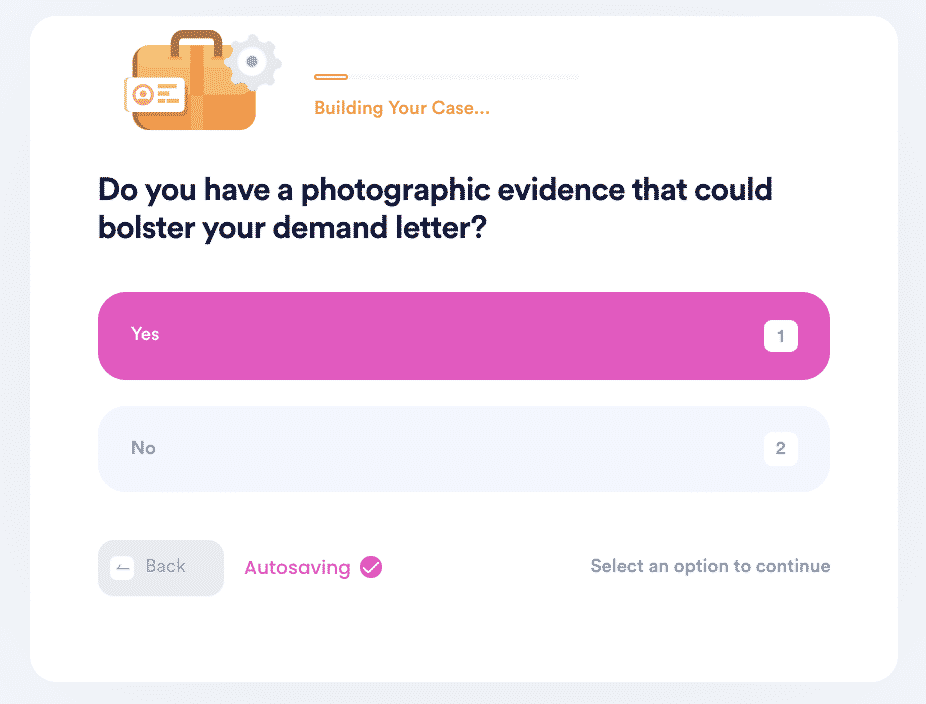

- Provide details about why you're filing the lawsuit including photographic proof and other important information.

Follow those steps to the letter, and you will be in great shape to at least have your case heard by the court.

Other Ways That DoNotPay Can Be Helpful

There are a few other ways that DoNotPay may assist you going forward. They have programs to help with many of life's frustrating issues, including

| Helping with bills | Notarizing documents | Reducing property taxes |

| Robocall compensation | Getting free trials without being charged for them |

There are a lot of things on your to-do list that you probably don't have the time or energy to handle right now. DoNotPay has simplified the process for you to knock these items off the list easily. That will help free up more of your time to get the things you really care about done. If that sounds ideal to you, then just know that this is an option that you should explore.