How to Waive Chase Sapphire Preferred Fees Quickly

Bank fees are arbitrary charges levied by banks monthly for everything from maintenance and servicing to overdraft fees or insufficient money in your account. These costs might sneak up on you at the most inconvenient times when you are already struggling to pay your bills but cannot afford to pay more.

The majority of people are unaware of these fees, including the , but they do exist.

The Chase Sapphire Preferred

is one of the best travel credit cards available, earning the title of Select’s best travel credit card with an annual fee of less than $100. In mid-August 2021, the card added a slew of new advantages while maintaining the exact yearly cost.

Along with the hefty introductory bonus, cardholders can make use of various travel benefits as well as a specialized rewards program, all of which help justify the $95 annual cost.

Benefits From Chase Sapphire Preferred

This card is designed for travelers and food lovers, offering:

- 5X points on Chase Ultimate Rewards travel

- 3X points on dining

- 3X points on select streaming services

- 3X points on online grocery purchases (excluding Target®, Walmart®, and wholesale clubs)

- 2X points on all other travel purchases

After spending about $4,000 on purchases in the first three months after creating an account, new cardholders will receive 60,000 bonus points.

When redeeming points for travel, use the Chase Ultimate Rewards system. The Chase Sapphire Preferred has a particular benefit: they’re worth 25% more. When you book hotels, airlines, cruises, and other travel straight through the travel site, the welcome bonus can be worth up to $750.

Additional Advantages

Aside from incentives, Chase Sapphire Preferred cardholders can take advantage of various travel and purchasing protections, which add to the card’s value.

-

Fees

If you use the rewards program to its most significant potential, it can easily be countered. The annual cost for the Chase Sapphire Preferred is $95 per year. Other travel credit cards, such as the luxurious Chase Sapphire Reserve, which has a $550 annual fee, have a higher fee.

Spending as little as $3,800 on travel and dining each year and redeeming points through Chase Ultimate Rewards might help you recoup the $95 annual charge for the Chase Sapphire Preferred. If you don’t use the portal to redeem points, you’ll have to spend a total of $4,750 on travel and eating each year.

-

Travel

A new $50 yearly Ultimate Rewards Hotel Credit, trip cancellation and interruption insurance, auto rental collision damage waiver, luggage delay insurance, trip delay reimbursement, and travel and emergency help services are among the benefits available to travelers.

Plus, there are no international transaction fees on purchases made outside of the United States, saving you the standard 3% fee charged by other cards.

-

Shopping

Purchase and extended warranty protection are available on purchases purchased with the Chase Sapphire Preferred.

Chase Offers give you access to fantastic shopping deals at various stores. These deals usually give you a predetermined amount of money back in the form of a credit statement, which is issued to your account within 14 business days.

In addition, Chase has an online shopping gateway that offers additional benefits for purchases made through a specific link. By purchasing with your qualifying Chase Sapphire Preferred and using the link supplied through the portal, you can earn bonus points.

What Are Some Ways to Get Around the Chase Sapphire Preferred Yearly Fee?

| Reward Yourself | Spend on meals and travel each year to cover the card’s $95 annual fee through incentives. After booking travel through Chase Ultimate Rewards, you’ll get 5X points, 3X points for meals, and 2X points for all other travel expenditures. |

| Sign Up for a Free DashPass Account | Another option is to use the complimentary DashPass subscription that Sapphire cardholders receive for a year to offset the price. You will get a minimum of one year free if you activate by March 31, 2022, worth around $120. It will cover the $95 annual cost more than once. |

| Take Advantage of the Welcome Bonus | If you prefer to look at the broad picture, you can use the welcome bonus to offset the annual cost for up to five years. The 60,000 points are worth $600 in statement credits, which you can use to offset the yearly fee. |

Overall, using the Chase Sapphire Preferred Card to pay for ordinary transactions can easily offset the $95 annual fee. You can also use DashPass, the card’s $50 yearly Ultimate Rewards Hotel Credit, and the card’s welcome bonus to recoup the price. All the same, apply for a waiver using DoNotPay, and we will help you have a waiver.

How Can DoNotPay Help You?

Repeating this method for each bank fee you get, on the other hand, is a waste of time. Furthermore, you are not required to pay these additional fees or experience financial losses simply by keeping your money in the bank.

That is why DoNotPay can appeal your fees and interest on your behalf and have them waived or returned immediately.

To begin, complete the following steps:

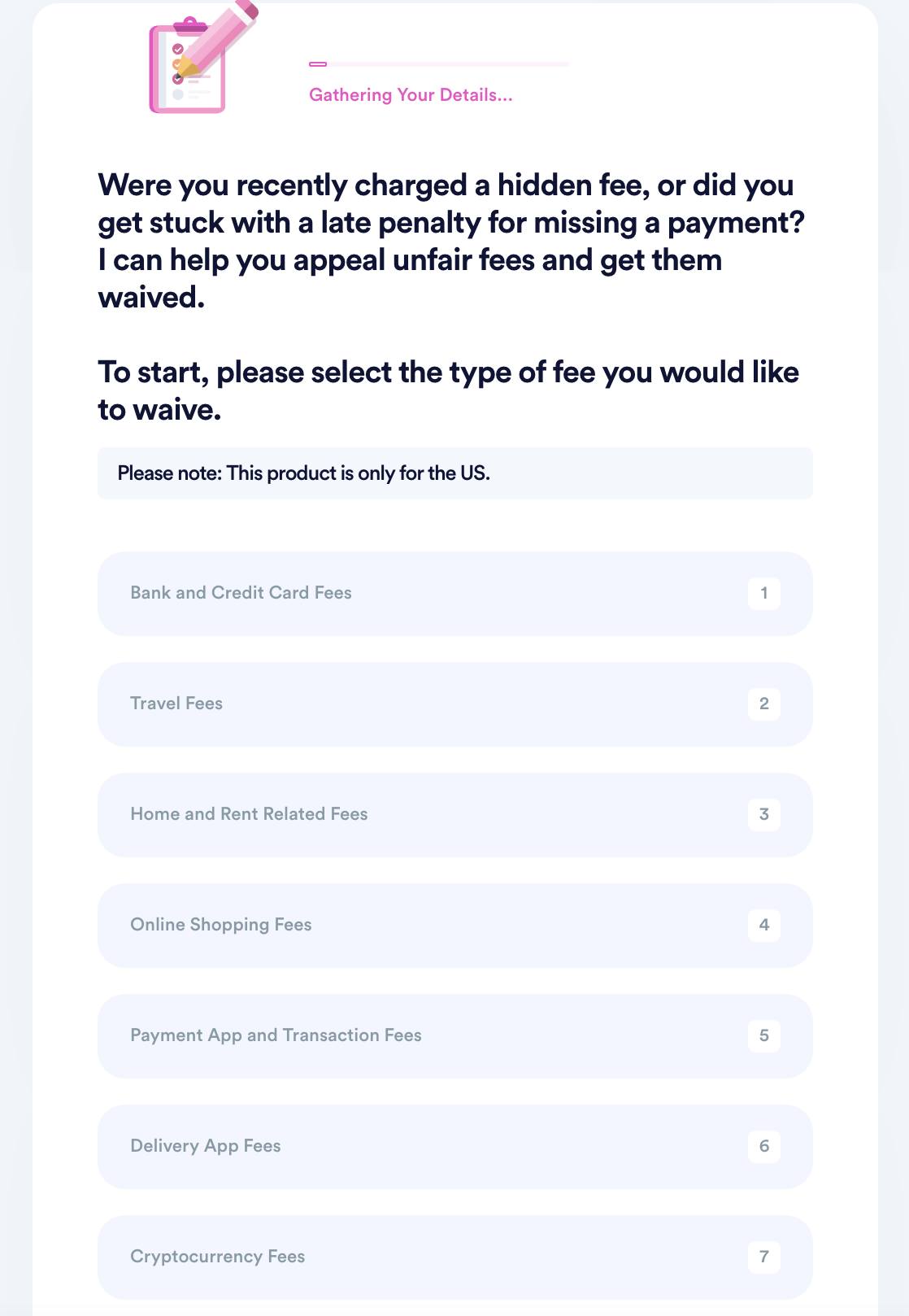

- Search “appeal fees” on DoNotPay, choose the Fight and Waive Fees product, and select the type of fee you want to appeal.

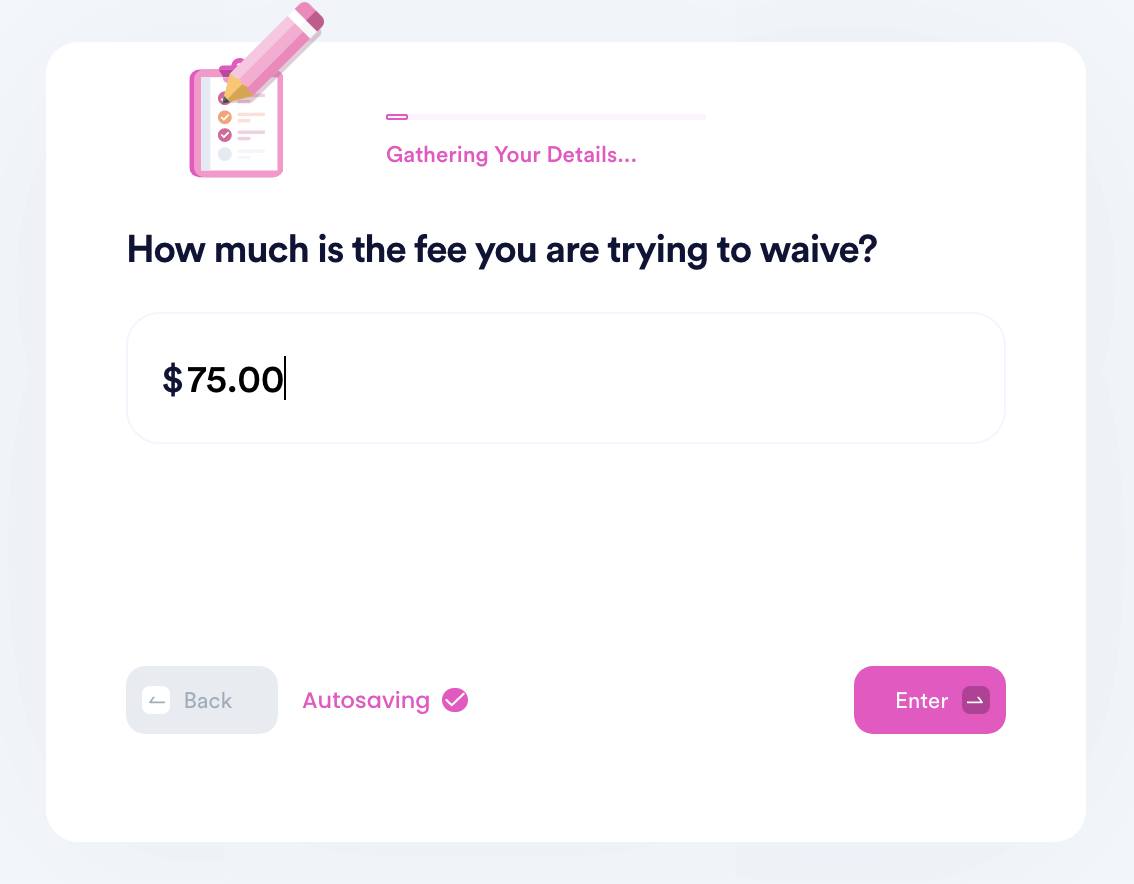

- Select the merchant you want to appeal fees for and enter the details of your transaction, including an associated account if you have one.

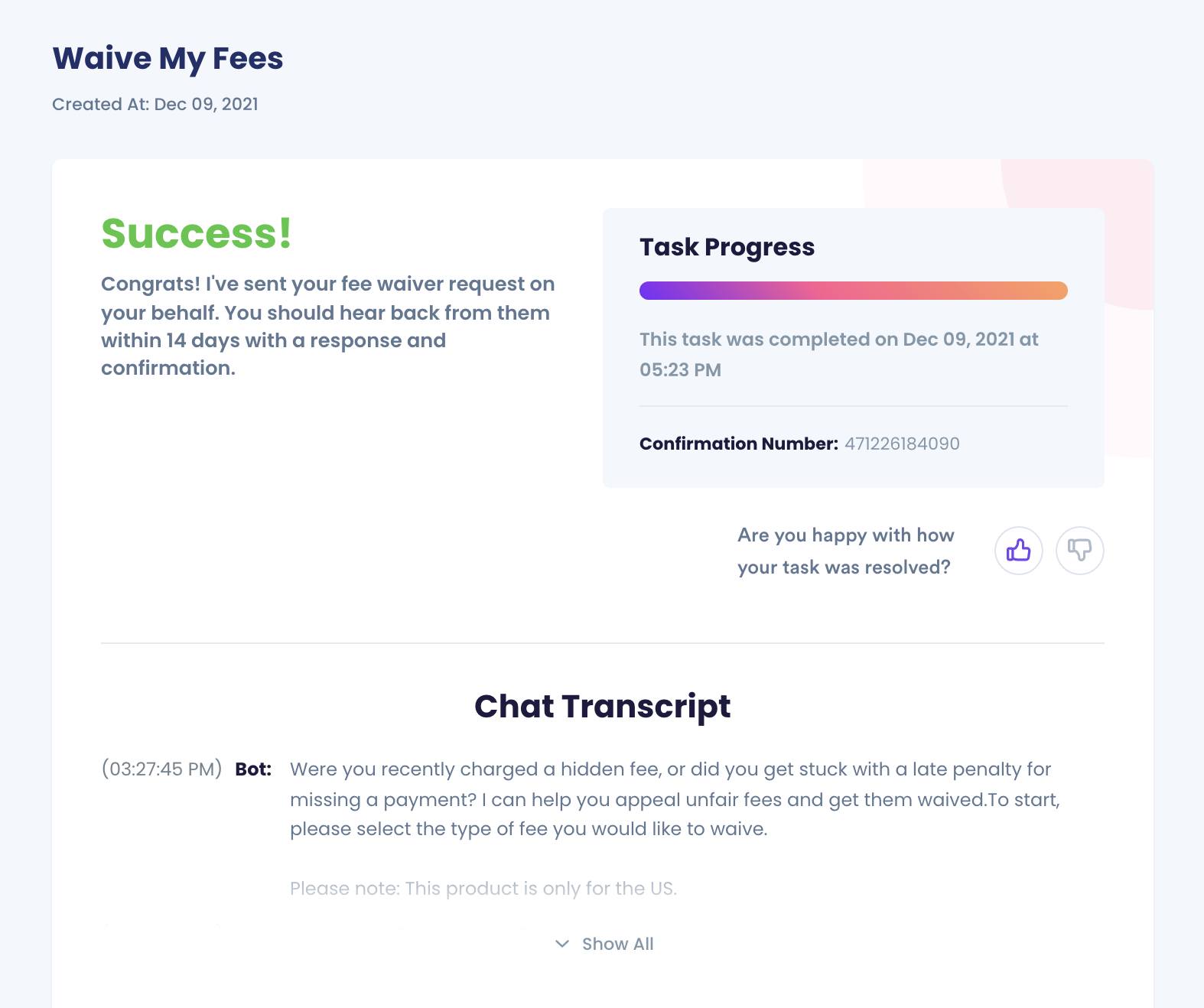

- Submit your case! DoNotPay will generate the best argument for your case and make sure your fee waiver request gets sent to the merchant for processing.

It’s as simple as that! DoNotPay will send your appeal letter to your bank on your behalf, ensuring that you get your money back. If your banking institution has any additional concerns, we shall contact you directly.

What Else Can DoNotPay Do?

DoNotPay can help you waive different fees like:

- eBay fees

- Coinbase fees

- Robinhood fees

- Paypal seller fees

- Spirit Airlines baggage fees

- HOA fees

- Etsy fees

- Chase checking account fees

- American Airlines baggage fees

- Shopify fees

- And many more!

By

By