3 Steps to Take After a Wrongful Repossession in Georgia

Repossession of your car by your lender can never occur at a convenient time. You may be out with friends, visiting a loved one, shopping, or even at the hospital when your lenders decide they have had enough. Even though you anticipated the repossession, it is never a welcome occurrence.

Wrongful repossession may happen if you have paid your dues but have not been registered by your lenders, or if they breach the peace while repossessing. In either case, getting justice on your own can get complicated.

DoNotPay is the fastest, easiest, and most convenient way to . We can help you file a demand letter

What Does Georgia Law Say About Car Repossession?

If you have defaulted on your lease, been late on your car payments, or have defaulted on the finance contract for your car, the law of the State of Georgia gives your creditors the right to do any of the following:

- Repossess your car

- Sell your call

- Send Demand Letters To you for the debt

If your creditors send demand letters to you and win the case, they have the right to levy your bank accounts and garnish your wages to repay your debt.

The creditor has the liberty not to notify you of the repossession but may hire a third party such as a towing vehicle or a repossession firm to handle the repossession.

However, some guidelines should be followed during repossession. The repossession agents must not:

- Use physical force against you

- Access locked or fenced areas without your permission

- Damage your property or the car

- Threaten you

Can the Police be Involved in the Repossession of My Car?

Yes, the police can sometimes be involved in the repo. Although repo sessions should be peaceful, there might be tension between you and the repossession agents. Police officers should be informed of the repo beforehand and might be called to the scene if there is a breach of peace.

There are limits to what the police can and can't do on a vehicle repossession scene. These are

- The police may not help the repo agent or facilitate the repossession process

- The police should not command you to hand over the keys or to step aside as your auto is being towed away.

- The police may not threaten to arrest you on repo confrontation grounds

A breach of the peace when attempting to repossess a vehicle can include the following actions by the creditor to repossess the vehicle and here’s what you need to do:

| Situation | What to Do |

| Threatening to send the debtor to prison | A repo agent may claim you're breaking the law by trying to stop the repossession, and even threaten to have you arrested or sent to prison; but as long as you're not hurting anyone, these are empty threats. This is a civil matter, not a criminal one. You won't go to prison for missing your car payments or for trying peacefully to stop the repossession. |

| Breaking into the home of the debtor | If you need to protect your car from repossession, close it up in a garage or put it behind a locked fence. This is only a short-term solution, but it gives you time to call a KC bankruptcy lawyer and stop the repossession from going through. |

| Repossess the collateral despite the consumer's objections | If the borrower becomes aware of the repo man's intrusion and objects to the repo man being on their property, the repo man must leave or they're trespassing. |

| Entering into a closed garage | Protecting borrowers' garages as the law protects the rest of their homes makes sense because homeowners expect that their right of privacy and seclusion extends to all of their homes and unlawful entry into their garage also creates a risk of retaliatory violence. |

| Threatening the use of physical force or violence | If a repo man threatens you physically or wields any sort of weapon when approaching you, report it to the police as soon as possible. |

| Forcing the debtor out of his vehicle | In general, repo agents are not supposed to touch you or use force on you, unless in self-defense. |

What Can I Do If My Car Was Illegally Repossessed?

If all your loan payments are updated, but your lender takes possession of your car, it is considered illegal. Vehicles should only be repossessed if you failed to make payments and made no point of communicating with your lenders.

If your car has been illegally repossessed, you have the authority to send demand letters to your lenders. Before setting out to send demand letters to your lenders, you should be sure that the repossession was illegal.

How Do I Know if the Repossession Was Illegal?

Repossession is considered unlawful if any of the following happen:

- The lenders failed to inform the police of the repo

- The agents caused a breach of peace

- The agents forcefully entered your premises

- The lender did not send you a full notice after taking your car

- The agents damaged your property

- The police officers used their power to aid in the repo

- Your lenders take possession of your car despite having settling the debt as agreed

Any of the above actions represent a violation of your constitutional rights, enabling you to take action against the involved police officers, the repo agents or your lenders.

Actions to Take After an Illegal Repo

To send demand letters to your offenders, you should consult a consumer protection attorney who will help you go through the whole process. You should ensure that you have the following details to strengthen your case:

- Updated loan payment proof

- Date and time of repossession

- Name of the repo agent, company, and the license number of the tow vehicle

- Badge number of involved police officers

- Photo of the affected property

- A copy of the police report on the occurrence

Suing the offenders will help you regain your wrongly possessed vehicle and get compensated for any damage that might have occurred in the process.

Get Back Your Repossessed Car With the Help of DoNotPay

Suing your lenders or filing for bankruptcy is not among the easiest procedures to reclaim repossessed property. If you need help to easily and successfully fight for a wrongful care repossession, DoNotPay has you covered.

DoNotPay can help you file a demand letter for wrongful possession using your state's laws and help you reclaim your vehicle. In the case the repo was valid, you will have to pay off any balance you owe to reclaim your vehicle. If you can't afford the payments, DoNotPay can help you ask for a payment plan or negotiate the balance you owe.

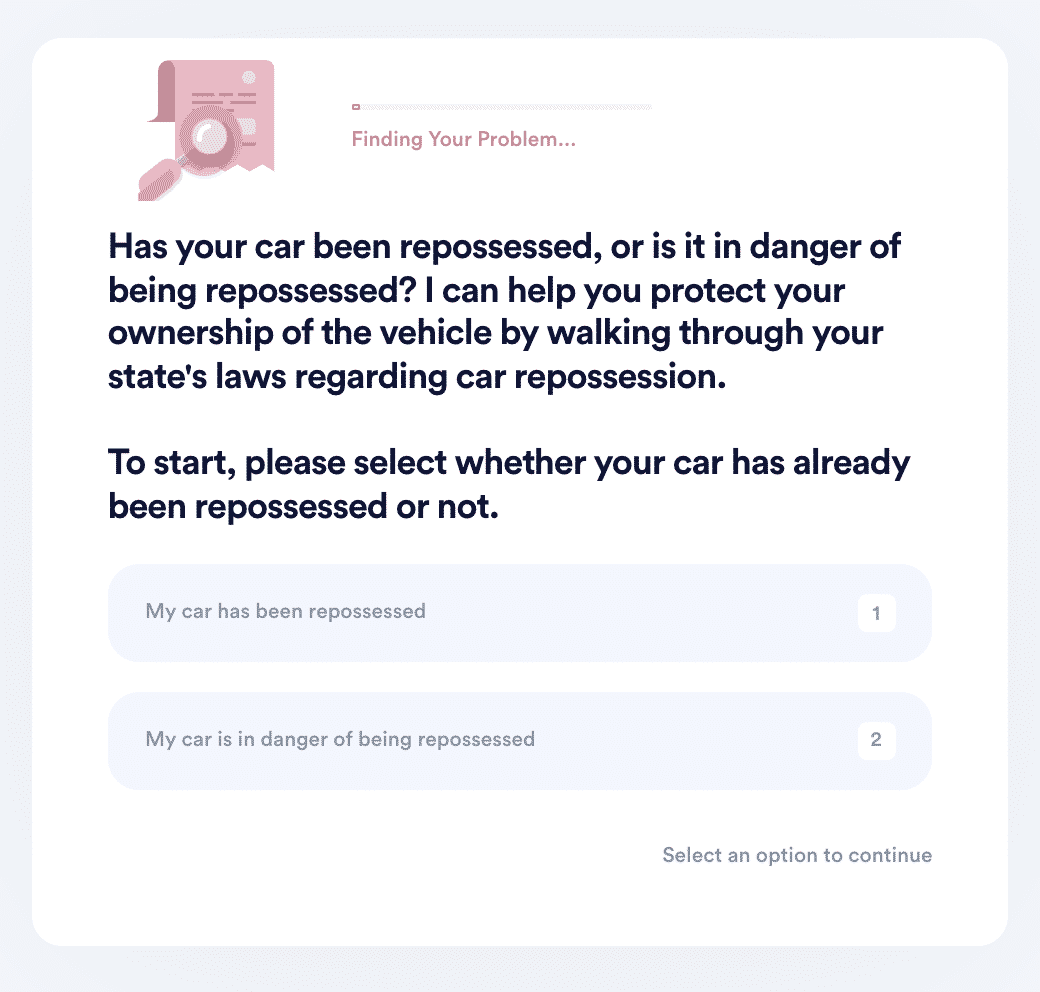

- Search "car repossession" on DoNotPay and select whether your car has been repossessed or is in danger of being repossessed.

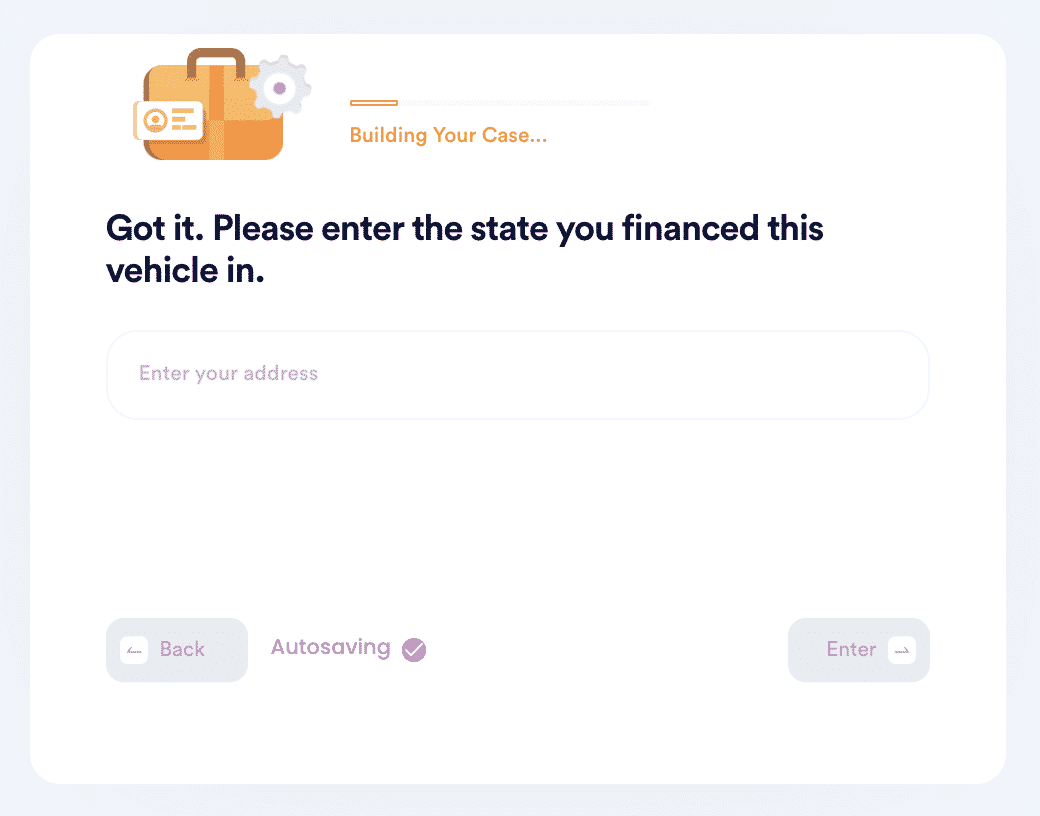

- Enter the state you financed this vehicle in, and let us walk you through your state's repossession laws to see if your car was or is being wrongfully repossessed.

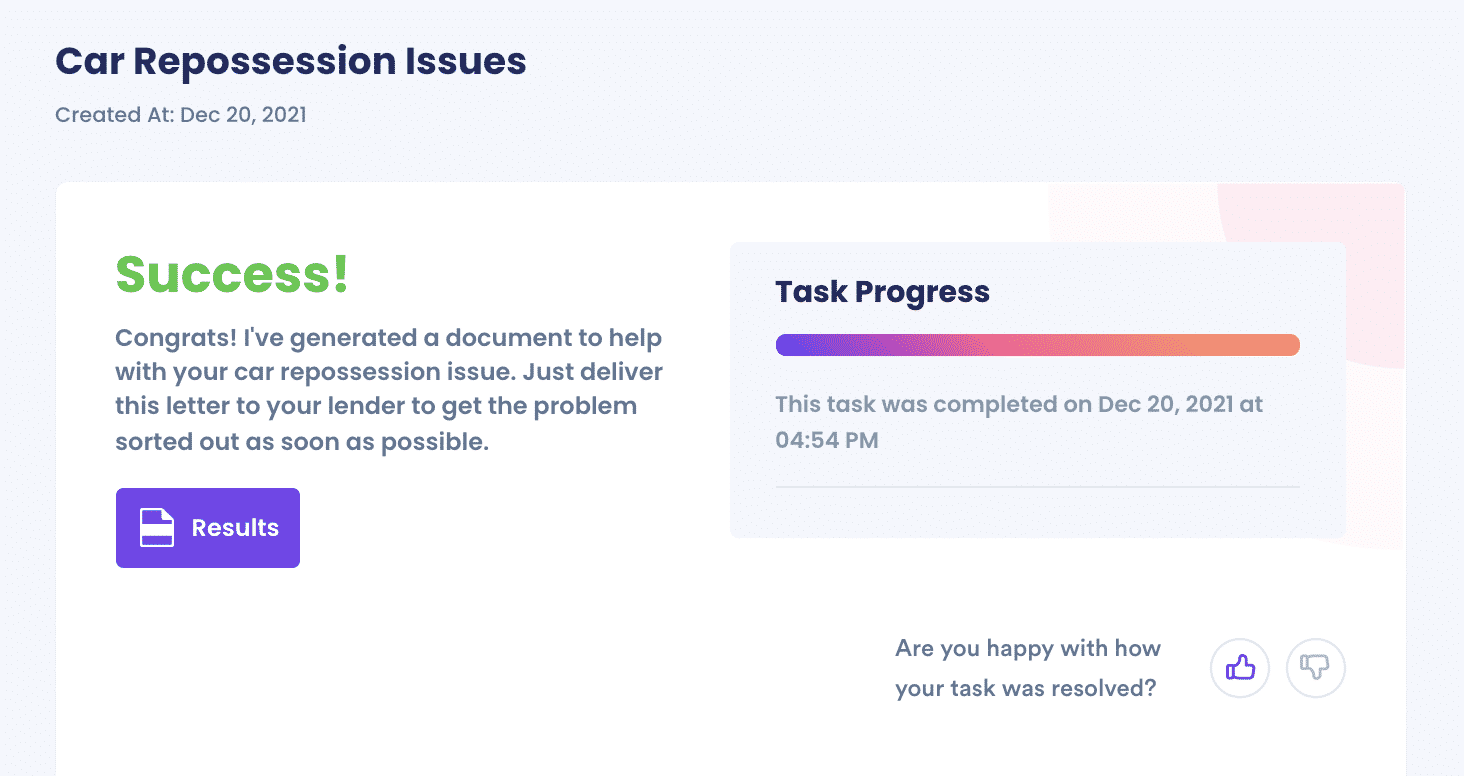

- If we can make a case for wrongful repossession, DoNotPay will file a demand letter on your behalf to the lender to fight against.

And that's it! DoNotPay will make sure your issue gets sent to the right place. We'll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

What Else Can DoNotPay Do for You?

DoNotPay is a reliable platform to fast, easy, and successfully . We provide you with a platform where you can send demand letters to anyone, fight bureaucracy, and perform all your long tiresome processes.

We work with government entities and private companies to provide you with the following services and more, with just a click of a button:

- Discover and apply for scholarships

- Find discounts on products and services

- Automatically cancel your free trials

- Applying for your clean credit report

- Closing your bank account

- And many more

Try it today.

By

By