How to Fight and Waive Offerpad Fees

Offerpad is a real estate platform for selling and buying homes and properties. It is one of the easiest ways to sell your home and maximize your Returns on Investment on your resale. As with any service provider, Offerpad charges its customers a fee.

Unlike traditional agents who charge 6% service fees, Offerpad fees stand at 5%. Generally, Offerpad is a real estate company buying eligible homes in a few chosen markets. Offerpad charges fees and flips homes for resale on the open market to profit.

If you want to sell your home fast, Offerpad provides near- cash offers as long as a fast-closing gate. Unfortunately, Offerpad's costly fees mean you may get less overall from the home resale.

You can try fighting and waiving the extra fees on your own. However, the process can be highly aggravating, tiring, and prolonged, with zero chances of success. On the other hand, DoNotPay can help you waive the excess , allowing you to maximize your home resale.

In this article, we will how to fight and waive excess Offerpad fees.

How Much Are Offerpad Fees?

Expect to pay an 8-15% fee of your sale price in case you sell your home with Offerpad. In most cases, are higher than the typical 6-11% fee you pay when working with real estate agents. Here is a breakdown of Offerpad fees:

Cost

| Offerpad Fees | Commission |

| Service Fee | 6-10% (7% average) |

| Closing Costs | 1-3% |

| Repairs and Concessions | 1-2% |

| Total | 8-15% |

Does Offerpad Have Hidden Fees?

Offerpad's high fees translate to earning less overall from a property sale. In addition, several independent Offerpad reviews also cite high repair costs often surpassing the concessions you typically pay for in a traditional property sale.

In case you want to resell your property for top dollar without any hidden fees, you can rely on other service providers such as Clever—which is a free service pre-negotiating reduced fees on your behalf with top local realtors.

Generally, while Offerpad lists its fees transparently on its website, it is less apparent that the company occasionally charges clients a 1% cancellation fee. Offerpad provides the initial cash offer, and as a seller, you must enter into the contract (purchase agreement) before the deal proceeds to the inspection part.

However, trouble may arise here. When providing the inspection report, Offerpad may also provide an updated cash offer reflecting the repair credits. You will have 4 days to consider Offerpad's offer at this point.

Consequently, within the 4-day window, you may:

- Reject the offer and walk away

- Negotiate over the repair credit

- Accept the offer and comply with the repair credit.

- Unfortunately, if you decide to back out after the four-day window, you will suffer a 1% cancellation fee, depending on the company's initial cash offer.

How to Fight and Waive Offerpad Fees Yourself

Owing to the 1% hidden cancellation fee, you may feel obligated to fight Offerpad fees. While doing it independently, Offerpad does not provide a clear channel or steps to ask for fee waivers. Therefore, you may have to contact the customer reps directly with your concerns about high fees. Consequently, you will have to prove beyond doubt that you indeed quality to fight and waive the Offerpad fees.

In most cases, you only stand a chance of avoiding the fees if you get charged wrongly, and you can prove that is the case. This process is physically and psychologically draining, especially if you do it alone. On the bright side, DoNotPay can help you fight and waive any extra unwanted fees promptly and effectively.

How to Fight and Waive Offerpad Fees With the Help of DoNotPay

If you want to avoid the Offerpad fees, DoNotPay can help you do so in a few easy steps:

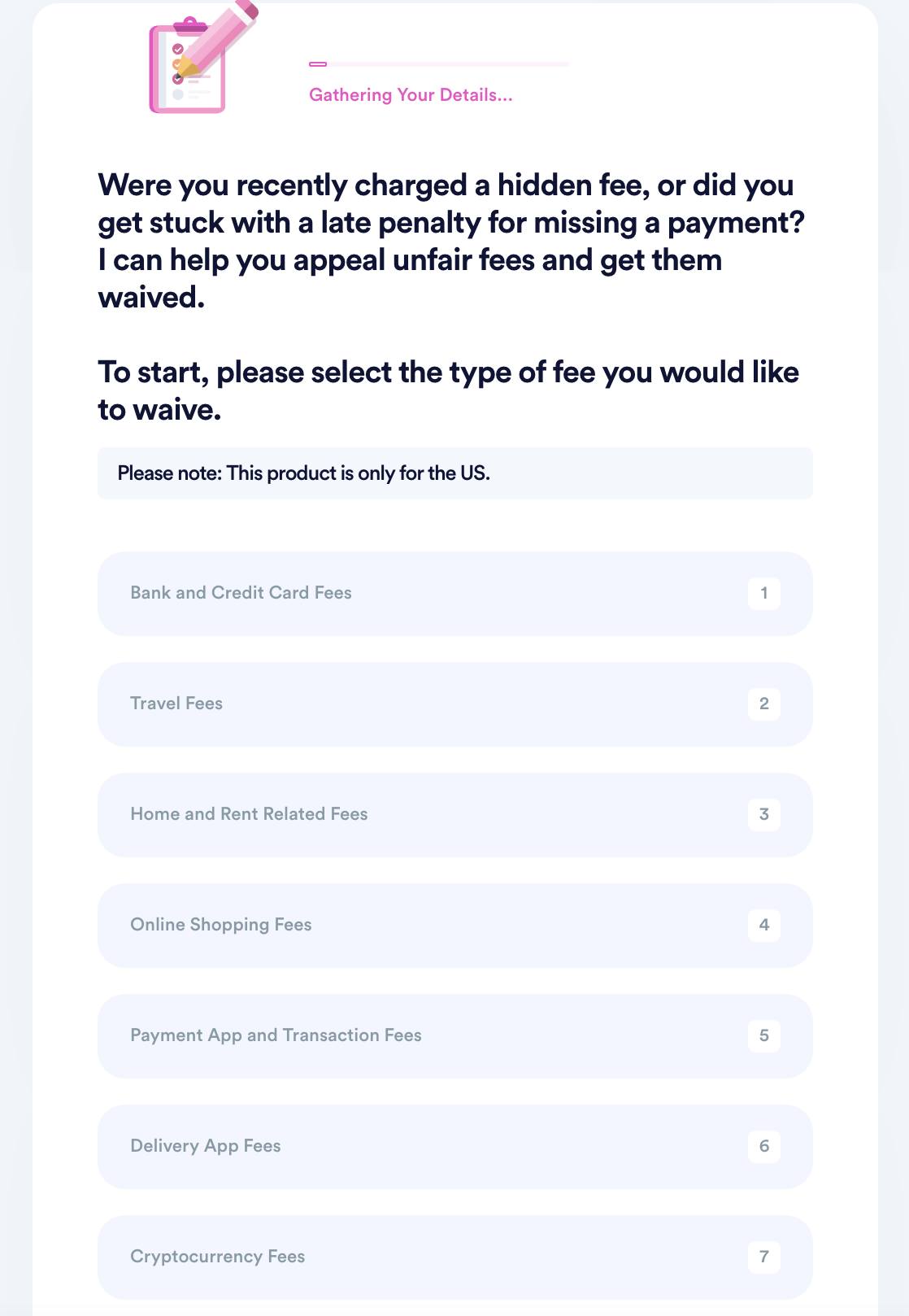

- Search "appeal fees" on DoNotPay, choose the Fight and Waive Fees product, and select the type of fee you want to appeal.

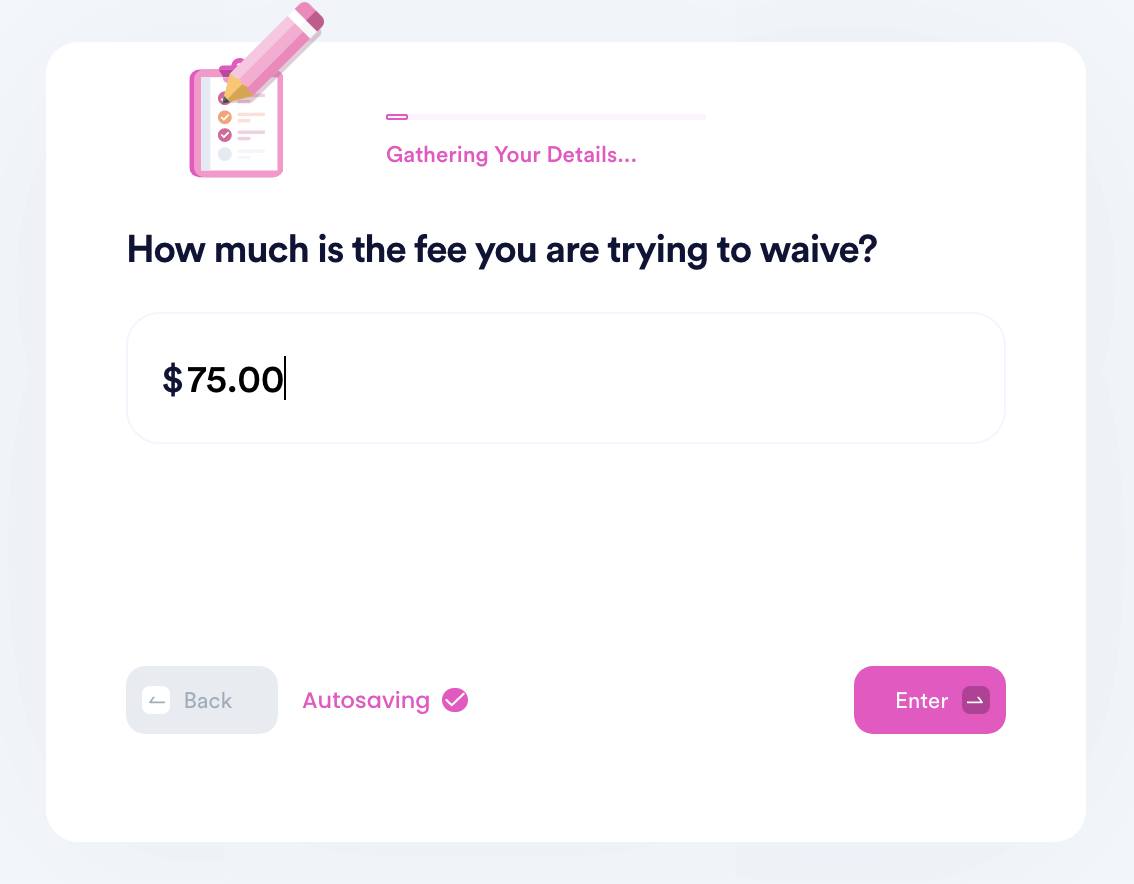

- Select the merchant you want to appeal fees for and enter the details of your transaction, including an associated account if you have one.

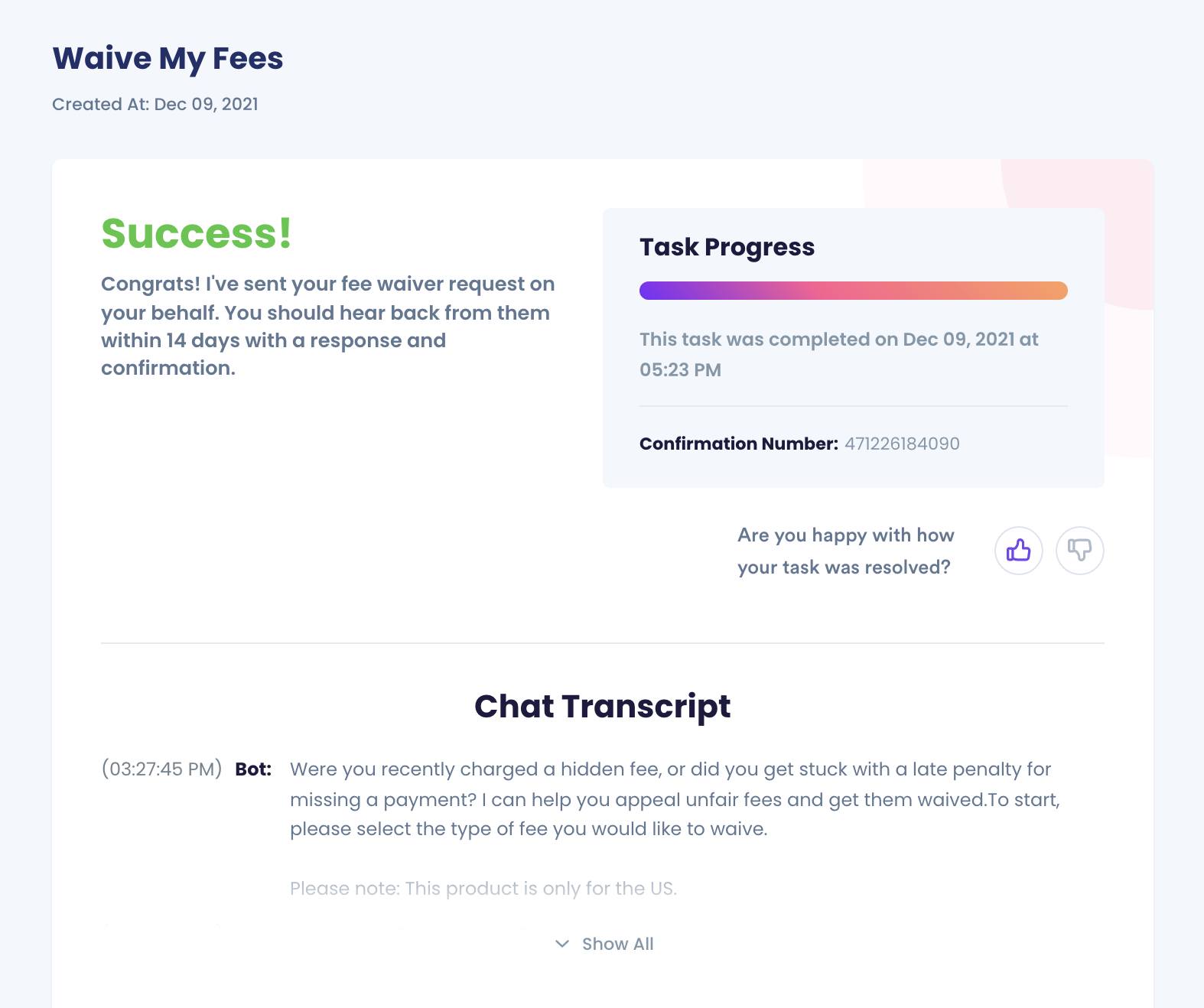

- Submit your case! DoNotPay will generate the best argument for your case and make sure your fee waiver request gets sent to the merchant for processing.

Sign up with DoNotPay to help you fight Offerpad fees when selling your property.

Why Fight and Waive Offerpad Fees With DoNotPay?

Easy process

Fast and prompt

Higher chances of getting fee waivers

DoNotPay Works Across All Platforms

Besides fighting and waiving Offerpad fees, DoNotPay can also help you with:

- Fighting Etsy fees

- Fighting Shopify fees

- Fighting Chase Checking account fees

- Fighting American Airline baggage fees

- Fighting Coinbase fees

- Fighting PayPal seller fees

- Fighting HOA fees

- Fighting eBay fees

- Fighting Spirit Airline baggage fees

- Fighting Robinhood fees.

How Else Can DoNotPay Help?

DoNotPay is a highly reliable Robo lawyer with the requisite skills and experience to help you deal with different companies and service providers. Therefore, besides helping you fight and waive Offerpad fees, DoNotPay can also help you:

- File a complaint against a company

- Appeal a banned account

- Get airline flight compensation

- Reduce property taxes

- Create passport photos

- Standardize documents

- Notarize documents

- Contact embassies and consulates

- Discover and apply for scholarships.

Are you listing your property for sale on Offerpad and looking to maximize the sale for a higher ROI? Reach out to DoNotPay to start fighting excess Offerpad fees!

By

By