The Hassle-Free Way to Close Your Santander Bank Account Online

Banks offer the most practical means of managing your money no matter where you live. However, several factors may influence your decision to close your bank account. If you now bank with Santander but are considering switching to another institution, you will need to know more about .

But first, we would like to introduce you to the DoNotPay Close Bank Account solution, which makes switching to a new bank simple and convenient. With the help of our product, you will learn more about how closing your bank account may affect your credit and whether you need to close your bank account when relocating to another country.

Reasons to Close a Santander Bank Account

You could want to for various reasons. Commonly, it may result from:

| A dormant account | If there have been few transactions in your account for the past two years, shutting it might be something you consider. Lack of regular activities can result in a dormant account and hence closure by the bank itself. |

| Adjustments at the Bank | You can be forced to close an account with your bank if certain modifications are made. It would be a good idea to close your bank as well, for instance, if your bank ceases operations in your state, closes branches there, or exits the banking industry entirely. |

| Lack of balances | If you have a zero balance in your account, closing it can be a factor to consider. Besides, most banks require no minimums but prohibit having an empty bank account for days or months. Some people also try to avoid the monthly fee by withdrawing the entire amount and closing the account. |

These are but a few of the factors that may influence your decision to close your Santander or other bank accounts. You can even close a bank account when the account holder dies. While some banks have simple processes for closing, others are so convoluted that it may take a lot of measures. With all banks, DoNotPay is your go-to solution for an easy process.

How Do I Close a Santander Bank Account?

If you currently bank with Santander but are considering switching to another account, you can close your bank account via one of the following methods:

In-Person Visit

You can close your Santander bank account in person by visiting one of the local branches and letting customer service help you with the process.

Through Online Channels

This seems to be the most accessible approach to closing an unwanted account. You can do so through the company's online banking or mobile banking app. And these are the necessary steps:

- Sign up or log in to the mobile app or online banking platform.

- Click the live chat helper offered by the company's chat with us option.

- Ask to have your account closed.

- Include all necessary details, such as the account to which you want your balance and interest payments delivered.

Through a Letter

Alternatively, you can close your Santander bank account by writing a letter and mailing it to the location-specific Santander address. However, if you choose this option, you will need to give some of the following crucial information:

- Your name, address, and contact information

- Specific details about where you want your amount to be paid

- The sort code and account information for the account you want to close

- Your right to revoke any mandates for direct debit.

You should include any cards and checkbooks related to the account for added security. Within 14 days after receiving your letter, your account should be closed.

These channels provide the slowest and most time-consuming ways to close your Santander bank account. Thus, you can't rely on them for emergency or security reasons. As a result, you cannot rely on them in an emergency or for security reasons. For instance, receiving feedback via a letter may take at least 14 days, while internet routes may be subject to delays. DoNotPay steps in as the ideal solution at that point. We assist you in avoiding inconveniences and delays so that your problems are resolved as quickly and conveniently as possible.

How to Quickly Close a Santander Bank Account with DoNotPay

If you want to close your Santander Bank Account easily but aren't sure where to begin, DoNotPay can help. We help you generate a cancellation letter in 6 easy steps:

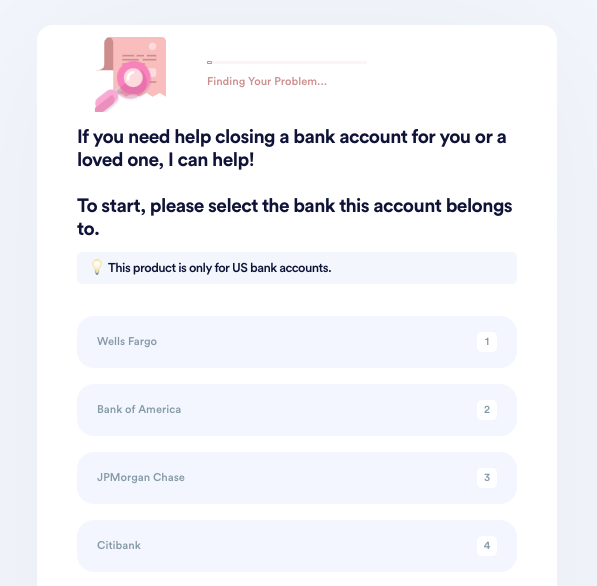

- Go to the Close Bank Accounts product on DoNotPay.

- Select which bank the account was opened under, and enter the account type, account number, and your local branch location.

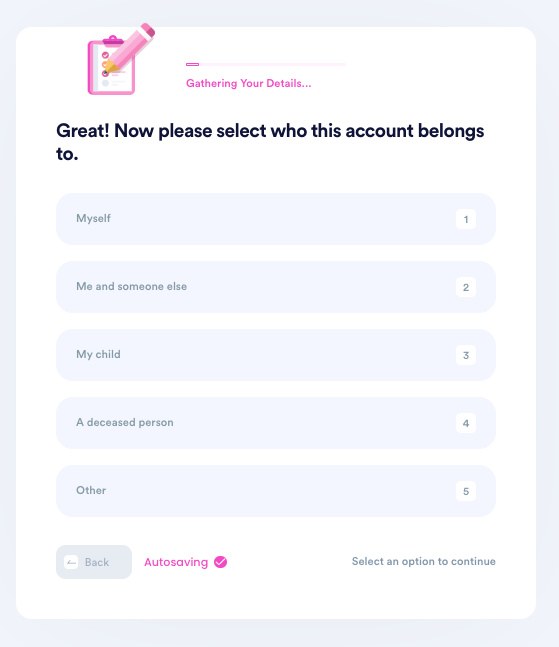

- Indicate who this account belongs to. If the owner or co-owner has passed away, upload a death certificate or other formal evidence. If you are not the original account owner, upload evidence of your relationship to the owner.

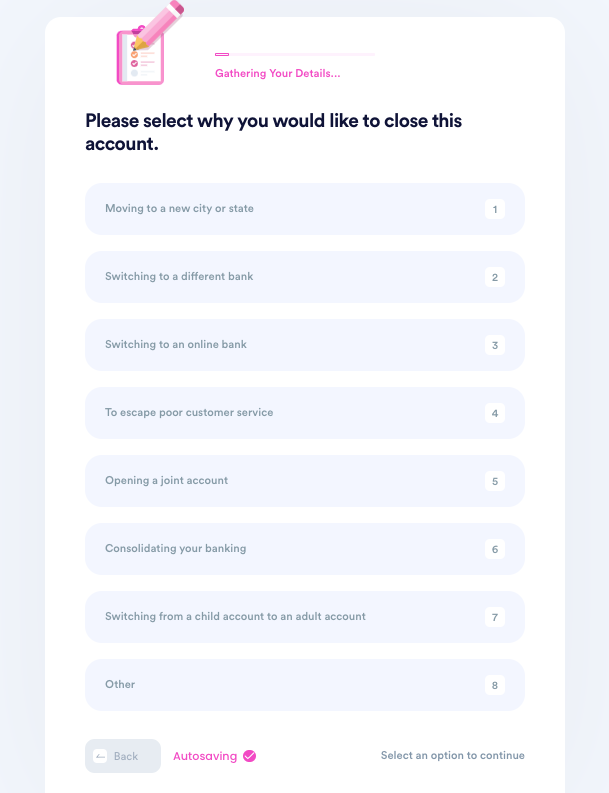

- Tell us why you need to close this account.

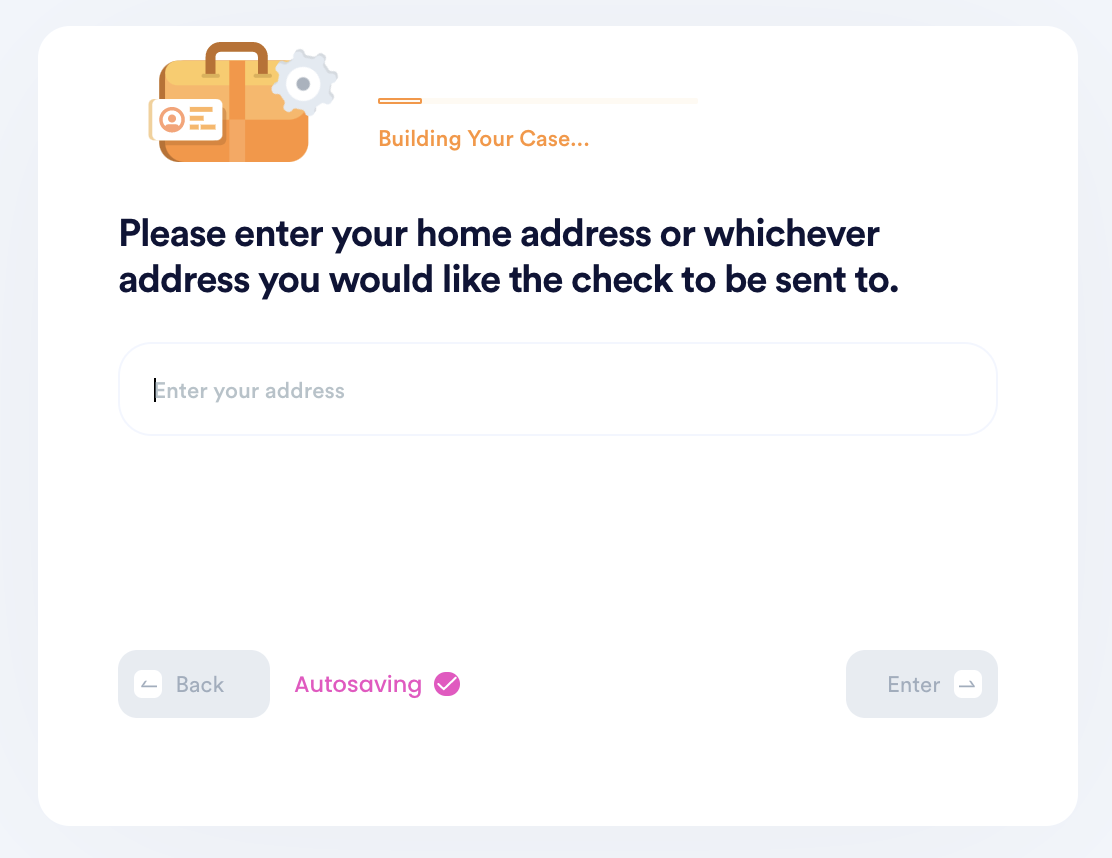

- Enter your contact information, including email, phone number, and the address you want any remaining funds to be sent to.

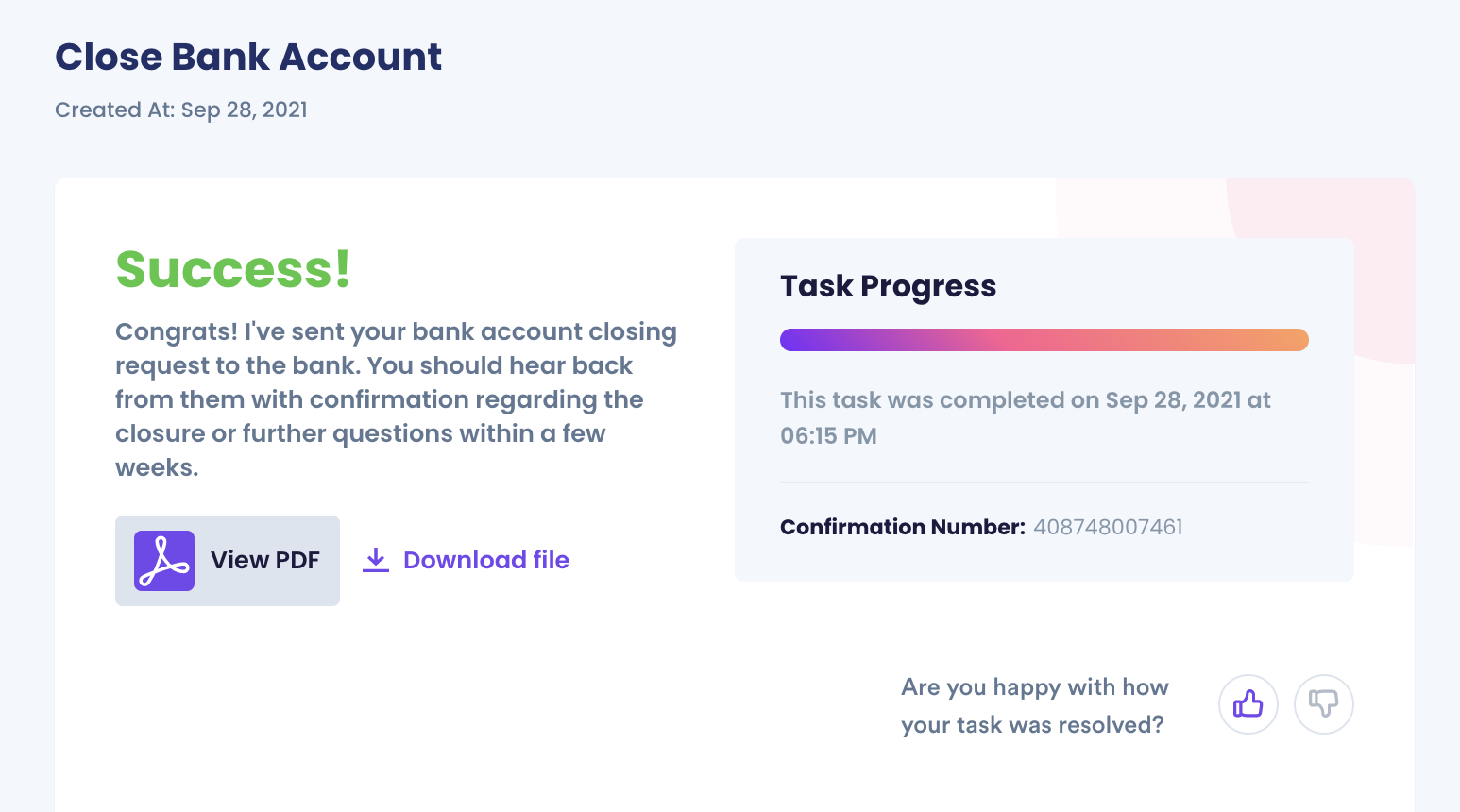

- Submit your task! DoNotPay will mail the request letter on your behalf. You should hear back from the bank with confirmation or a request for more information within a few weeks.

DoNotPay Works Across All Companies, Entities, and Groups with the Click of a Button

We can help you close bank accounts for other institutions as well, including:

What Else Can DoNotPay Do?

Our product is also helpful in helping you resolve:

- Small claims court

- Getting credit cards

- Gift card cash back

Sign up for DoNotPay for help in resolving any issue.