Yes, You Can Refuse to Pay Hidden Bill.com Fees—Here's How

Bill.com is a financial software company that provides businesses with a suite of tools to manage their finances, including invoicing, payments, and expenses. The company charges a monthly fee for access to its platform and transaction fees for each bill that is paid or invoice generated.

are relatively lower for automated payments (such as those made by credit card or ACH) than for manual payments (such as those made by check). But still, the fees can add up. You may try to appeal the fees, though this is always a long and daunting process.

DoNotPay offers an easy way to fight and waive Bill.com fees. We'll help you file an appeal and increase your chances of getting the fees waived. With our service, you don't have to worry about the hassle or the paperwork—we'll take care of everything for you.

How Much Does Bill.com Charge Per Transaction?

Bill.com charges transactional fees of $0.49 as ePayment/ACH processing fee, $1.69 and $1.49 to mail checks and invoices, and $9.99 to $22.99 for fast pay fees. There's also a 2.9% transaction fee/payment (fees apply to payer) for credit or debit card payments and merchant fees.

has several packages each with different features and fees. Here's a breakdown of their fees and plans.

| Plan | Price |

| Essentials | $45/per user/month |

| Team | $55/per user/month |

| Corporate | $79/per user/month |

| Enterprise | Variable |

Tips to Avoid Bill.com Fees

There are a few things you can do to avoid Bill.com fees in the future:

Choose e-Payments Instead of Checks

Paying by check incurs a $1.69 processing fee, while electronic payments (ACH or credit/debit card) are only $0.49. If possible, opt for e-payments to save on fees.

Batch Your Payments

You can avoid the $0.49 processing fee for each payment by batching your payments. When you batch payments, Bill.com processes all of the payments together rather than individually. This means you only have to pay the $0.49 processing fee once, even if you're paying multiple bills.

Pay Your Bills Early

Consider the duration. An overnight payment by check will cost you $22.99, whereas a three-day one will cost you $11.99.

Use DoNotPay to Waive Late Payment Fees

Even if you're unable to avoid a late payment fee, you can use DoNotPay to file an appeal and try to have the fee waived. We'll help you gather all the necessary documentation and evidence, and we'll even file the appeal for you.

Does Bill.com Have Hidden Fees?

Many companies have hidden fees, and unless you do your math correctly, you could be hit with fees you didn't know about. But Bill.com has listed all its costs and charges on the platform. Unlike its peers like PayPal, which charges on a percentage basis, Bill.com charges $0.49 per ACH payment, which is not only low-cost but also straightforward. Knowing how much you'll be paying for each transaction makes it easy to account for all costs rather than guesstimating what the percentage fee will come out to.

How to Appeal Bill.com Fees

If you want to appeal Bill.com fees on your own, follow these tips:

- Gather all documentation related to the fees in question, including any emails, invoices, or receipts showing what you were charged and when.

- Write a clear and concise letter explaining why you believe the fees are unjustified and what you would like Bill.com to do (waive the fees, refund the charges, etc.).

- Include your contact information and a daytime phone number so Bill.com can reach you if they have any questions.

- Send your letter via certified mail with the return receipt requested, so you have proof that it was received.

- Be polite and professional in all correspondence with Bill.com.

While following these tips may give you a better chance of waiving your fees, the process is still long and complicated. DoNotPay can help you file an appeal and increase your chances of success without hassle.

How to Appeal Bill.com Fees Using DoNotPay

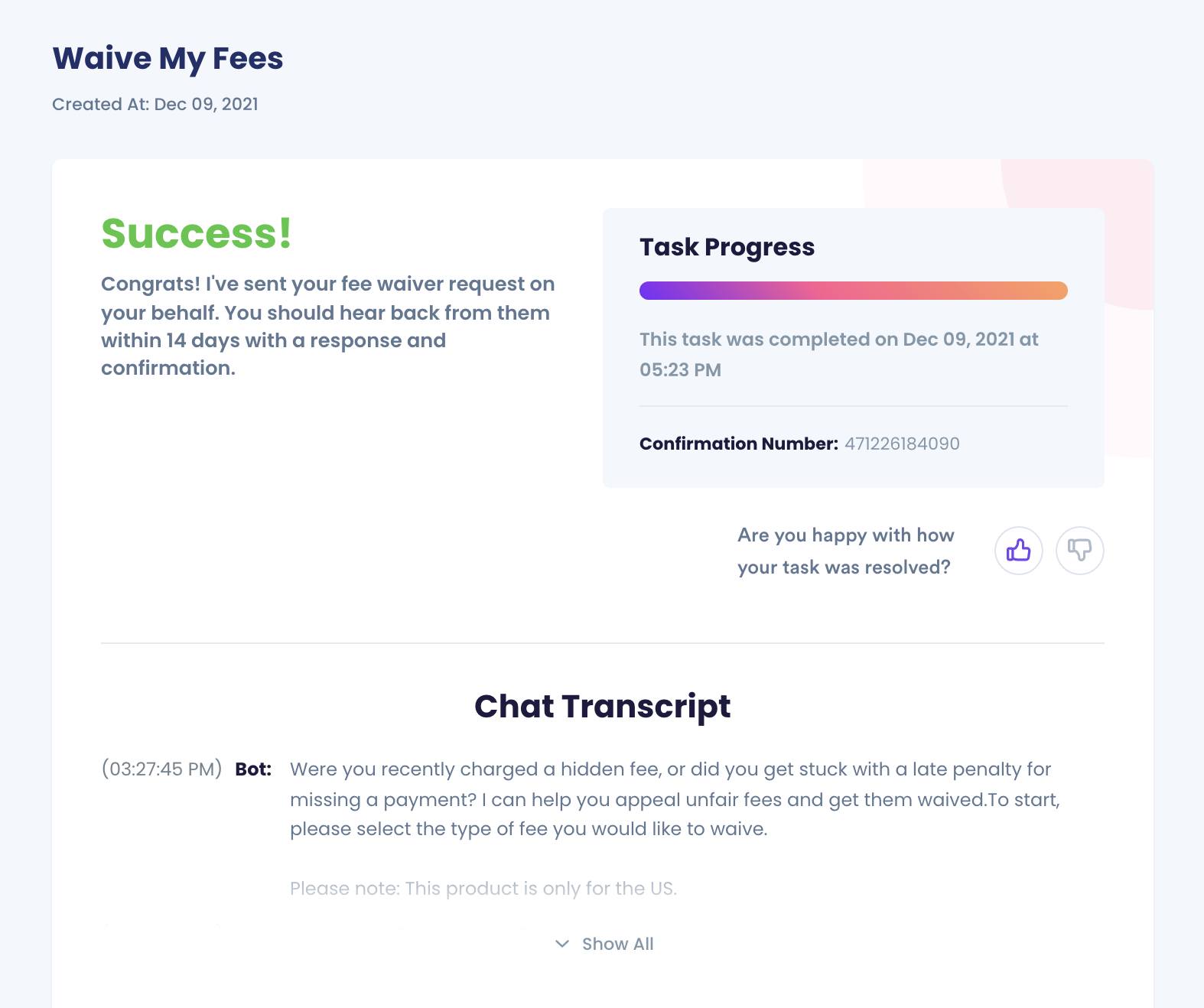

Appealing fees can be complicated and time-consuming, but with DoNotPay, it's easy. We'll help you gather all the necessary documentation and evidence and even file the appeal for you.

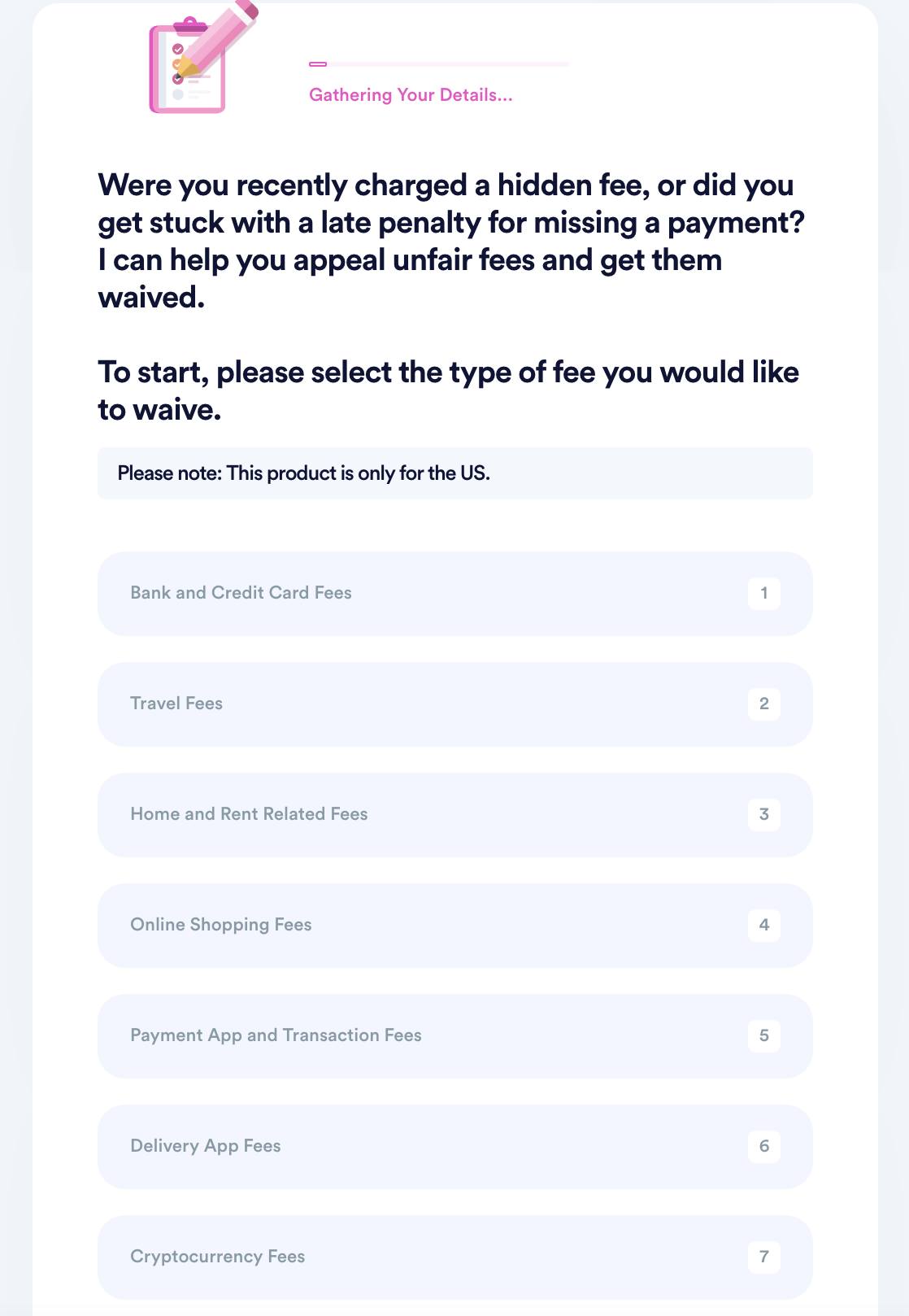

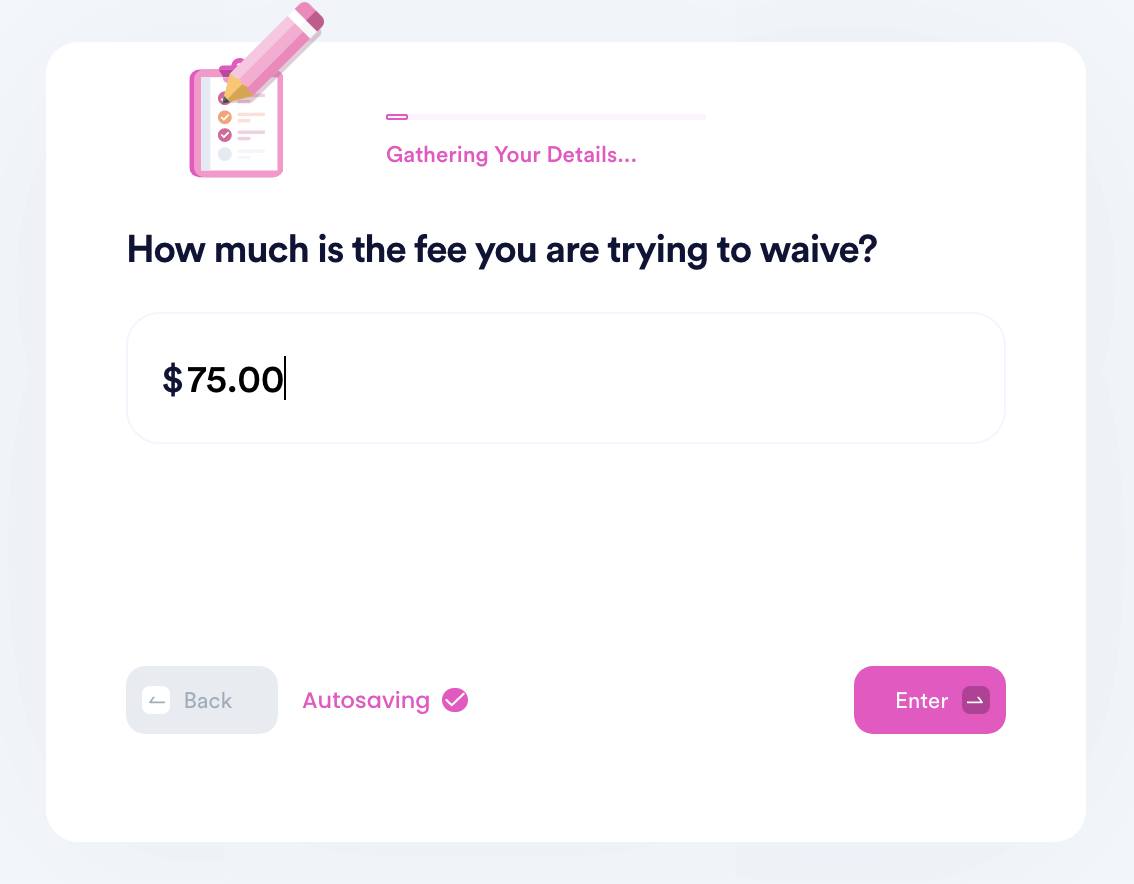

- Search "appeal fees" on DoNotPay, choose the Fight and Waive Fees product, and select the type of fee you want to appeal.

- Select the merchant you want to appeal fees for and enter the details of your transaction, including an associated account if you have one.

- Submit your case! DoNotPay will generate the best argument for your case and make sure your fee waiver request gets sent to the merchant for processing.

Why Use DoNotPay to Appeal Bill.com Fees?

DoNotPay is the best way to appeal Bill.com fees because we're faster, easier to use, and more successful than any other option. Our app is:

- Fast: DoNotPay only takes a few minutes to appeal a fee

- Easy to use: With DoNotPay, you don't have to worry about writing appeals or hiring a team. We'll do it all for you.

- Secure: DoNotPay uses military-grade encryption to keep your personal information safe.

- Successful: We have a 90% success rate regarding fee appeals!

DoNotPay Works Across All Companies With The Click of a Button

DoNotPay is the world's first AI Consumer Champion and can help you fight and appeal fees across other companies globally. We can appeal eBay fees the same way we can with CoinBase, Robinhood, and Etsy.

DoNotPay can also help appeal:

- PayPal Seller fees

- Spirit Airlines baggage fees

- HOA fees

- Chase checking account fees

- American Airlines baggage fees

- Shopify fees

What Else Can DoNotPay Do?

DoNotPay can do more than help you appeal fees. We also offer a wide range of other services, including helping you:

- Reduce property taxes

- With airline flight compensation

- Discover and apply for scholarships

- Appeal banned account

- Create passport photos

- With embassies and consulates

- Notarize any document

- File a complaint

Sign up today to get started.

By

By