How to Report Fraud to IRS

Paying taxes is a civic duty of every American citizen. The unfortunate thing is that not all taxpayers are honest enough to comply with the set tax rules. Many people try to take undue advantage of loopholes or illegal means to evade paying taxes.

While people think that tax fraud is a victimless crime, the real victims are honest taxpayers. Because of some tax evaders, all taxpayers have to pay more taxes. To stop this from happening and bring back the lost money into the economy, . The IRS comes down heavily on tax evaders by imposing stiffer penalties on them.

What Exactly Is Tax Fraud?

Tax fraud is an illegal method that some taxpayers use to cause a mismatch between the tax which is collected and the one which should have been collected. In simple words, it is a deceptive practice used by a taxpayer to reduce taxable income. This way, the taxpayer defrauds the government by not paying all the taxes they are liable to pay.

Taxpayers use different methods to avoid paying taxes or accumulating more tax deductions than they are eligible for. Some examples of tax evasion are:

| Filing fake tax return | Filing a fictitious return with false income and deductions to reduce one’s actual income |

| Hiding taxable income | Hiding some of the taxable sources of revenue to reduce the tax burden |

| Claiming false deduction | Claiming false deductions such as charitable donations or business losses to save on taxes |

| Filing fake documents with IRS | Submitting counterfeit documents with the IRS to avoid paying taxes |

| Claiming false income | Claiming tax refunds for not paying taxes by underreporting their taxable income |

Tax evasion is a serious crime, and the IRS will not take it lightly. If you are caught evading taxes, then there might be serious consequences for you. You may end up in jail or be fined heavily by the IRS, depending on your offense.

Why You Should Report Tax Fraud?

In case you have evidence that someone is evading taxes, you can report fraud to the IRS. The best thing about following this course of action is that if the IRS actually manages to catch hold of a tax evader, you will be rewarded for helping in catching these crooks.

How to Report Fraud to IRS on Your Own

If you know someone who is committing tax fraud, then report them to the IRS. You can even file an anonymous complaint against them. The IRS treats all tax evasion complaints seriously and tries to check the veracity of each complaint.

You should give as much information about the evader for the IRS to investigate them. Make sure that you include the following information:

- Taxpayer's or Business' Name and address

- Social Security Number or Employer Identification Number

- Description of the taxpayer's business

- The type of tax return filed for each year

- An estimate on how much you think the evader owes in back taxes

- Any evidence including but not limited to W-2s, 1099s, bank records, etc.

Use Form 3949-A to lodge a report to the IRS. You cannot report fraud to the IRS over the phone. After you file the complaint with the IRS, they will take necessary action to investigate and collect back taxes from the evader, making life difficult for them. You should report any such malpractices to check tax evaders and bring back lost money into the economy.

Why Use DoNotPay to Report Tax Fraud

Often people find it hard to report tax fraud on their own. If you are one such person, then DoNotPay is here for you.

- With DoNotPay, your anonymity and privacy are guaranteed.

- It guides you through the whole process step by step and even checks if all details have been submitted correctly or not. All you need to do is provide as much information as possible and submit your report. You can even attach relevant documents such as W-2s or bank statements. There are no complicated forms to download and fill out.

- The information is sent to the right people so they can start investigating.

How to Report Tax Fraud Using DoNotPay

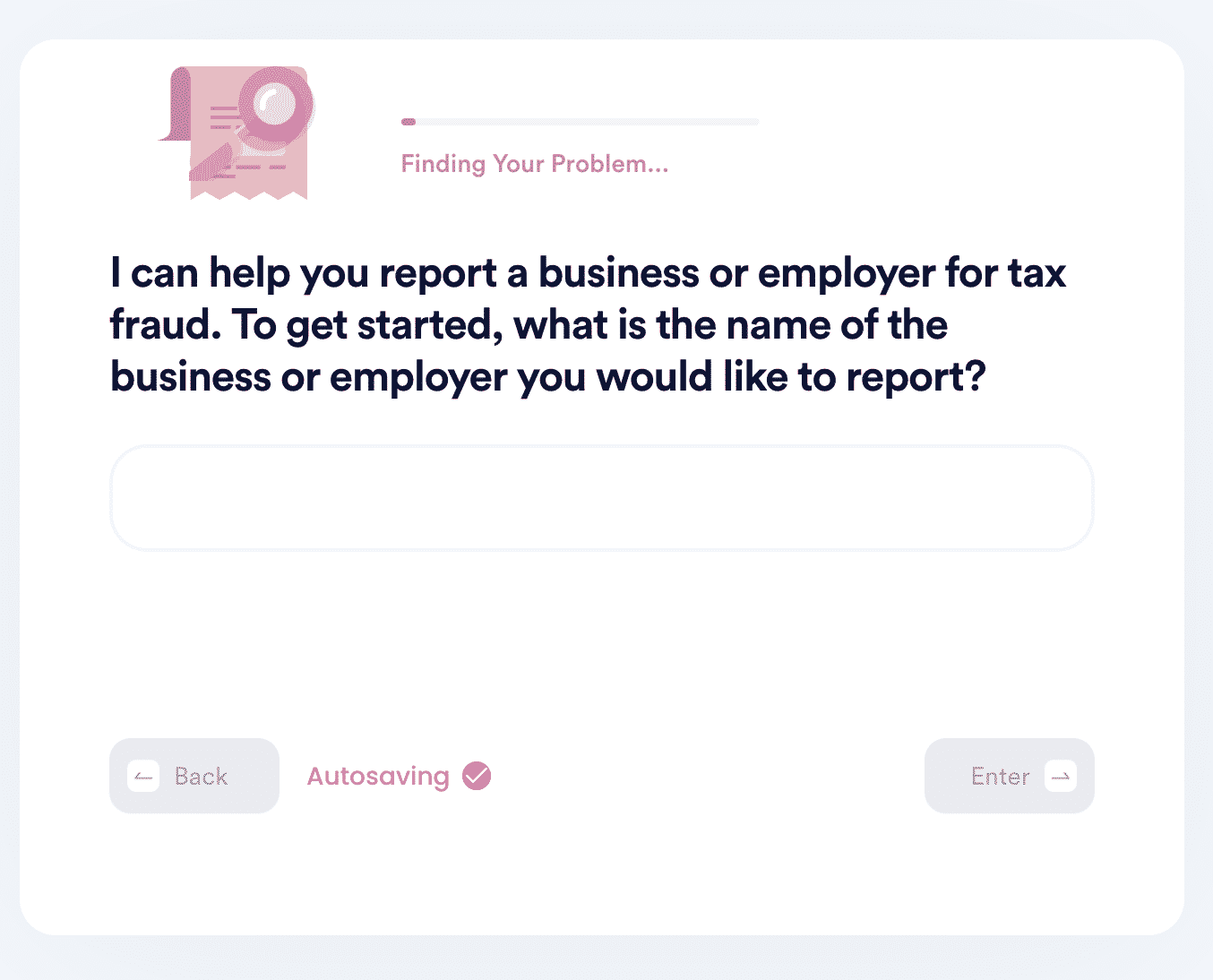

If you want to report tax fraud but don't know where to start, DoNotPay has you covered. Create your own cancellation letter in 5 easy steps:

- Open the DoNotPay Report Tax Fraud product.

- Enter the business you would like to report for tax fraud.

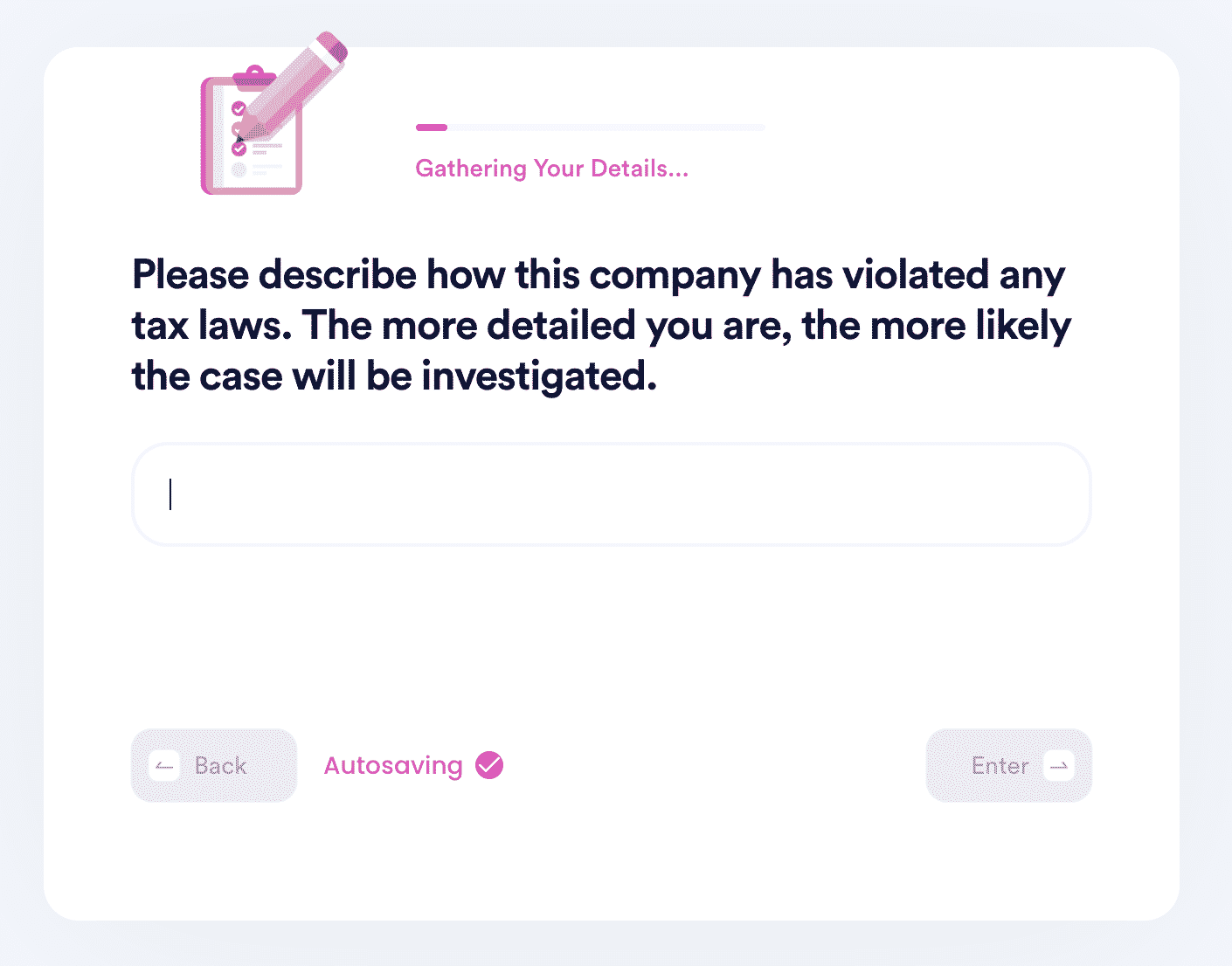

- Provide the details of suspicious activity and as much evidence as you can provide.

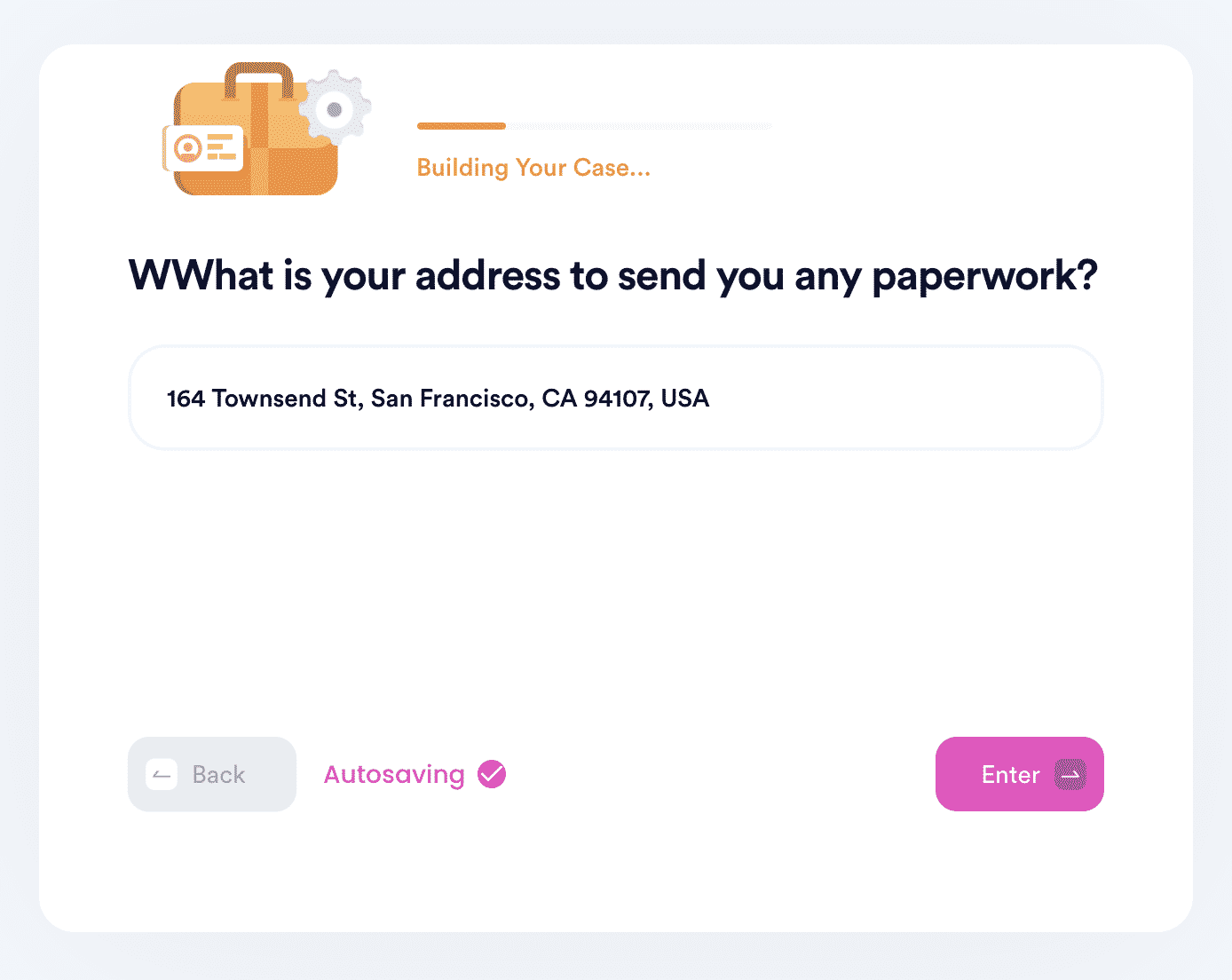

- Confirm your contact information.

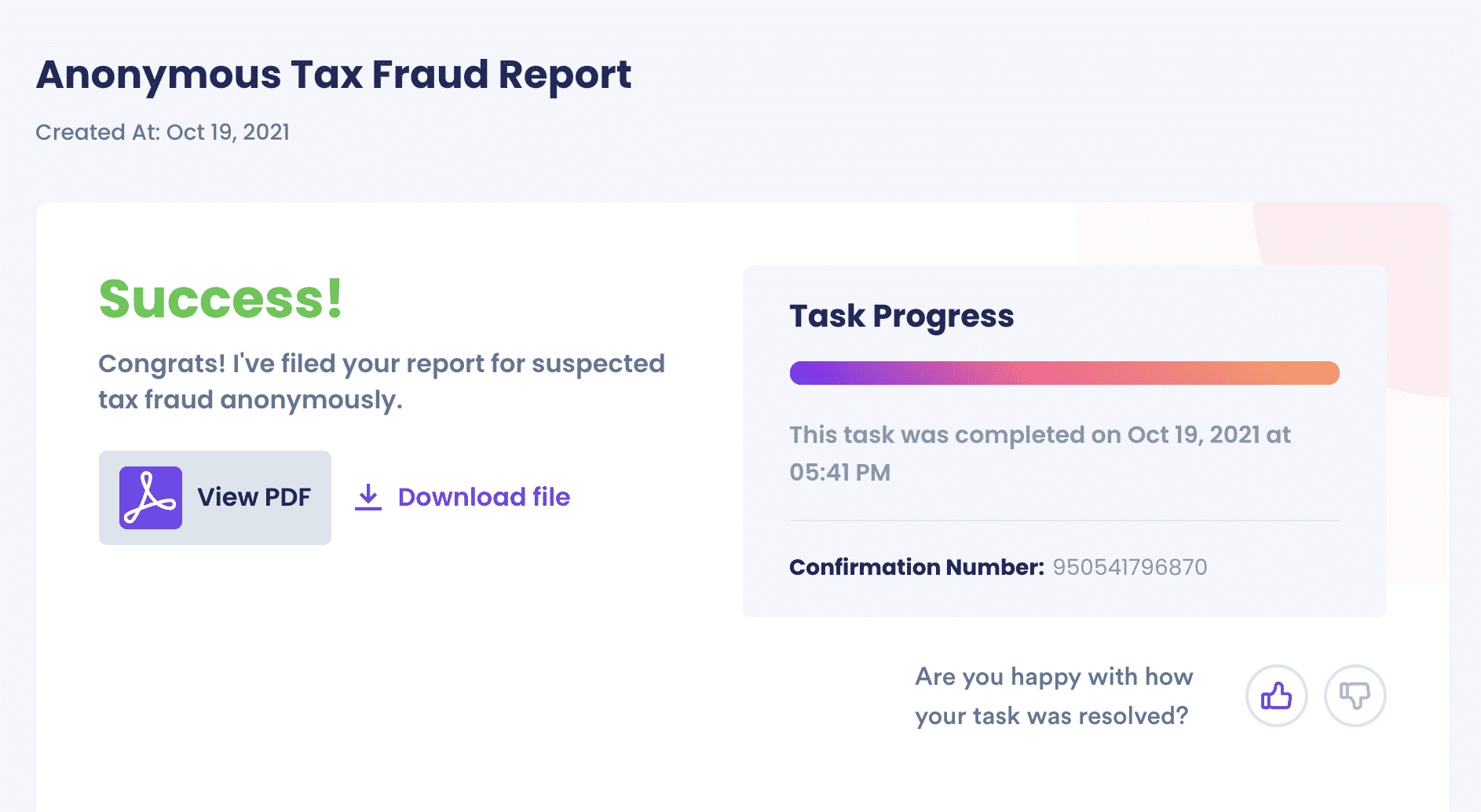

- DoNotPay will automatically generate the official report and send it on your behalf. The IRS will contact you regarding cash rewards once the case is investigated.

What Else Can DoNotPay Do?

Apart from helping you to report fraud to IRS, DoNotPay can also help you do the following services:

- Report your boss or landlord for IRS fraud.

- Learn how to create a letter to report tax fraud.

- Report someone claiming your child on taxes.

- Reporting fraud in different states, including California and New York.

By

By