How to Write a Letter to Close Your Bank Account

If you have a bank account that you no longer want, you may decide to close it. Unfortunately, this often sounds easier to do than it is. Before you get frustrated over closing your bank account, know that there is an easier way to get it done. You can write a .

Though many banks like Chase Bank offer the option to fill out a close bank account form, the process can be time-consuming and complicated. The easy alternative is writing your request, but not everyone will know how to write a .

You can look online for a sample letter to close your bank account and transfer funds, or you can ask DoNotPay to help you get through this challenging time. We make it as simple as 1, 2, 3.

Why You May Request to Close Bank Account

There are many reasons you may choose to close out a bank account. Most often, we do it because our life’s situations have changed in some way.

Banks, although generally not happy about it, will offer several ways for you to get it done. They do understand that sometimes it is not practical to keep an account that is no longer necessary. You should ask how to raise a request to close a bank account if you are:

| Closing Out a Deceased Loved One’s Account | The loss of a loved one is a very common reason for closing bank accounts. To do it, you will need a statement showing that the person has passed away and then an authorization letter for bank account closure. |

| Separating from Your Partner | Couples will generally put themselves in the same bank account, especially if they are together for many years. If the relationship ends, then it may be necessary to close the account and start fresh. Banks understand this and are generally happy to help you through this difficult situation. They may give you the option to write a partnership bank account closing letter. Depending on the bank you use, there may be an application for closing a joint bank account. |

| Relocating to a New Area | With online banking available, you may move and decide to keep your current bank account when relocating. This could mean getting a Bank of America close account letter template if they are your current bank. |

| Find Better Bank Rates Elsewhere | You may want to write a bank account closure letter if your bank doesn’t offer services or options that meet your needs. Perhaps a new bank will allow you to:

It is your money and your security. If a bank no longer meets your needs, you can request to close that account to use a bank that will be more beneficial to you and your credit. |

| Need to Change a Business Bank Account | Like divorces, business needs sometimes change because it may cease to be a business. Business partners will not need to keep an active account if there is no longer going to be shared finances for it. |

| Need to Upgrade Your Personal Account | Many banks offer basic or child accounts. As your financial situation changes, it may no longer meet your needs. You can then close out the basic account and upgrade to something that allows you to bank the way you need to. |

Starting the Process: Letter to Bank Requesting to Close the Account

Most bank accounts can be closed in one of four ways:

- In-Person

- By Phone

- By Mail or Email

- Bank Account Closure Form

For most people, a letter to close a bank account is the simplest option. However, you will need to state it clearly enough that your bank will recognize it and accept it. This means you will likely need to find a sample letter of direction to close your bank account. A basic example will include:

- The Date of Your Request. This is helpful if you need proof of when you sent a notice to close a bank account.

- Your Purpose. You should clearly state that you want the bank to close out the account and stop transactions because you are getting a divorce, relocating, etc. If closing a loved one’s account, you should include proof that you are authorized to close it.

- Your Account Information. Names on the accounts, account numbers for checking or savings, and other information should be included.

- Clear Directions on Where to Send Remaining Balances. It is best if you do not clear your account before all transactions have been completed. The bank can wait on current transactions to clear and then mail you a check for the balance.

- A Request for Confirmation from Your Bank. Your bank can give you a bank account closure statement that proves you are in the process of closing out the account. It is useful for your records, but it can also be necessary for issues.

- Your Signature and Printed Name. Signatures should match your account signature and the printed name is there for clarity.

- Mailing Address and Phone Number. Your bank needs to be able to contact you if there are any issues with the signed request to close a bank account.

You will also need to include a photocopy of your ID as well as other proofs of your identity depending on the circumstances of your application to close the bank account. There are also situations where you may need a notarized letter to close a bank account. If unsure, you should contact your bank to ask for advice.

How Long Does a Bank Account Close Application Take?

Banks are not known for quickly closing out accounts. They want to make sure that all outstanding debts have cleared and that there is no more money coming in. This protects them from financial hits and you as well. However, most people do not want to wait a couple of weeks or months for their financial institution to finally release their funds.

One way to take the stress off yourself is to set up a new bank account for your money to be deposited into and start adding money before attempting to close out your previous account. This will allow you to have access to some money until your account fully closes, and a check is mailed to you.

Your other, faster option is to have DoNotPay take care of the application for closing an SBI bank account. We can speed up closing bank accounts and all you have to do is provide the relevant information.

Why Use DoNotPay for Bank Account Closing Form Completion?

First and foremost, no matter which bank you are currently trying to close, DoNotPay can get the process taken care of quickly. We work across all companies, entities, and groups, so that no matter which bank you have, they will listen to us.

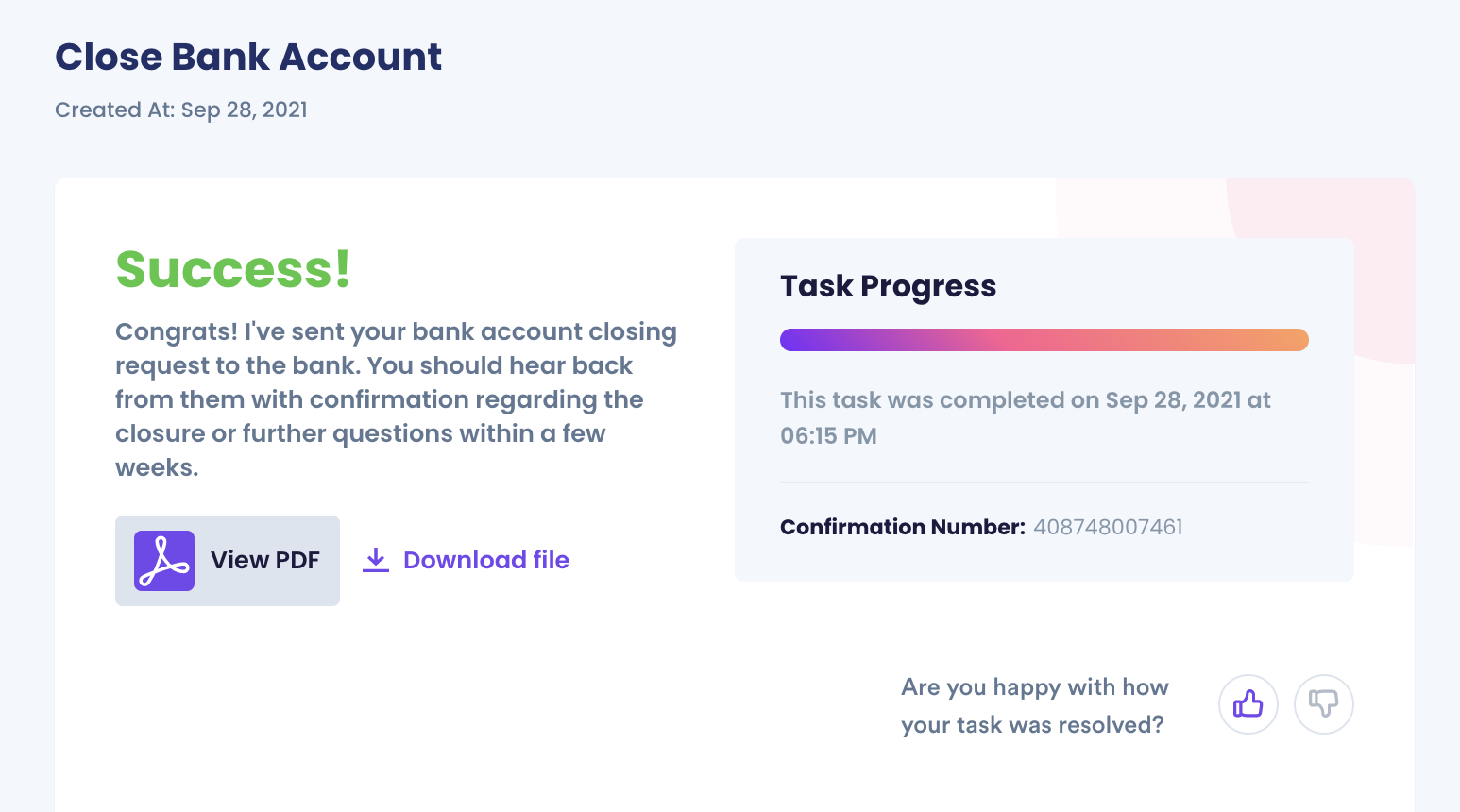

Our guarantee to you is that your bank account will be closed quickly without any disputes from your financial institution. You do not have to find your own sample letter from bank to customer to close an account. We do the paperwork and banks respond to our requests immediately.

If you want to close a bank account quickly/easily but don’t know where to start, DoNotPay has you covered. Create your own cancellation letter in 6 easy steps:

- Go to the Close Bank Accounts product on DoNotPay.

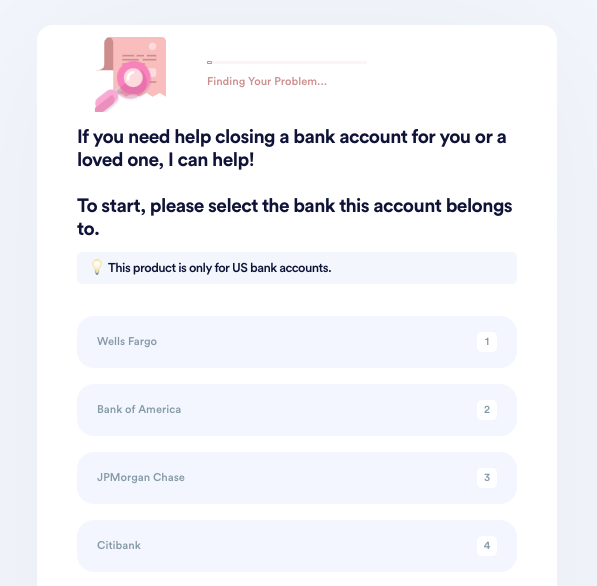

- Select which bank the account was opened under, and enter the account type, account number, and your local branch location.

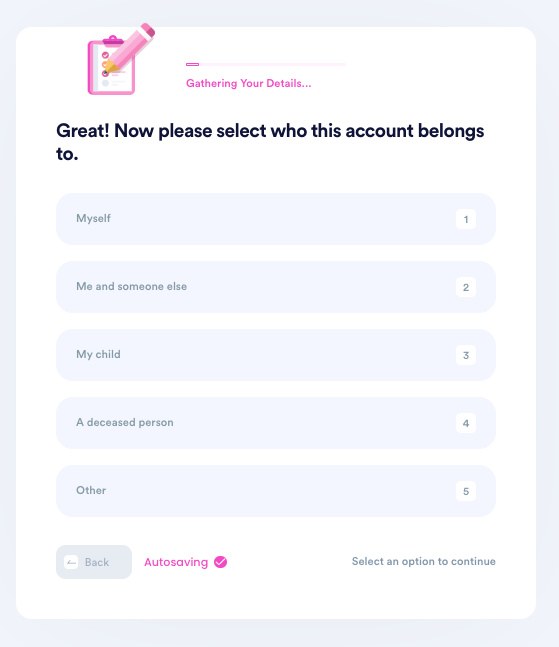

- Indicate who this account belongs to. If the owner or co-owner has passed away, upload a death certificate or other formal evidence. If you are not the original account owner, upload evidence of your relationship with the owner.

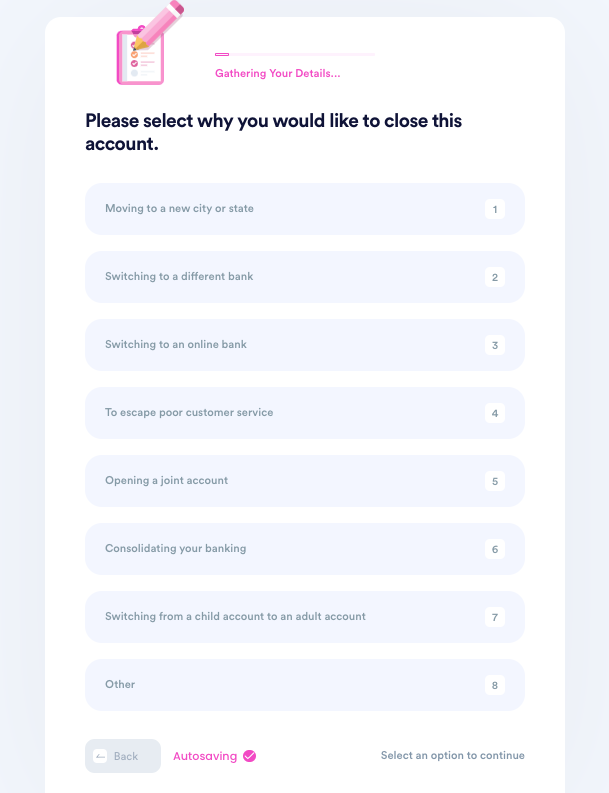

- Tell us why you need to close this account.

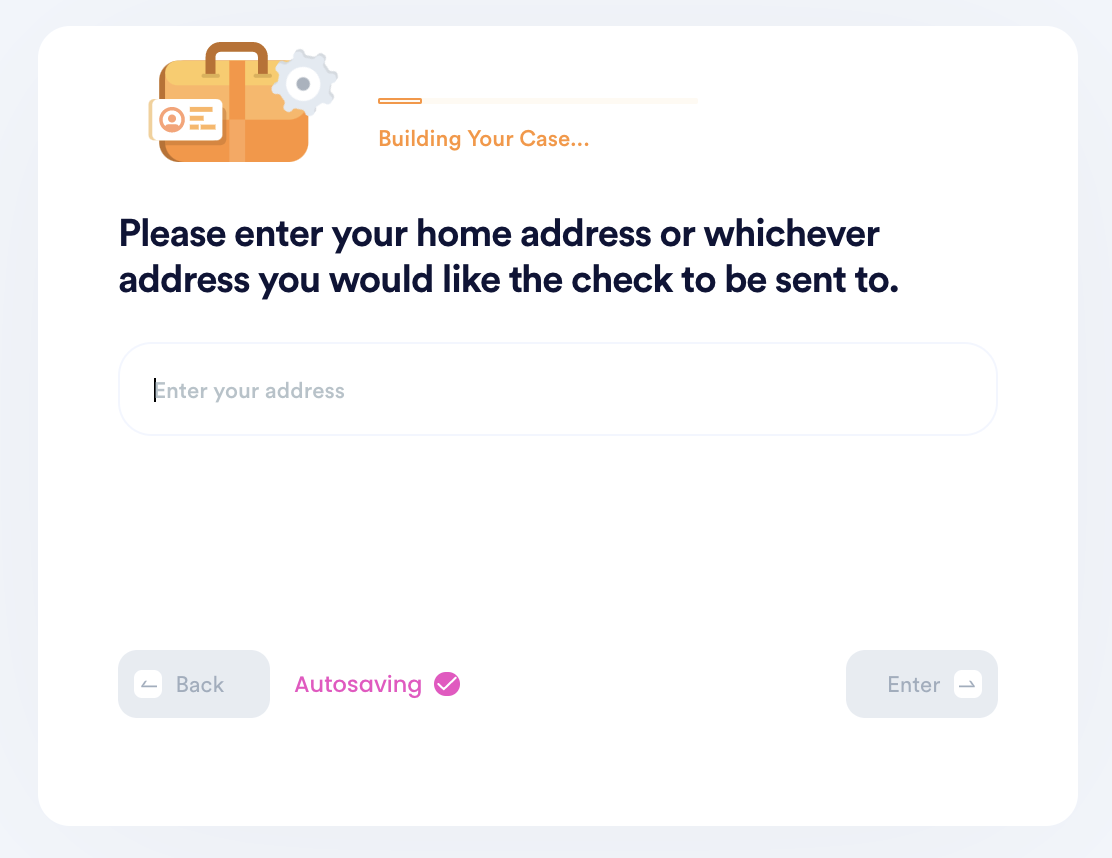

- Enter your contact information, including email, phone number, and the address you want any remaining funds to be sent to.

- Submit your task! DoNotPay will mail the request letter on your behalf. You should hear back from the bank with confirmation or a request for more information within a few weeks.

Other DoNotPay Services

Beyond doing our part to make it easy for you to close a bank account by mail, DoNotPay can assist with a variety of services that will make your life less complicated. We can:

- Find Unclaimed Money

- Virtual Credit Cards

- Chargebacks and Refunds

- Notarize Documents

- Business Loan Requests

If you are ready to avoid finding a close bank account letter template, join DoNotPay. As the world’s first robotic lawyer group, we promise to take care of you, quickly, easily, and securely.