Is Cushion AI Legit? Here’s What You Need to Know

Annually, customers pay billions of dollars in credit card interest and bank fees. While some of these fees are understandable, there is a chance that you could be paying fees that you shouldn't be, or you are being charged a high-interest rate.

There are companies out there designed to help you avoid this occurrence. One such company is Cushion AI which uses artificial intelligence to analyze your finances and a support page to address your queries. But the question is: ? Sign up to know this and much more.

What Is Cushion AI?

Cushion AI is a financial technology designed to remove fees and interest charges on your bank and credit card accounts. They can also negotiate existing fees you are about to pay or have already paid. The technology, founded in 2016, aims to help customers steer clear of avoidable bank fees and get refunds on the money they have already paid.

How Does Cushion AI Work?

The tool's dashboard scans your current accounts and informs you of the aggregate banking fees paid over the past 12 months. You can do this using the free version but would have to pay if you wish to access premium services such as negotiation.

How Much Will I Pay for Cushion AI?

To access premium service on the platform, you would have to part with $4.99 annually. For this amount, you get to enjoy the following features:

- Scanning of your daily transactions

- Immediate alert each time a bank fee is charged

- Monitoring your expenses and account balance enables cushion AI to warn you of potential overdraft fees.

Aside from the above features, there is also an optional add-on in which you can enjoy fee negotiation conducted on your behalf. There is no extra upfront charge, but you will have to contend with the following:

- A 39% cut for Cushion AI for any fees that have been successfully negotiated.

- No say on what fees cushion gets to negotiate or doesn't negotiate.

Is the Cushion App Legit?

Yes. The app is legit and is backed by famous venture capitalists like Afore and Flourish Ventures. However, cushion AI does not guarantee that you will save your money. Your experience with the app might depend on factors such as your financial institution's discretion to give a refund, the fees you are paying, and the purpose of such fees.

How Safe Is Cushion AI?

The platform uses Plaid, a third-party service that provides read-only access to financial accounts. Therefore, while Cushion AI can read your financial information, they cannot move funds on your behalf.

Is Cushion AI Worth It?

Cushion AI only works on banking and credit card fees. Thus, it has limited features and cannot get certain refunds on your behalf, help you cancel unwanted subscriptions, or even negotiate credit card APRs.

The platform does not negotiate:

- Internet

- Medical bills

- Phone bills

The amount charged on recovered fees is also relatively higher than what is charged by competitors that negotiate a wider variety of bills.

A look at reviews points out many satisfied customers. Still, there is a proportion not happy with what's on offer. For instance, the fact that Cushion Ai does not negotiate certain a reduction on certain fees does not go down well with some customers.

Also, given you have no say in what fees the app negotiates on your behalf, you may have to take it upon yourself to call the bank and negotiate or ask for a refund, which some would say defeats the app's purpose.

Some customers also report that the app can charge a fee for money they were not negotiating, such as money refunded into your account due to fraud. You may also not get a quick response from the customer service as you are dealing with an artificial intelligence platform.

Therefore, choosing to go with Cushion AI would depend on the type of fees you want negotiating on your behalf or refunded. If you want more than what Cushion AI offers, you should try DoNotPay.

Get Refunds With DoNotPay

DoNotPay's chargeback product helps you get your cash back when:

- There are problems with the delivery

- You were promised a refund but never got it

- You come across unrecognized fraudulent charges.

All you have to do to enjoy these services is follow the easy steps below.

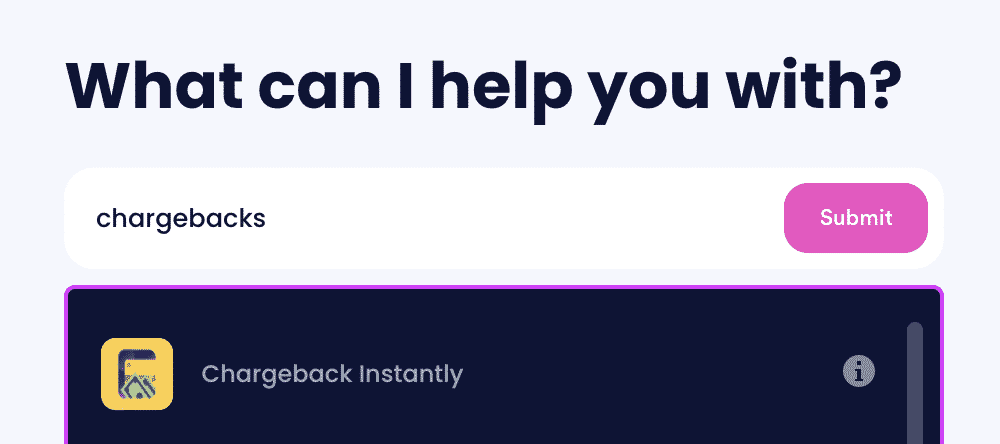

- Search "chargebacks" on DoNotPay.

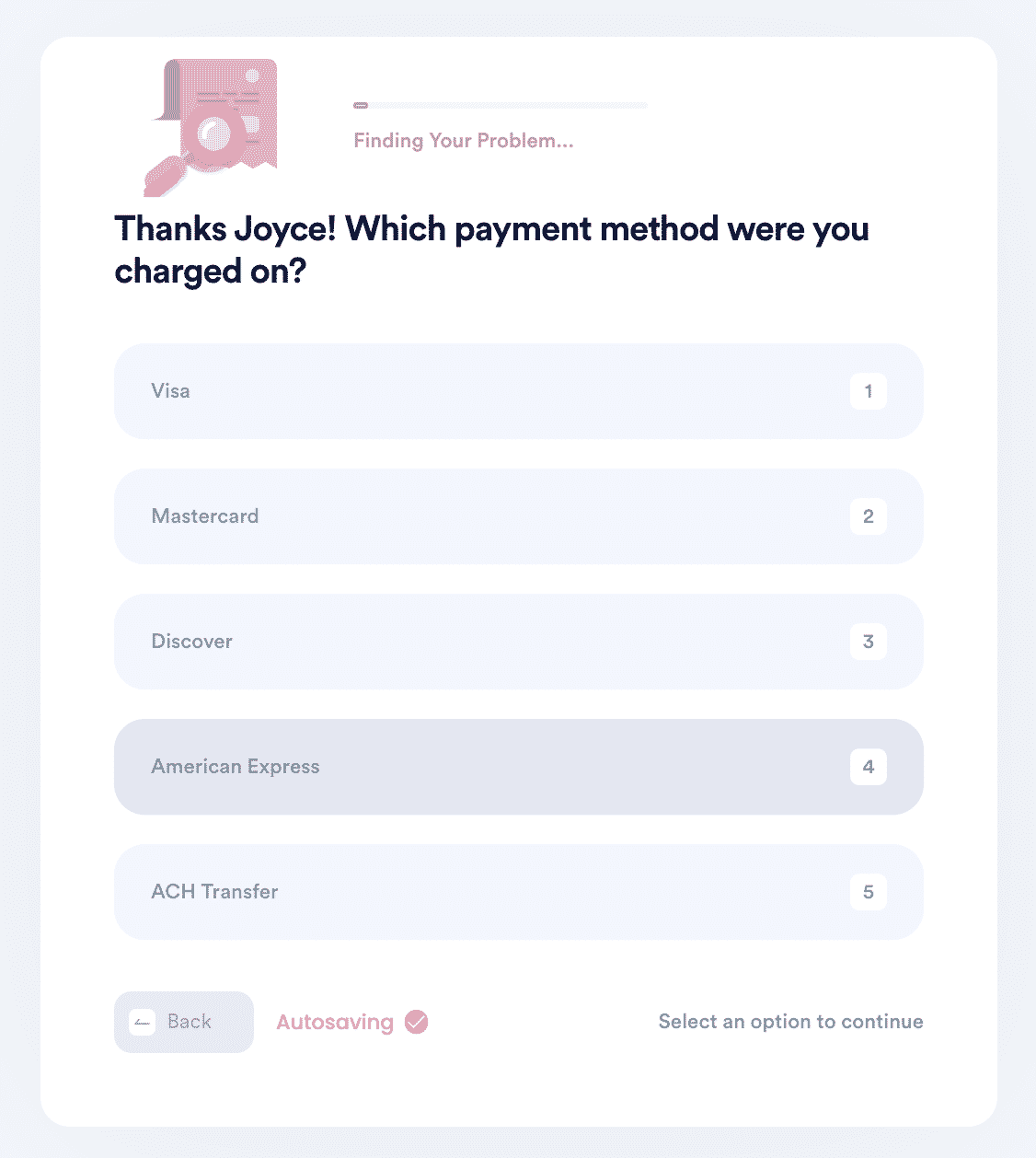

- Tell us which credit card (or ACH transfer) the payment was on, and enter the name of your bank and the merchant.

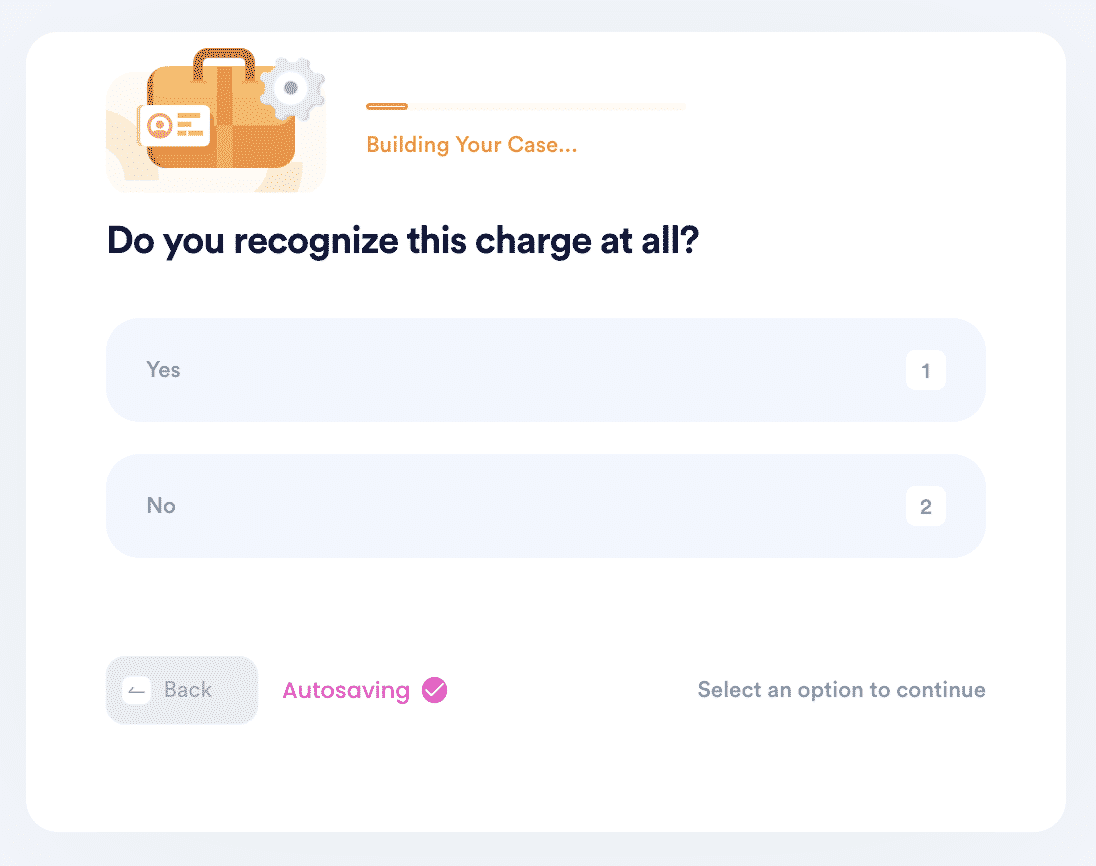

- Select the reason for your chargeback, and provide relevant details, including the charge amount, the charge date, a description of the payment, and any files you can upload as evidence.

We will generate a chargeback and have your charge re-deposited into your account within a few days.

DoNotPay Works Across All Companies

We can also provide reviews for the following:

| Experian Boost reviews | Formswift review | Fastweb reviews |

| Equifax Free Credit report review | Lifelock reviews |

What Else Can DoNotPay Do?

Apart from getting money back on your behalf, you can also trust us with your efforts in:

- Scheduling a DMV appointment

- Getting free trials without giving out your credit card information

- Analyzing terms of service

- Filing a complaint

- Finding unclaimed money

With this guide, we hope we have answered the question: ? Sign up with us to enjoy these and other services we offer.

By

By