W-2 Sent to the Wrong Address in Tax Season? Get Your Form and Avoid Identity Theft With DoNotPay

They say two things are certain in life-death, and taxes. The star of tax season every year is your W-2. Your employer reports your earnings to the IRS so that you pay no less and no more than your share of taxes. Without that form, it's difficult at best to get all the information you need to file your taxes. Unfortunately, there is a small chance your W-2 will get sent to the wrong place. If your and you are wary of identity theft, DoNotPay can help you deal with the fallout.

What Someone Else Could Do With Your W-2

The most common use for your W-2 is to file your taxes with the IRS, but your W-2 is also proof of your earnings history, which can be used for other financial purposes like applying for a mortgage. Since your W-2 has your social security number and all your wage information, someone can use it to file for work-related benefits.

|

Tax Theft |

Your W-2 can be used to file taxes on your behalf. While this may sound like a good thing, this means they can get your tax refund if you are entitled to one. If you are told that your return is a duplicate filing, you need to file a report with the IRS. |

|

Unemployment Theft |

With your social security number, someone could file for unemployment benefits in your name. You will have to report this to your state's labor department. |

Spotting Signs of Identity Theft

With the birthdate and social security number on your W-2, identity thieves can do a lot of damage to your finances and credit. You may notice that:

- New loans have been taken out

- Medical claims start being denied

- Utility accounts have been opened

- Your credit card account balances don't match transactions you remember making

Whether you've noticed these signs or are just on the lookout, there are some actions you can take to get ahead of thieves.

- Set up alerts on your accounts for any suspicious activity

- Place a fraud alert - If you place an alert with one of the three major credit bureaus, the information will be relayed to the remaining two. It may be prudent to place an extended fraud alert or a credit freeze on your report as well. The extended alert will last for seven years instead of the standard one-year period.

- Check your credit report for new accounts.

Reporting Identity Theft to the FTC

There are two ways to report identity theft to the FTC:

- Online at identitytheft.gov

- Over the phone at 1-877-438-4338

If you report online, you will get an identity theft report that you can then use to file a report with your local police. You can also get a personalized recovery plan so that you have a concrete checklist of actions you can take to set everything right.

Reporting Identity Theft to the Police

In large identity theft cases like data breaches, the thief's identity is likely unknown. You may still be entitled to compensation if your information was acquired because of lax security, but filing a police report may not gain you anything. In the case of a wrongly sent W-2, if you notice any strange activity in your finances or on your credit report, reporting to the police may make sense because you have a sense of where the fraudulent activity is coming from.

To file a police report, you will want to bring

- A government-issued photo ID

- Proof of your address, such as a mortgage statement or utility bill

- Your FTC Identity Theft Report

- Proof of theft, such as fraudulent transactions or collection notices

If the police don't have the resources to handle your report, they may direct you to your state attorney general.

Fighting Identity Theft With DoNotPay

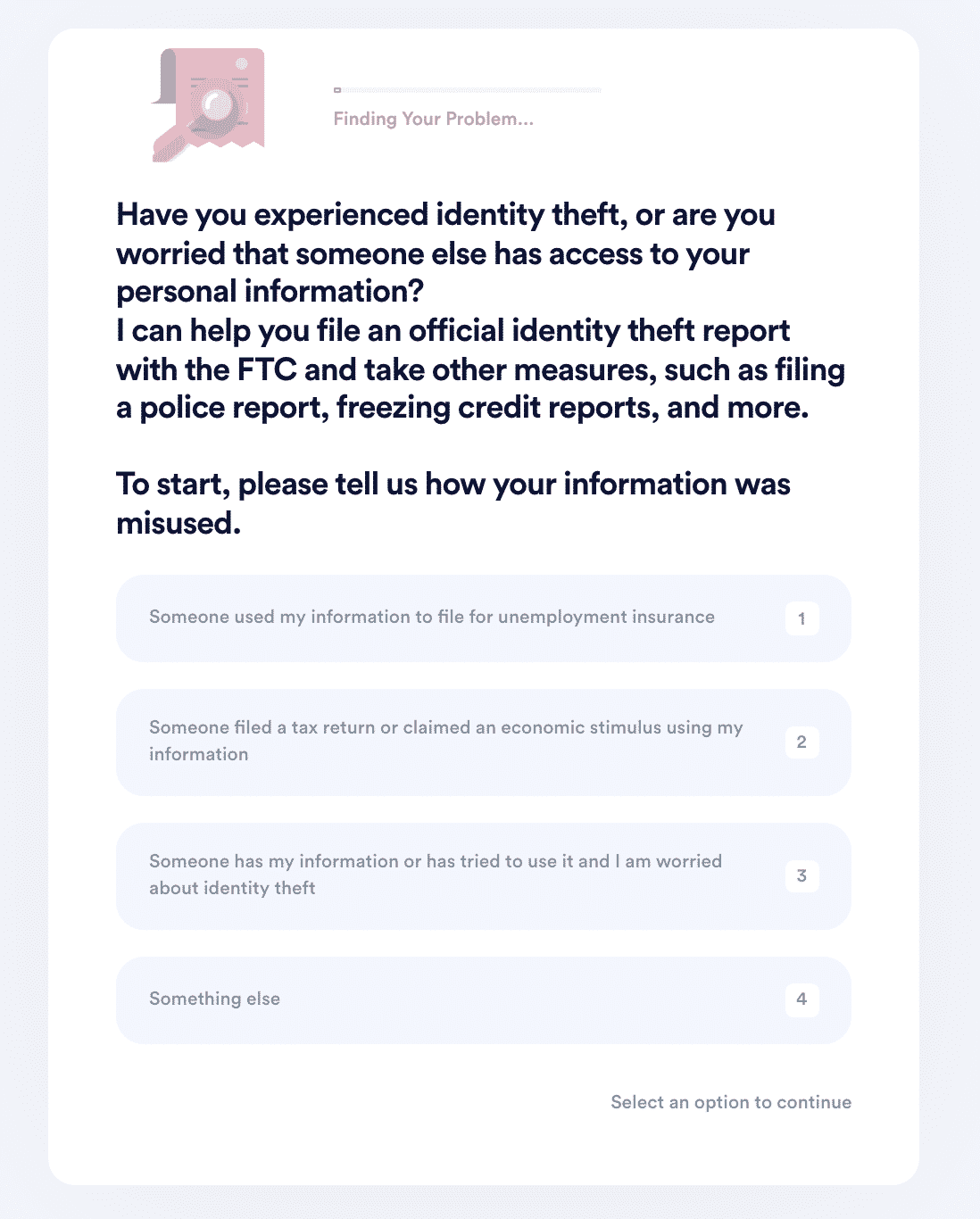

If your and you want to minimize any damage to your finances and credit, DoNotPay can help you get started in just three steps:

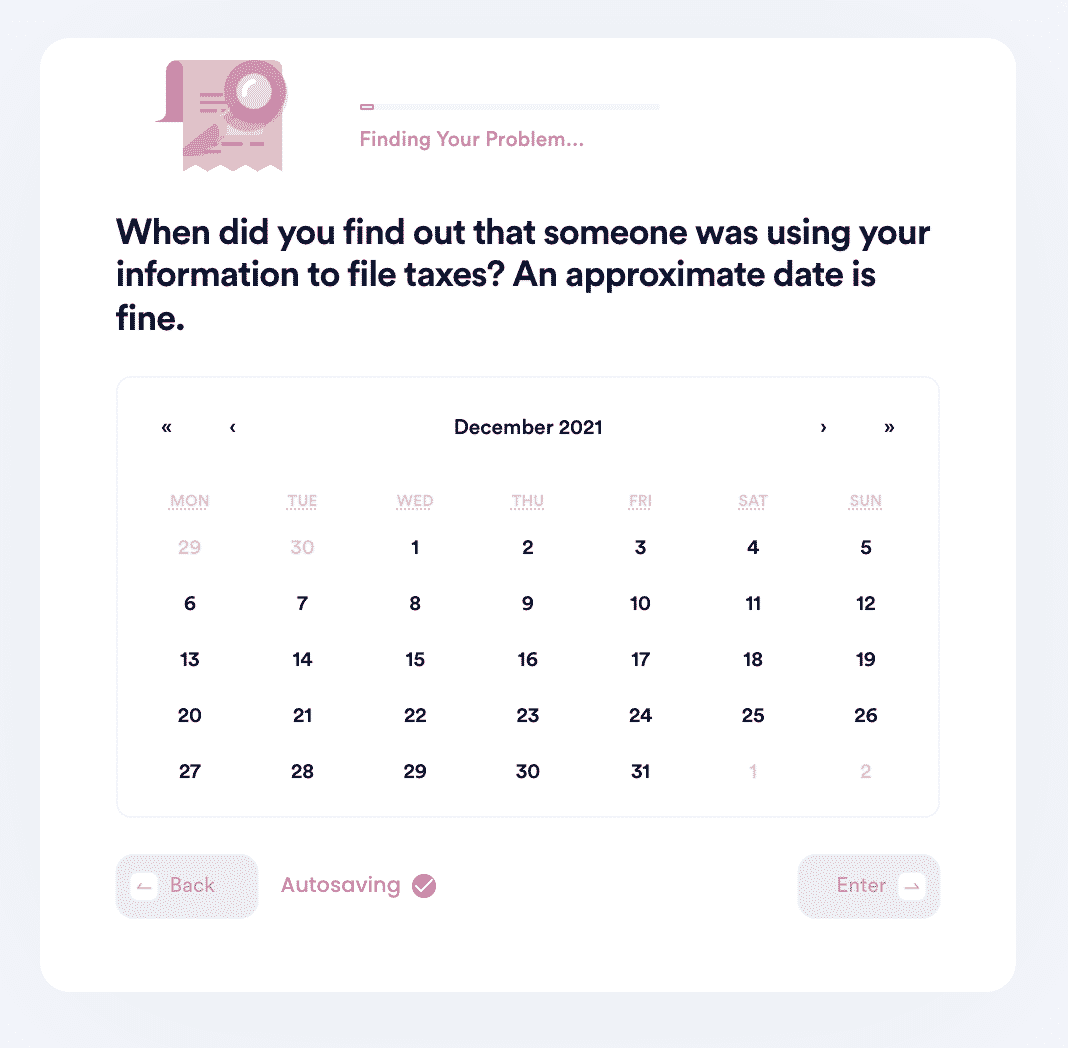

- Search "identity theft" on DoNotPay and select the type of incident you would like to report.

- Tell us more about the incident that occurred, including the location, date, time, financial loss, and any suspect information you may have.

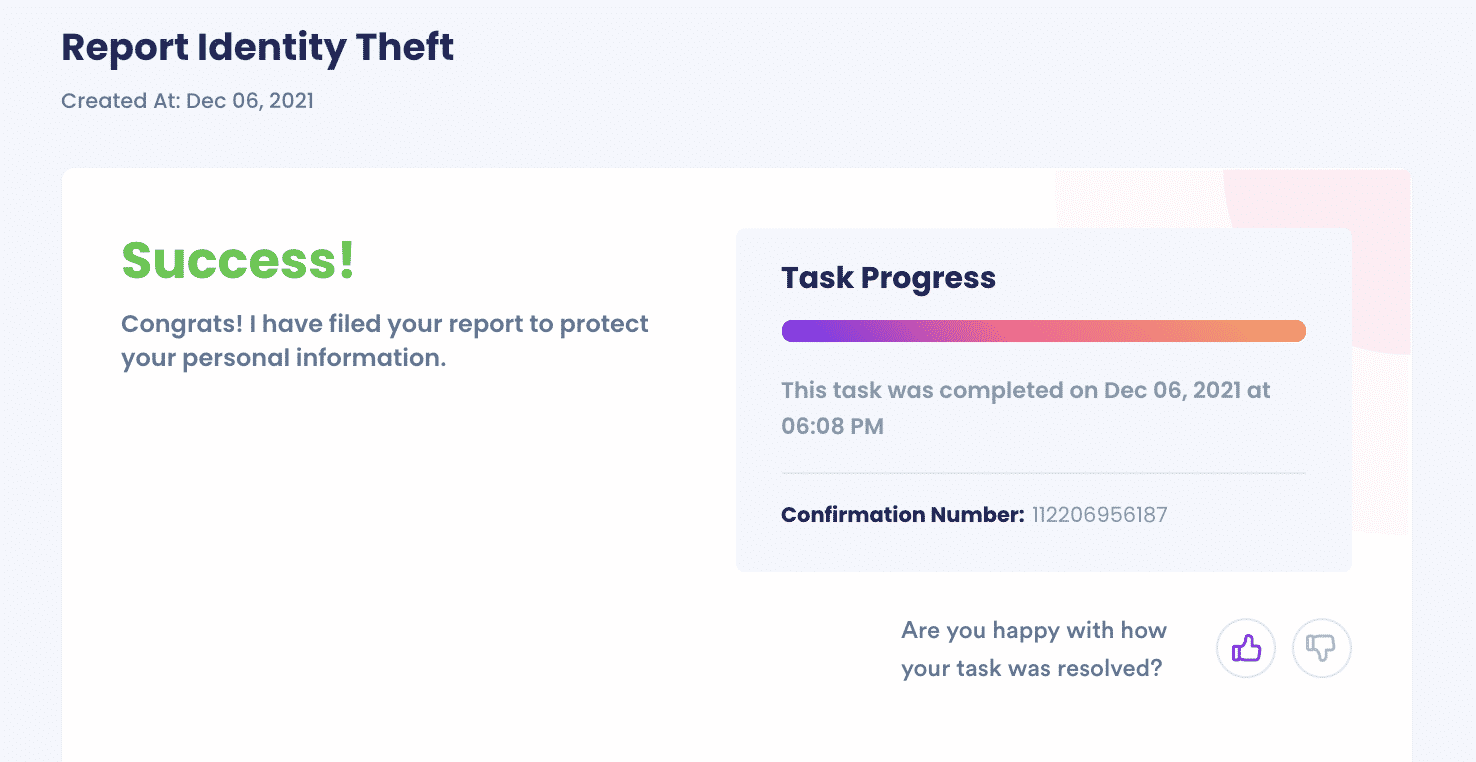

- We'll identify whether you should file an FTC report, contact the IRS, freeze your credit report, contact state agencies, or file a police report. Once we guide you through the best options, we'll automatically submit the reports on your behalf!

And that's it. DoNotPay will make sure your issue gets sent to the right place. We'll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

Keep More Time for Your Priorities With DoNotPay

You have enough on your plate without things like identity theft causing your plans to go wrong. Let DoNotPay handle some of those tasks for you. We can help you with:

|

Suing someone in small claims court | |

|

Filing insurance claims |

And more. Try DoNotPay today so you can start breathing easier.