Appeal Navy Federal Overdraft Fees In 3 Steps

Everywhere you turn, there seems to be a hidden fee associated with an account or provided service. Whether it is eBay or PayPal seller fees, airline baggage fees, or checking account fees, the extra money charged can add up over time.

Even though Navy Federal Credit Union is not-for-profit, they are not exempt from charging additional fees to their customers. Established at the end of the Great Depression, the financial institution has been servicing the needs of enlisted men and women since 1933.

With a vast array of accounts and credit card products, tacked onto an account with insufficient funds are significant, ranging between $20 and $29. Account-holders on a tight budget often have a difficult time accepting the exorbitant fee, sometimes incurred in error.

DoNotPay can help you appeal these excessive fees, putting money back in your pocket where it belongs. Navy Federal overdraft fees can often be waived, and we can show you how.

How Much Are Navy Federal Overdraft Fees?

Navy Federal Credit Union charges its customers additional fees for a variety of reasons. For instance, Flagship Checking account holders have assessed a $10 fee every month if their account balance falls below $1,500 in the statement period. When it comes to , there are several ways charges are accrued:

| Non-Sufficient Funds | For an account that has non-sufficient funds, a $29 Navy Federal overdraft fee is charged each time a check or ACH debit is returned. |

| Visa Check Card Overdraft Fee | A $29 Navy Federal overdraft fee is placed on all accounts with non-sufficient funds to cover a charge. |

| Transaction Fee | Every time Navy Federal pays for an overdraft, there is a $20 associated fee, unless the transaction is $5 or less. |

| OOPS Fee | The Optional Overdraft Protection Service (OOPS) costs $20 per month and protects customers from . |

How to Avoid Navy Federal Overdraft Fees

According to the Consumer Financial Protection Bureau, most overdraft fees occur from debit transactions that are $25 or less.

There Are Several Ways to Avoid Navy Federal Overdraft Fees:

- Regularly monitor your accounts to make sure you are maintaining a sufficient balance.

- Set up account alerts for low balances so you can make a deposit before the balance falls below the predetermined threshold.

- Link your account to another account that can cover unexpected withdrawals to eliminate overdraft fees.

There Are Also a Few Special Rules When It Comes to Navy Federal Overdraft Fees:

- Navy Federal will not charge an overdraft fee if the overdrawn amount is less than $15 at the end of the business day after all transactions have been posted.

- Only one over-limit fee will be assessed per day.

- OOPS only provides protection of up to $500, including all fees and transactions that cause the overdraft to occur.

How to Dispute Navy Federal Overdraft Fees on Your Own

If you believe your account was overdrawn in error, or you would like to dispute the , contact the credit union at 1-888-842-6328 for assistance. Dependent upon your account history, a customer service representative may be able to waive the fee.

Next Steps for Disputing Navy Federal Overdraft Fees if You Can’t Do It Yourself

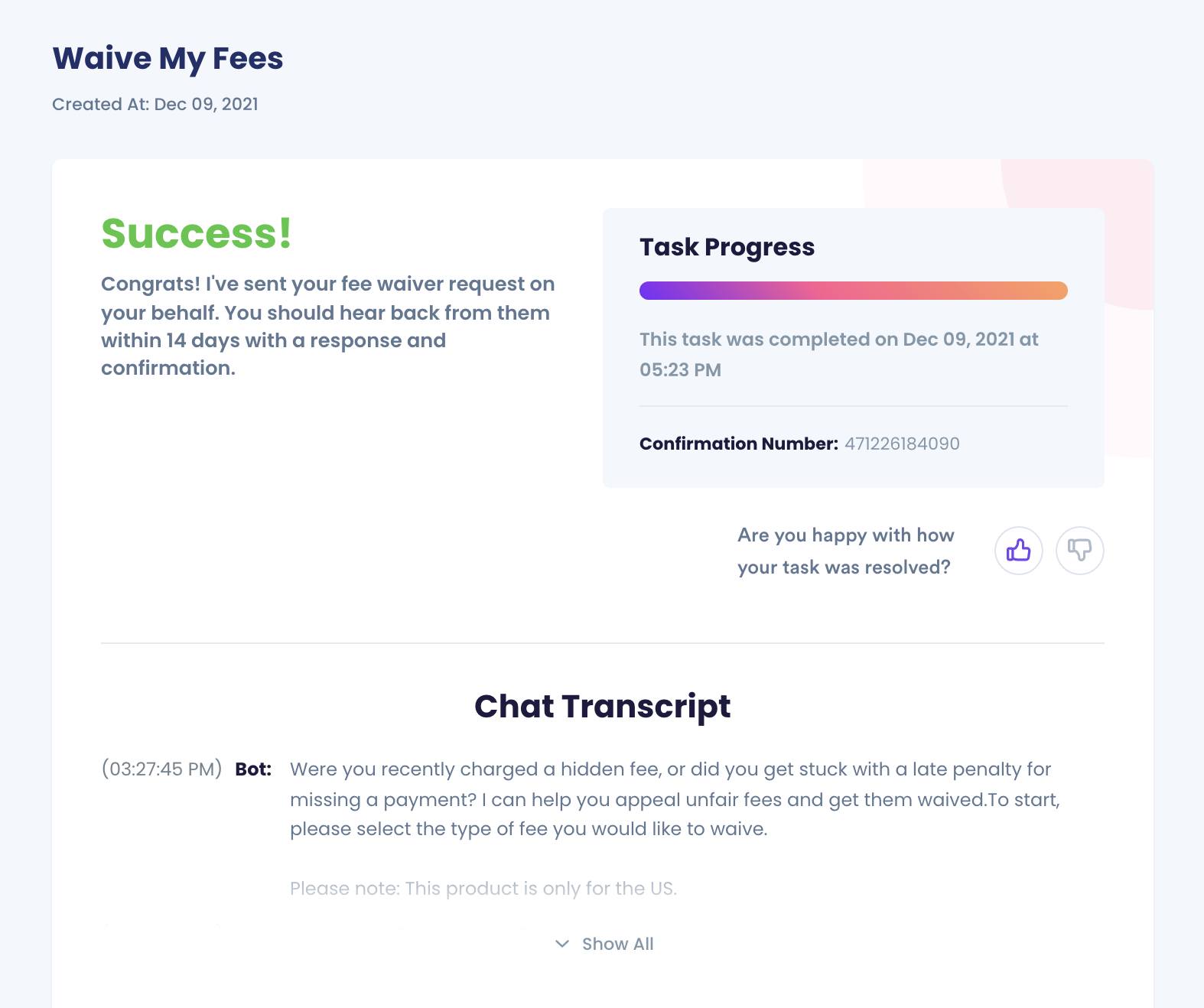

DoNotPay has extensive experience dealing with customer service issues and has been successful in helping people waive Navy Federal overdraft fees. The automated system is easy to use and the perfect solution for getting money back into your account.

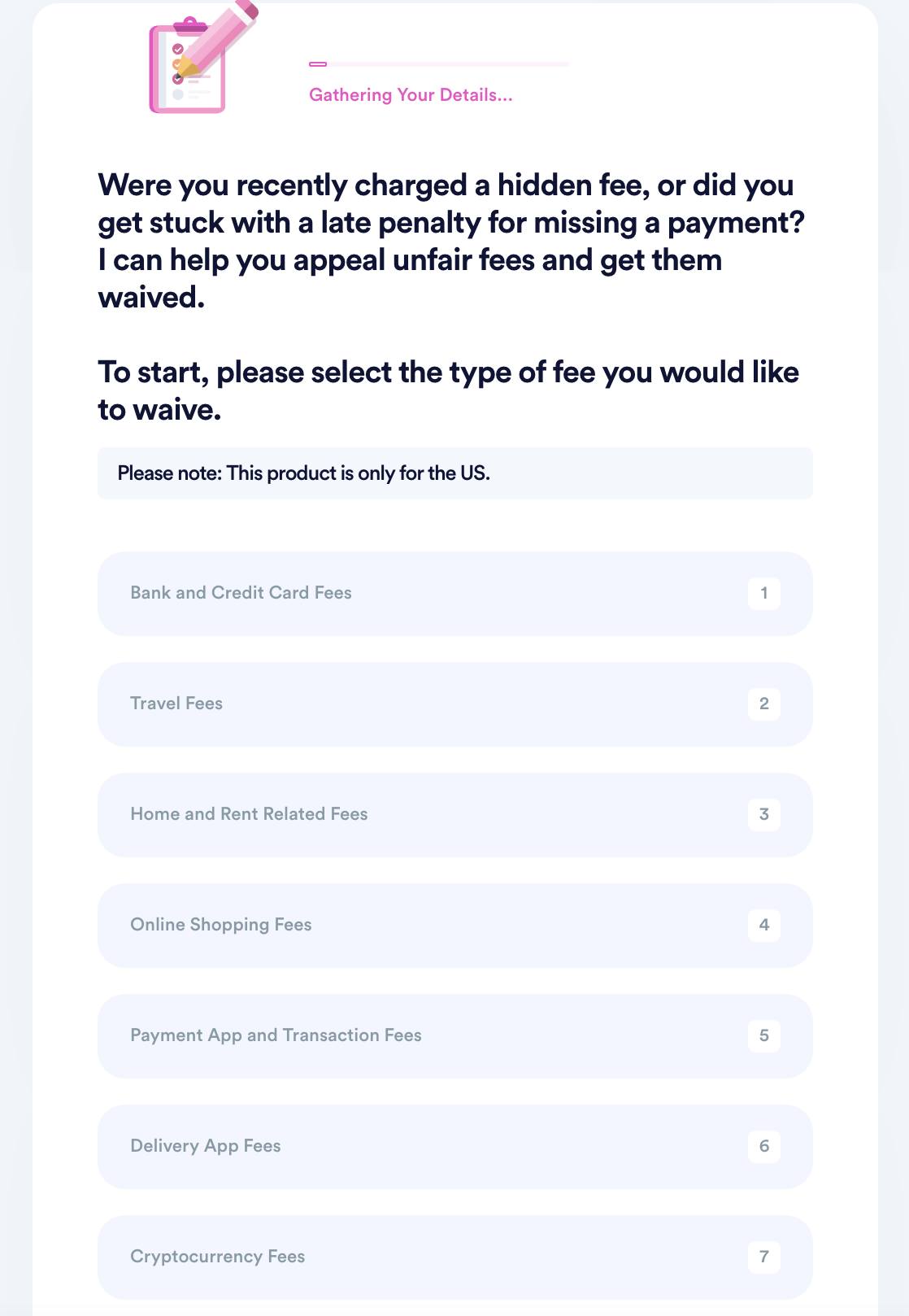

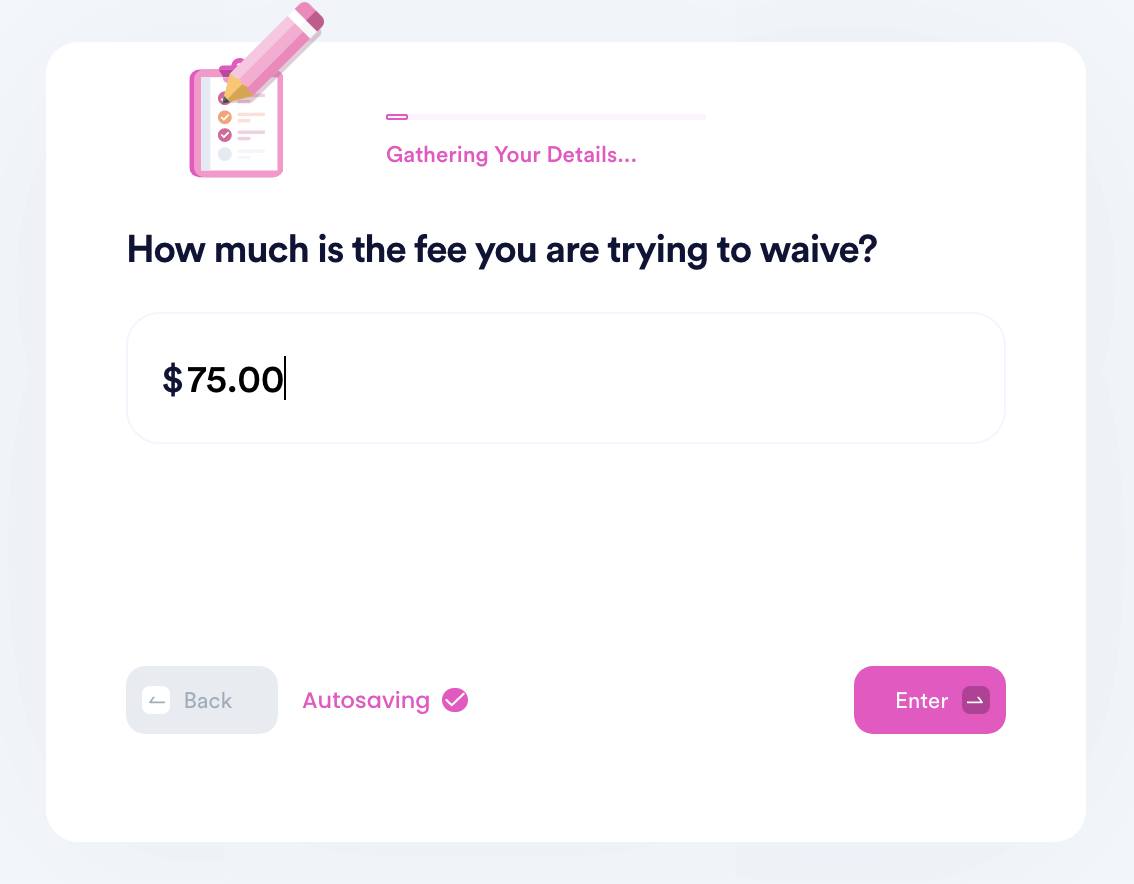

Here's how you can use DoNotPay to appeal fees:

- Search "appeal fees" on DoNotPay, choose the Fight and Waive Fees product, and select the type of fee you want to appeal.

- Select the merchant you want to appeal fees for and enter the details of your transaction, including an associated account if you have one.

- Submit your case! DoNotPay will generate the best argument for your case and make sure your fee waiver request gets sent to the merchant for processing.

Why Use DoNotPay to Dispute Navy Federal Overdraft Fees?

DoNotPay is appealing to so many customers because it is:

- Fast—It only takes a few minutes to file a dispute, eliminating time-consuming forms and complicated websites.

- Easy—The automated prompts guide you through the entire process.

- Successful—You can rest assured knowing Navy Federal is considering reserving the fees on your account.

What Else Can DoNotPay Do?

Disputing is just one of the many things our automated system can help you with. Many of our loyal customers have found success:

- Applying for scholarships

- Contacting embassies and consulates

- Creating passport photos

- Reducing property taxes

- Requesting a chargeback with no fuss

DoNotPay is like having a personal customer service representative at your disposal any time of day or night. In addition to contacting Navy Federal Credit Union on your behalf, the service can help you dispute fees associated with

- Coinbase

- Homeowners Associations (HOA)

- Etsy

- Shopify

- Robin Hood

- American Airlines

With DoNotPay on your side; there is nothing you can't do. Let the premier automated service help you with all your customer service needs, eliminating unnecessary fees once and for all.

By

By