How to Dispute a BB&T Transaction and Get Your Refund the Easy Way

Do you need to dispute a transaction with BB&T, a popular bank that offers plenty of online banking options? Unfortunately, there may come a time when you discover an unauthorized transaction on your account, which could leave you struggling financially. In order to get your money back, you will need to dispute the transaction with BB&T, but you may not be sure how to proceed. DoNotPay is here to help You need to get your money back in your account as soon as possible, and we can help streamline that process.

How to Dispute a Charge with BB&T on Your Own

You may have to provide a great deal of information over the phone, which can take a lot of time out of your day. You may also need to provide a form of proof, including past receipts or a fraud report, that may establish why you feel that your card has been compromised and what fraudulent charges have appeared on your card. Finally, you may need to wait some time for BB&T to approve the chargeback, leaving you without your money in the meantime.

Beginning in 2019, BB&T and SunTrust began the process of merging their companies into what is now known as Truist Bank. While BB&T and SunTrust are still transitioning some aspects of their members’ banking experience, including online bank logins and customer service calls, former members of either bank will go through a slightly different process to file a dispute:

| Former BB&T Clients | Those who previously banked with BB&T will need to contact a Truist representative at 844-4TRUIST (844-487-8478) or speak with someone in person at a local Truist branch. |

| Former SunTrust Clients | Although SunTrust clients are able to access their funds through BB&T ATMs until the final transitions of the merger are complete, all other account operations will continue to go through SunTrust until the transition to Truist is fully complete in early 2022. Visit your local SunTrust branch to speak to a representative, or call 800-SUNTRUST (800-786-8787). |

Filing a transaction dispute manually can be a tedious process, but DoNotPay can help dispute the charge quickly to get your money back in your account sooner.

BB&T Fraud Protection Policy

BB&T indicates that if your card is lost or stolen, you have a 100% zero liability policy in place that will help protect you. The bank may, in many cases, reimburse 100% of fraudulent transactions if your debit card information is compromised. In order to dispute a charge, you should call BB&T as soon as possible.

- You have 60 days to dispute a billing error.

- You have 60 days to file a dispute for a service not rendered or improperly executed.

If you need to dispute a fraudulent charge, you may also want to file a police report, which can help track down the person or entity responsible for stealing your card information and hold them accountable.

According to the Federal Trade Commission, you have the right to file a dispute if:

- Your charge lists the wrong information

- You have a charge for goods or services you did not receive

- The bill for a charge was not sent to your current address, assuming that the creditor has your current address

- You had asked for written proof of purchase, but did not receive it

- In a transaction of more than $50, you did not receive the services you asked for. In this case, you must make a good faith attempt to reach a resolution before filing a dispute.

How Long Will It Take to Get a Refund Through BB&T?

If you have a chargeback requiring a complex investigation, it could take between four weeks and 90 days for the investigation process. In some cases, it could take weeks or months to get your money back.

Chargeback Dispute Challenges You May Face

You may encounter a variety of challenges when disputing your chargeback refund, including:

- A long investigation process

- A lack of evidence regarding the claim

- A dispute from the person who issued a fraudulent charge against your account

DoNotPay can help avoid those challenges and streamline your request for a refund.

How to Dispute a BB&T Transaction with DoNotPay

DoNotPay makes it easy to get the refund you deserve. Log into your account and visit the "File a Chargeback" screen. Then, follow the on-screen prompts to:

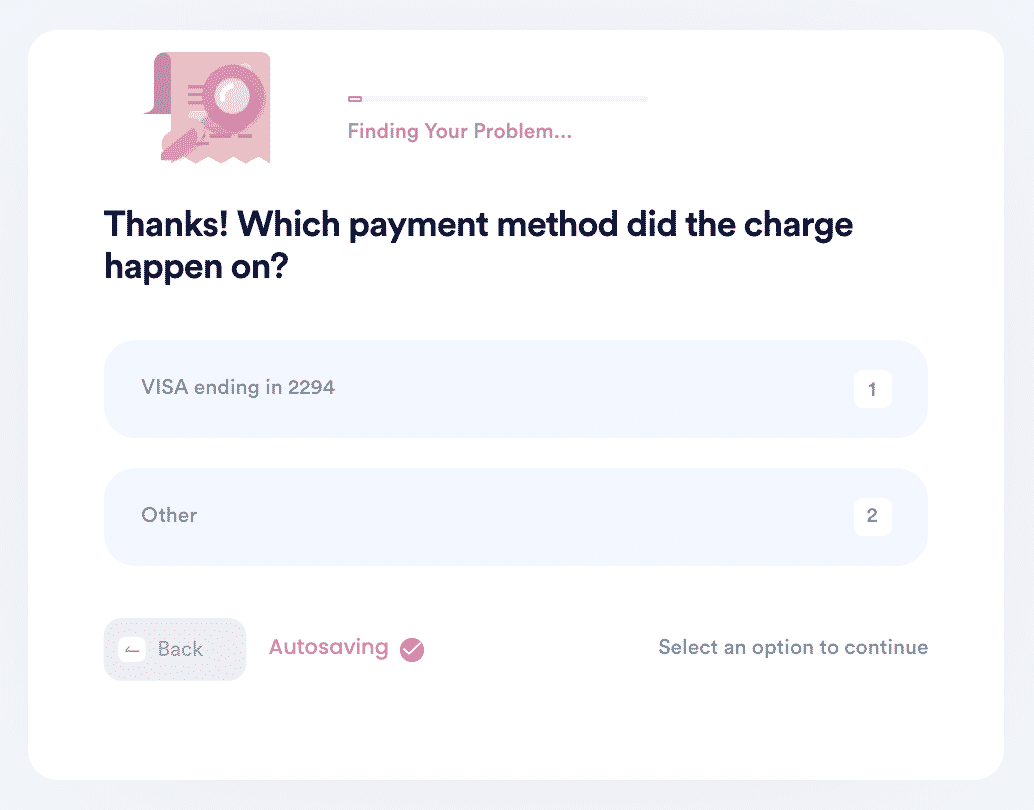

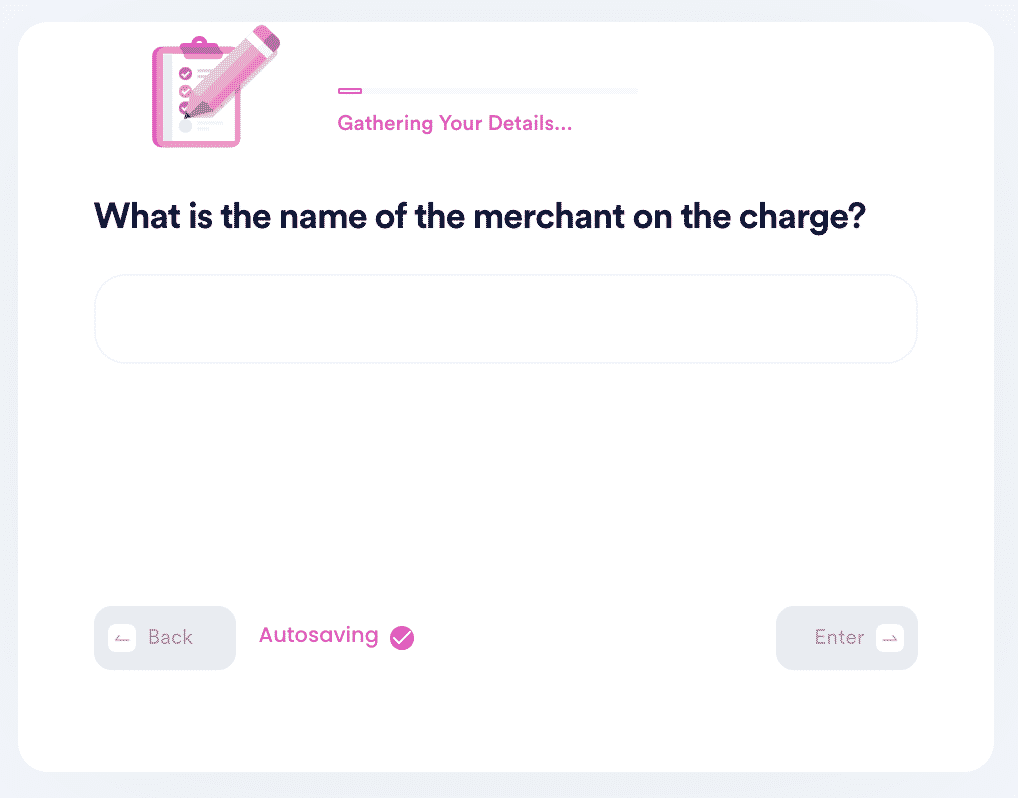

- Select the Payment Method and the Name of Your Bank: Choose the payment method where the fraudulent charge appeared. On the next screen, enter BB&T to designate that you need to file a chargeback with this particular bank.

- Share the Information Requested About the Charge: Who filed a charge that you didn't agree to? Enter it when requested, then confirm when prompted. Next, you'll be asked to confirm the date when the charge occurred and the amount of the transaction.

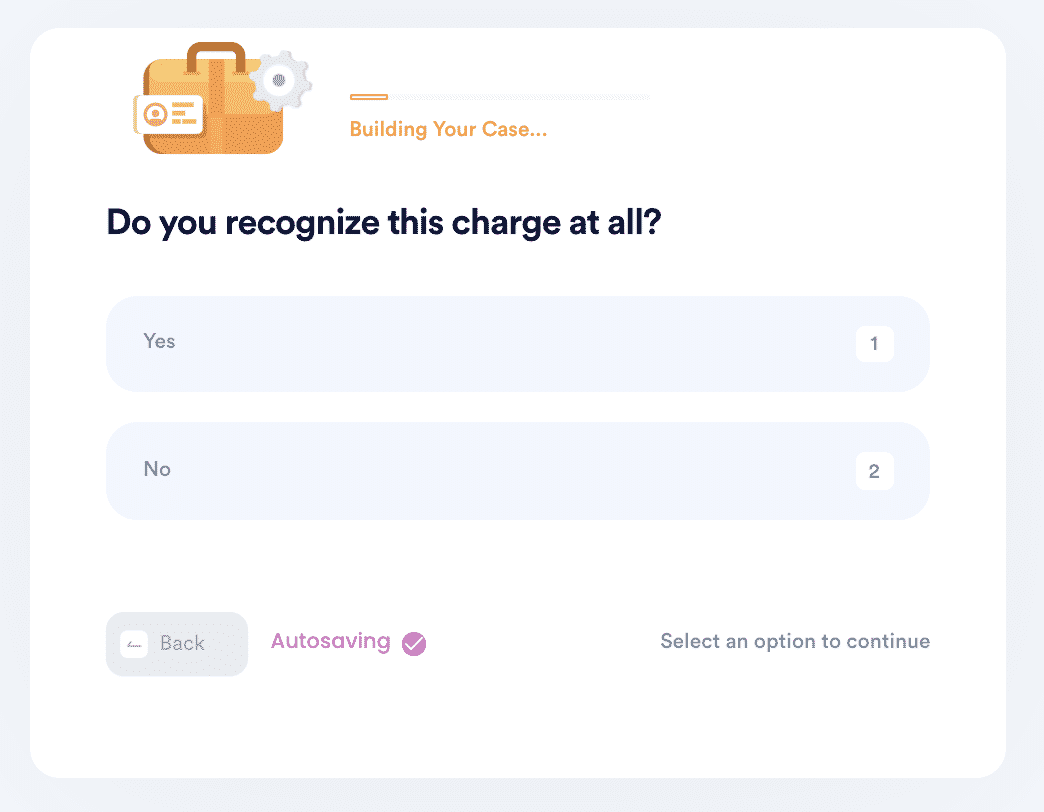

- Build Your Evidence: Share relevant information about the charge on your account. For example, do you recognize it at all? Is this a place you typically shop? Could someone else who is authorized to use your account have made this transaction for you? Answer the questions as they appear on the screen.

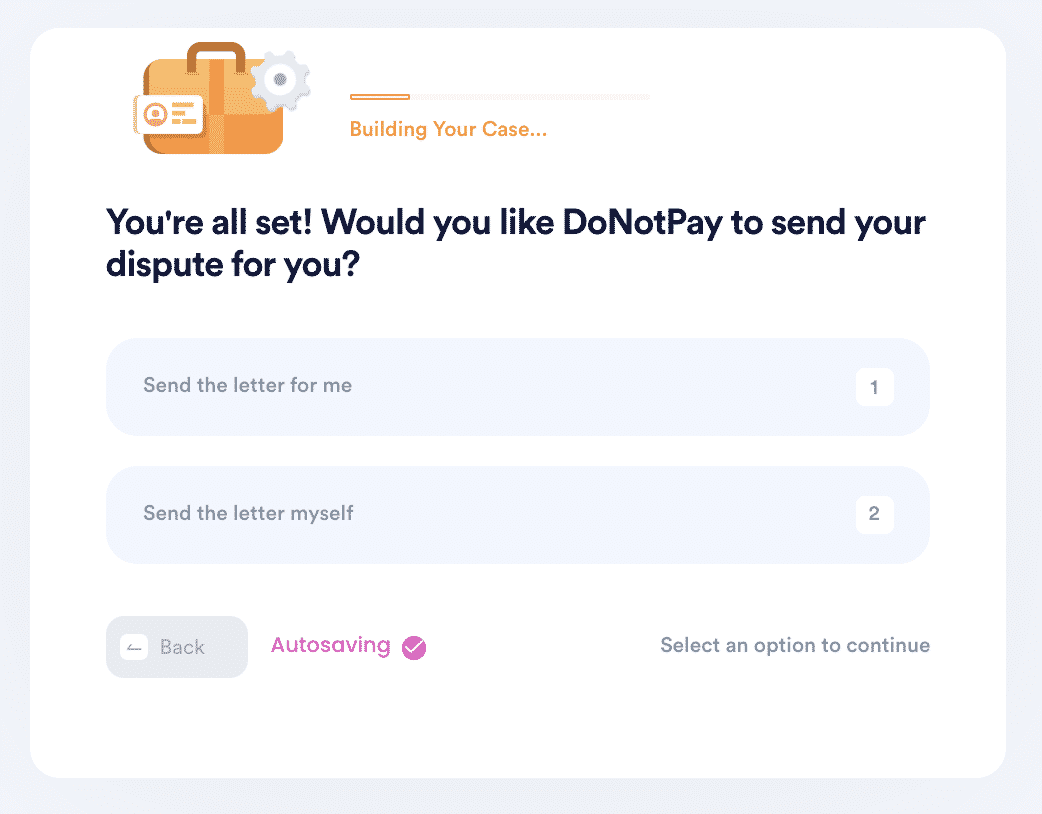

- Finalize: Verify your personal information and how you want to handle the dispute, whether you want DoNotPay to send it for you, or you prefer to submit it to BB&T yourself. Provide your signature, and you're good to go! From there, DoNotPay will take care of the dispute for you. It will be faxed automatically to your bank, with all the VISA and MasterCard codes that can help you win your case.

How Can You Check Your Refund Status?

To check on the status of your refund, you will need to contact a Truist representative at 844-4TRUIST (844-487-8478) or speak with someone at your local branch.

What Else Can DoNotPay Do?

DoNotPay can help with a variety of services that you use on a regular basis. Our easy-to-use app can help you with:

- Virtual credit cards

- Burner phone numbers

- Secure refunds for plane tickets and other services

- A host of other services that can help you avoid costly fees

You can use DoNotPay’s “File a Chargeback” product to simplify the disputes process with these businesses:

By

By