How to Get Your Klarna Late Fees Waived

If you are an online shopper, you have probably noticed the number of payment services that let you pay for a purchase over several weeks. You link your account to a payment method (such as a debit or credit card), and they will charge you, typically once every two weeks, until the purchase is paid in full.

Unlike layaway, in which you receive your merchandise after it is fully paid, services like Klarna help you get your merchandise immediately. However, things happen, and sometimes you accrue late fees that are added to your next billing cycle. If you want to have your waived, DoNotPay can help.

Klarna Services and Late Fees

Klarna offers two payment options, and the late fee charges are slightly different. These options are:

| Pay in Four Installments | This four-installment payment plan is set up to divide your total purchase over four scheduled payments. You get your merchandise right away, but you make payments every two weeks until it is paid in full.

If your payment does not go through on the scheduled day, Klarna will make a second attempt. You will be notified by email of the unsuccessful payment. If a second attempt to collect payment is still unsuccessful, you will have a late fee of $7 added to your outstanding balance, but it will not exceed 25% of the value of your order. A missed payment will be added to the total of the following scheduled payment amount, and missing payments may get you blocked from using Klarna's payment options in the future. |

| Monthly Financing | For larger purchases, Klarna offers credit options through a partnership with WebBank. If the monthly payment is late, you could be charged up to $35.00 per missed month. The late fee, however, will not exceed your minimum amount due. |

How to Avoid Late Fees With Klarna

To avoid late fees, there are a few things you should keep in mind.

- Make sure your account can cover the Klarna payment and that your bank will not reject or return the charge.

- Extend the payment due date if that option is available.

- Pay the installment early or pay the full amount ahead of schedule.

- In the app, click on My Klarna.

- Click on Payments.

- Select the Order.

- Click Payment Options, and follow the instructions.

- Klarna advises that if you are going through a hardship and need help planning your future payments, you can contact customer service to find a solution.

How to Request Klarna Late Fees Be Waived on Your Own

If you didn't act quickly enough to avoid , you might still be able to request that Klarna waive your late fees.

- Go to the Klarna website or app and log in to your account.

- Chat with Customer Service:

- Through the Klarna app: Find the customer service button, click contact us, and click "chat now."

- Through the website: Look for the "chat with us" button in the upper right corner.

- Explain your situation. Be honest, polite, and courteous.

- There is no guarantee that they will waive the fee, but you can always give it your best shot. If it's a one-time occurrence and you have a good payment history with Klarna, you may have a better chance of having the fee waived.

Let DoNotPay Assist With Getting Klarna Late Fees Waived

The only way to get Klarna late fees waived is to chat with customer service. If you are having trouble finding the time to chat or have been unsuccessful, DoNotPay can help.

Here's how you can use DoNotPay to appeal fees:

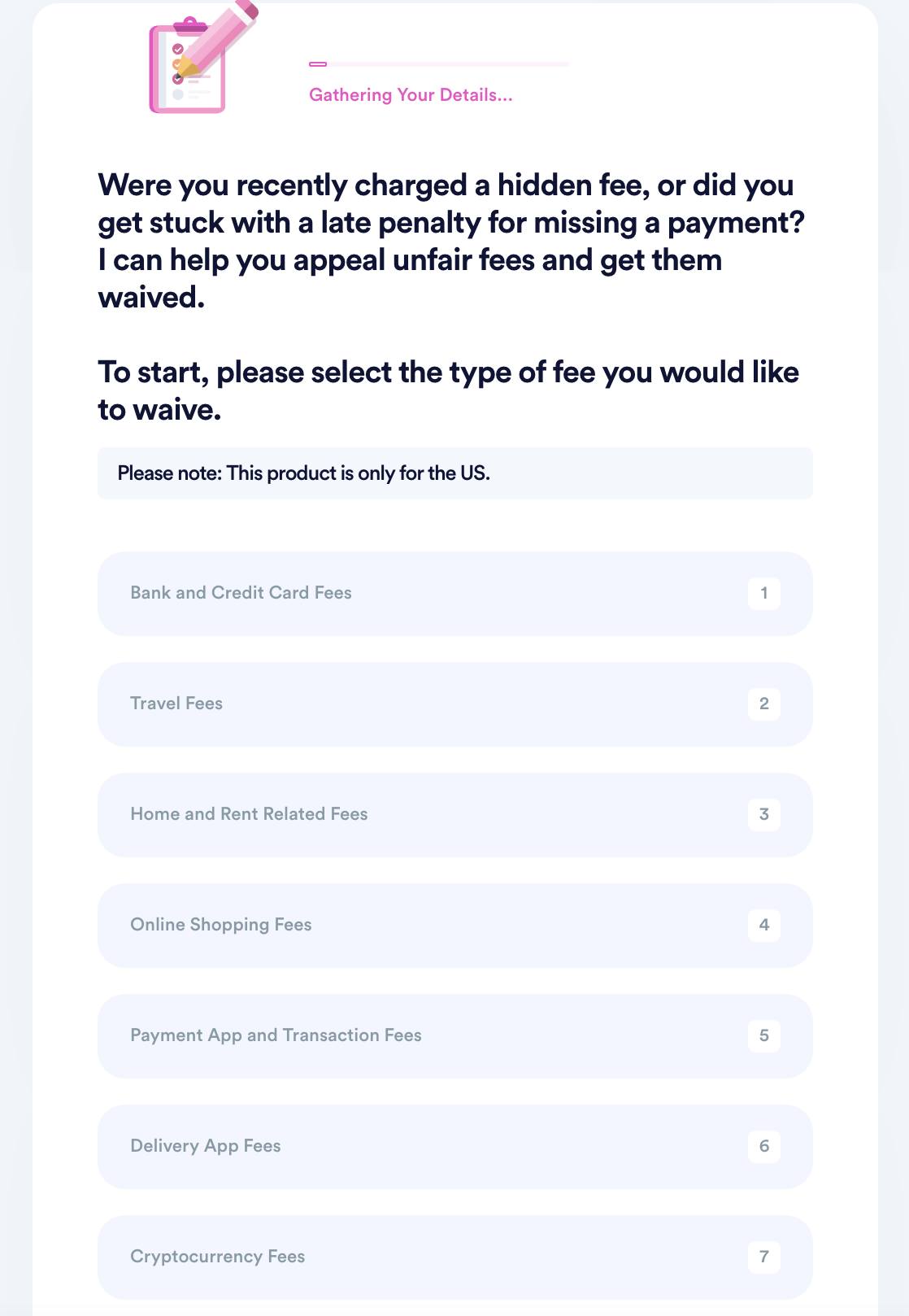

- Search "appeal fees" on DoNotPay, choose the Fight and Waive Fees product, and select the type of fee you want to appeal.

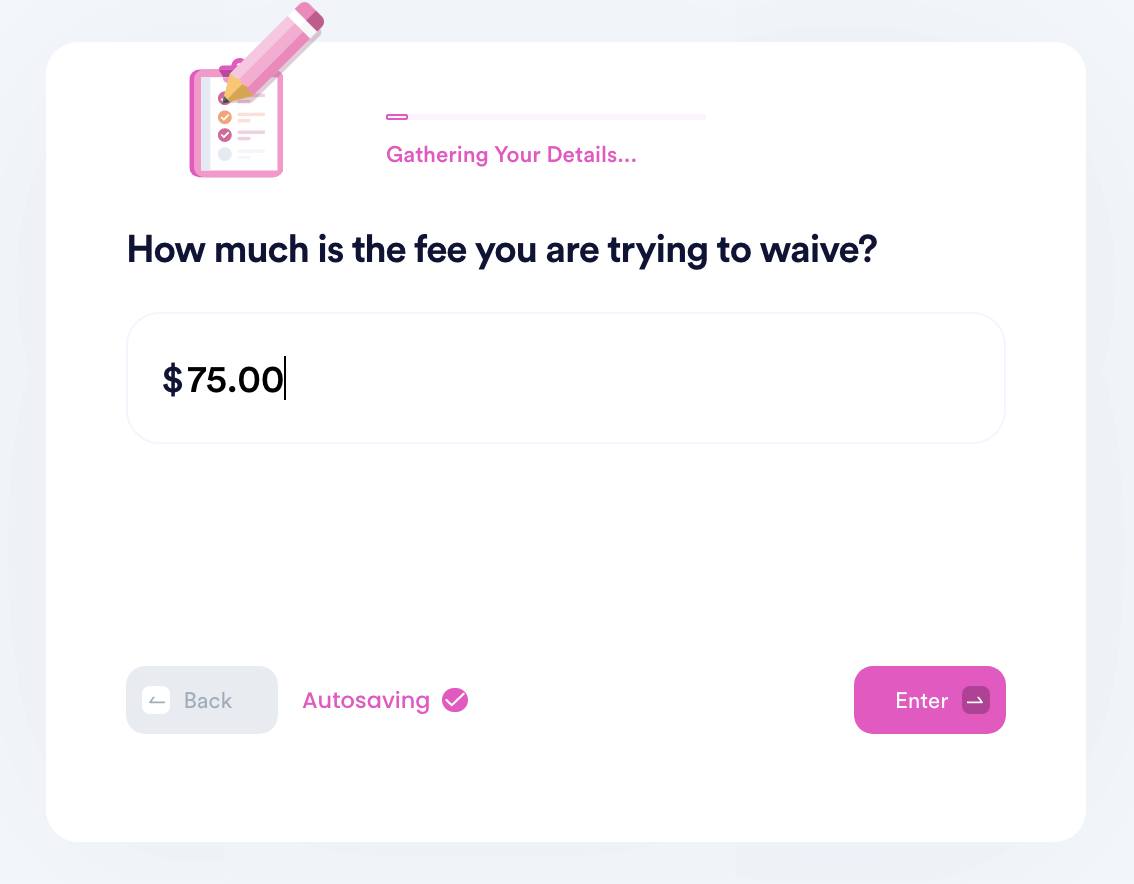

- Select the merchant you want to appeal fees for and enter the details of your transaction, including an associated account if you have one.

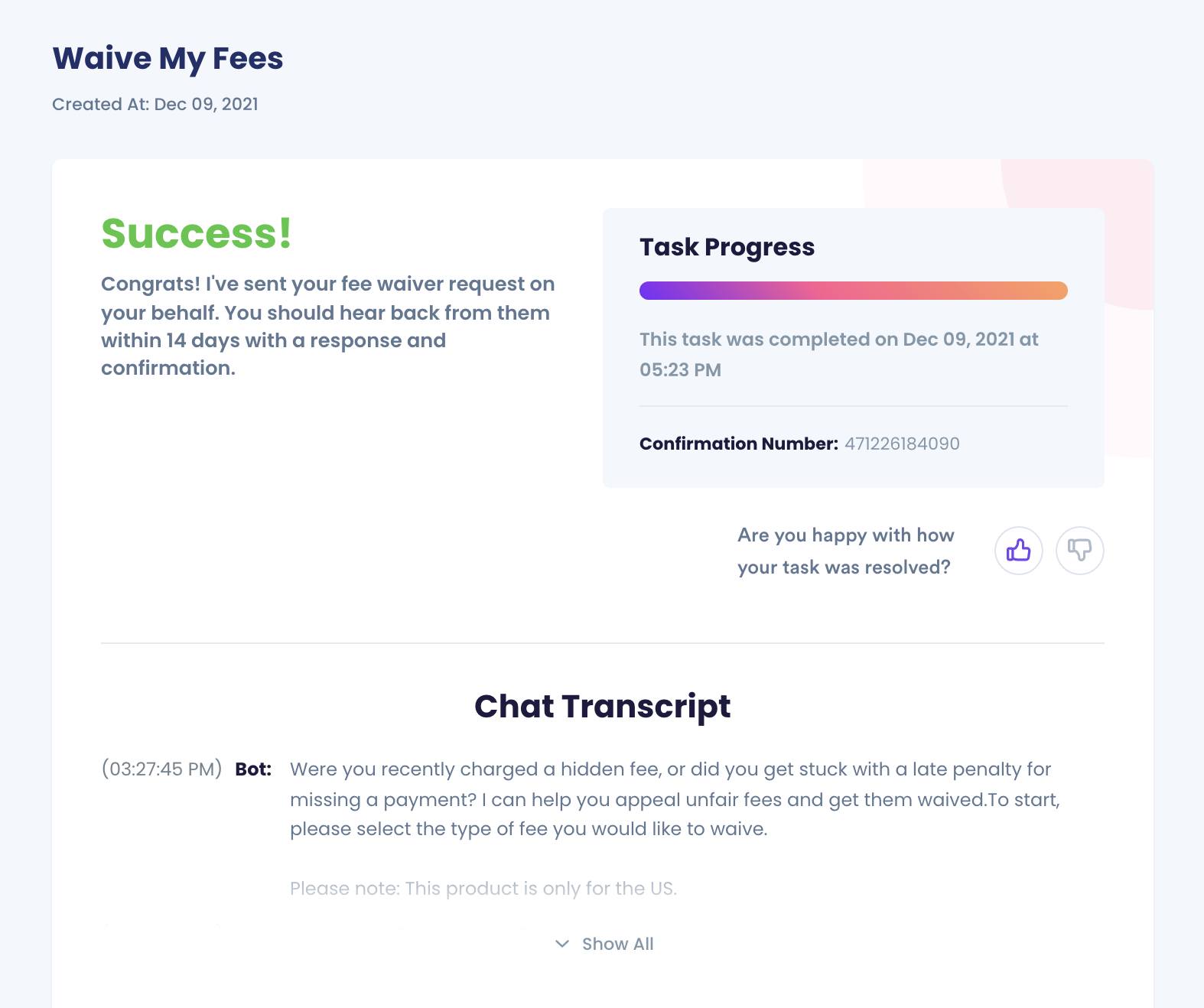

- Submit your case! DoNotPay will generate the best argument for your case and make sure your fee waiver request gets sent to the merchant for processing.

Why Use DoNotPay to Request Fee Waivers?

Your time is valuable, so you can go ahead and start the process of requesting a late fee waiver right now.

In fact, DoNotPay can help you request fee waivers for any business, such as:

- eBay Fees

- Coinbase Fees

- Robinhood Fees

- PayPal Seller Fees

- Spirit Airline Baggage Fees

- American Airline Baggage Fees

- HOA Fees

- Etsy Fees

- Chase Checking Account Fees

- Shopify Fees

If you are having other issues with your online purchases and transactions, such as fighting chargebacks or making returns, DoNotPay has services to help. We will make the necessary appeals and make the best case for you.

DoNotPay makes it fast, easy, and successful.

What Else Can DoNotPay Do?

Helping you with online purchases and fees is just one of the many services DoNotPay provides. We can help you:

- Discover and Apply for Scholarships

- Contact Embassies and Consulates

- Notarize Documents

- Find the Correct Standardized Documents

- Create Passport Photos

- Reduce Property Taxes

- Airline Flight Compensation

- Appeal Banned Accounts

- File a Complaint

No matter what your issue or concern, DoNotPay can help.

By

By