No, You Don't Have to Pay Discover International Fees

If you're traveling internationally to a country where they are widely accepted, credit cards can be the best way to access foreign currency. Discover cardholders may wonder what they may be subject to. Fortunately, Discover does not charge international transaction fees for any of its cards. Still, there are some important things for you to know about how to use your credit card abroad as effectively as possible.

If you're charged an international fee by mistake or you use a different credit card company that does charge international fees, DoNotPay can help you appeal those fees with minimal effort. Here's what you need to know about using your Discover card abroad.

Does Discover Charge International Fees

Discover card users can rest assured that none of the company's cards charge an international fee. Cardholders should know two things:

- Cash back or miles benefits will also apply to international purchases.

- Cards can be used internationally, but they aren't accepted everywhere.

Contact Discover

If you have trouble using your Discover card while abroad, or if the card is lost or stolen, it's important to know that the number you need to call is different from the number you use in the U.S. Outside of the U.S., Discover's customer service number is +1-224-888-7777.

Exchange Rates

Some merchants offer a service called dynamic currency conversion (DCC), which allows you to complete a transaction in U.S. dollars rather than the local currency. To get the best conversion rates, opt-out of this service when it's offered to you. DCC rates are set by the merchant, so they can be much worse than the ones offered by a bank. Complete transactions in the local currency to avoid this.

How to Prepare to Use Your Discover Credit Card Abroad

While Discover does not impose international transaction fees on its cardholders, there are still some things that are important to take care of before using your credit card in another country.

-

Make Sure Your Card Will Be Accepted

While Discover cards can be a good option for international travel because they don't charge foreign transaction fees, they aren't as widely accepted as other credit card companies, especially in Europe. If you're planning a trip to Europe, it's a good idea to bring a Mastercard or Visa as a backup, since those cards are more widely accepted.

-

Research Networks

When shops and restaurants display logos of credit cards they accept, they may display a partner company's logo that indicates that they also accept Discover cards. Some examples are:

- Diners Club International, in many countries

- JCB, in Japan

- RuPay, in India

-

Tell Your Credit Card Company You’ll Be Traveling

Whenever you travel, it's a good idea to let your credit card company know where you're going ahead of time. This will prevent your legitimate transactions from being mistakenly flagged as fraud. Discover offers two options for registering your travel plans:

- Through your online account

- By phone at 1-800-347-2683

-

Ask For a Pin

Many international credit card readers request a PIN to keep your transactions secure. U.S. credit cards usually have PINs, even if they're not regularly used, so you may want to contact Discover to request yours before your trip. Having a PIN for your card may help your transactions while abroad go more smoothly.

Avoid International Credit Card Fees With DoNotPay

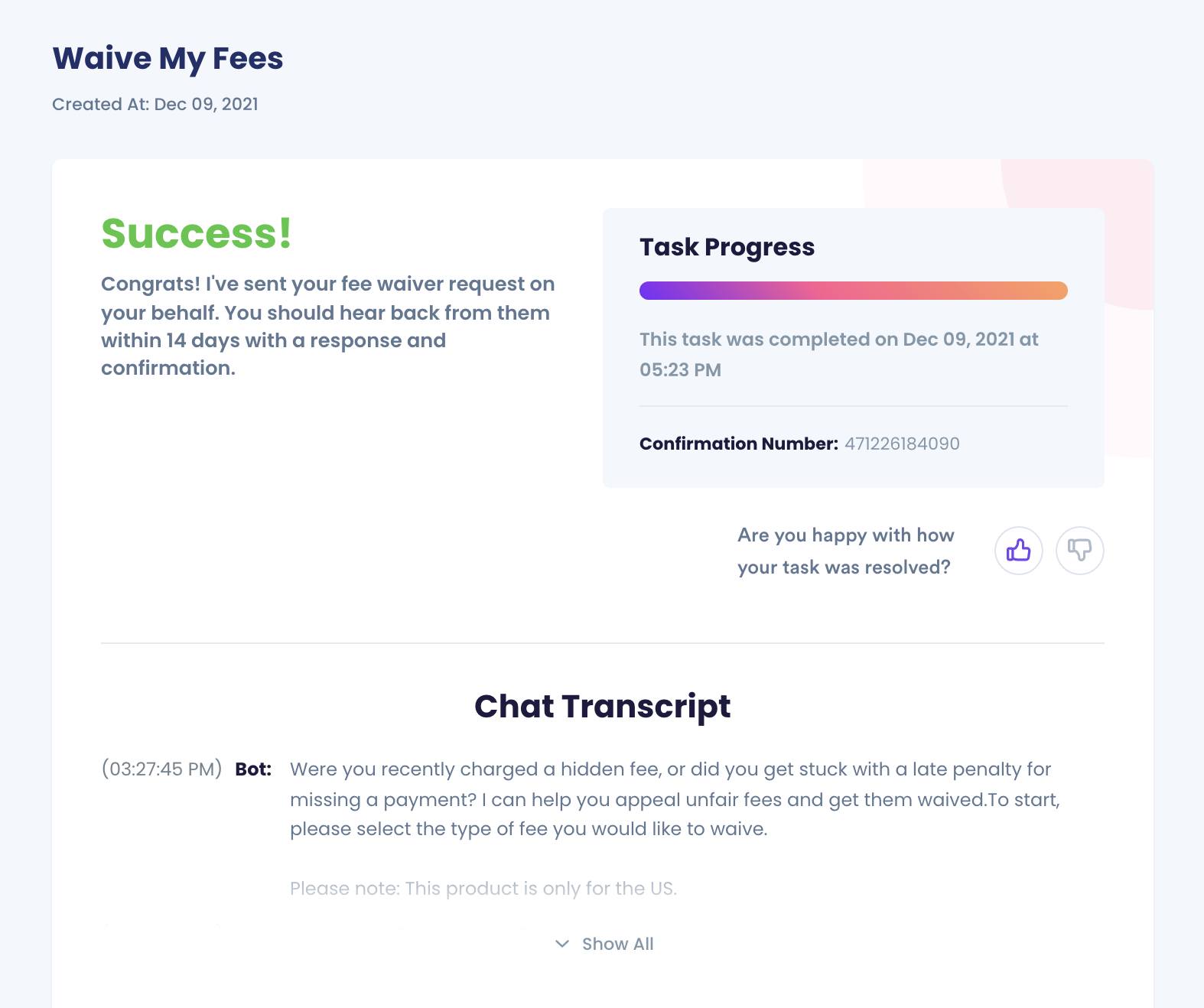

If you've been charged an international fee by Discover in error or if you use a different credit card company that does charge international fees, DoNotPay can help you challenge those fees.

International transaction fees can add up over the course of a trip, so appealing to your credit card company and asking them to be waived can be a good idea that saves you a significant amount of money. DoNotPay's fast, easy and successful system can help you conveniently appeal your international transaction fees.

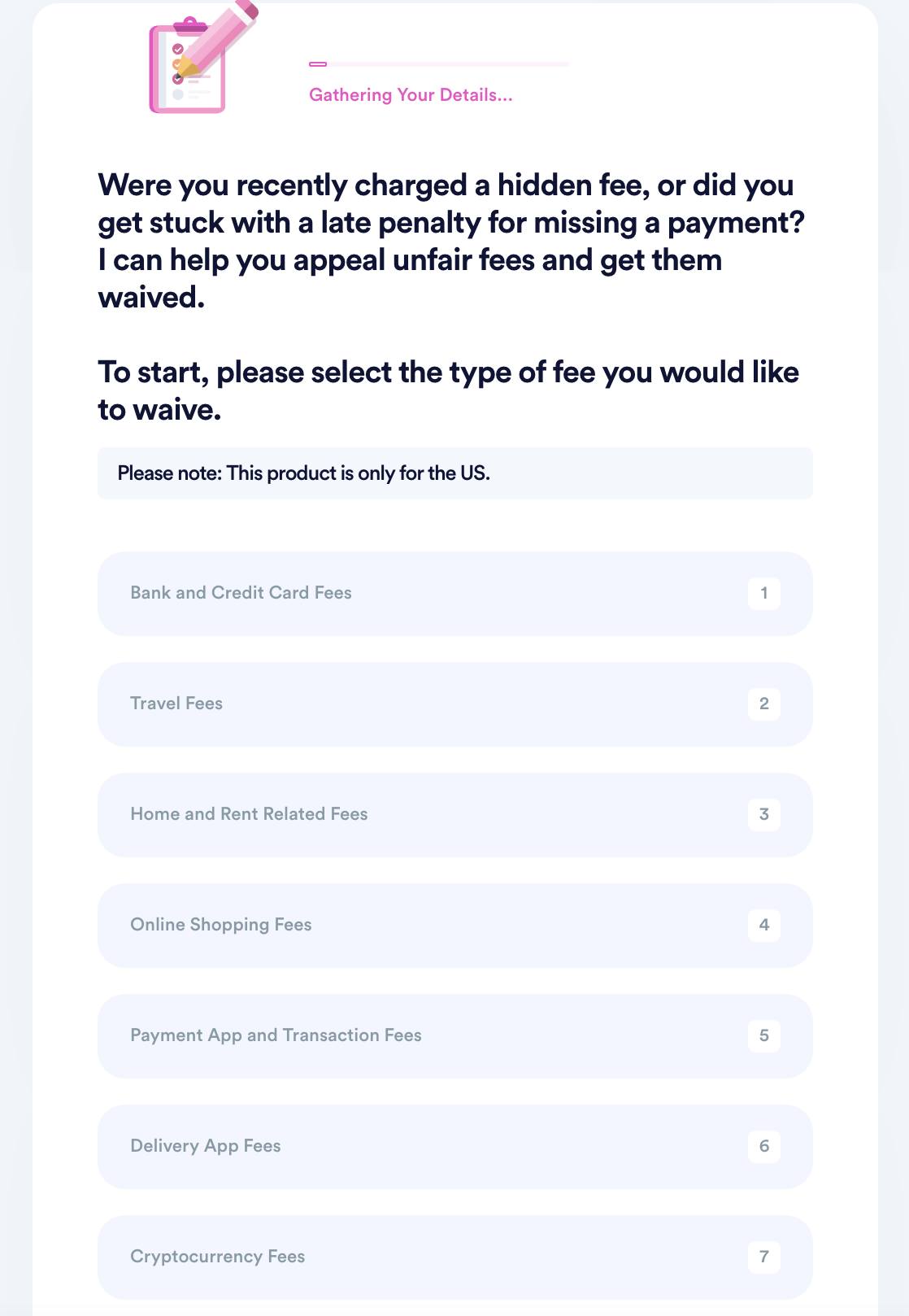

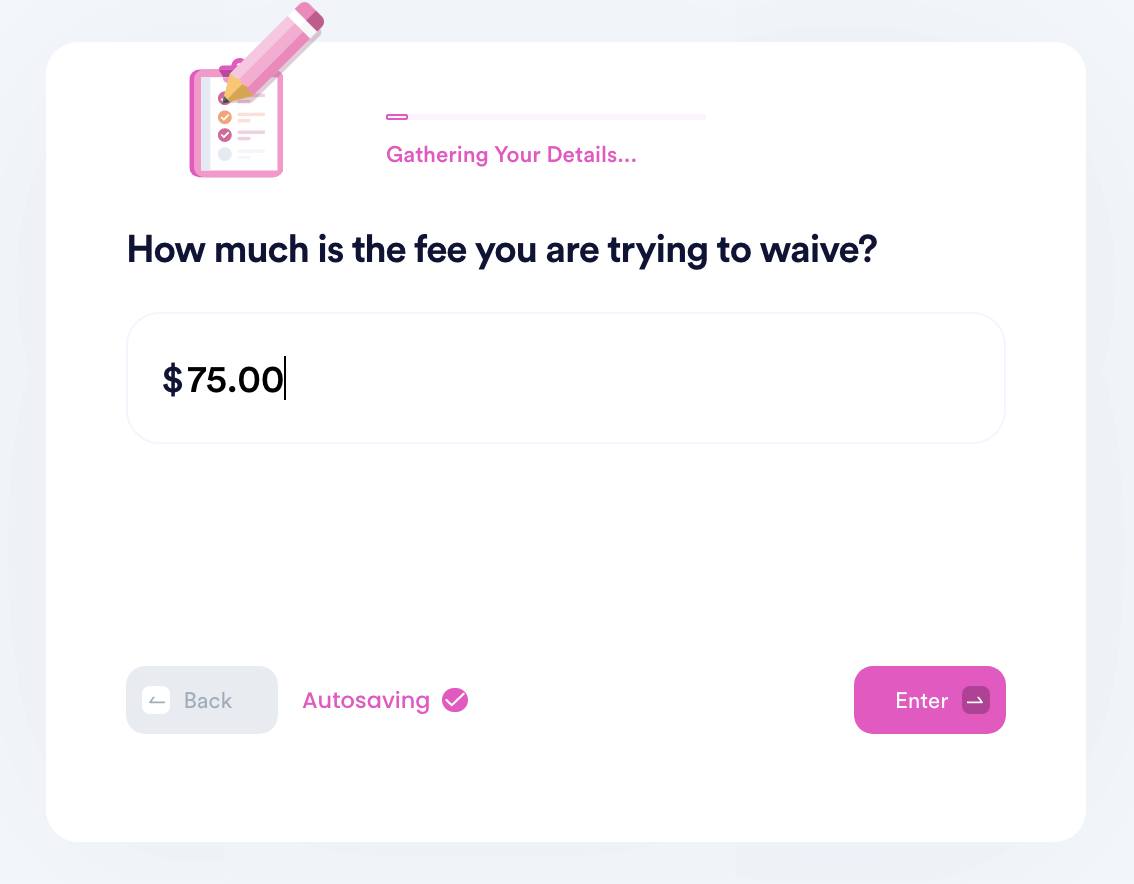

Here's how you can use DoNotPay to appeal fees:

- Search "appeal fees" on DoNotPay, choose the Fight and Waive Fees product, and select the type of fee you want to appeal.

- Select the merchant you want to appeal fees for and enter the details of your transaction, including an associated account if you have one.

- Submit your case! DoNotPay will generate the best argument for your case and make sure your fee waiver request gets sent to the merchant for processing.

DoNotPay Works Across All Companies With the Click of a Button

DoNotPay can help you request fee waivers anywhere you're charged fees from one place, so you can save both time and money. Some companies and services DoNotPay can help with include:

| eBay fees | Coinbase fees |

| Robinhood fees | Paypal seller fees |

| Spirit Airlines baggage fees | American Airlines baggage fees |

| Chase Bank checking account fees | Etsy fees |

| Homeowners Association (HOA) fees | Shopify fees |

What Else Can DoNotPay Do

DoNotPay can help with many other issues you may encounter while shopping and traveling, including:

- Returning items

- Filing chargebacks

- Getting passport photos

- Getting compensation after being bumped from a flight

If you're hoping to have your international transaction fees waived, contact DoNotPay now.

By

By