How to Appeal Fisher Investments Fees Quickly

Fisher Holdings is a multinational money management organization based in Camas, Washington. are high since the firm works primarily with clients with at least $500,000 in equity capital. Its WealthBuilder portfolios, granted on a circumstantial basis, have a far lower investment threshold of $200,000. Small account sizes are also accepted at the company's discretion, although these accounts, like all WealthBuilder portfolios, will be subject to a higher charge rate of 1.50%.

Most financial investments have hidden costs. These aren’t just the opportunity costs of you foregoing one item in favor of another. Unfortunately, many of us overlook significant investing charges because fine language and jargon can be bewildering.

While these fees may not appear significant at first, they can quickly build up over time. But did you know that you have the option of appealing the fees every time you invest? DoNotPay will help you spot the hidden fees and help you petition for refunds from the Fisher Investments company.

How Much Fee Does Fisher Investments Charge per Transaction?

Knowing the details of your is the first step in combatting them. On portfolios under $500,000, Fisher Investments fees include a 1.5% all-inclusive fee. With greater account balances, the cost is as low as 1.25%. There are no commissions when trading on your account.

How to Avoid High Fisher Investments Fees on Your Own

It's easier than ever to cut your fees and other investment charges in today's age of financial transparency. The first and most important guideline is to pay attention. Do you realize how much you're spending on bank account fees right now? What are the differences between brokerage commissions, fund cost ratios, and 401(k) fees?

There's virtually always a free or low-cost alternative that doesn't compromise on features. If you want to develop wealth faster, your objective is to determine where your holdings are losing money and then fill in the gaps with better options.

Here are some strategies to cut your investment costs and expenses and keep more of your profits multiplying for you as you try to boost returns while maintaining low prices.

| Choose From a Variety of Free Bank Accounts | Aside from your investment account, you'll need a checking account and possibly a couple of savings accounts. Here’s the difference between the two:

Banks frequently charge monthly service charges for these accounts. They make you feel better by telling you that it is not an issue because these fees can be waived as long as you keep a specified minimum balance. |

| Invest in Index Funds With Low Fees | Few controlled mutual funds outperform market indices, and of those that do, many have high expense ratios, resulting in inferior returns. There also exist zero-expense index funds that need no minimum investment. Fees and expense ratios are therefore essential considerations. |

| Look for Mutual Funds With No Sales Charge | You may be charged a fee when you begin trading in mutual funds. Whenever possible, try to avoid them. Share mutual funds impose a fee when you first buy them, and the purchase fee is referred to as a sales charge. If a mutual fund, for example, charges a 5% sales charge and you acquire $100 in stock, you'll pay an additional $5 in costs on top of your investment.

You don't want to pay fees or waste time determining which mutual funds charge what fees and under what circumstances. If you prefer mutual funds to ETFs, seek funds that don't charge a sales fee and also have a low-cost ratio that doesn't charge any recurring service fees. |

| Don't Make the Mistake of Trying to Time the Market | Timing the market used to be even more expensive than it is now. You were hit with commissions every time you entered and exited the market.

But even if you trade without commissions, you should avoid timing the market.On top of fees, it also leads to irrational investing, bad decisions, and reduced income yield. Furthermore, the price of tomorrow's decrease could still be higher than today's. Stop squandering money by attempting to outwit the market and instead systematize your trades. This also saves you time and hassles from constantly monitoring the markets. |

Next Steps for Avoiding or Appealing Fisher Investments Fees If You Can't Do It Yourself

Here's how you can use DoNotPay to appeal fees:

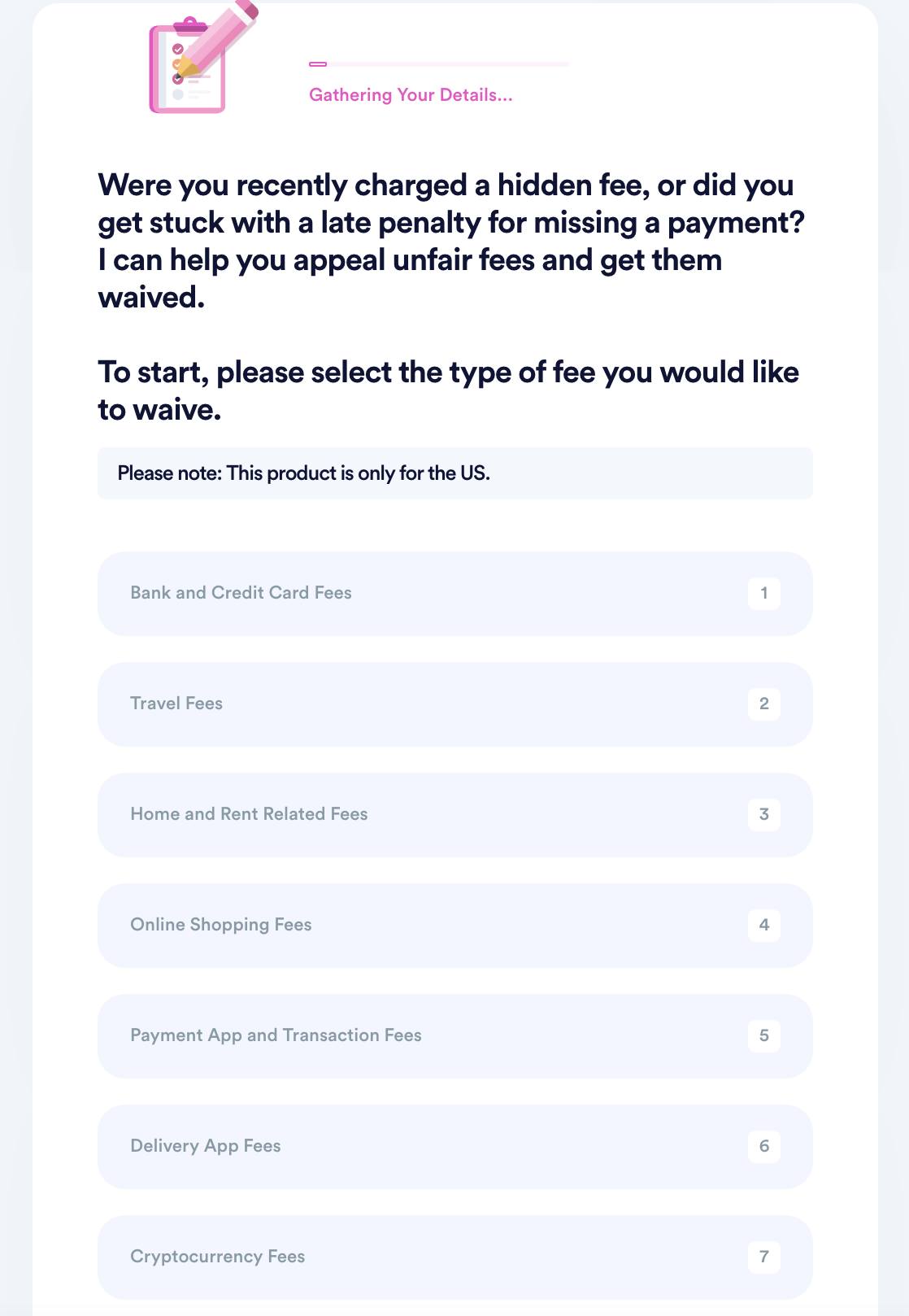

1. Search "appeal fees" on DoNotPay, choose the Fight and Waive Fees product, and select the type of fee you want to appeal.

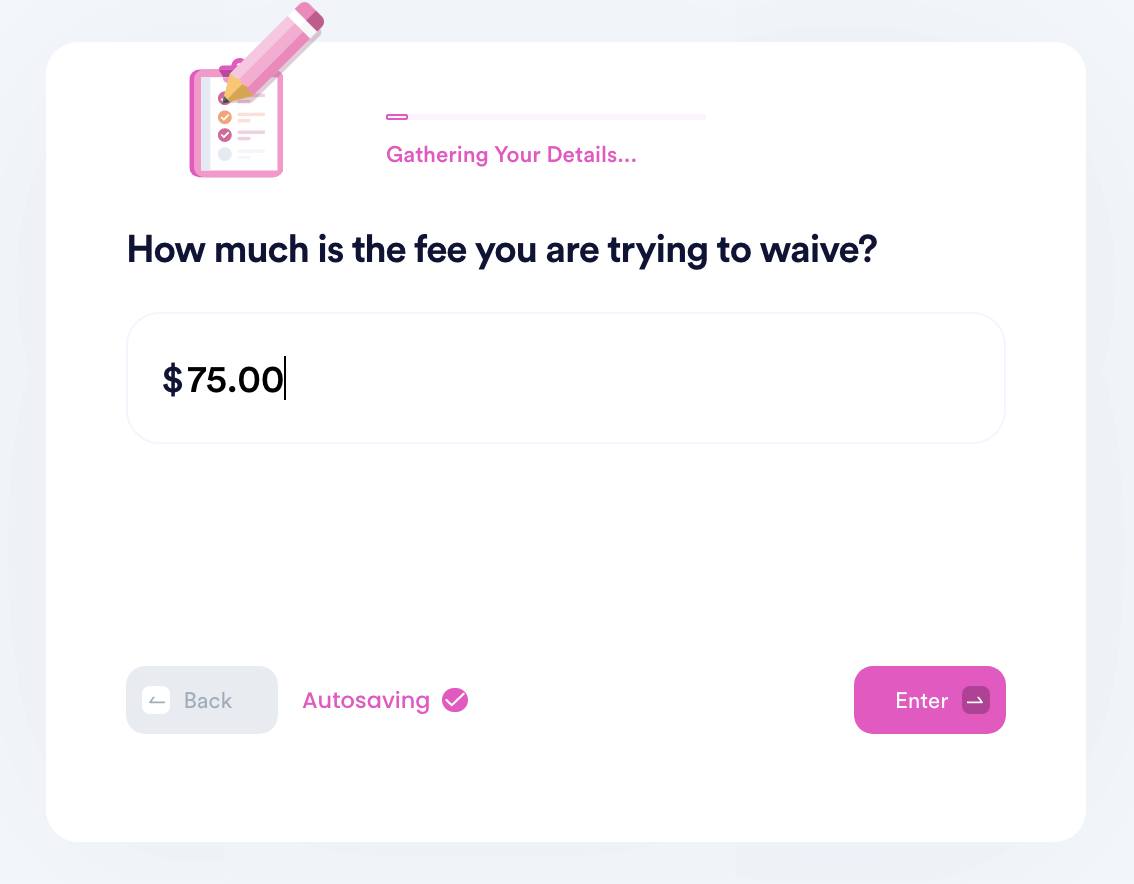

2. Select the merchant you want to appeal fees for and enter the details of your transaction, including an associated account if you have one.

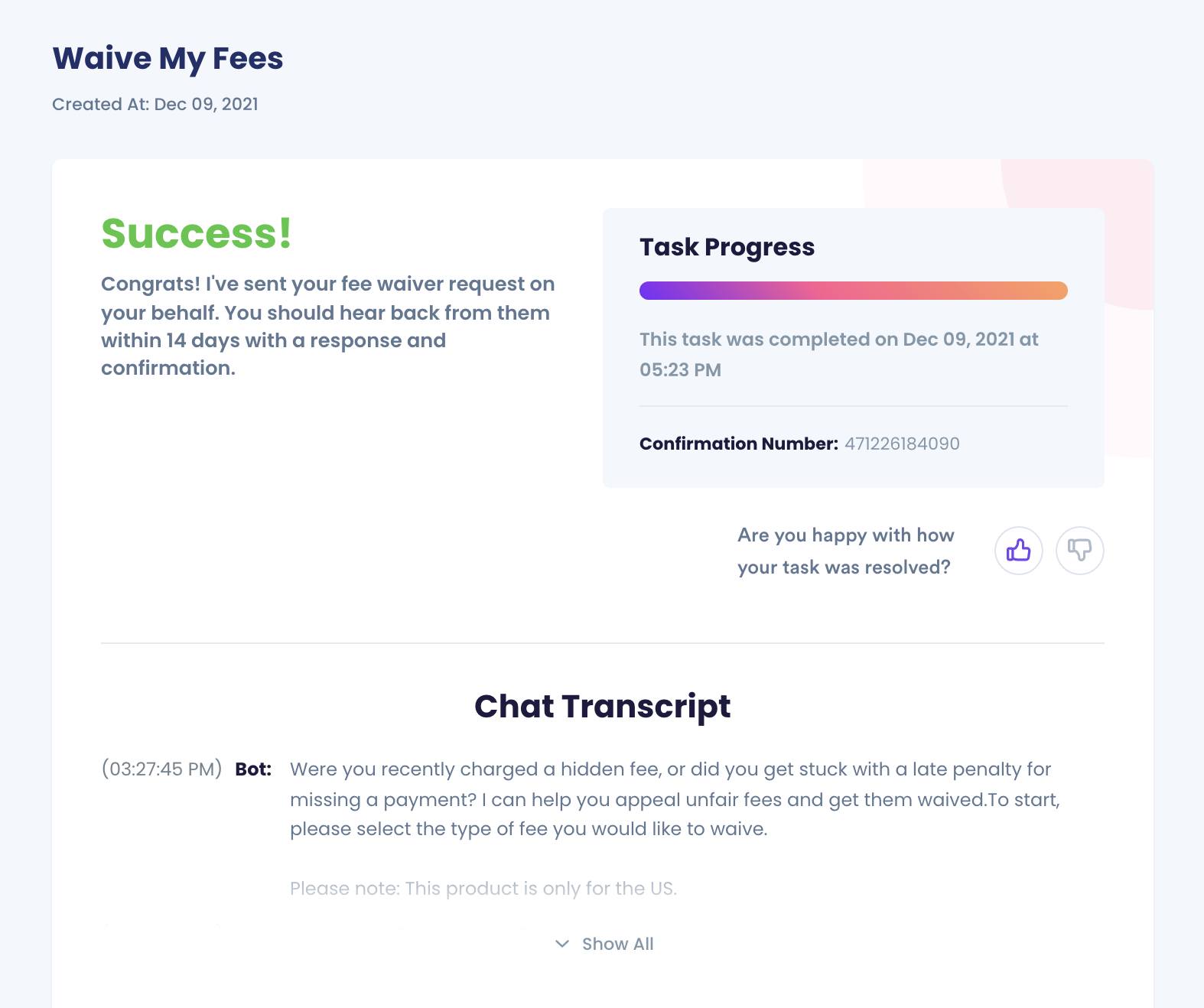

3. Submit your case! DoNotPay will generate the best argument for your case and make sure your fee waiver request gets sent to the merchant for processing.

DoNotPay Works Across All Companies, Entities, and Groups With the Click of a Button

DoNoPay will not only show you how to avoid high Fisher Investments fees. We can also help you appeal fees from:

- eBay

- Coinbase

- Chase checking accounts

- Robinhood

- PayPal

- Etsy

- Shopify

- American Airlines baggage

- Spirit Airlines baggage

- HOAs

Join us today at DoNotPay. We have got you covered.

By

By