Stopping a Car Repossession in 3 Easy Steps

Millions of cars are repossessed in the US every year. Missing a car loan payment is risky. An auto lender has the right to repossess your car if you miss a payment without giving you any notice. DoNotPay can help you .

You can always try to stop the vehicle repossession by yourself, too. Stopping the repossession on your own can be quite frustrating and time-consuming.

DoNotPay is the world’s first AI Consumer Champion. It makes the process faster and easier.

How Do You Get a Car Back After Repossession?

You can get your vehicle back after repossession if you:

- Pay the loan and all the repossession costs such as towing, storage, etc. in full.

- Request the lender for a loan reinstatement by clearing the balance you owe and other costs.

- Ask the lender to refinance your loan and negotiate the terms of payment afresh.

- File for bankruptcy via Chapter 7 or 13.

The repossession is like a dark cloud hanging over you and won't go away in a hurry. The repo hurts your credit score and appears in your credit report for the next seven years.

If you agree with your lender, your loan repayments will reflect in your credit report, but not if you re-acquire the vehicle when the lender puts it up for auction.

What Is Wrongful Repossession of a Vehicle?

Let’s talk about vehicle repo loopholes. The repo agents are not always right, and sometimes you may encounter wrongful repossession. A repossession process is often uncomfortable and tense, but it shouldn’t feel dangerous.

The lender has a right to repossess, but the repo agent must carry out the repo in a lawful way. If the repossession agent uses force or violence, you can send demand letters to the lender. Wrongful repossession includes:

- Threatening

- Using physical force

- Accessing fenced-in or locked premises without permission

- Damage to your vehicle or property

What Happens if You Fail To Pay Deficiency?

When a lender repossesses your car for a loan default, they may auction the car to recover the remaining balance and repossession fees.

If the amount recovered from the auto sale does not cover these expenses, the balance is a deficiency, which you must pay. The lender has a right to take you to court to compel you to pay.

How to Succeed at Stopping a Car Repossession

You can stop a car repossession by:

| Filing For Bankruptcy | You get a stay restricting the auto lender from repossessing the vehicle when you file for bankruptcy under Chapter 7 or 13. |

| Loan Refinance | Request a loan refinance from the auto lender. Negotiate your payment plans to ones you can easily afford. |

| Pay Your Loan | Paying your loan installments on time ensures the lender never initiates an auto repossession. |

These methods are time-consuming and not 100% guaranteed to work. Dealing with lenders is a tough nut to crack, considering the many repossessions they deal with daily.

Stopping a Car Repossession With DoNotpay

These methods can frustrate you. The lender may be unwilling to renegotiate. They become adamant about selling your car to recover costs. DoNotPay can help you draft a letter and send it to your lender to refinance or reinstate the loan.

How DoNotPay helps:

Wrongful repos are illegal. If a repo agent wrongfully repossesses your vehicle, DoNotPay helps you draft and send a demand letter to reclaim your car using your resident state laws.

If the lender and repo agent acted within their rights to repossess your car, you must pay the balance to reclaim it. If you are struggling financially and unable to make the payments, DoNotPay will assist you in asking for a better payment plan or negotiating your owed balance.

How DoNotPay can help with car repossessions:

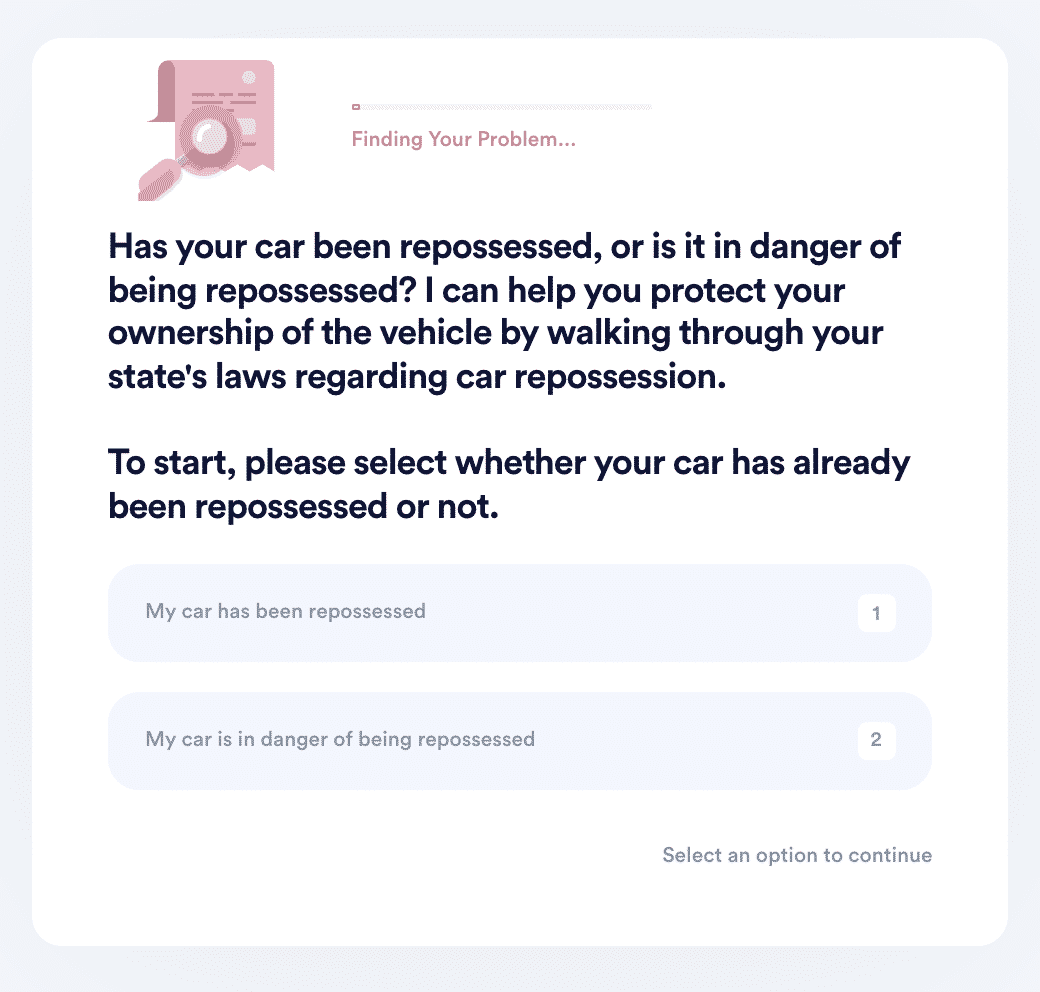

- Search "car repossession" on DoNotPay and select whether your car has been repossessed or is in danger of being repossessed.

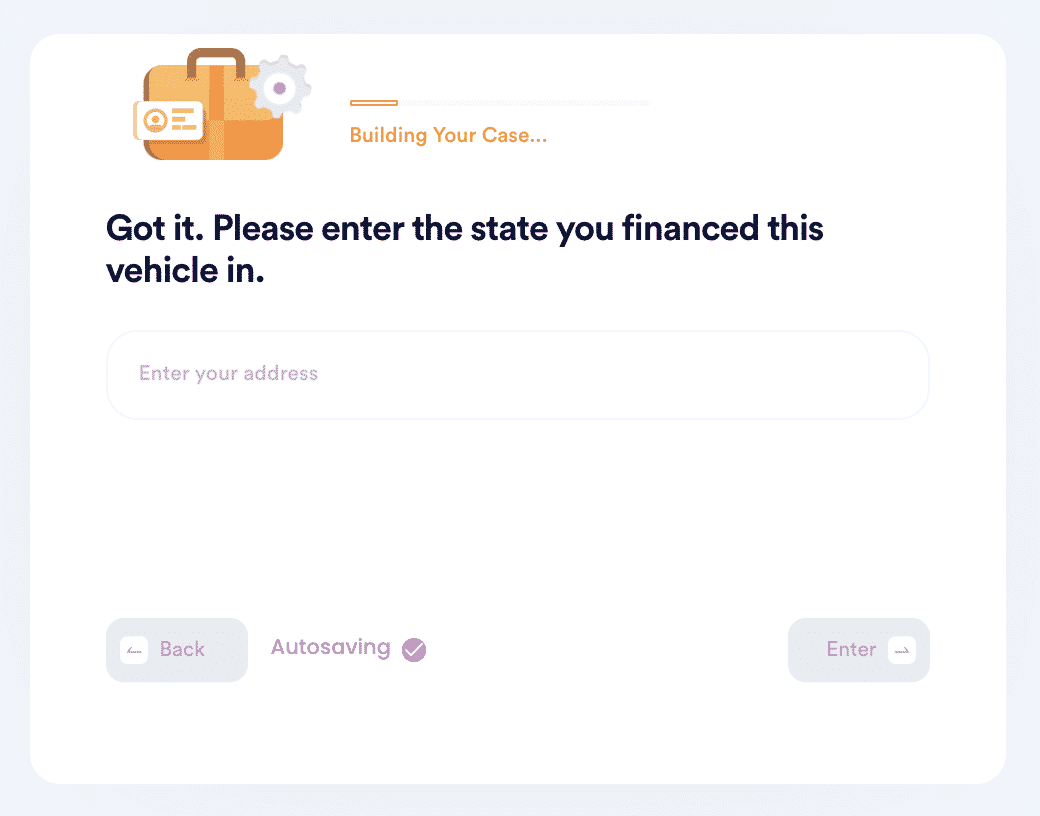

- Enter the state you financed this vehicle in, and let us walk you through your state's repossession laws to see if your car was or is being wrongfully repossessed.

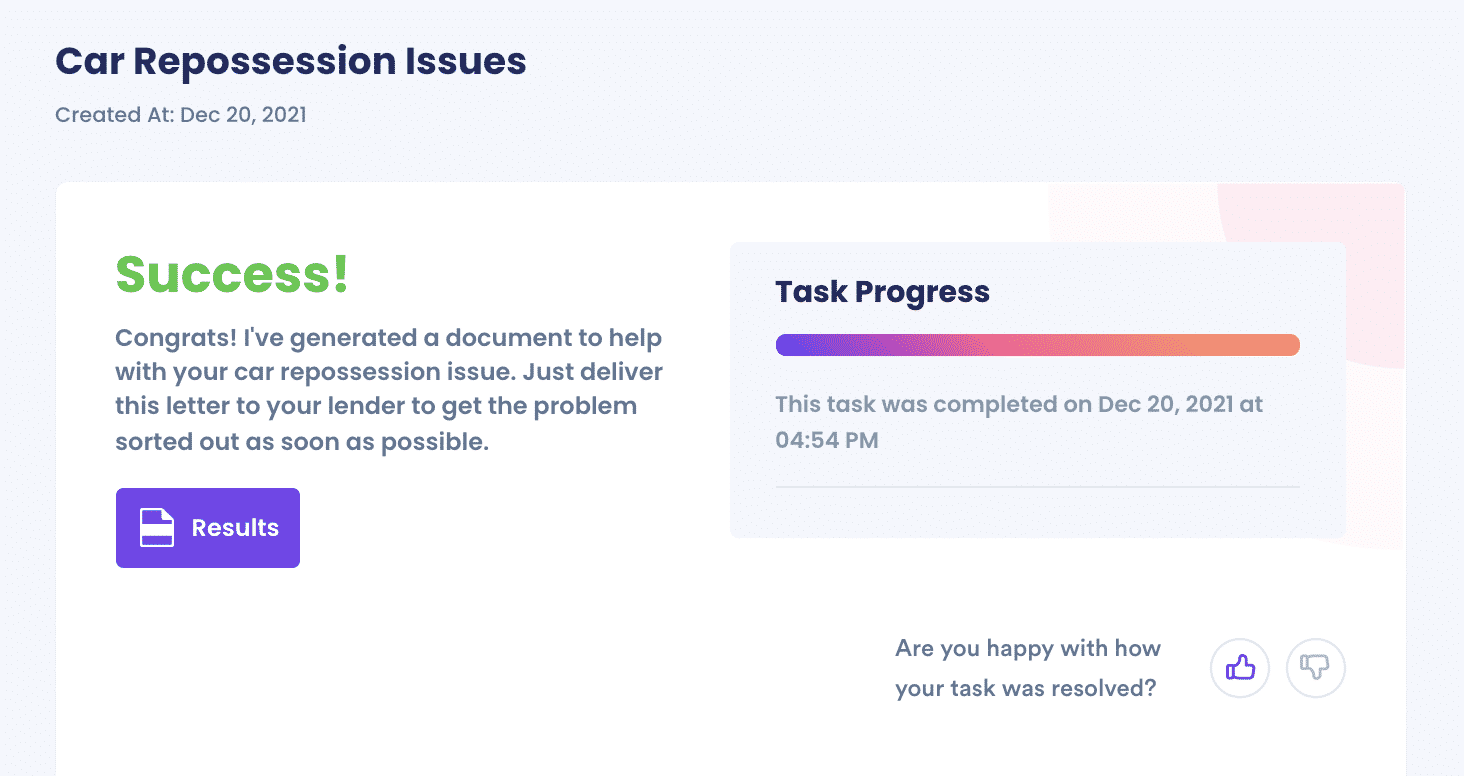

- If we can make a case for wrongful repossession, DoNotPay will file a demand letter on your behalf to the lender to fight against.

And that's it! DoNotPay will make sure your issue gets sent to the right place. We'll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

Why Use DoNotPay?

DoNotPay is an automated and easy way to stop car repossession. Its:

- Fast: It's the fastest way to get results with lending institutions that have a lot of bureaucratic red tape, like banks and lienholders

- Easy: With a click of the mouse and while in your home or office's comfort, it's easy to use DoNotPay. You don’t need to visit the bank in person, or the tow yard.

- Successful: You can count on DoNotPay to work hard to achieve positive results.

What Else Does DoNotPay Do?

DoNotPay solves more than car repossessions. It also manages the following:

- Insurance Claims

- Robocall Compensation

- Late delivery Refunds

- Chargebacks and Refunds

- Free Raffle Tickets

- Contact Embassies and Consulates

- Appeal Parking Tickets in Any City

- Create a Power of Attorney

- Compensations for Victims of Crime

- Schedule Appointments With The DMV

Try it today. See how easy paperwork can be with DoNotPay.