Repo Company Stole My Property: 3 Steps to Take Now

Car repossession is heartbreaking as it entails the loss of ownership of a vehicle after defaulting on loan payments. The process is a double tragedy for you if the car repo agents inside your car during or after a car repossession. Car repo agents should follow the stipulated state guidelines while recovering a car on behalf of the creditor.

Car repo agents should allow you to take all your items before recovering the car for auction. Essentially, the repo agent is responsible for all items in the vehicle after repossession. They are responsible for any missing items in the car, especially if they were present during the repossession. Some rogue car or lose your property, making it hard for you to retrieve your items, especially if they were high-value items. You can make a claim against the car repo agents and creditors if they refuse to return or compensate for the .

DoNotPay saves you the trouble involved in reclaiming stolen property after a wrongful car repossession. DoNotPay helps you draft a compelling demand letter for wrongful repossession as per the state laws to help you recover your stolen property.

DoNotPay can also help you recover your vehicle by negotiating practical payment terms with your creditors. All you need to do is sign up to DoNotPay and follow the simple steps under the "Car Repossession" product.

What Constitutes Wrongful Car Repossession

Knowing what constitutes wrongful car repossession helps you argue your case while reclaiming your vehicle or property. A breach of the peace when attempting to repossess a vehicle can include the following actions by the creditor to repossess the vehicle and here’s what you need to do:

| Situation | What to Do |

| Threatening to send the debtor to prison | A repo agent may claim you're breaking the law by trying to stop the repossession, and even threaten to have you arrested or sent to prison; but as long as you're not hurting anyone, these are empty threats. This is a civil matter, not a criminal one. You won't go to prison for missing your car payments or for trying peacefully to stop the repossession. |

| Breaking into the home of the debtor | If you need to protect your car from repossession, close it up in a garage or put it behind a locked fence. This is only a short-term solution, but it gives you time to call a KC bankruptcy lawyer and stop the repossession from going through. |

| Repossess the collateral despite the consumer's objections | If the borrower becomes aware of the repo man's intrusion and objects to the repo man being on their property, the repo man must leave or they're trespassing. |

| Entering into a closed garage | Protecting borrowers' garage as the law protects the rest of their home makes sense because homeowners expect that their right of privacy and seclusion extends to all of their homes and unlawful entry into their garage also creates a risk of retaliatory violence. |

| Threatening the use of physical force or violence | If a repo man threatens you physically or wields any sort of weapon when approaching you, report it to the police as soon as possible. |

| Forcing the debtor out of his vehicle | In general, repo agents are not supposed to touch you or use force on you, unless in self-defense. |

During the repossession, take written notes of the events that occur. Be sure to include:

- Date and time of day

- Name of repossession company, agent name, and license plate of tow truck

- Police officer name, department, and badge number

- Police report and number

- Witness names and contact information

- Photographs of damage to the vehicle or property

- A statement detailing events, or take a video on your cell phone

Steps to Take After a Repo Company Steals Your Property After a Car Repossession

It is essential that you pick up all your belongings before a car repo goes with your car, especially your jewelry, clothing, tools, and cellphones. You should act fast in case you encounter wrongful car repossession. The first step you should take is to contact your creditors to inform them of any property in the car, especially if the car repo agents deny you the chance to pick up your property. You can also contact the relevant authorities to report illegal car repossession.

Most states give you the right to inspection before auctioning your car. The laws state that a creditor or repo agent should send you a notice and inventory of all the items found in your car within 48 hours of getting the car. The right of inspection allows you to pick up all your belongings.

If you are denied the right to inspection after car repossession, you can send demand letters to your creditor and repo agent for wrongful car repossession. In addition, suing the creditors and repo agents will help you recover any stolen property during a car repossession.

The process can be time-consuming and challenging, especially if you lack awareness of undertaking the process. High chances are you might lose your property and car to rogue car repo agencies and creditors. Involving experienced third parties such as DoNotPay will help you limit losses and recover your car.

How DoNotPay Helps in Reclaiming Stolen Property After Car Repossession

DoNotPay can help during a wrongful car repossession. DoNotPay's team drafts a compelling demand letter per the state's laws. It sends it to your creditor or car repo agent, demanding them take responsibility for the lost or stolen items during the car repossession.

DoNotPay can also help you file a complaint in a situation where a breach of the peace occurred during the car repossession. DoNotPay guides you on how to recover your car after repossession to avoid auction by negotiating practical payment terms with your creditor.

Follow the simple steps on the Car Repossession product on DoNotPay to recover your lost or stolen property. The steps are as follows:

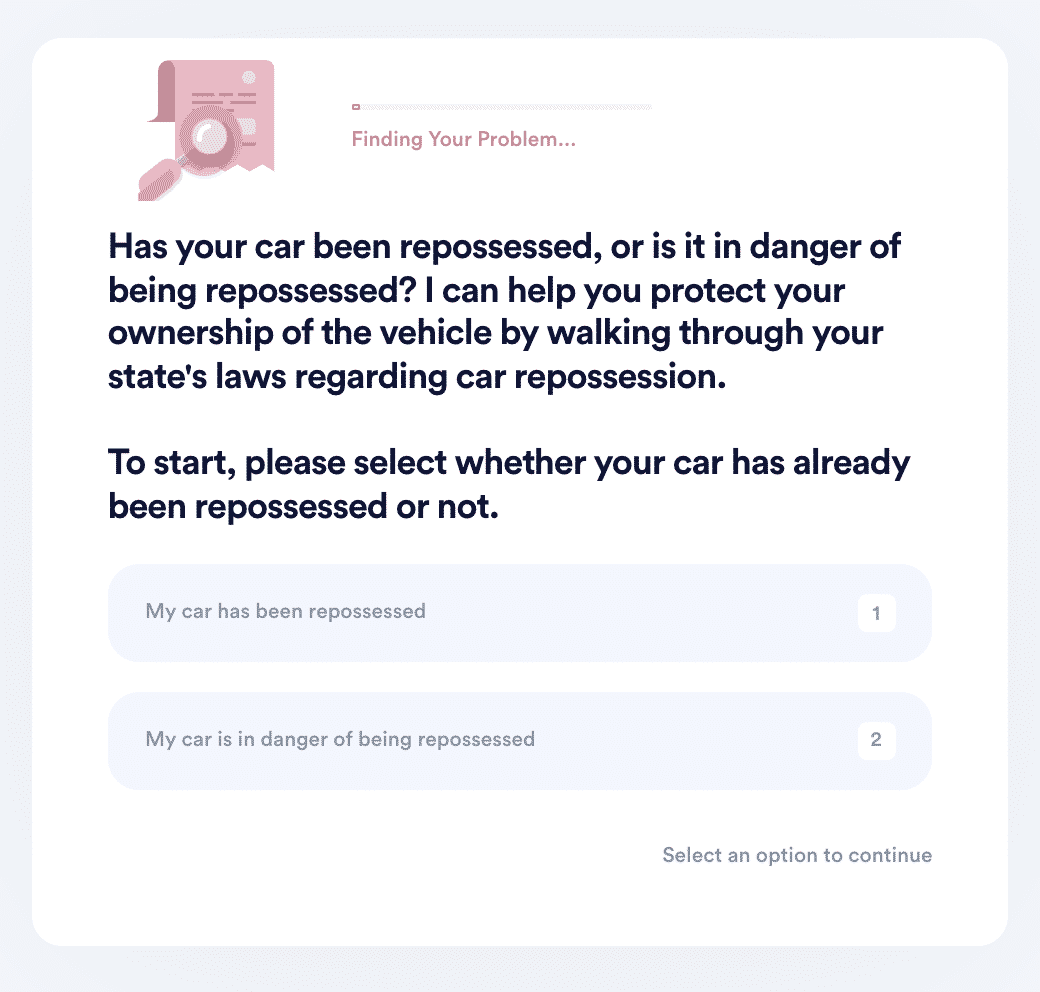

- Search "car repossession" on DoNotPay and select whether your car has been repossessed or is in danger of being repossessed.

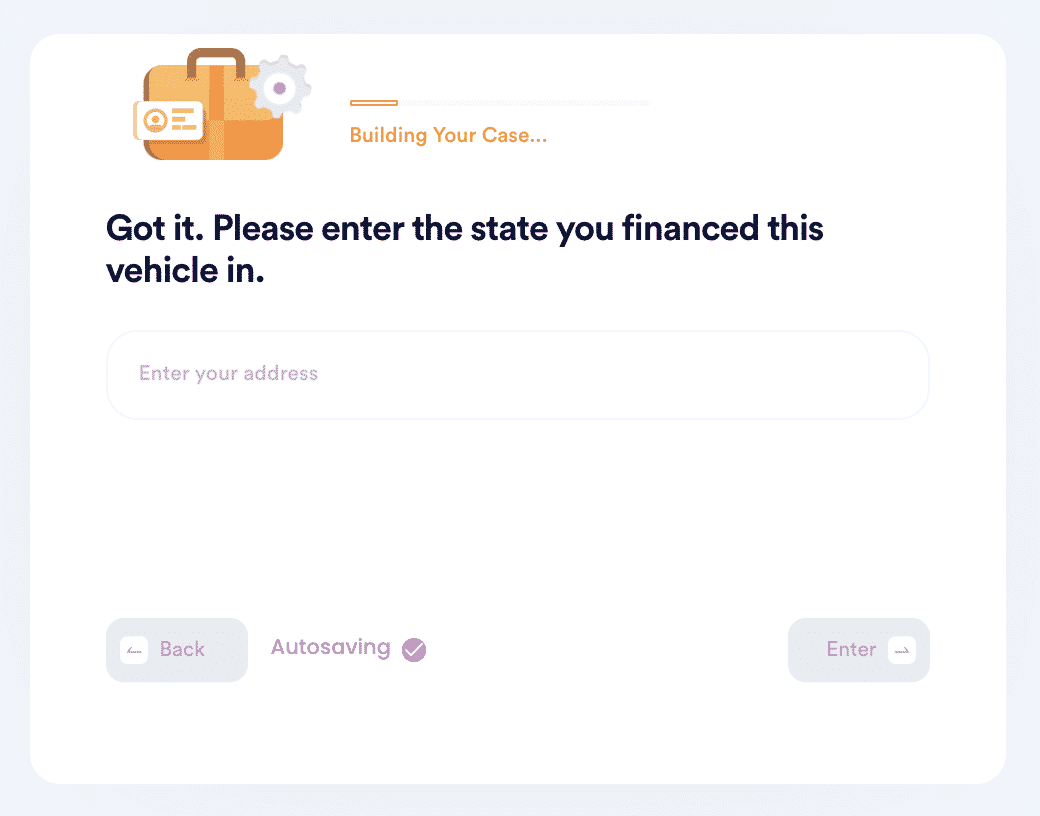

- Enter the state you financed this vehicle in, and let us walk you through your state's repossession laws to see if your car was or is being wrongfully repossessed.

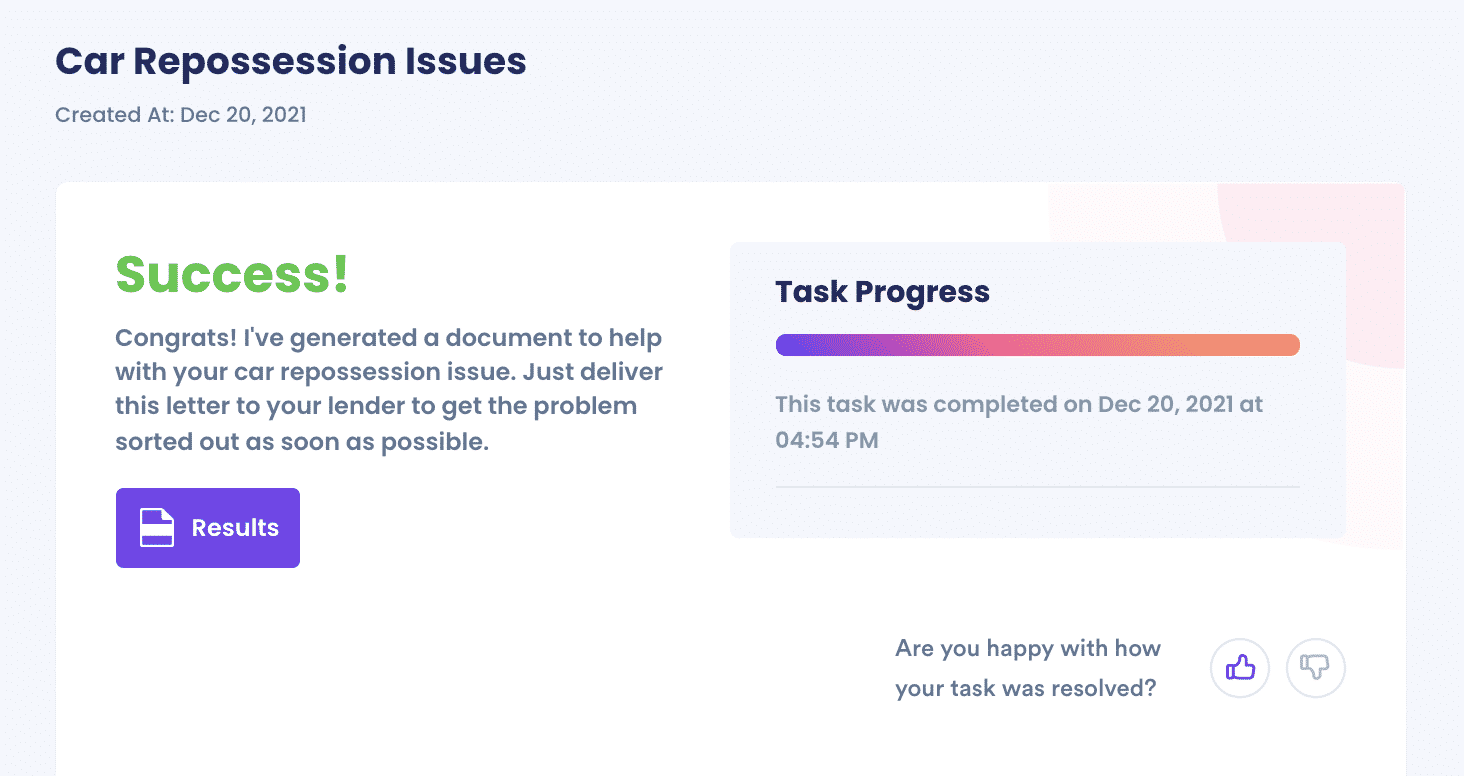

- If we can make a case for wrongful repossession, DoNotPay will file a demand letter on your behalf to the lender to fight against.

And that's it! DoNotPay will make sure your issue is sent to the right place. We will upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

Why Use DoNotPay

Here are the main reasons you should use DoNoPpay over other methods while reclaiming your stolen property after wrongful car repossession.

- It is fast. The process only entails responding to simple prompts.

- It is dependable. DoNotPay's team is highly skilled and experienced at addressing car repossession issues.

- It is convenient. You can access DoNotPay services anywhere in the comfort of your home, as it is online-based.

Other Social and services DoNotPay Offers

DoNotPay can not only help you reclaim your stolen property after a car repossession, but the product is also designed to help you win cases in many industries and sectors.

Let's look at additional things DoNotPay can help you accomplish:

- Filing SEC complaints

- Finding lost items

- Car lease negotiations

- Canceling timeshares

- Appealing banned accounts

- And many more

Get to DoNotPay today and use it to recover your stolen property under the car repossession product.

By

By