How to Reclaim Your Car After a Wrongful Repossession?

It's hard to deal with a car repossession, especially since it can happen without notice. These problems always crop up at the worst times. What may complicate things further is a . They are emotionally draining and require you to take time off your schedule to clear it up.

If you want to reclaim your car faster and more conveniently, try DoNotPay. For a wrongful car repossession, DoNotPay can draft a using your state laws to help you reclaim your car.

What Is Wrongful Repossession of a Vehicle?

Wrongful repossession occurs when your lender or a repo agent repossesses your car by mistake through administrative errors, or illegally by not following procedures.

Wrongful repossession examples include:

| If you are not a defaulter | If you have made all payments on time as per the installment contract, then your lender has no right to repossess your car.

Such a situation typically occurs due to administrative errors. |

| Breach of peace | Breach of peace refers to when a car owner objects to the repossession of their car and resorts to a physical confrontation with the repo agent.

If the car has not been lifted onto the tow truck, then the repo crew should not resort to physical force when towing the car as this constitutes a breach of peace and illegal repossession of a vehicle. |

| Breaking into an enclosed area | Your lender or repo agent should not access your closed garage or any other enclosed area to repossess your car. |

| Access to private property | If you have specifically denied the repossession crew access to your property, then the repo agent is not legally allowed to repossess your car. |

| Law enforcement involvement | Repo agents are required to provide repossession notice to the local enforcement for purposes of maintaining peace.

The agents, however, cannot use the presence of law enforcement to threaten arrest, or force you to give away the car keys. The police should also not order you to 'step aside' or to 'hand over' the keys as they are not allowed to enable the repossession. |

| Insufficient prior notice | For a contract with pre-notice requirements, the lender should not repossess the car without providing the borrower with sufficient pre-repossession notice. |

| Non-provision of a reclaim notice | After repossessing the car, the lender is required to provide notice on how you can reclaim your vehicle.

The lender should also inform you on how they intend to dispose of the car if you are unable to reclaim it. |

| Damaging the car and your personal property | A repo agent should not damage personal property or the car during repossession. |

| Non-provision of a deficiency notice | Your lender should provide notice of the auction or sale of the vehicle and the deficiency you are required to pay.

If the car was sold at an unreasonable price, leading to a high deficiency, then this also constitutes wrongful repossession. |

What Can I Do if My Car Is Illegally Repossessed?

Taking the following steps after an illegal repossession should help you resolve the issue:

- Prepare all the car purchase and repossession paperwork - These may include bank statements, all correspondence with your lender, and payment documents. The repossession paperwork may include a statement detailing the events, the repossession company's details, a police report, and detailed evidence of any property or car damage.

- Research your rights - You are required to learn and understand your local laws to help you build a solid case for wrongful repossession.

- Hire a lawyer - A consumer rights attorney will help review your case, provide you with the best options, and give you the next best steps to take for your case.

Can I Send Demand Letters To for Wrongful Repossession?

Yes. You have a right to send demand letters to for wrongful repossession even if you missed payments on the car. You can seek damages if you can prove that your car was repossessed illegally either due to administrative error or procedural illegality. Some of the damages you can send demand letters to for include:

- Statutory damages - which cover the act of wrongful repossession

- Consequential damages - these cover the negative impact the repossession has on your credit score

- Property damages - awarded for property damage that occurs during the repossession

If you prefer to prepare the case yourself, you can use DoNotPay's Complaint Letters product. It provides helpful documents including a court script to assist you to win your wrongful repossession case.

Solve Wrongful Repossession With the Help of DoNotPay

Solving wrongful repossession by yourself can easily become lengthy and frustrating. You need to take time to learn all your local laws so you can investigate whether your consumer rights were violated.

You are also required to gather all your paperwork and any other evidence including the car sale agreement, the repossession company's details, and a police report if you would like to send demand letters to the parties involved. These processes take time and effort and may end up disrupting your life significantly.

With DoNotPay, you get to enjoy fast and automated services at the click of a button.

How DoNotPay can Help With Car Repossessions

DoNotPay can help you file a demand letter for wrongful possession using your state's laws and help you reclaim your vehicle. In the case the repo was valid, you will have to pay off any balances you owe in order to reclaim your vehicle. If you can't afford the payments, DoNotPay can help you ask for a payment plan or negotiate the balance you owe.

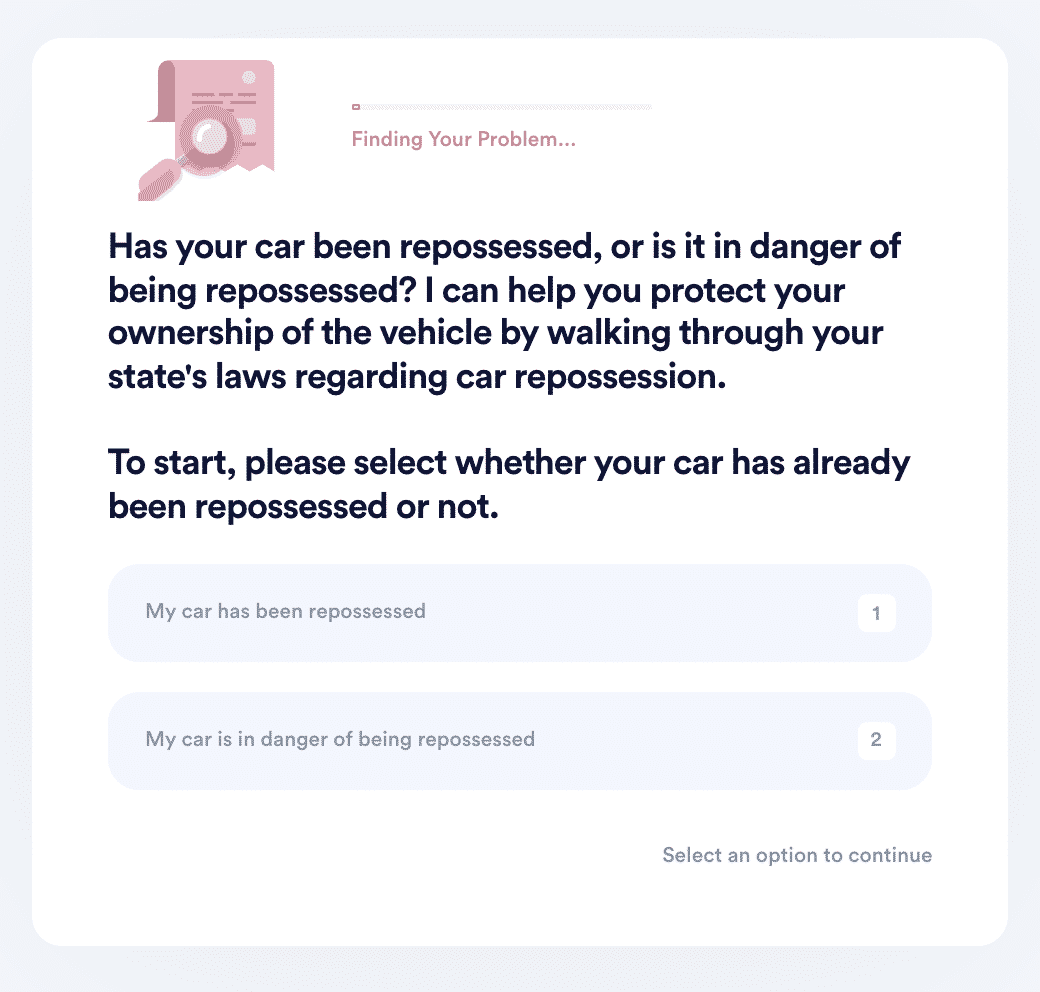

- Search "car repossession" on DoNotPay and select whether your car has been repossessed or is in danger of being repossessed.

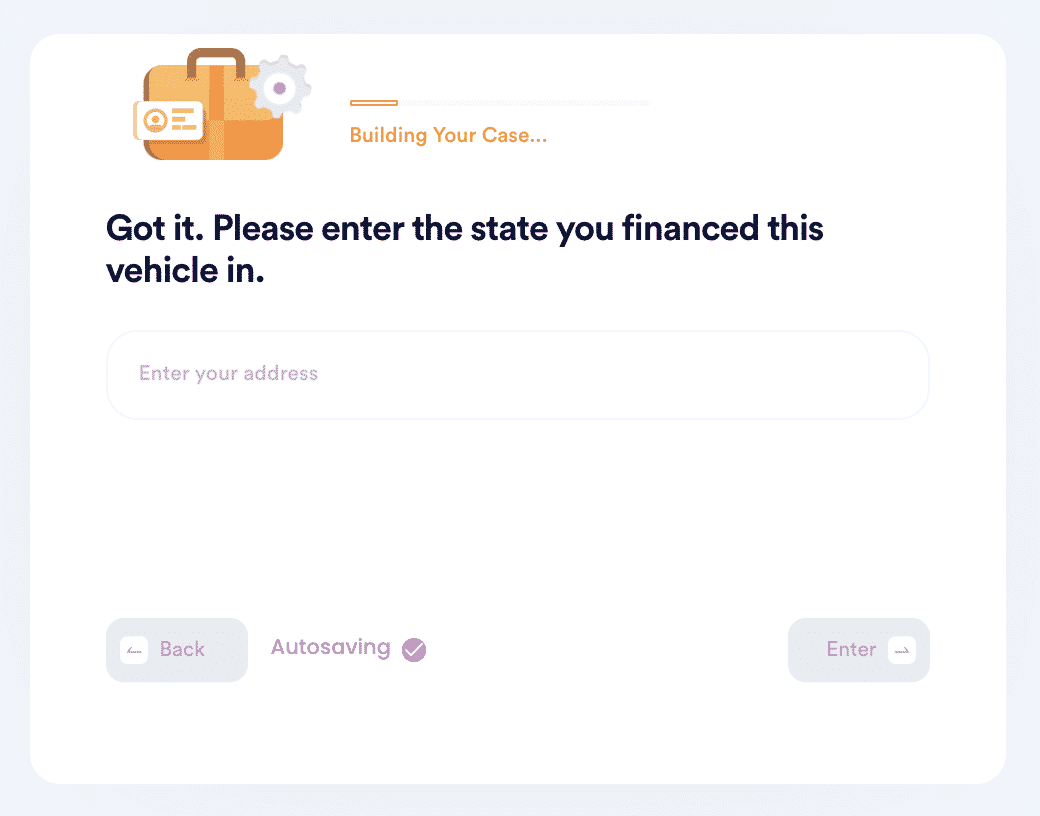

- Enter the state you financed this vehicle in, and let DoNotPay walk you through your state's repossession laws to see if your car was or is being wrongfully repossessed.

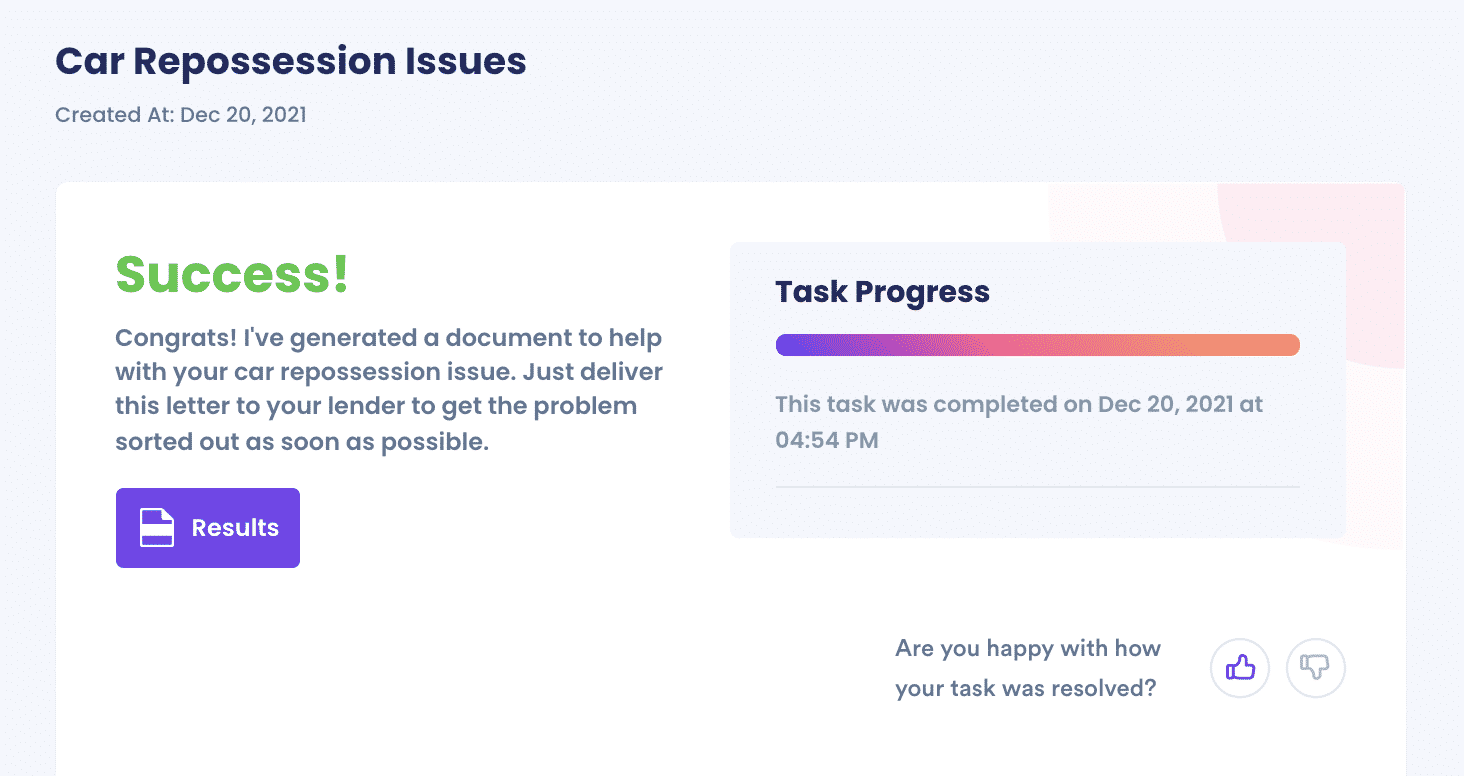

- If DoNotPay can make a case for wrongful repossession, it will file a demand letter on your behalf to the lender to fight against.

And that's it. DoNotPay will make sure your issue gets sent to the right place. We'll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

What Else Can DoNotPay Do?

Helping you solve a wrongful car repossession is only one of the many things we can help you with.

Here are other services you can enjoy on DoNotPay:

- Filing a complaint against any company

- Send Demand Letters To anyone in the Small Claims Court

- Dealing with parking tickets

- Airline flight compensation hacks

- Finding lost items

- Jumping the phone queue for any company

- Finding a child travel consent

Dealing with a wrongful repossession is frustrating, especially if you try to solve it yourself. Let DoNotPay help you find the right steps for your case so you can get your car back.

By

By