Dispute Morgan Stanley's Hidden Fees Effortlessly

Fees are an unfortunate fact of life. Fees associated with HOAs, Chase, American Airlines, and Shopify are some common fees that you could run into. However, investor-associated fees can be tricky because they can sometimes hide in plain sight.

Investment services have been growing in recent years due to the ease of access for consumers who would not have invested in the past. As a result, those that are not savvy about the fees associated with investing can sometimes fall victim to unnecessary fees. With DoNotPay, we'll show you with companies such as Morgan Stanley as well as others.

In 2020, Morgan Stanley was fined $5 million by the Securities and Exchange Commission for tacking on extra fees to the accounts of certain clients who had expected to pay a single price for financial advice. The SEC found that Morgan Stanley had charged customers fees without disclosing those fees when Morgan Stanley asked outside brokers to make trades. Let's take a look at what you can do if you think you were charged hidden fees and how to recover them.

Morgan Stanley Fees Explained

Investors in Morgan Stanley pay an annual fee depending on the total amount of assets in accounts at the end of the preceding quarter, which is charged quarterly in advance. Advisory services for retirement or trust accounts can be established in addition to a personal investment account. The minimum asset requirement for investing with Morgan Stanley is $10,000.

Below is a table of the commission schedule for Morgan Stanley.

| Investment | Fee |

| $0 - $199,999 | 2.25% |

| $200,000 - $299,999 | 2.15% |

| $300,000 - $399,999 | 2.05% |

How to Avoid Morgan Stanley Hidden Fees

Here are a fews ways to avoid fees with Morgan Stanley:

- Hire a fee-based advisor, not a commission-based one

- Negotiate a financial advisor's fee

- Use a passive investment style that requires less work from the investment advisor and usually results in lower fees for the investor

How to Waive Fees on Your Own

If you find you have fallen victim to hidden fees and would like to have those fees waived or refunded, there are a few things that you can do. You can contact Morgan Stanley's customer service and simply ask. One of the best ways to get fees waived in general is to reach out to the customer service team and talk to them about your situation.

Another option is to research your own fees to see if there was a mistake or an undisclosed fee that was attached to your account. According to Reuters, Morgan Stanley was fined $5 million by the SEC for attaching undisclosed fees to client's accounts. Though Morgan Stanley has never admitted wrongdoing in the matter, you may still be entitled to compensation if you were charged erroneous charges in connection with the ruling in 2020.

As you can see, this can be cumbersome and confusing, especially if you are not a seasoned investor.

Next Steps for Waiving Hidden Fees With Morgan Stanley if You Can't Do It Yourself

If you can't do it yourself, let DoNotPay help. Here's how you can use DoNotPay to appeal fees:

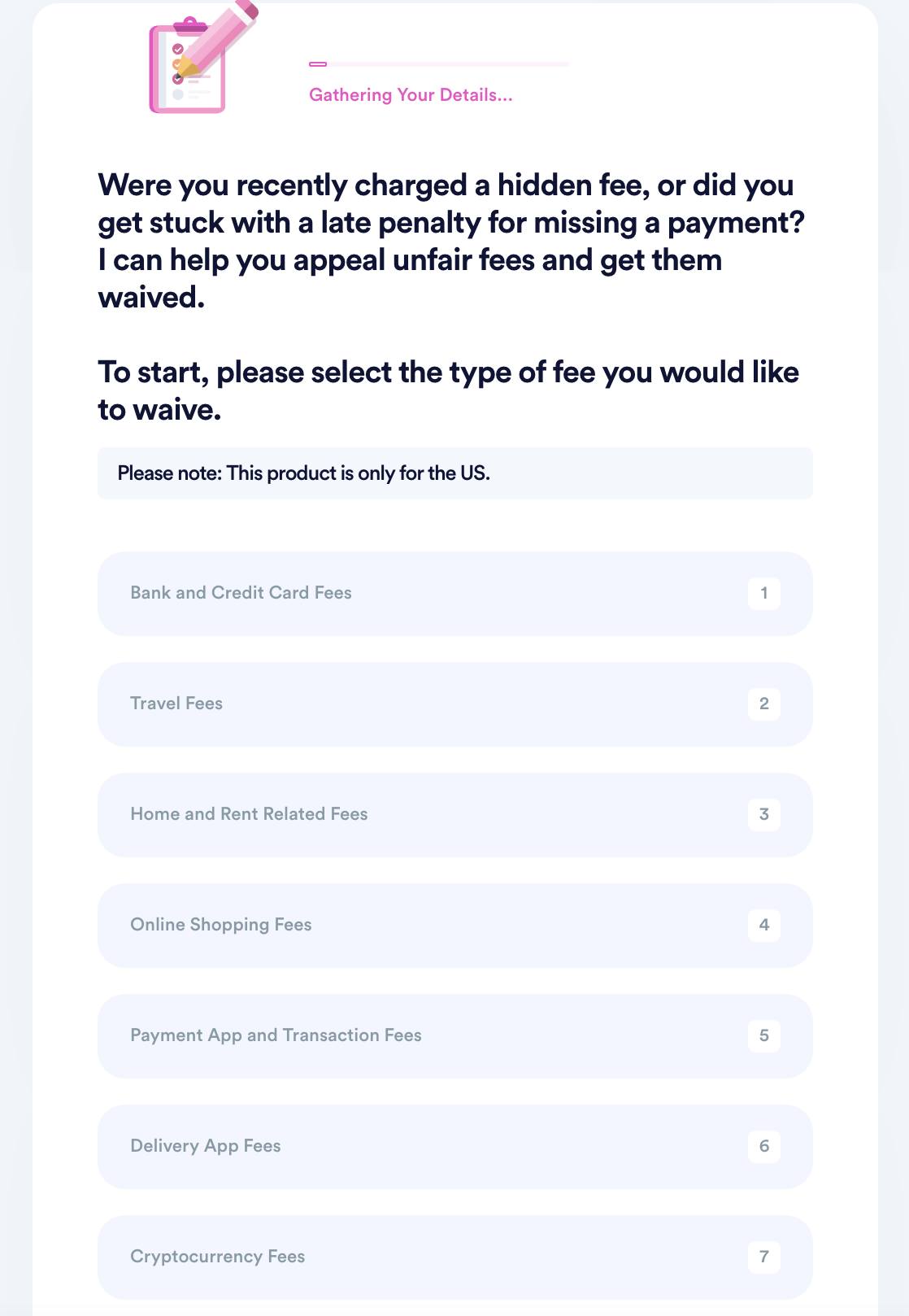

- Search "appeal fees" on DoNotPay, choose the Fight and Waive Fees product, and select the type of fee you want to appeal.

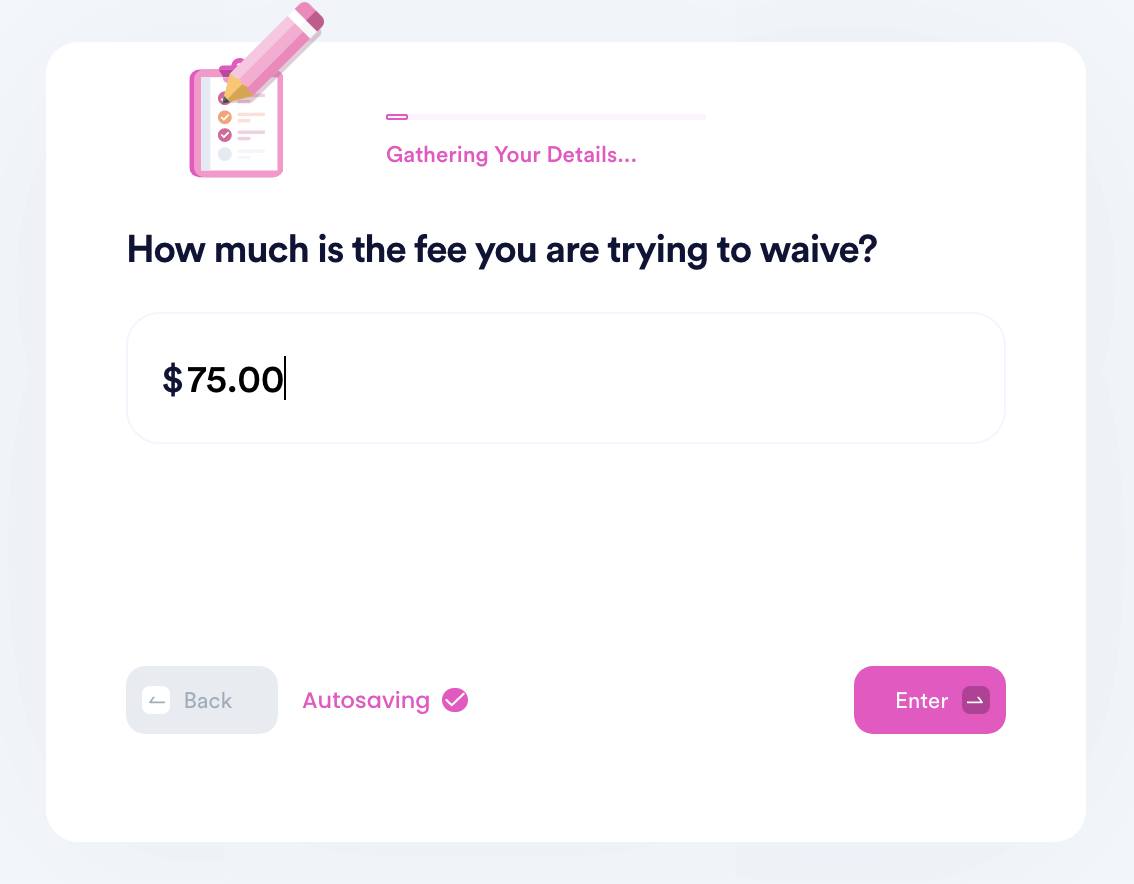

- Select the merchant you want to appeal fees for and enter the details of your transaction, including an associated account if you have one.

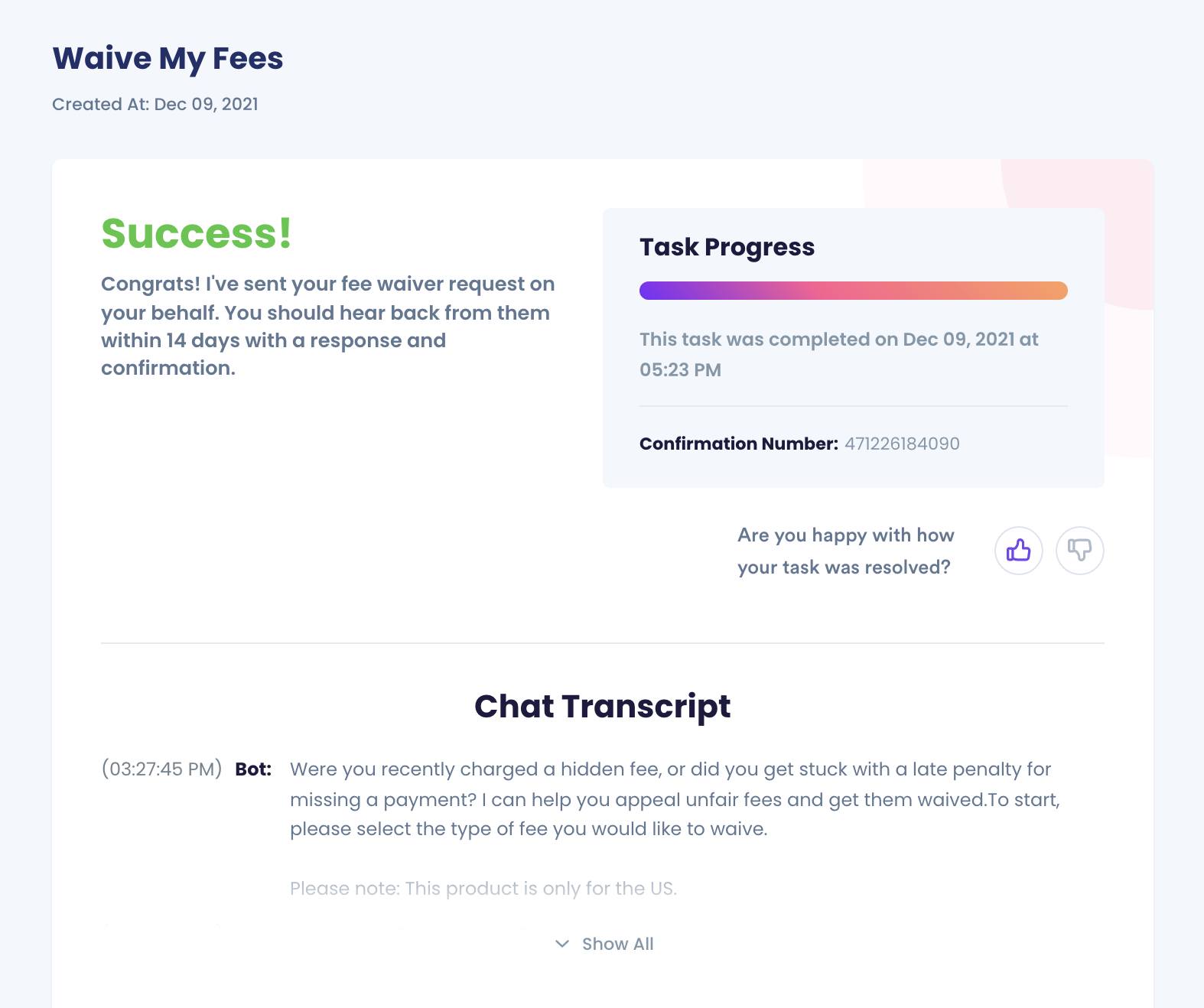

- Submit your case! DoNotPay will generate the best argument for your case and make sure your fee waiver request gets sent to the merchant for processing.

Why Use DoNotPay to Get Your Fees Waived

If you've been charged hidden fees by Morgan Stanley, it can leave you feeling angry, frustrated, and overwhelmed.

DoNotPay Fights Hidden Fees Across Many Companies With the Click of a Button

DoNotPay can not only help you waive fees with Morgan Stanley, we can also help with fees associated with:

- Ebay

- Coinbase

- Robinhood

- PayPal

- Spirit Airlines

- Etsy

What Else Can DoNotPay Do?

There are a number of things DoNotPay can do to simplify your life. Not only can DoNotPay help you with fees, we can also help with:

Fees are sometimes unavoidable, but it can be a cumbersome process to research what fees can be waived and how to go about it. Let DoNotPay help get your fees waived as well as help guide you through everything from getting a document notarized to appealing a banned account.

By

By