Discover Discarded—How To Cancel Discover Payment Protection

Discover is a credit card company based in the United States. The company offers cardholders a payment protection plan to help manage finances. While the feature may be useful in some situations, Discover will sometimes sign users up without informing them. Months or years can pass without the users noticing they are being charged a monthly fee for payment protection. The company has been sued for adding this monthly charge and making it difficult to cancel the subscription.

If you’re having trouble canceling Discover payment protection, DoNotPay can step in and solve the problem in minutes.

Cancel Discover Payment Protection on Your Own

To cancel Discover’s payment protection plan, you have to get in touch with customer service. Here’s how you do it:

- Call 877-883-1959

- Ask to speak to a representative or agent

- Request that they cancel payment protection

If you were signed up for payment protection without your knowledge or consent, ask the company for reimbursement. You can threaten action if they refuse to comply with your request.

Take a look at the methods you can use to cancel Discover payment protection:

| Can I Cancel With | Yes/No |

| No | |

| Letter | No |

| Phone | Yes |

| In Person | No |

| Website | No |

| DoNotPay | Yes |

DoNotPay Can Cancel Discover Payment Protection Asap

Canceling a service like Discover’s payment protection can be a hassle. Credit card companies make canceling inconvenient and try to keep you on plans for as long as possible. If you want to avoid spending hours on the phone arguing with Discover’s representatives, use DoNotPay to cancel the protection plan. Our app lets you take care of the problem in minutes, without having to leave your couch. Here’s how you cancel using DoNotPay:

- Sign in to our app from your

- Go to the Find Hidden Money tab

- Enter Discover Payment Protection in the text box

- Confirm

DoNotPay will get to work and cancel the payment protection plan. After we’re done, you won’t have to contact Discover or worry about them charging you again. We’ll notify you as soon as the process is complete and the service is canceled.

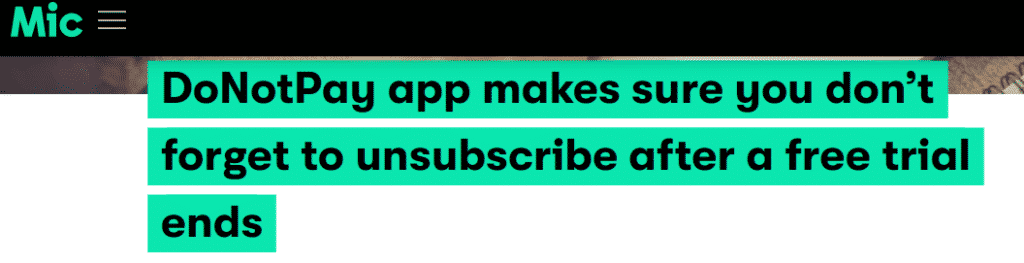

Use DoNotPay To Track Your Unused Subscriptions

Discover’s payment protection plan isn’t the only service that flies under most consumers’ radars. Americans spend more than $300 per year on unused subscriptions, whether they signed up for them or not. It can be challenging to keep track of everything you pay for, which leads to a lot of lost money.

DoNotPay can help you avoid losing money by monitoring your paid subscriptions. Connect your email or bank account to our AI Consumer Champion, and we’ll show you a list of the services you pay for. You can then choose the subscriptions you want to cancel and the ones you want to keep.

What To Do if Discover Won’t Cancel Your Payment Protection Plan

If you called Discover and they refused to cancel payment protection, you can file a complaint with the Consumer Protection Finance Bureau. If there are enough consumers with the issue, the bureau might file a lawsuit.

To take matters into your own hands, use DoNotPay to send demand letters to Discover in small claims court. Our app makes this complicated bureaucratic process much simpler and more straightforward. DoNotPay has been recognized by the American Bar Association’s Louis M. Brown Award for providing accessible assistance.

Here’s what DoNotPay can do to help when Discover refuses to cancel payment protection or you:

| The Issue | Can DoNotPay Help Me? |

| Signed up for payment protection without consent | Yes |

| Don’t know how to join a class-action lawsuit against Discover | Yes |

| Want to request a refund | Yes |

DoNotPay Will Help Solve Other Issues

No matter which service you’re subscribed to, DoNotPay can help you cancel it. If you no longer want to pay for regular credit reports from Experian or TransUnion, our app will make canceling a breeze. Use DoNotPay to cancel anything from Gold’s Gym memberships to Chegg subscriptions.

We’ll also help you with other mundane daily tasks. If you aren’t sure how to start a Netflix or PlayStation free trial, we’ll show you how to do it without risking your money.

Access our app from your , and you can start enjoying the various benefits we offer our users. Take a look at the different tasks we can simplify:

- Contesting parking tickets

- Getting in touch with your incarcerated loved ones

- Jumping the boring phone queue when getting in touch with customer service reps

- Getting your revenge against robocalls

- Fighting speeding tickets you didn’t deserve

- Dealing with problems with credit cards

- Asking for refunds and compensation for delayed or canceled flights

- Suing law-breaking people and companies in small claims court

- Canceling other subscriptions or memberships

- Applying for other clinical trials

- Filing a claim for any warranty

- Waiving college application fees

- Getting refunds from any company

- Freeing yourself from spam mail forever

- Signing up for free trials without risk

- Taking care of spam text messages

- Protecting your work against copyright infringement

- Dealing with bills when you can’t pay

- Protecting yourself from stalking and harassment

- Signing up for services without phone verification

- Disputing traffic tickets

- Scheduling a DMV appointment fast and easy

- Finding any unclaimed funds under your name

By

By