How to Fight Owning.com Hidden Fees and Get Them Waived

Owning is a direct-to-consumer mortgage lender and real estate brokerage that offers a variety of tools to take the stress and enormous cost out of real estate transactions.

Owning.com doubles up as a mortgage lender and real estate company. The website offers mortgage refinancing, home buying and selling tools such as iBuying, and home trade-ins for consumers looking to make the process of buying, selling, and financing real estate fast and easy.

Like most platforms, the website's usage is subject to payment of certain fees. Even though some of the lender fees might be justified, you may incur some hidden fees imposed by the lender just because they can. Thankfully, DoNotPay can help you discover and help you fight to have them waived.

How Much Does Owning Charge Per Transaction?

zero-down home purchase mortgage product allows customers looking for a mortgage to fund their home purchases at zero closing costs. Customers looking to refinance their mortgage loans can use Owning's no-cost refinance product without needing to pay any upfront fees or charges. In exchange for covering your closing expenses, lender fees, and third-party services, the lender charges you a higher mortgage rate.

Owning.com Fees Explained

By using Owning.com, customers looking to secure or refinance mortgages can request mortgage rate quotes, submit applications, and close on their home mortgages conveniently. As with any other digital mortgage lending platform, usage of the website is subject to upfront payment of fees.

Owning.com allows customers to refinance existing home loans or purchase new homes with no upfront closing costs.

| Fees Covered by the Lender | Fees Owning Charge Borrowers |

| Loan Origination Fee | Existing Lender Payoff Fees |

| Underwriting Fee | Prepaid Interest |

| Processing Fee | Property Taxes |

| Appraisal Fee | Transfer Taxes |

| Title Insurance | Inspection Fees |

| Escrow Fees | Discount Points |

Given that Owning will have covered the upfront costs that are normally due at signing, the lender will recoup the money by substantially raising the interest rate. While Owning's products do let you save money upfront, you ultimately pay for those savings by paying a higher interest rate.

How to Avoid Hidden Fees

There are some ways how you can avoid hidden fees. These include;

- Understanding that each trade-off the lender is giving has a price and avoiding trade-offs that will result in higher interest rates during the loan period are the best ways to prevent hidden fees.

- Consider paying closing costs in full upfront if you can. This enables you to maintain your mortgage rate as low as possible and prevent paying hefty rates.

- Your mortgage will cost less if you can afford to put down some cash. Even though Owning does not demand a down payment, putting some money down will let you lock in a lower interest rate.

Does Owning Have Hidden Fees?

No-cost refinancing and zero-down home purchase mortgages are not as transparent as they look. These mortgages have additional costs and are often more expensive than they appear to be. Mortgage products from Owning are no different. You could end up paying for hidden fees in the form of higher monthly mortgage payments and interest without realizing it.

How to Fight Owning Hidden Fees and Get Them Waived by Yourself

If you believe your mortgage loan is not cost-effective or that you're paying hidden fees, you should contact Owning and request that they waive additional fees. Give Owning a call at (833) 346-1397.

What if I Can’t Do It on My Own?

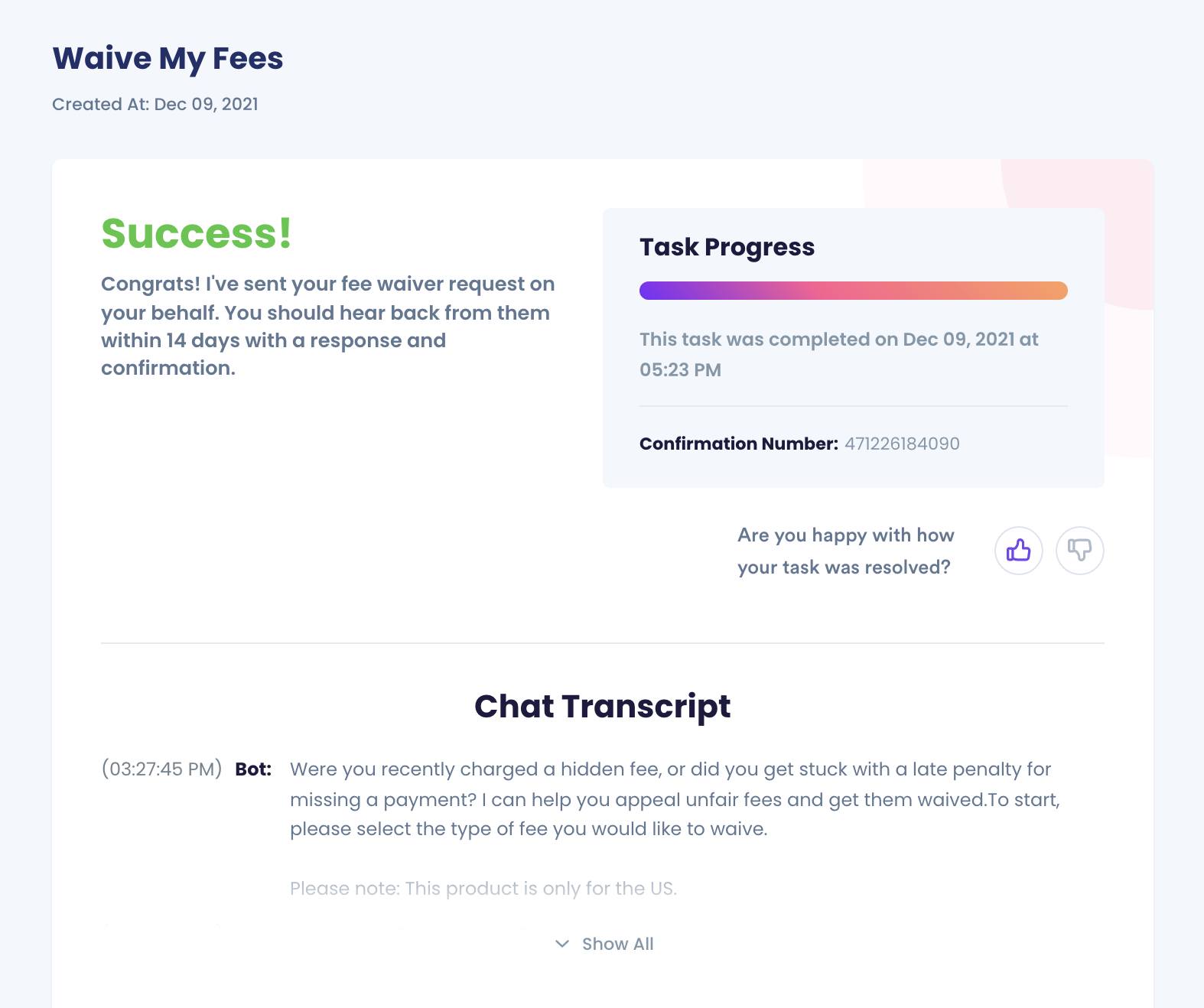

Does getting Owning to waive the fees on your own feel daunting? You don't need to worry. DoNotPay can help you fight and waive fees you feel you shouldn't have to pay. You only need to give us a little information concerning your issue, and we will contact Owning on your behalf to have the hidden fees waived.

Let DoNotPay Help You Fight and Waive Owning.Com Hidden Fees

The most convenient way of contacting Owning.com is through DoNotPay. DoNotPay's fight and waive fee product is a more practical and efficient way of fighting hidden fees and getting them waived.

Using our fight and waive fee product, fighting and getting the fees waived is now quick and easy.

Here's how you can use DoNotPay to fight and waive Owning.com hidden fees:

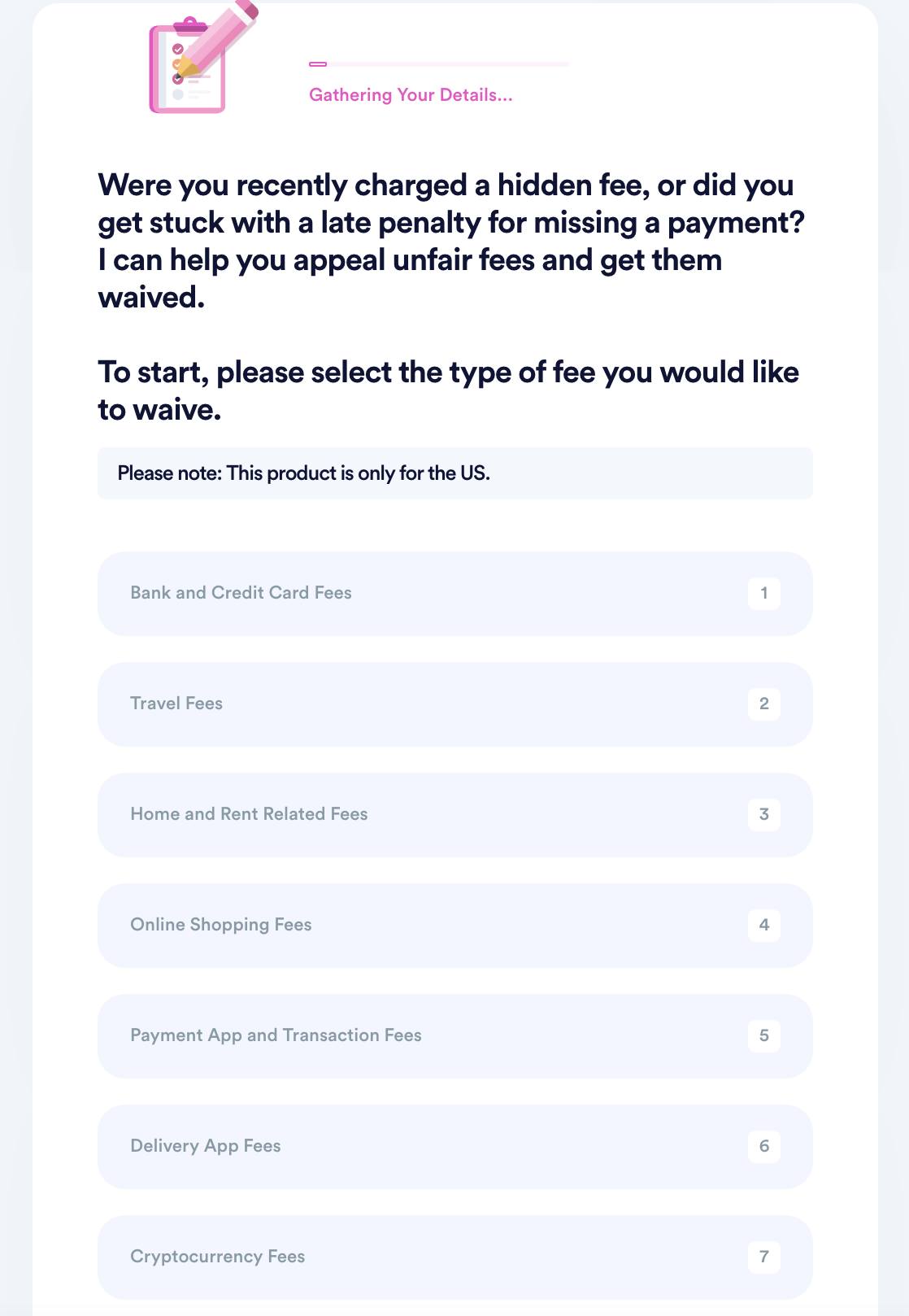

- Search "appeal fees" on DoNotPay, choose the Fight and Waive Fees product, and select the type of fee you want to appeal.

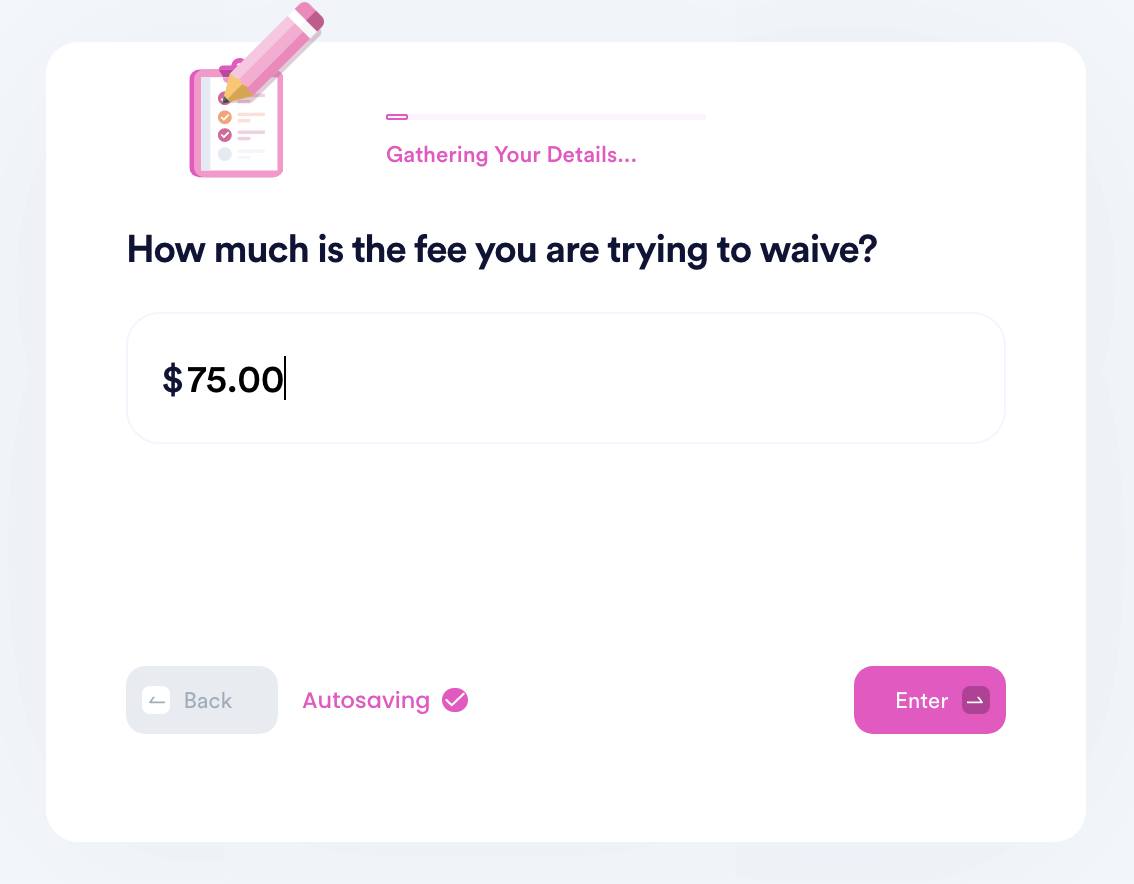

- Select the merchant you want to appeal fees for and enter the details of your transaction, including an associated account if you have one.

- Submit your case! DoNotPay will generate the best argument for your case and make sure your fee waiver request gets sent to the merchant for processing.

DoNotPay Can Help With Other Fees

Owning is not the only company DoNotPay can help you with. DoNotPay can also help waive fees from several banks, airlines, and companies. DoNotPay can help with:

- Coinbase Fees

- Chase Checking Account Fees

- eBay Fees

- Robinhood Fees

- PayPal Seller Fees

- Spirit Airlines Baggage Fees

- HOA Fees

- Etsy Fees

- American Airlines Baggage Fees

- Shopify Fees

What Else Can DoNotPay Do?

Curious about DoNotPay's other services? DoNotPay has developed numerous incredible products and services to help simplify your life. In addition to helping you fight and waive fees, DoNotPay can take the hard work out of everyday issues such as:

- Discovering And Applying for Scholarships

- Contacting Embassies and Consulates

- Notarizing Any Documents

- Standardizing Documents

- Creating Passport Photos

- Reducing Your Property Taxes

- Getting Compensation for Late or Missed Flights

- Appealing Banned Accounts

- Filing A Complaint with Any Company

to start enjoying these and more services without a hassle!

By

By