Closing Your HDFC Bank Account Online

HDFC Bank offers a wide range of banking services, including saving accounts, fixed deposit accounts, National Savings Certificate (NSC), credit cards, or loans. HDFC account is convenient for non-resident Indians who want to keep a bank account in America.

Despite its obvious utility, there are occasions when one needs to close their HDFC accounts. Doing it on your own can be tedious and unsuccessful. Luckily, with DoNotPay, becomes a matter of a few clicks.

Why Would You Need to Close an HDFC Bank Account?

You might need to close your account if you no longer wish to maintain the relationship with HDFC Bank. Some reasons for include:

- You are relocating back to India, so you have to close your American account.

- You have decided to start a relationship with another bank.

- You wish to change the type of account you have with HDFC Bank. For example, if you want to downgrade your savings account.

- You don't use it anymore, and the maintenance charges are too high.

How Do I Close an HDFC Bank Account on My Own?

You can do the following if you want to close your HDFC Bank Account on your own. The procedure varies depending on whether the account had money or had an overdraft facility.

Closing an Account With Money

To close this account, you have to follow these steps:

- Download the HDFC Bank account closure form.

- Fill the form by giving your particulars.

- Verify the information and then sign the form.

- Submit the form to your HDFC branch after emptying your account.

Closing an Account With an Overdraft Facility

If your account had an overdraft facility, you first must clear the outstanding amount. You can do this by transferring or depositing money to offset the balance. Once this is done, you can follow the steps above on closing an account with a positive amount.

Note: While visiting the HDFC Bank, carry proof of your identity and any documents related to the account.

Potential Costs When Closing a Bank Account

Here are some potential costs associated with closing a bank account:

| FEE | COST | REASON FOR THE CHARGE |

| Wire transfer fee | Domestic outgoing: $24 to $35

Domestic incoming: $15 to $20 Plus a service fee: Amount depends on the bank | You may incur this charge if you transfer any remaining funds from your old account to your new one. Both the old and new banks may charge you for the wire transfer. |

| ACH Transfer Fee | $0 to $5 | The automated clearing house (ACH) is an electronic fund-transfer system in the US. If you transfer the remaining funds from your old account to your new one, you may incur this charge. |

| Early Account Closure Fee | $10 to $50 but can also be pro-rated depending on the age of your account or a flat-rate charge | You may incur this charge if you close the account before it reaches a certain period of maturity. |

| Overdraft/NSF Fee | $27 to$35 | You may incur this charge if any checks or automated payments bounce. |

| Stop Payment Fee | $30 to $36 | You may incur this fee if you request any stop payments on checks you’ve issued from the old account. |

| Monthly Maintenance Fee | $2 to $16 | You may incur this charge if your balance with the old account is below the minimum daily requirement while you’re transitioning to a new account. |

Can HDFC Bank Refuse to Close My Account?

Closing an HDFC Bank can be quite challenging. Simply put, HDFC Bank can refuse to close your account. There are situations where the bank may refuse to close your account. These include:

- You have a negative balance in your account. Not only will this prevent you from closing your account, but closing your bank account can also hurt your credit score.

- You have a lock-in associated with your account, and it has not been lifted.

- You have not surrendered all the documents related to the account.

- The bank officials aren't satisfied with the identity documents you presented to close the account.

With DoNotPay, you can quickly close your HDFC Bank Account without facing these challenges. Therefore, if you're looking to close your HDFC account, do it online with DoNotPay. As shown below, it’s easy and will only take a few minutes of your time.

How to Easily Close an HDFC Bank Account With DoNotPay

If you want to quickly close an HDFC Bank Account but don't know where to start, DoNotPay has you covered. Create your cancellation letter in 6 easy steps:

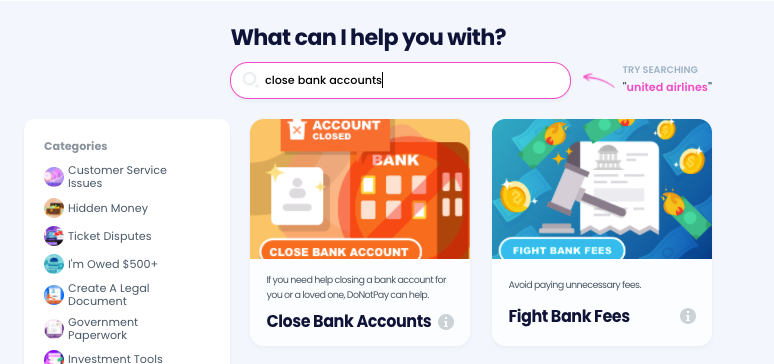

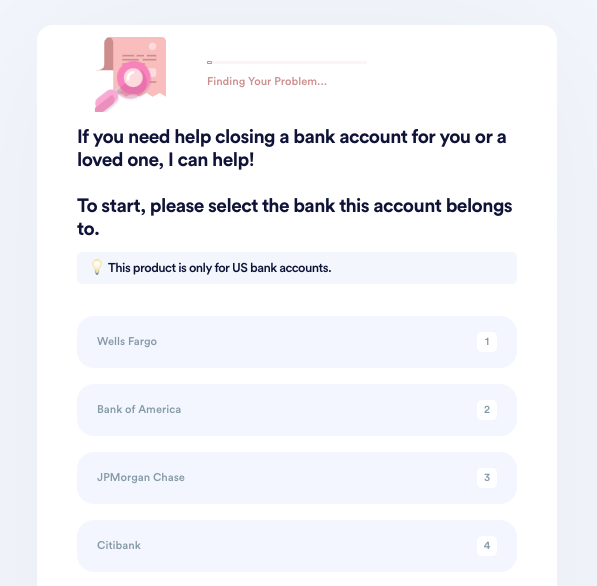

- Go to the Close Bank Accounts product on DoNotPay.

- Select which bank the account was opened under, and enter the account type, account number, and your local branch location.

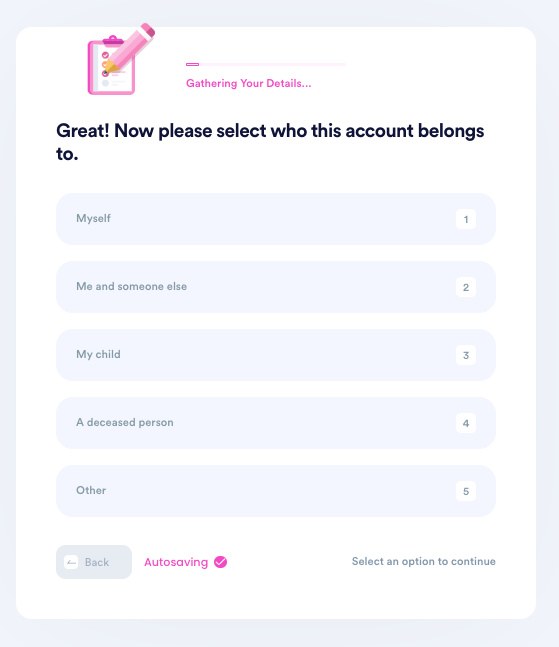

- Indicate who this account belongs to. If the owner or co-owner has passed away, upload a death certificate or other formal evidence. If you are not the original account owner, upload evidence of your relationship with the owner.

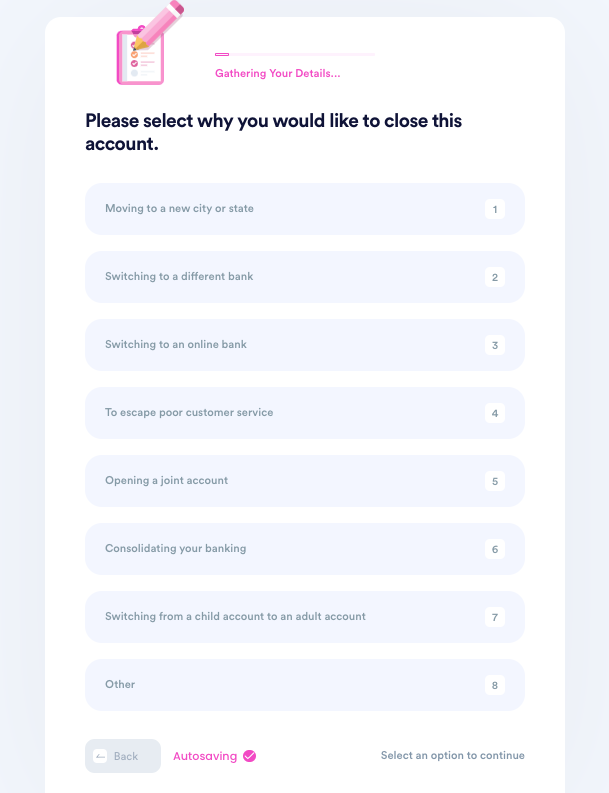

- Tell us why you need to close this account.

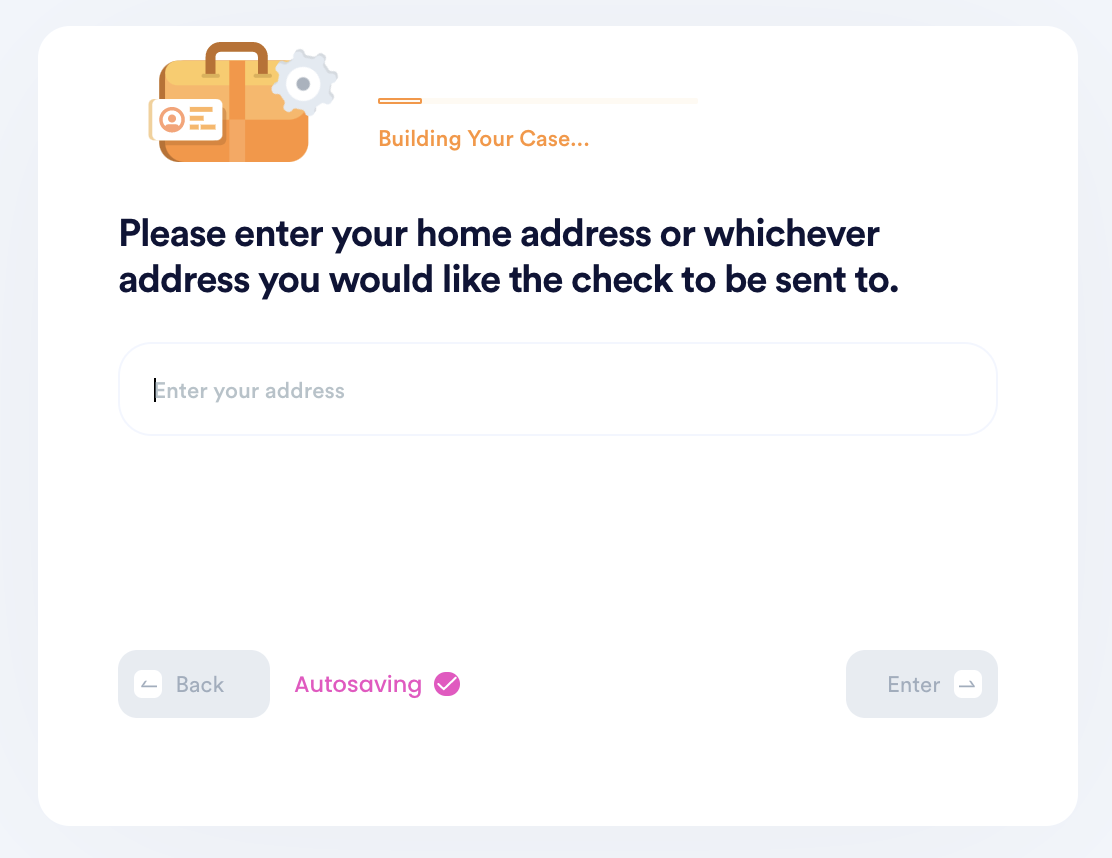

- Enter your contact information, including email, phone number, and the address you want any remaining funds to be sent to.

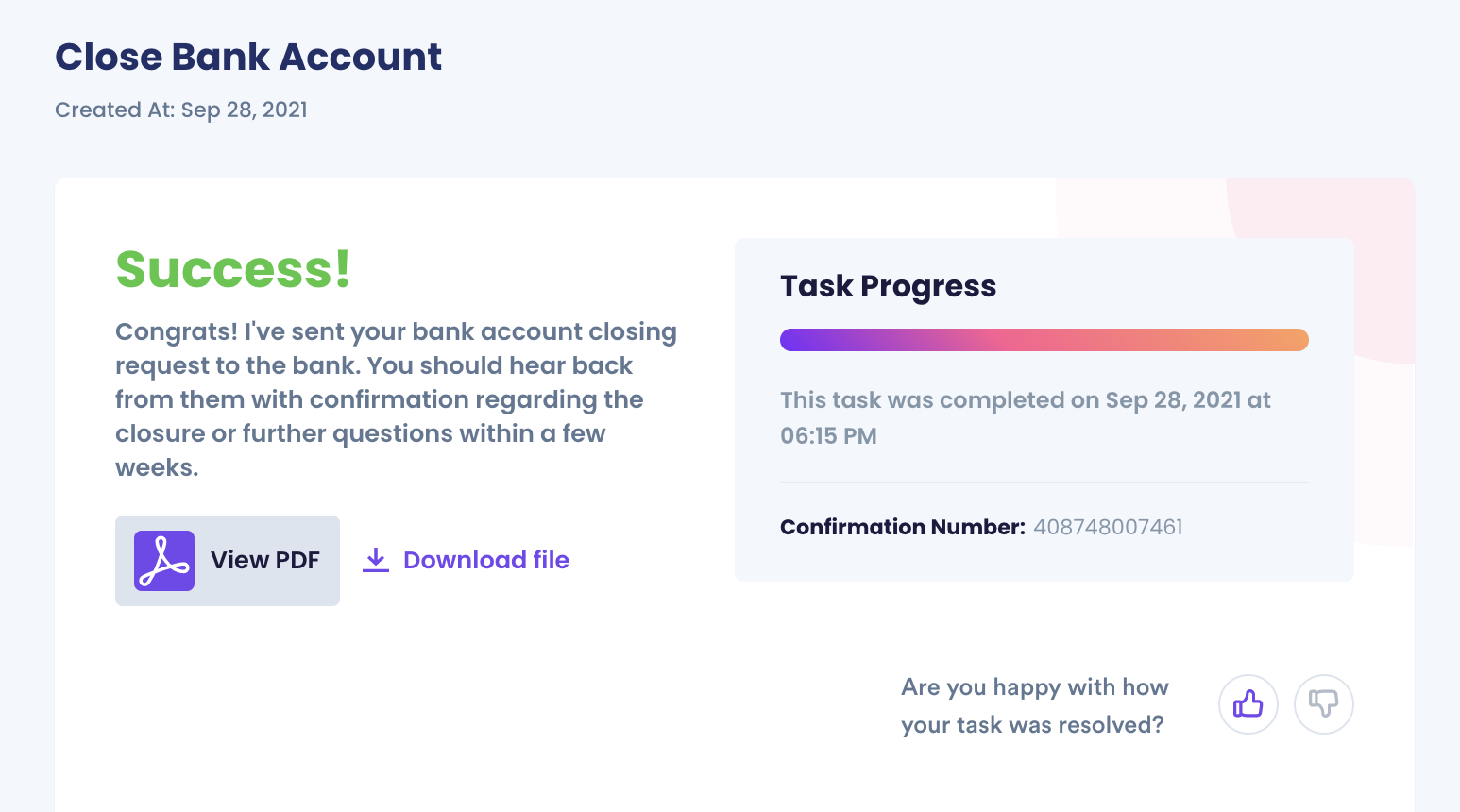

- Submit your task! DoNotPay will mail the request letter on your behalf. You should hear back from the bank with confirmation or a request for more information within a few weeks.

Why Use DoNotPay to Close Your HDFC Bank Account?

Don't waste hours going back and forth with customer service reps. DoNotPay will gather the required information, customize an HDFC closure form letter, and mail it on your behalf. You also stand to attain the following benefits:

- DoNotPay is fast: We save you time by avoiding unnecessary account closure procedures. There is no need to fill out forms, hold meetings in person, or call multiple branches.

- DoNotPay is easy to use: We simplify account closure by automatically sending the account closure form to the relevant department of HDFC Bank.

- DoNotPay is practical: We help close down your HDFC Bank accounts by following up with the bank until they process your request. You do not need to learn how to navigate the business bureaucracy and form letters, and our team will work until things go through.

What Else Can DoNotPay Do?

Aside from closing your bank account, DoNotPay can also assist with other bank-related concerns such as:

- When the bank closes your account

- Closing a bank account when a loved one passes away and doesn’t leave a will

DoNotPay does not just help you close accounts with HDFC but also accounts with other banks such as:

We are on a mission to fix the world's problems with the help of technology. Apart from helping you close your HDFC Bank account, we can also help with the following:

- Send Demand Letters To persons at the Small Claims Court.

- Get cashback from your gift card purchases.

- Learn about credit cards.

Imagine what it would be like if you didn't have to worry about closing your bank account. It's now possible with DoNotPay. If you previously had issues successfully closing your bank account, please don't hesitate to contact DoNotPay for a quick resolution.