What Constitutes a Wrongful Repossession In California?

Hundreds of car repossessions occur each day in California. On the positive, there are laws to check the excesses of repossession agencies. But on many occasions, these companies ignore these laws when repossessing a car, resulting in a breach of peace.

Handling wrongful repossession can be a stressful time, considering how reliable your vehicle is. And you may not have enough funds to rent or buy a new car. If you're facing this situation, you still have rights and a beam of hope. DoNotPay partners with certified attorneys to make sure you get help.

When Is There Car Repossession in California?

In California, a creditor can repossess a car without a court order if there is a default. A default is when:

- You fail to pay for the loan on the due date.

- There is no suitable insurance on the car.

What Are Car Repossession Laws in California

The Bureau of Security and Investigative Services (BSIS) sets guidelines for repossession in California. They issue a license to Repossession Agents and Private Investigators. Besides that, BSIS bears the burden of protecting consumers from exploitations from repossession operators.

If you feel a company broke repossession laws when discharging its duties, send a complaint to the BSIS. You can also check the BSIS to verify the license of a repossession outfit.

When Is There Wrongful Repossession in California?

Under BSIS, agencies must complete the repossession without creating a scene.

Use this guide to determine if a repossession was wrongful in CA.

| A “repo” can be unlawful if the agents: |

|

Sometimes the lender may take possession of your car before the agreed payment date. In that case, there is wrongful repossession. You should engage a licensed lawyer to review the conditions for repossession to ensure there was a default.

Wrongful repossession is a crime in California, and you can claim compensation. DoNotPay can help you file a complaint letter against these agencies and reclaim your vehicle. Sometimes the company representatives may not respond to your complaints, frustrating your efforts. In that case, you can send demand letters to them with the DoNotPay Complaint Letters product.

Before then, let's see how you can redeem your car from repossession companies.

How Can You Get Your Car Back After Repossession?

You can redeem your car in California by paying all debts, including the repossession costs. After getting your vehicle back, you can keep delivering on the contract as before. Sometimes the lender may deny you this right before the due date expires, and if so, you can make a claim.

Here are the things to consider when planning to get back your car on your own:

- The lender will notify you of your rights to redeem your vehicle.

- They must remind you of the conditions to fulfill if you want your car back.

- The notice should include the time it takes before they auction your vehicle.

- You cannot file bankruptcy to prevent car repossession in California.

We recommend you contact a licensed attorney to help you make the right decisions. DoNotPay boasts certified lawyers to help you review and determine a wrongful repossession.

What Happens if You Fail To Pay Repossession in California?

Are you wondering about the consequences of failing to pay off your loan after repossession? Let's find out.

- California repossession laws permit the creditor to auction your car when the redemption period expires.

- The lender will send a notification that states what your vehicle was sold for and the balance you're to pay.

- If the car's auction price is lower than your debt, the lender will collect the balance from you.

How Can DoNotPay Help You Solve Car Repossession Problems in California?

If the agencies repossessed your car, there is still hope. Under California law, there are options to help you manage debt and recover your vehicle. The car recovery process can be less stressful with DoNotPay car repossession attorneys.

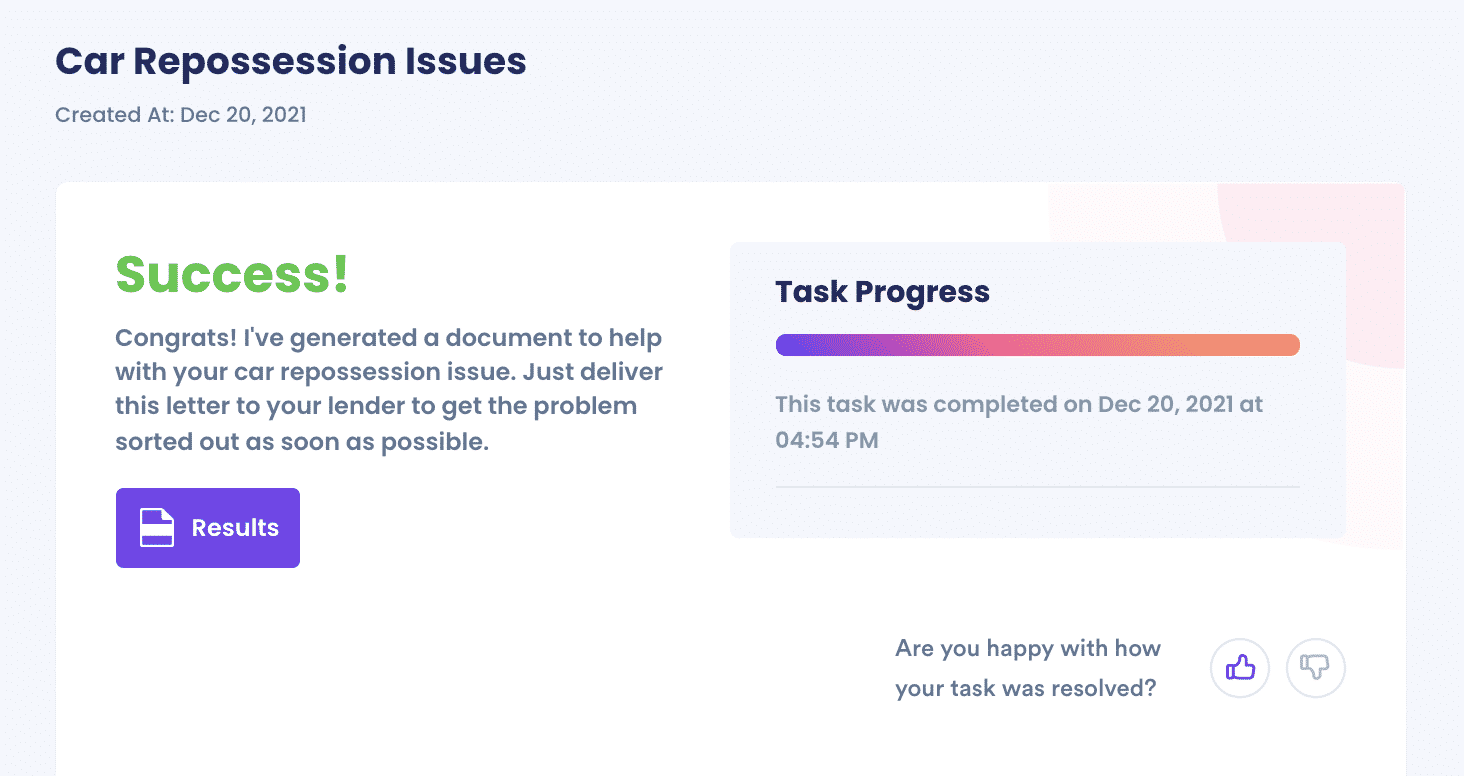

DoNotPay can help you file a demand letter for wrongful possession using your California laws and help you reclaim your vehicle. If the repo is valid, you will have to pay off any balances you owe to recover your car. If you can't afford the payments, DoNotPay can help you ask for a payment plan or negotiate the balance you owe.

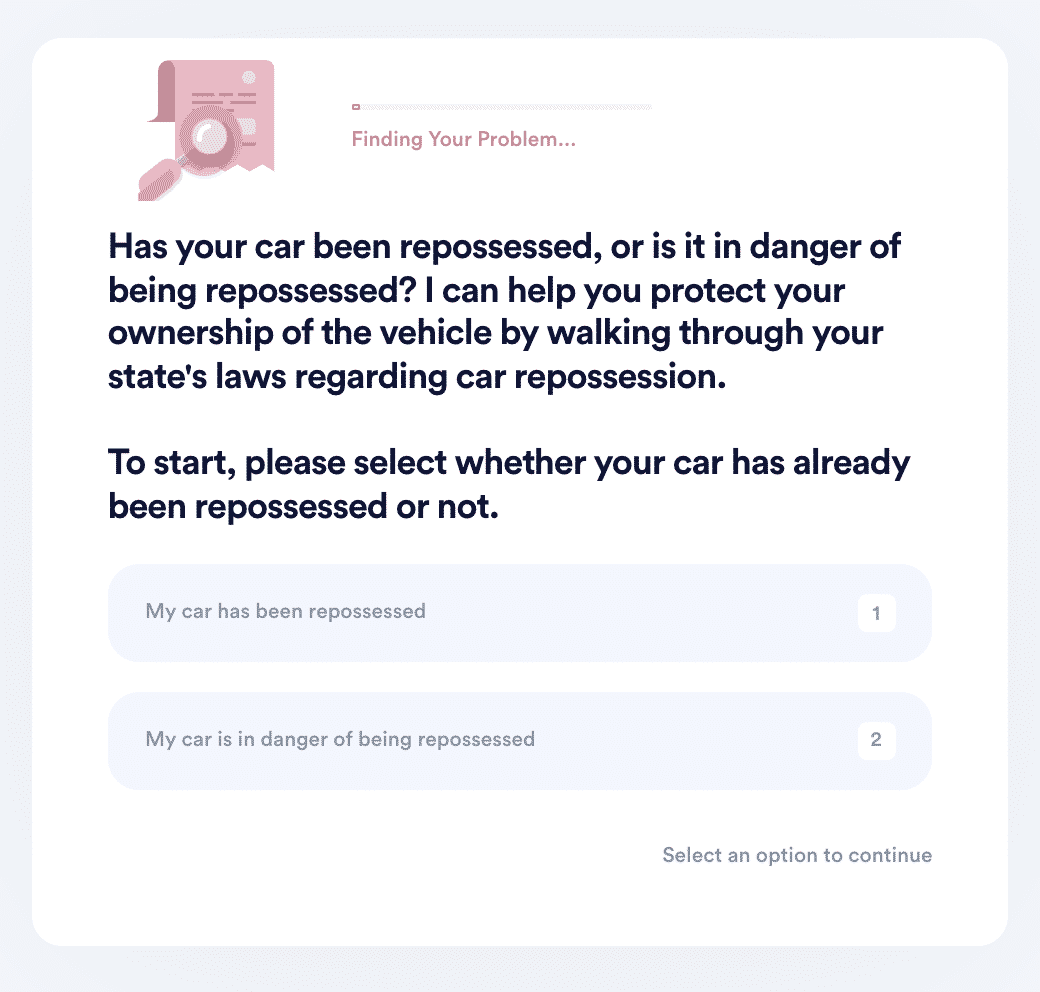

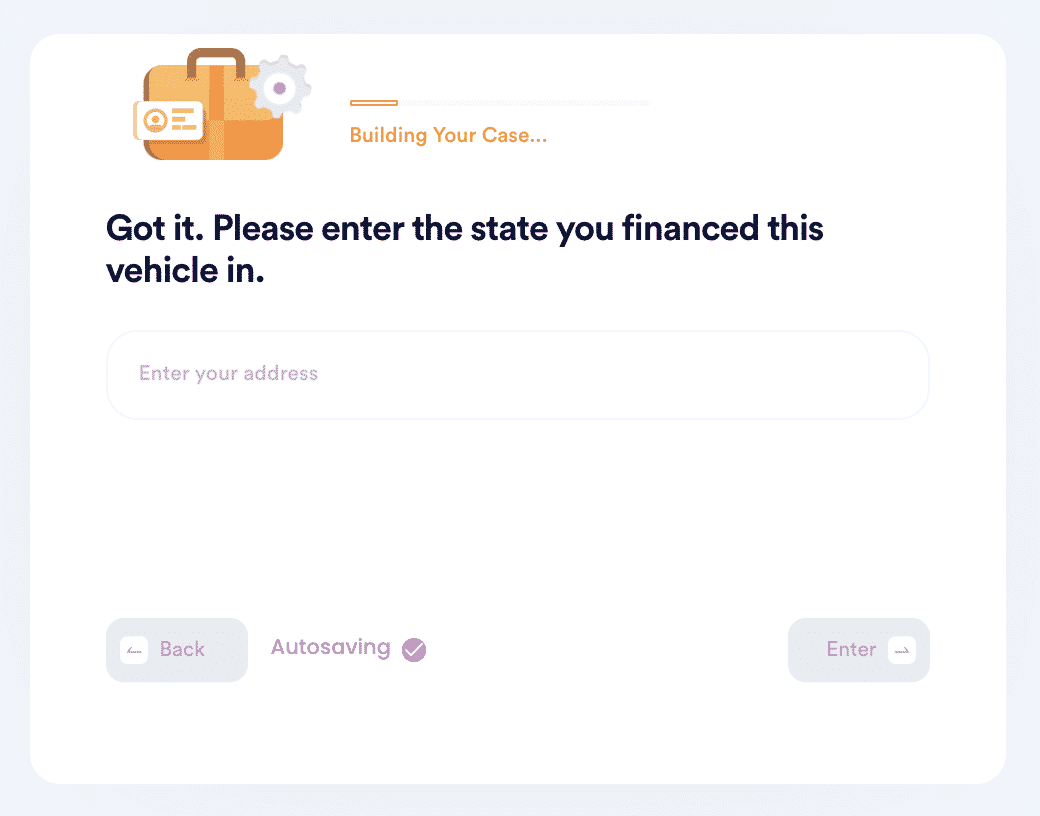

- Search "car repossession" on DoNotPay and select whether your car has been repossessed or is in danger of being repossessed.

- Enter the state you financed this vehicle in, and let DoNotPay walk you through your state's repossession laws to see if your car was or is being wrongfully repossessed.

- If DoNotPay can make a case for wrongful repossession, DoNotPay will file a demand letter on your behalf to the lender to fight against.

What Else Can DoNotPay Do for You?

Take advantage of DoNotPay experience, passion, and skills whenever you need help with:

- Small claims court

- Customer service

- Airline flight compensation

- Find lost items

As always, feel free to contact DoNotPay to help you with

By

By