Report Oregon Tax Fraud Quickly and Easily

Like the rest of the country, there has been a steadily rising increase in Oregon tax fraud through falsified W-2s, identity theft, or claiming someone else's child as a dependent.

Nationally, there is a difference of approximately $681 billion between tax money collected and tax money owed. This money is all due to tax fraud and tax evasion by those who do not want to pay the total amount owed. Tax fraud adversely affects the average American. DoNotPay views these actions as unfair to those who struggle and still meet their tax obligations fully and on time. We believe that there should be an easy way for the average citizen to help the IRS identify businesses and corporations involved in these illegal tax activities.

has created a way for the average person to help fight the travesty of tax fraud. Our new tax fraud reporting product enables you to easily report any suspicious tax activities on businesses, corporations, and individuals with whom you do business. The best part is that you will have an opportunity to earn cash rewards for doing so, or you can choose to report the activity anonymously. All you need to do is answer a few short questions about the company and its suspicious activity. DoNotPay files an official report with the IRS on your behalf. You can then earn as much as 30% of the money collected by the IRS.

What Exactly Is Tax Fraud?

Tax fraud is defined as the result of individuals or businesses that "willfully and intentionally falsify information on a tax return to limit the amount of tax liability." Or using false information on the tax return to avoid paying everything they owe. Examples of tax fraud include:

- Using a fake social security number

- Claiming personal expenses as business expenses

- Claiming false deductions

- Knowingly failing to file payroll tax reports

- Failing to report any cash payments to their employees

- Not reporting all of their income

- Failing to withhold federal income taxes from employee paychecks

- Failing to report and pay payroll taxes that have been withheld from employee pay

- Claiming an exemption for a nonexistent child

Is Tax Evasion the Same as Tax Fraud?

While tax evasion falls under the umbrella definition of tax fraud, tax evasion is illegally avoiding paying taxes owed. It carries a different sentencing structure than other types of tax fraud. An example of tax evasion is rate manipulation, where an employer manipulates Unemployment Insurance payroll tax rate to achieve a lower rate to pay less money in taxes.

Why Should You Report Oregon Tax Fraud?

Oregon tax fraud affects every resident in the state. Your tax dollars are used to fund several essential state services, including:

| Education | 52% goes to Education: K-12, community colleges, and higher education. |

| Human Services | 27% goes to Human Services: Medicaid, food stamps, senior services, mental health, and child protective services. |

| Public Safety | 17% goes to Public Safety: Police, Department of Justice, correctional facilities, and juvenile corrections |

| Other Services | 4% goes to Other Services: Highways, forestry, library services, agriculture, and environmental quality |

How to Report Oregon Tax Fraud On Your Own

Accessing the tax fraud reporting system is highly confusing. You need to start by visiting the State of Oregon’s website.

NOTE: The path to finding the Department of Revenue is not identified and is challenging to navigate.

To report Oregon tax fraud on your own, you can:

- Go to the State of Oregon's website home page.

- Select Looking for a State Agency, Search Agencies.

- Scroll down the page and select Revenue.

- Scroll to the bottom of the page, and under 'Get Help,' select Report Fraud or Identity Theft.

- On the Fraud Report page, select either Identity Theft or Tax Evasion and click 'Next.'

- Complete the form and click 'Submit.’ You have now completed the form for the State of Oregon. You will now need to report the information to the IRS.

- Open a new window, and go to IRS.gov.

- Scroll to the bottom of the page, and under their 'Resolve an Issue' option, select Tax Fraud.

- Carefully read the material on the Tax Fraud Alerts page, and scroll down to the bottom of the page and select Report Suspected Tax Fraud Activity.

- Read the contents of the page. Click on Form 3949A, Information Referral.

How to Report Oregon Tax Fraud With DoNotPay

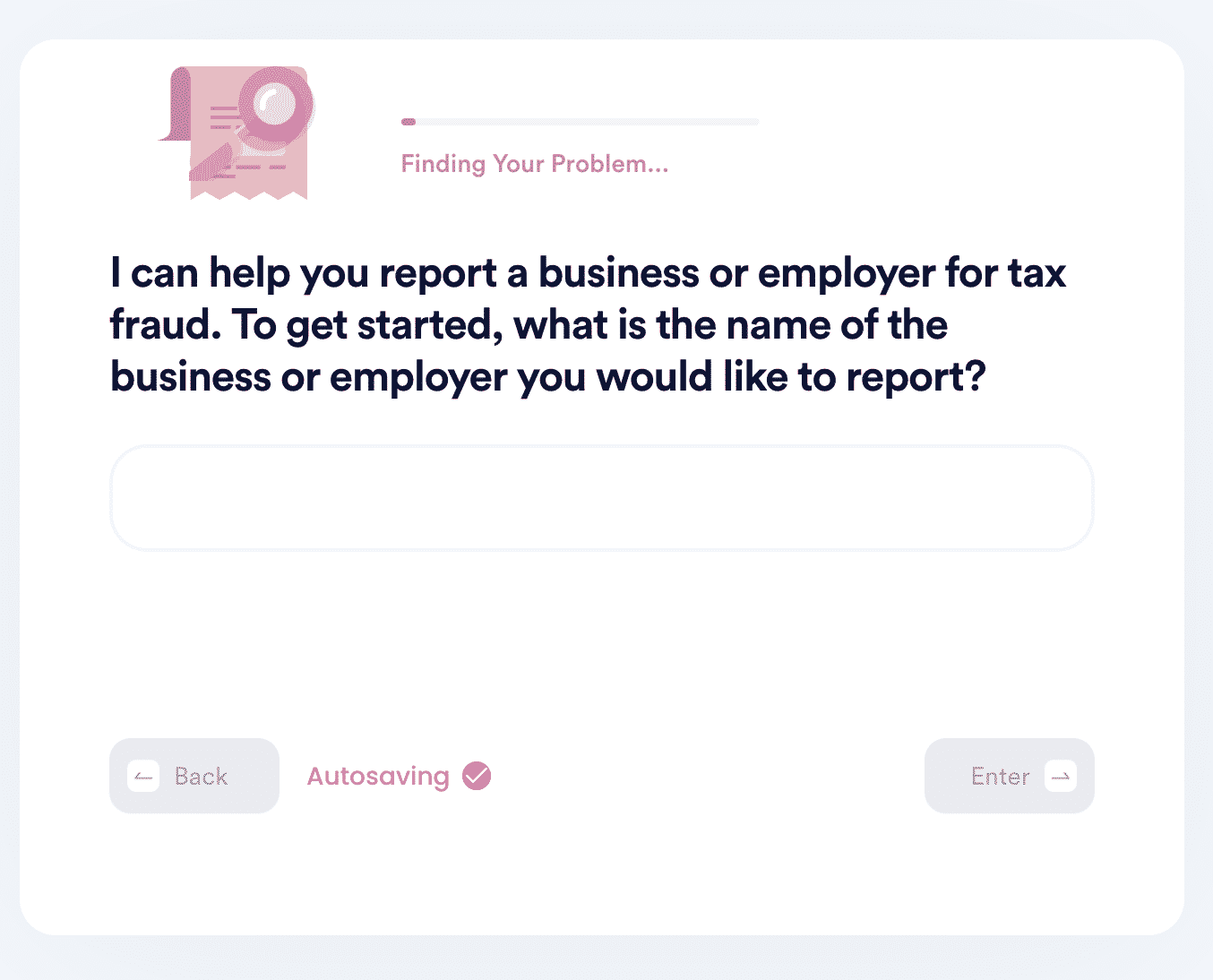

If you want to report tax fraud but don't know where to start, DoNotPay has you covered. Create your cancellation letter in 5 easy steps:

- Open the DoNotPay Report Tax Fraud product.

- Enter the business you would like to report for tax fraud.

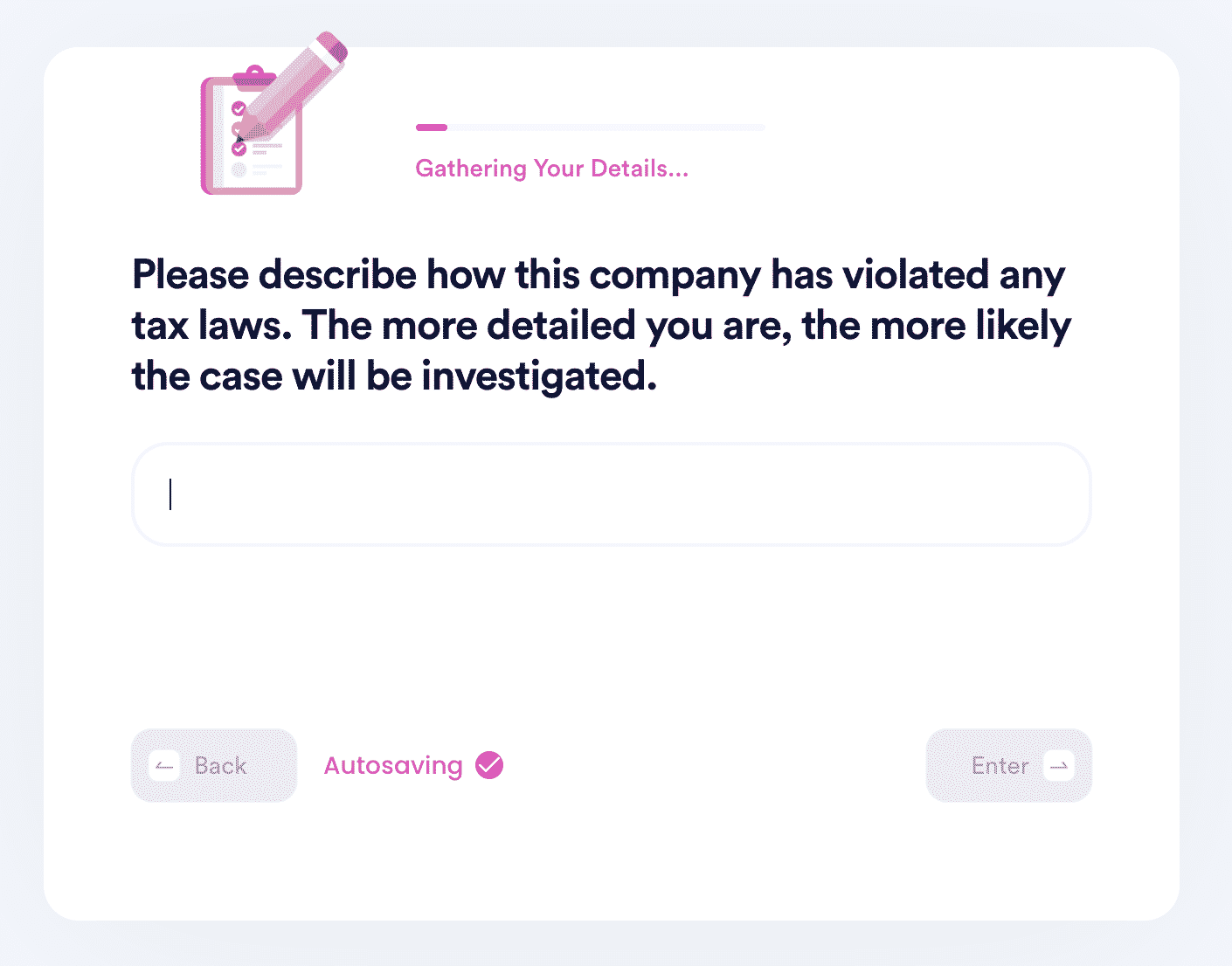

- Provide the details of suspicious activity and as much evidence as you can provide.

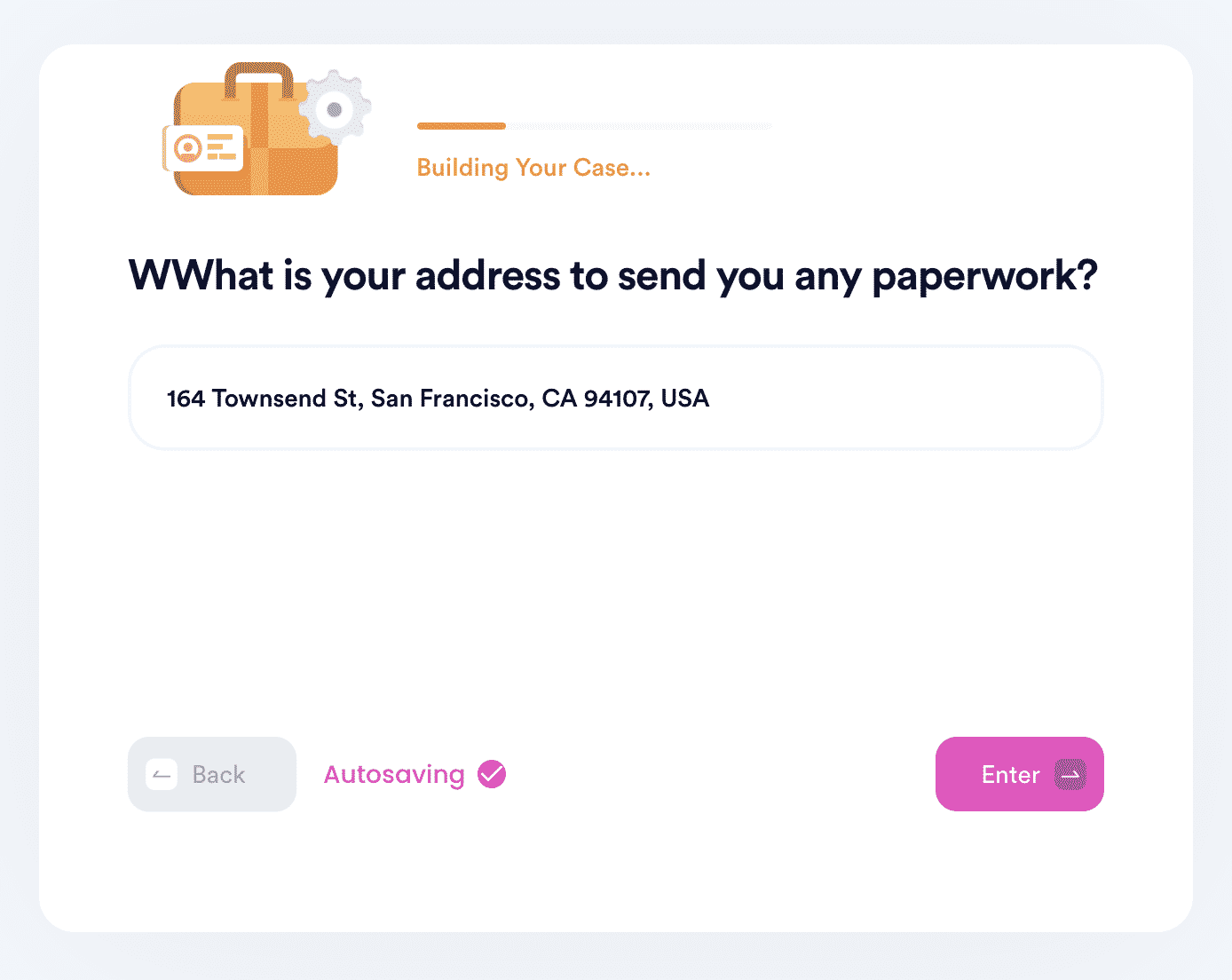

- Confirm your contact information.

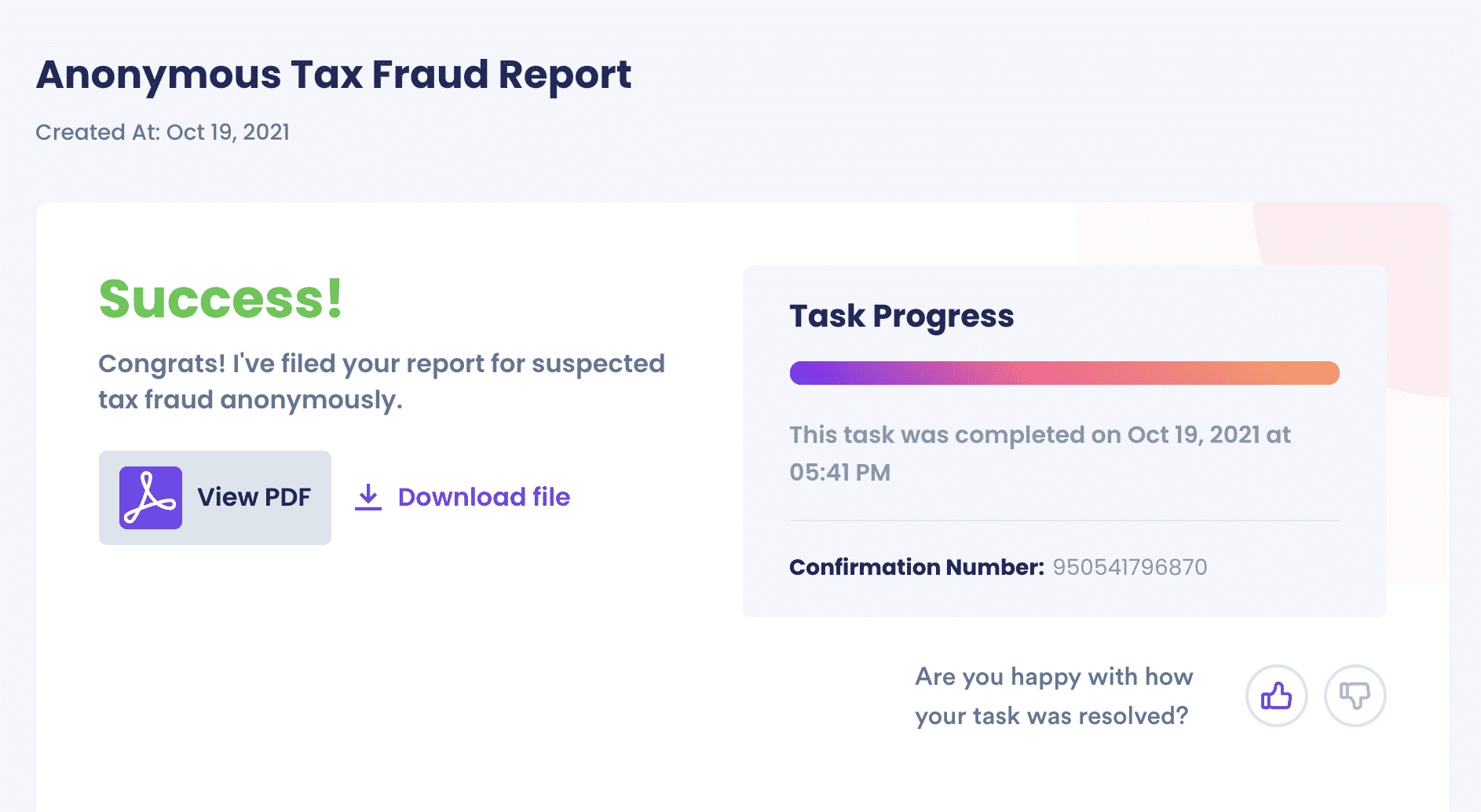

- DoNotPay will automatically generate the official report and send it on your behalf. The IRS will contact you regarding cash rewards once the case is investigated.

Why Use DoNotPay to Report Oregon Tax Fraud?

is the simplest way to prepare your report of suspected tax fraud to the IRS. In less than 5 minutes, DoNotPay will have prepared your statement and is ready to submit it on your behalf.

What Else Can I Do With DoNotPay?

There is so much help to be found on DoNotPay.

- Do you need to report another suspicion of tax fraud in another state? DoNotPay provides services such as the State of California tax fraud report and many others.

- Do you suspect that your landlord may be guilty of tax evasion?

By

By