How to Appeal PNC Overdraft Fees

PNC Bank operates in the Midwest, South, and Northeastern parts of the United States. It offers a wide array of traditional banking options virtually and in real-life, such as:

- Savings accounts

- Checking accounts

- Money market accounts

- Certificates of Deposit

The virtual wallet line of products helps people balance daily expenditures with short- and long-term goals. There are many great products and customer service points to PNC Bank, but that isn't to say there aren't any issues. There are some fantastic benefits but it's often necessary to fight .

Overdraft fees are a particular problem with members of PNC bank, and just like other banks like Chase, there are many valid reasons they should be disregarded. This guide reveals what you need to know about PNC fees and how to appeal them.

Overview of PNC Bank Fees

Banks like PNC must administer some fees just to be able to carry out the services they offer. Late payments and overdrafts cost the bank money and that cost must be passed on to the consumer. The problem, however, is that all too often, banks like PNC will charge considerably more than necessary and even make false charges.

Here are some of the typical fees associated with accounts at PNC:

| Monthly Maintenance | $7- $25 |

| Minimum Deposit | $25 |

| Overdraft | $36 |

| ATM | $3 |

| Card Replacement | $7.50 |

The are the highest. A few accidents and you could be in a serious financial deficit for the month, not to mention a deep ding to your credit. No one purposely overdrafts their accounts and more often than not, the fees add to an already financially precarious situation.

How to Fight PNC Overdraft Fees on Your Own

Overdraft fees are a tremendous financial burden on everyone, and they are unusually high at PNC Bank. Fighting them on your own takes considerable effort, time, patience, and knowledge. The first time you need to waive your overdraft fees, PNC will do so without much effort with a simple phone call to 1 (888) 762-2265.

If you do fight these fees on your own expect:

- A battle with the bank

- A lot of frustration

- The possibility that you won’t win

It's after the initial overdraft waiver that things become more challenging. In fact, it can get downright nasty trying to fight any subsequent overdraft fee from PNC. Fortunately, there is an easy solution.

The Next Steps to Fighting PNC Overdraft Fees When You Can't Do It Yourself

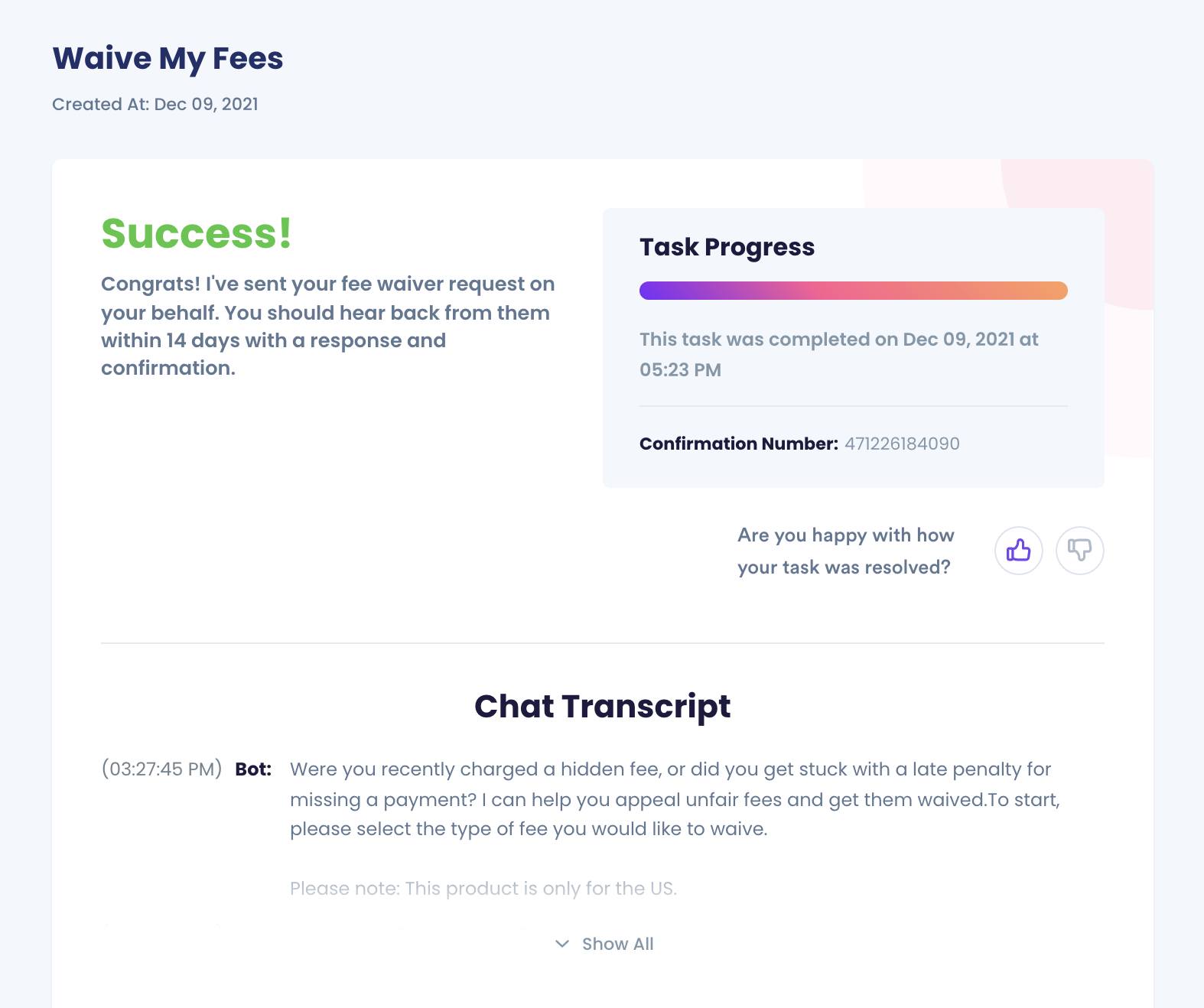

DoNotPay is the world's first AI attorney. Originally designed to battle excessive parking tickets, we soon became a leader in consumer rights-related quests. Anyone can download the app that uses AI to provide services for a low monthly fee. In short, we deal with everything from bureaucratic irritations to convoluted refund processes on your behalf.

PNC Bank overdraft fees are no different. We are here to help you rip the red tape and reveal the answers you're entitled to. Problems with PNC Bank fees and other charges shouldn't become your problem and our immense array of information is here to make sure it's not.

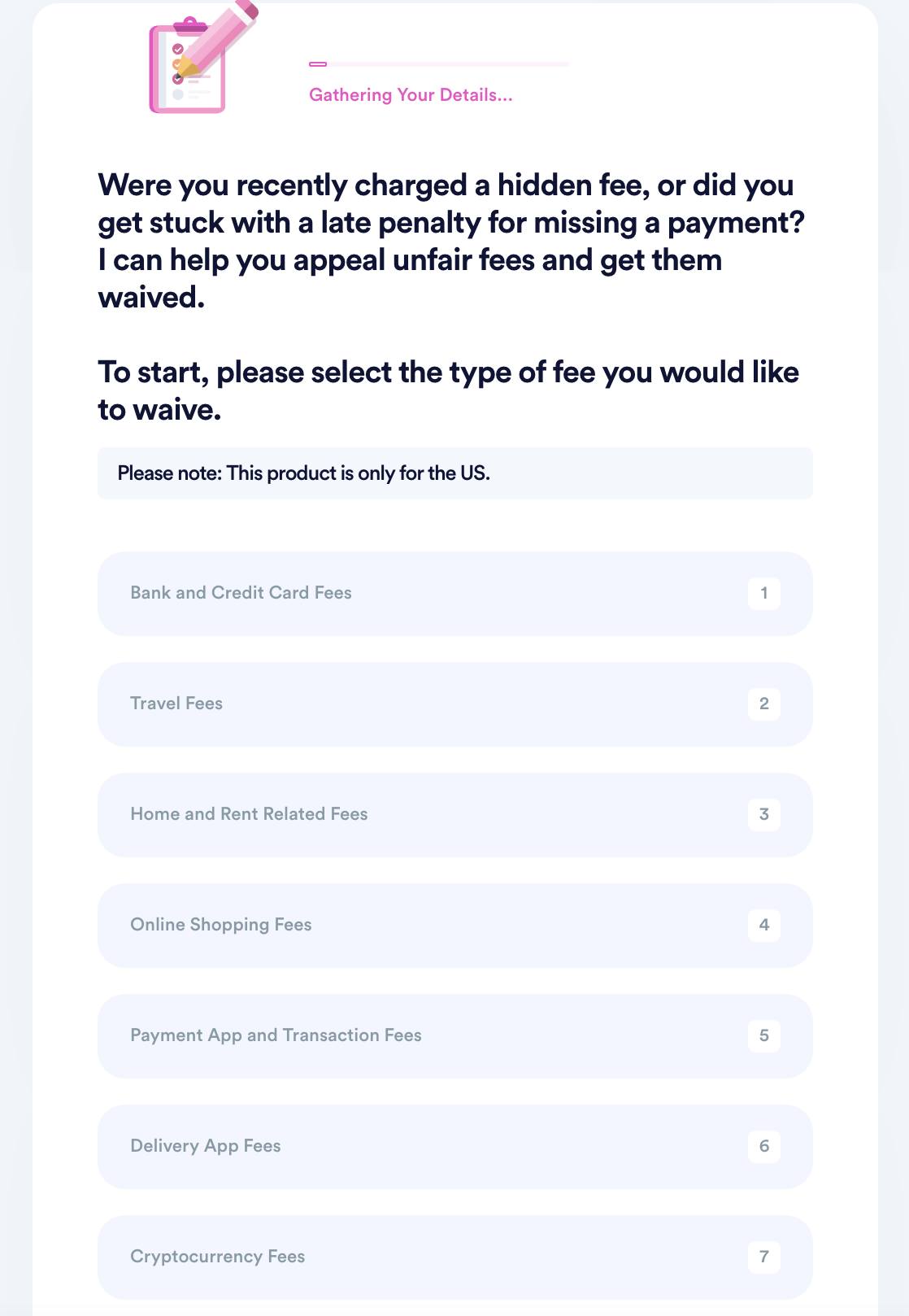

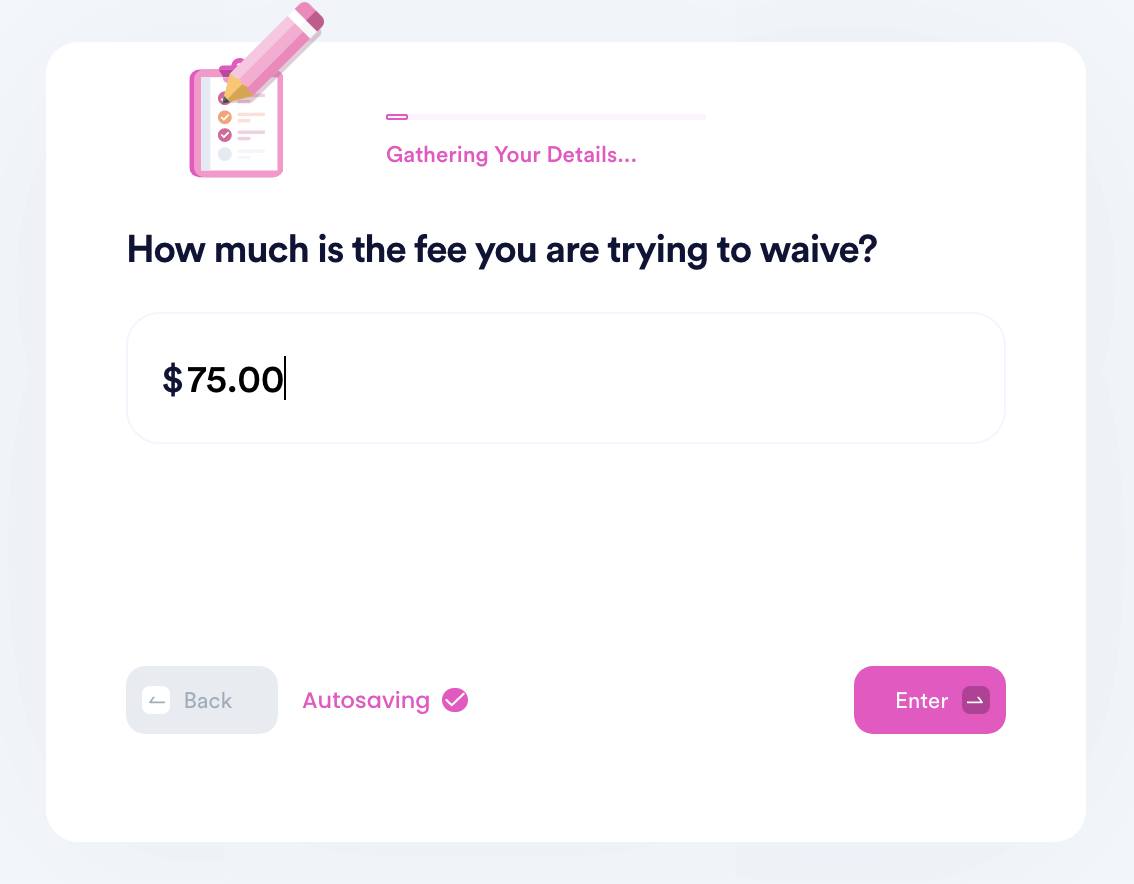

Here's how you can use DoNotPay to appeal fees:

- Search "appeal fees" on DoNotPay, choose the Fight and Waive Fees product, and select the type of fee you want to appeal.

- Select the merchant you want to appeal fees for and enter the details of your transaction, including an associated account if you have one.

- Submit your case! DoNotPay will generate the best argument for your case and make sure your fee waiver request gets sent to the merchant for processing.

Why Use DoNotPay to Appeal PNC Bank Overdraft Fees

There are so many unique reasons to use the DoNotPay line of products. Most are ultra-specific to our user's personal issues because we solve problems the other types of apps can't. Here's how we do it:

- Speed – We've already scoured the Internet for all the information you need, and it can be at your fingertips in a moment's notice. There's no longer a need to spend hours researching the problem.

- Simplicity – You're not required to memorize, organize, and categorize the steps in the overdraft appeal process any longer, or fill out pages of monotonous forms to get assistance. We expedite the entire process.

- Success – We always make the best case for our clients, no matter the situation, appeal, or overcharging setting. You can be sure all your bases are covered.

DoNotPay is also here for you if you want to learn about fighting fraudulent chargebacks and other phony fees.

The DoNotPay Experience

DoNotPay has a huge array of gathered knowledge ready to offer at your disposal. We've specialized in gathering all the information on the most frustrating, mundane tasks in all of American life. It isn't just about overdraft fee recovery. In fact, there are tons of other ways DoNotPay can help you right now:

- eBay fees

- Coinbase fees

- Robinhood fees

- Paypal seller fees

- Spirit Airlines baggage fees

- HOA fees

- Etsy fees

- American Airlines baggage fees

- Shopify fees

Check out DoNotPay for all of life's most frustrating needs.

By

By