Smart Hack That'll Get Your OfferUp Fees Waived

OfferUp provides an excellent eCommerce platform for people to trade goods. While the company claims that selling and browsing goods are free, it charges $12.9% of a successful sale or shipment, with a minimum of $1.99. But there are some hidden fees that most traders don't know about. But you can appeal and get cost-savings opportunities.

DoNotPay is a seasoned online robotic lawyer, helping people handle customer service complaints and appeal hidden charges, setting them up for refunds. We discovered that companies - from airlines and banks to hotels and HOA fees - include service charges that consumers learn about after receiving the final bill. We can help you to appeal so that you can get your cash back.

Remember these three points:

- With only a few clicks of a button, you can even appeal any fee with DoNotPay, even OfferUp or unwanted cryptocurrency charges.

- It all takes place online in three simple steps.

- Once you're done, DoNotPay will make a case on your behalf and present it to the merchant so you can get your refund.

How Much Does OfferUp Charge per Transaction?

OfferUp is a C2C online platform that lets sellers and buyers trade goods for free. It began as a top competitor of Craiglist, but after introducing a new shipping feature, it aims to compete with major eCommerce websites like Shopify and eBay.

Instead of charging users through tiered subscriptions, sellers must pay a service fee. After detailing the information of the on-sale item, sellers pay a service charge, usually 12.9% of the transaction fee, with a minimum charge of $1.99.

The table below explains OfferUp fees.

| The Fee | Amount | Pro or Con |

| Service Charge | 12.9%, or at least $1.99 | This fee can be a pro if you’re struggling to sell an item or service through other outlets. |

We noticed that OfferUp sellers only see the service-rate percentage when listing the item, but the actual amount only appears after you accept the offer. Subsequently, the transaction amount will be credited to your account after it has deducted your Paypal seller fee.

How to Avoid OfferUp Fees

It's a no-brainer that service fees with hidden charges can make your OfferUp operation costs spike. However, there are some measures you can take to avoid to reduce your overall operational expenses. They include:

Negotiate with suppliers

If you're an OfferUp seller who sells your goods in bulk, it would be best to negotiate with your suppliers. The chances are that you cater to many buyers, which means higher service fees. You can talk to your supplier about price reduction. Usually, if you can meet their payment dates and minimum order sizes, they can easily consider your appeal.

Market products strategically

Being online means you can use various digital advertising channels to create product awareness. It is critical to know which avenues help you maximize your marketing campaigns. You don't want to be paying OfferUp or Etsy fees while spending significantly on marketing with no ROIs.

Leverage discounts

Whether you're selling a used item or new handcrafted household goods, you can provide your prospects discounts to impact purchase decisions. Providing percentage discounts or conditional offers can boost your sales and cut inventory costs.

Use efficient packaging material

Most sellers usually overlook the costs of the packaging material. Purchasing exceedingly big packaging boxes for relatively smaller items is costly. By trimming the size to fit the item perfectly, you'll be reducing the amounts you spend on packaging and overall shipping costs.

How to Appeal OfferUp Fees on Your Own

, buyers can only make purchases under $500 according to USPS regulations. After spending such a significant amount on an item, it is understandable to want to claim a refund if the product doesn't meet the specs or is damaged.

If you receive a faulty product and demand a refund from the seller, you should report the case to OfferUp within four days of receiving the product. The return policy details that you can contact the seller within the first two days and the OfferUp customer service within the two remaining days.

If the seller responds positively to the request, OfferUp will send you a pre-paid shipping label to mail the item back to the merchant within five days. If they decline to acknowledge the problem, you should contact OfferUp customer service immediately.

Use DoNotPay to Appeal OfferUp Fees to Get Refunds

It's not OfferUp alone. Many companies and services offer hidden surcharges for the services they offer. Banks charge checking out fees while airlines make over $8.6 billion in ticket cancellation and baggage-handling fees annually; if you fail to read the fine print of your bill, you can easily miss these charges.

DoNotPay can help you appeal a wide range of hidden costs by many companies and industries, including:

- Online shopping fees

- Coinbase fees

- Robinhood charges

- Transaction on online payment services

- Brokerage fees

- HOA fees

- Hotel and resort fees

- Home lease termination expenses

If you're strict about your budget, you can leverage DoNotPay to appeal the fees to get refunds or waivers. Instead of filling out online forms, calling a company's customer care, or contacting a merchant via mail, DoNotPay pay is faster, enabling you to appeal the fees in three simple steps online.

Here are the three steps:

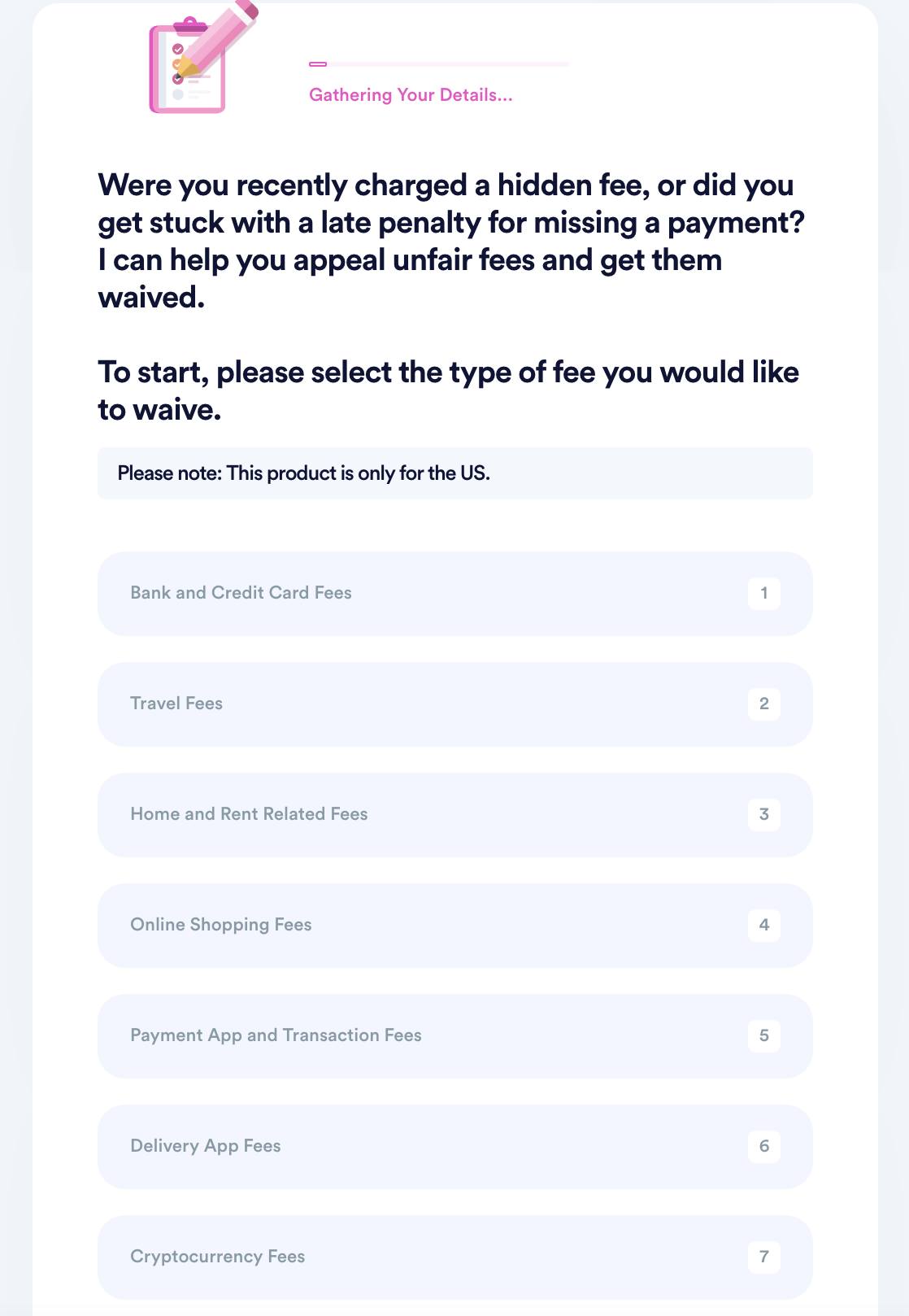

- Search "appeal fees" on DoNotPay, choose the Fight and Waive Fees product, and select the type of fee you want to appeal.

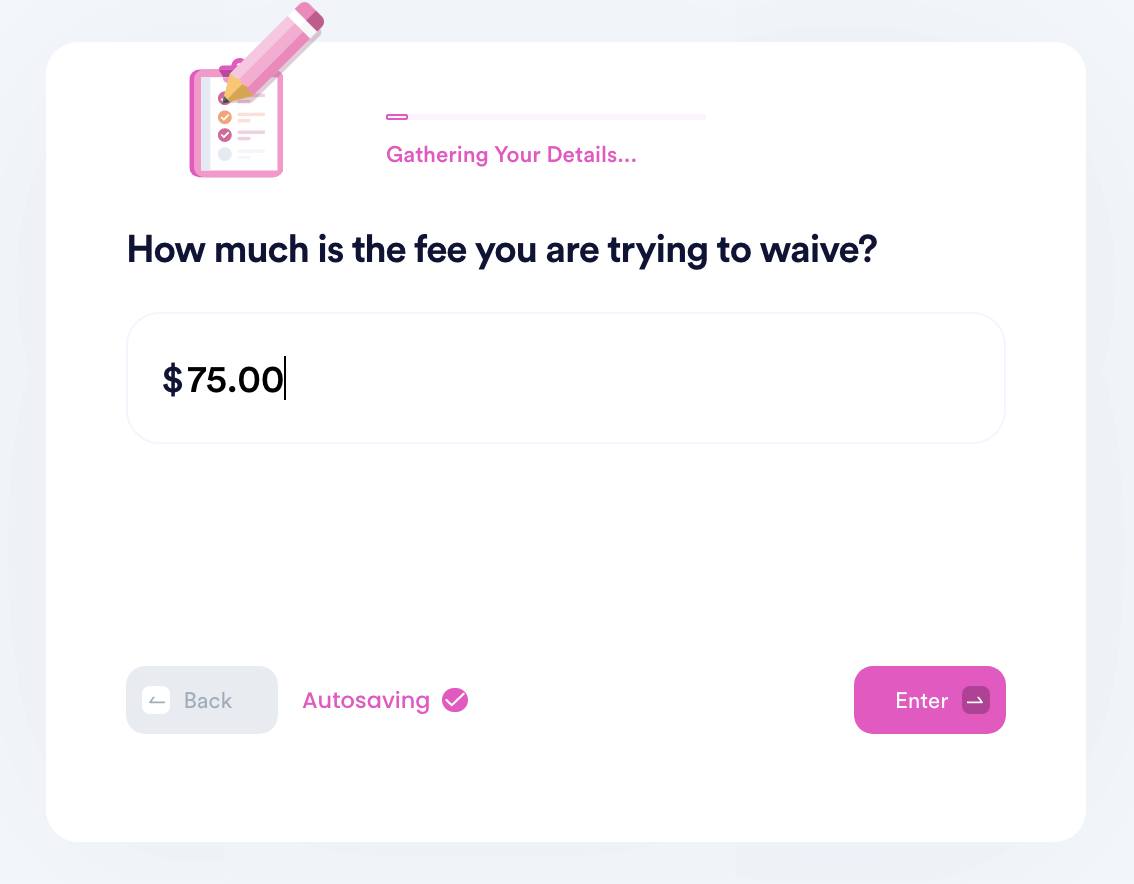

- Select the merchant you want to appeal fees for and enter the details of your transaction, including an associated account if you have one.

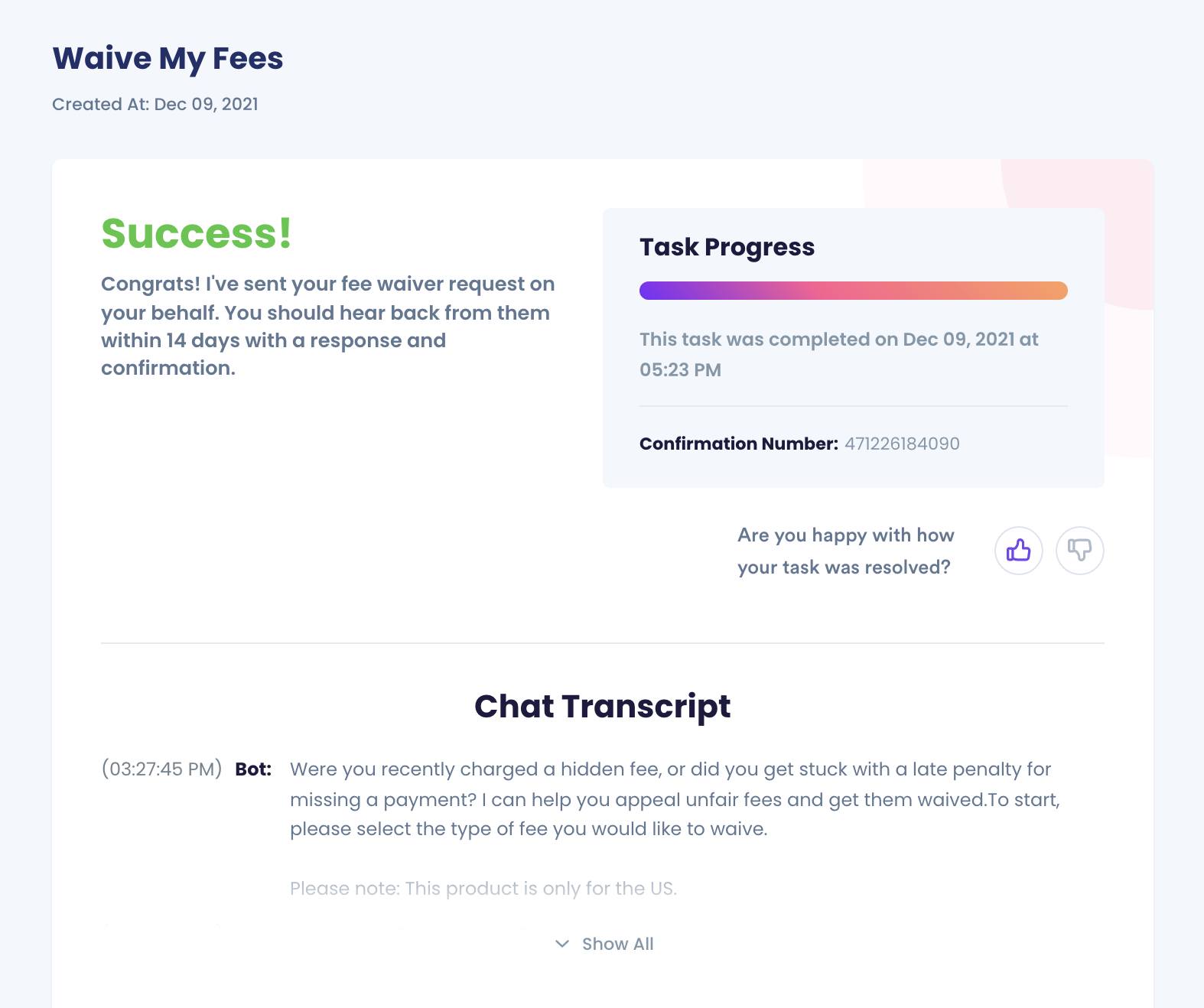

- Submit your case! DoNotPay will generate the best argument for your case and make sure your fee waiver request gets sent to the merchant for processing.

That's all. DoNotPay will generate a powerful argument on your behalf and send it to the merchant so they can process your money back.

What Else Can DoNotPay Do?

Helping people appeal hidden service fees is only one of the ways DoNotPay solves social and issues. You can depend on DoNotPay to help you with the following situations:

- Notarize any document

- Create passport-sized photos

- Reduce property taxes

- Airline flight compensations

- Handling issues with any embassy or consulate

Sign up today to get unfair fees waived!

By

By