Fight Back Against Unfair Acorns Fees With DoNotPay

Acorns self-describes as an American brokerage service. It's registered with all the right institutions like the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). It works by taking clients' spare change and saving/investing it. But there are fees involved, and many customers find themselves spending more on fees than they keep! If you're tired of paying and you're ready to fight back, DoNotPay can help!

This article explores four key points:

- How to fight back against unfair Acorns fees using DoNotPay. It's the best way!

- How to fight appeals and waive Acorns fees by yourself. It isn't easy.

- A little more information about Acorns.

- And some other hurdles you can overcome with DoNotPay.

Remember, DoNotPay is . Any time you feel like a big financial institution is taking advantage of you, make the app your first stop. It's excellent for fighting Chase checking fees, Robinhood fees, and many more.

But right now, you're fed up with Acorns fees. Let's see how easy it is to appeal to them with DoNotPay.

How to Waive Acorns Fees With DoNotPay

Here's how to use DoNotPay to appeal :

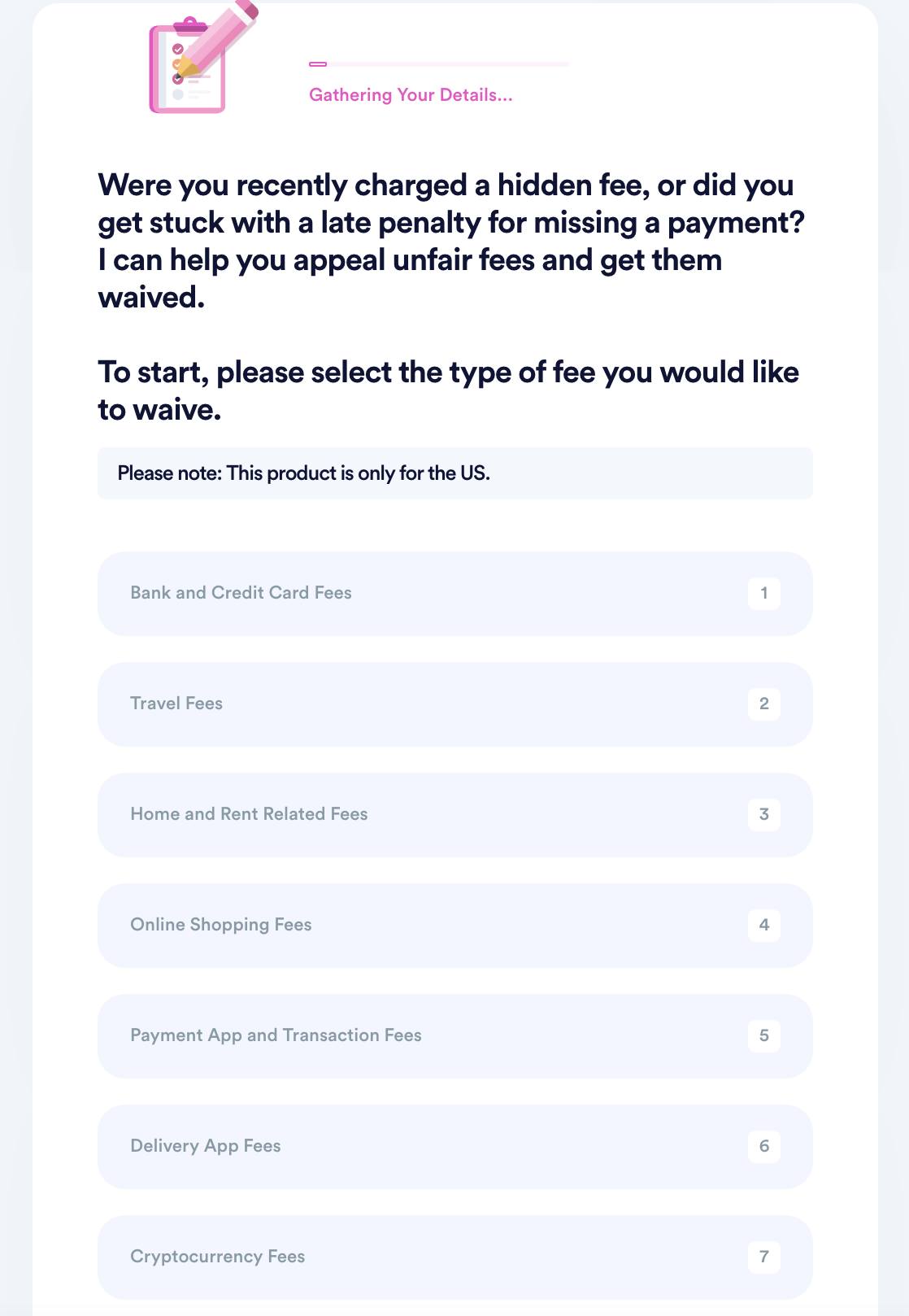

- Search "appeal fees" on DoNotPay, choose the Fight and Waive Fees product, and select the type of fee you want to appeal.

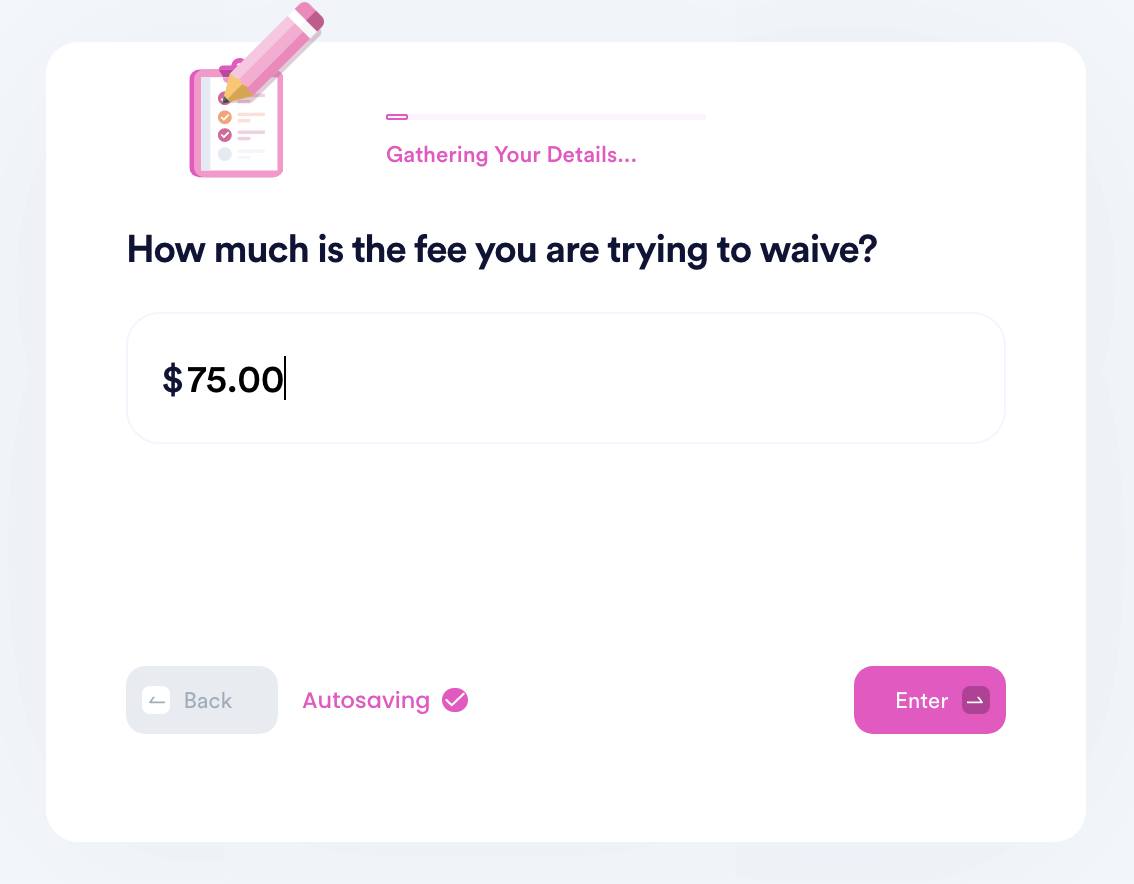

- Select the merchant you want to appeal fees for and enter the details of your transaction, including an associated account if you have one.

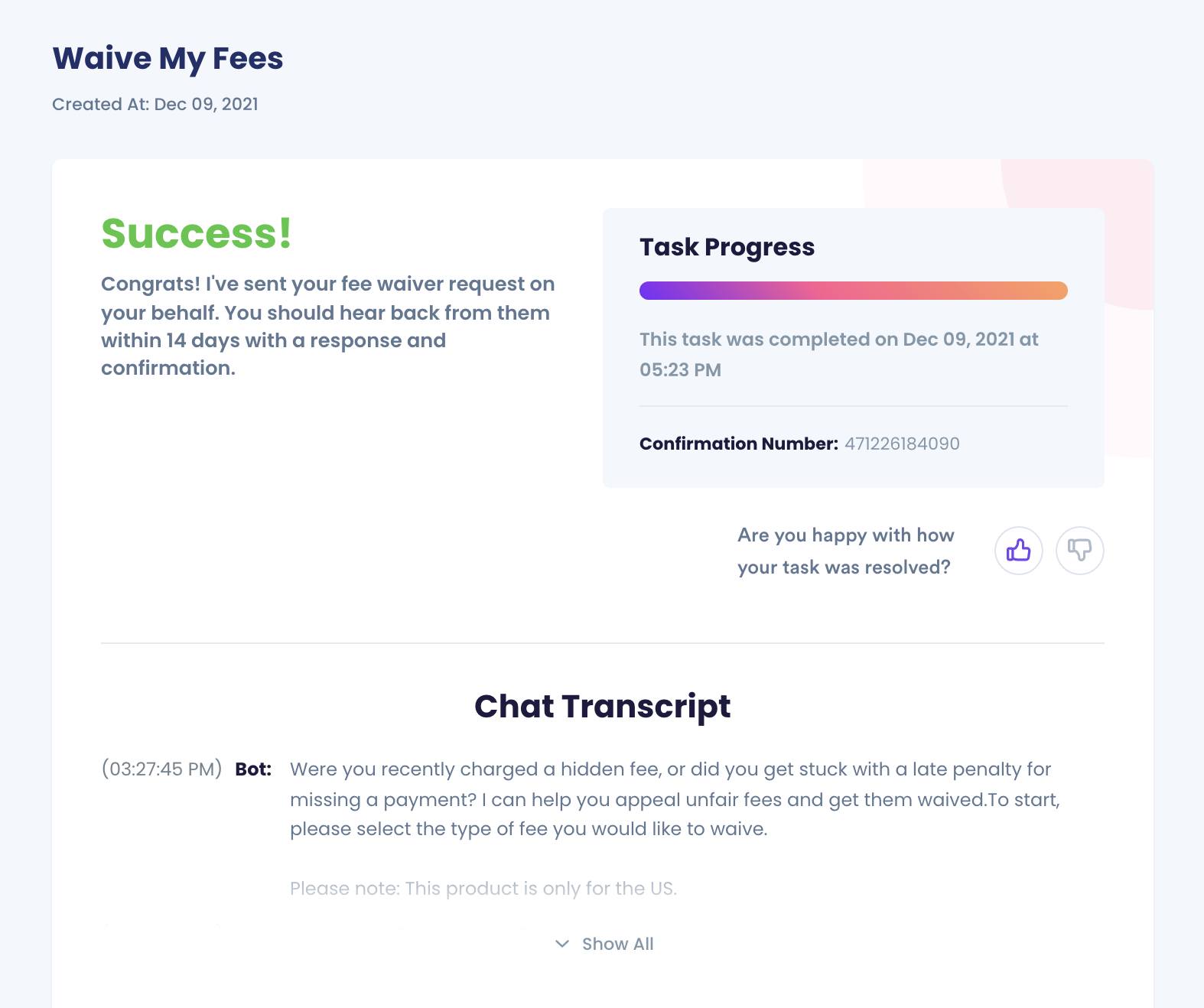

- Submit your case! DoNotPay will generate the best argument for your case and make sure your fee waiver request gets sent to the merchant for processing.

It's that easy! You don't need to spend hours on hold or argue with a customer service representative. You don't need to pour through complicated paperwork or write a strongly worded letter. Let DoNotPay handle everything for you. It's like having an attorney on your side all the time!

You can try to get Acorns fees appealed or waived by yourself. This method will take a long time because the paperwork is complicated. But let's take a closer look.

How to Get Acorns Fees Waived by Yourself

Frankly, Acorns is watched closely by financial institutions and submits itself to regulatory compliance checks with SEC and FINRA. The point is that Acorn's contracts are nearly ironclad. If you're not a lawyer or at least a trained paralegal, you're going to struggle to get Acorns fees waived.

But here's how to try:

- Gather your documents from Acorns, including any paper statements

- Log on to the app

- Or visit the customer service portion of the website

From there, you can try to speak to a representative about your unwanted fees. They'll likely give you a runaround about contracts. You can ask to speak to a supervisor and provide them with a contact phone number. A supervisor might call you back, eventually. They might give you some forms to fill out, or they might not!

- You can also try writing an email.

- Explain why you disagree with the Acorns fees in a professional and polite tone.

- Be sure to include all the details possible and the related dates.

- Include return contact information, like your phone number.

For instance, say something like, "On January 31, 2021, I was charged $3 for an individual banking package, but I only have a $1 per month investment account. Therefore, I request a refund of $2."

Acorns will send you a long, complex document to fill out and return. They're counting on the fact that your time is not worth the $1 or $0.25 to fill out a form correctly. And if you miss something important, like a date or signature, they'll toss your paperwork.

That's why DoNotPay is the better way! You don't need to be an attorney to get treated like one!

About Acorns Fees

Acorns fees start at $1 / month for all accounts with a balance under $1 million. Spoiler alert: you'll never save that kind of cash with spare change investing. Then, the monthly fee increases to $100 / month for every $1 million you have invested with the app.

Acorns also offer broader financial services, like checking and savings accounts, debit cards, and the like. At the time of writing, those cost $3 / month for an individual and $5 for a family plan.

This fee is meager compared to other banks, mutual funds, and investment brokers. Some other brokers charge a hefty percentage, and banks are always ready to nail consumers with a fee.

The challenge many Acorns customers face is those small fees, an extra quarter here or there that doesn't make sense. You don't need to take that abuse! Use DoNotPay to appeal and waive Acorns fees. It's easy!

And that's not all you can do with the app.

What Else Can DoNotPay Do for You Today?

Any time a big company takes advantage of you with unfair fees, make DoNotPay your first resource.

Use it to fight:

| eBay fees | Etsy fees | Shopify fees | PayPal seller fees |

| Spirit airline baggage fees | American Airlines baggage fees | Homeowner's Association (HOA) fees | Coinbase fees |

Just visit the app and follow those three little steps we outlined above. Try it today!

By

By