How to Close a Capital One Bank Account Easily

Capital One bank has a horrible reputation for customer service. They're known for surprise charges, hidden fees, high interest rates on credit cards and endless spam mail. If you're ready to , the DoNotPay App can help!

DoNotPay makes closing bank accounts fast and easy. How?

- You don't need to spend hours waiting on hold to speak with a customer service rep.

- You don't need to stand in line for hours at the branch locations.

In fact, you can close any bank account (, US Bank, PNC, Chase accounts and more) quickly with DoNotPay.

The simplest way to close your Capital One account is with the DoNotPay App. Let's start there.

Close Your Capital One Bank Account with DoNotPay

To close a Capital One account, just follow these easy steps:

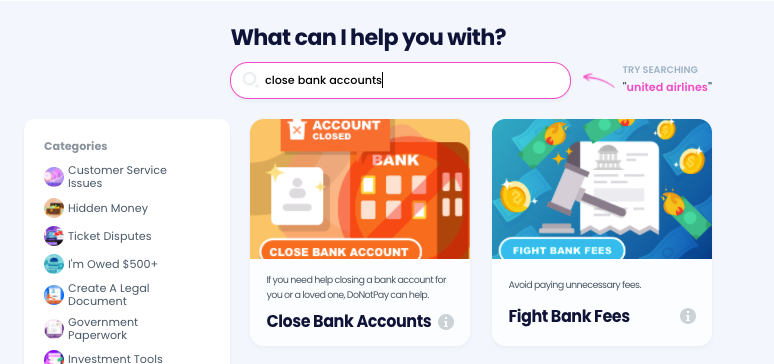

- Go to the Close Bank Accounts product on DoNotPay.

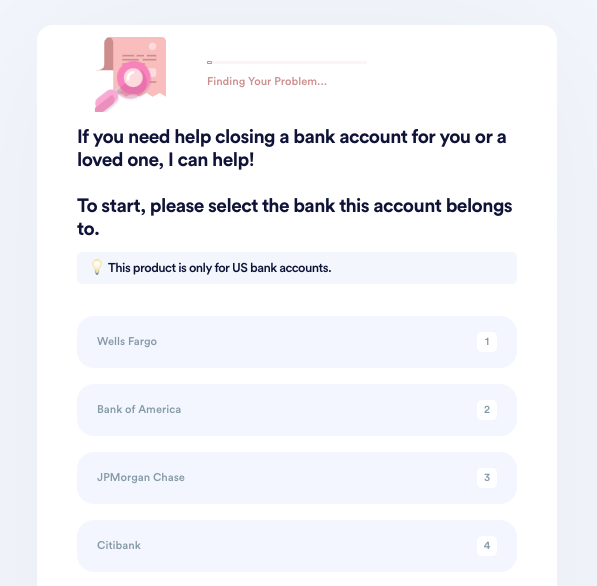

- Select which bank the account was opened under, and enter the account type, account number, and your local branch location.

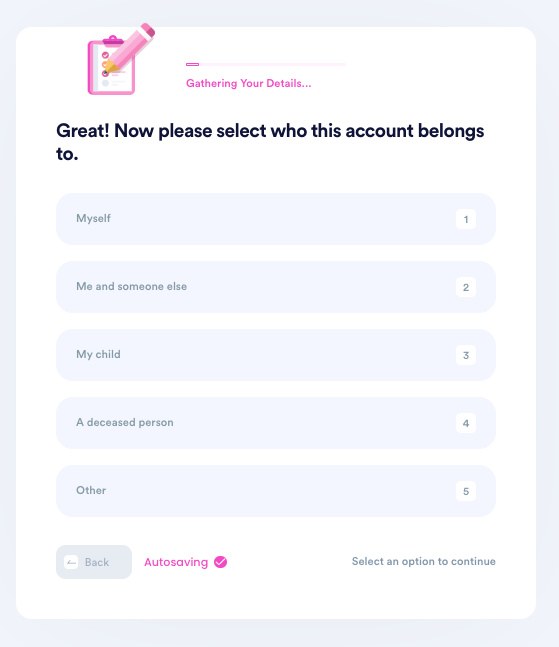

- Indicate who this account belongs to. If the owner or co-owner has passed away, upload a death certificate or other formal evidence. If you are not the original account owner, upload evidence of your relationship with the owner.

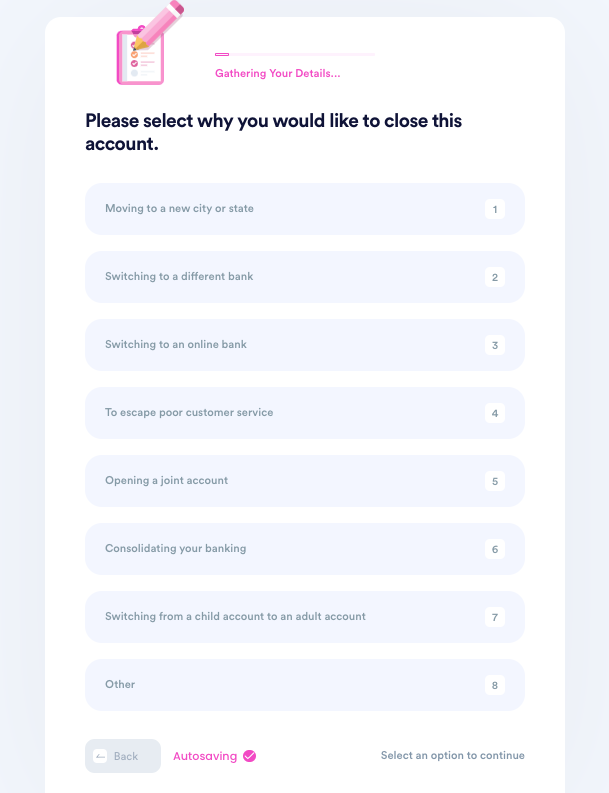

- Tell us why you need to close this account.

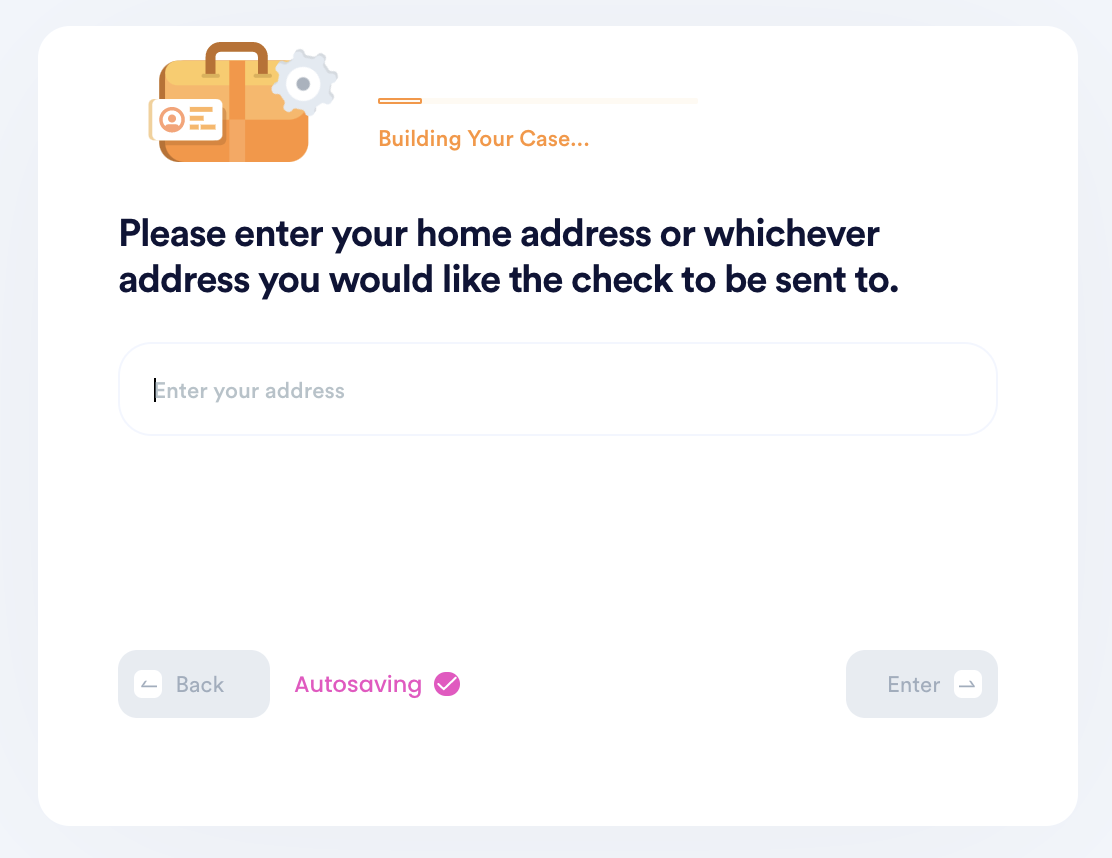

- Enter your contact information, including email, phone number, and the address you want any remaining funds to be sent to.

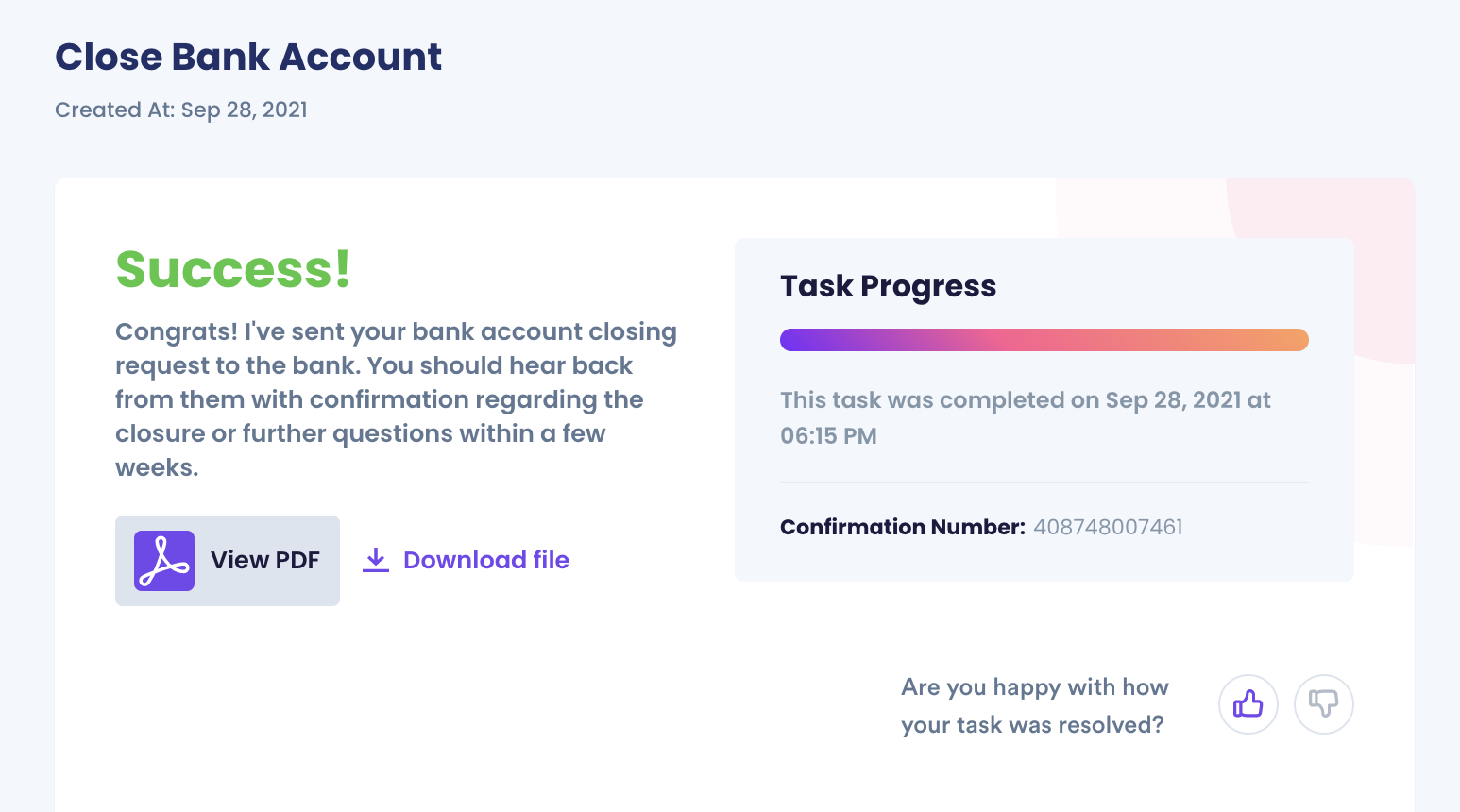

- Submit your task! DoNotPay will mail the request letter on your behalf. You should hear back from the bank with confirmation or a request for more information within a few weeks.

Wasn't that easy? DoNotPay takes all the stress out of closing Capital One accounts.

You can also close a Capital One bank account by yourself. Thanks to Capital One's bank account closure policy, you'll need to write a letter to get it done or visit a branch in person.

How to Close a Capital One Account by Yourself

Many people deal with Capital One online or via snail mail.

| In Person | Capital One bank might have a branch near you, and you can find it using Capital One's Location Finder tool.

You'll need to:

Remember to verify hours before you visit the branch. If there is no branch near you, you can write a formal cancellation letter to Capital One. |

| By Mail | You can always write this letter yourself, but the DoNotPay App is the much easier way.

Be sure to include:

Also, remember that Capital One has a horrible reputation for customer service, so send this letter via certified mail, and keep a copy for yourself. Otherwise, it may get "lost." |

Reasons People Close Capital One Accounts and Other Issues

We've already discussed Capital One's poor reputation. The Better Business Bureau (BBB) says more than 2,100 complaints have been filed in the last 12 months. Many complaints include spam mail, surprise fees and surprise charges, high interest rates, and awful customer service.

Aside from that, it seems like Capital One sometimes closes accounts for no known reason. If you're asking why Capital One closed your account, you'll need to read any communication they sent you. You can write a formal letter and ask them their reasons. It might have to do with credit scores or missed payments.

Remember, DoNotPay is the world's first AI Consumer Champion! You can use it for all sorts of paperwork.

Other Tasks You Can Handle With DoNotPay

Capital One bank is known for sending a ton of junk mail. You can use DoNotPay to stop it and all other forms of junk mail. You can also use the DoNotPay App to get out of timeshare contracts, pay utility bills, and battle traffic tickets!

Try it for:

Whether you need to because you've had enough of the terrible customer service or you're tired of surprise fees, the DoNotPay App can help you cancel that account ASAP. Try it today!