How to Report Spousal Identity Theft

Some spouses choose to keep their finances separate, but others are totally transparent about their financial situations. If you're among the latter, your spouse already knows so much about your financial data, which could risk if anything changes along the way. Although marriage joins you and your spouse together to become one, this does not apply to credit card history.

This is because if, for instance, your spouse opens a credit card in your name, it will directly affect your financial history without any consequences on their part. Notwithstanding, you need to handle the situation with an outcome in mind if such happens. If you seek to repair your relationship, you may not want to take any action against your spouse.

If the spouse continues with fraudulent acts, you should consider ending the relationship and reporting their act, since this will negatively impact your financial reputation. You'll either hold them responsible for clearing any debts they have acquired in your name or be required to clear the debts yourself, and this is where DoNotPay comes in handy. Alongside spousal identity theft, we'll also help you to report IRS, Experian, Social Security, Equifax identity thefts, among others.

What Is Spousal Identity Theft?

This occurs when your to open and use multiple credit accounts, misuse your Social Security number, sign documents, create other fraudulent accounts, and more – all without your consent.

What to Do if Your Partner Steals Your Identity

There are many steps you need to follow if your partner steals your identity:

- Place a fraud alert with a credit reporting company to be notified of any new requests for credit.

- Notify the creditors or any affected party

- Pay off any debt they might have taken as soon as possible. Else it will gain interest and continue growing.

- If not in a position to pay off the debt, you will need to press charges against your spouse so that the credit card companies can go after him or her to pay off the debt.

- Report the identity theft to FTC.

- Report the fraud to law enforcement to acquire a police report

- Report to the IRS since your spouse may use your Social Security number to file fraudulent tax returns.

- If you choose to stay in the marriage, be diligent about your money. You may consider separating your income from your spouse's for some time.

How to Prevent Spousal Identity Theft

If you have experienced spousal identity theft before, you should become more vigilant with your finances. Here are a few directives to help you prevent another identity theft occurrence:

| Find an in-state identity protection service | This will help you protect your identity in the future and help you monitor your credit. It will also temporarily alert you of any suspicious activities. |

| Run a credit report | This will help you know if there are any other accounts opened under your name without your knowledge. Once you get this information, ensure you freeze all those accounts that have been opened without your permission. |

| Remove your spouse as a user of your accounts | If they continue taking more loans, you will be responsible for clearing all the debts and risk destroying your financial reputation. |

| Consider closing and paying off joint accounts | You will, however, need court approval so that the debt existing at that time can be divided among the two of you if the accounts are still to remain. Put in writing how the payments will be handled and give a provision for worst-case scenarios. |

How to Report Spousal Identity Theft by Yourself

To report spousal identity, do these two things:

- Report to the Federal Trade Commission by visiting IdentityTheft.gov or calling 1-877-438-4338.

- File a police report with your local police office.

How to File a Police Report for Spousal Identity Theft

If your partner does not make amends, you may decide to report them to the police, as this will prove that you didn't commit the crimes your spouse committed using your name. Additionally, a debt collector, creditor, or other affected parties may insist that you produce a police report.

To file a police report, go to your local police station with

- A copy of your FTC Identity Theft Report

- A government-issued photo ID

- Proof of your address

- Any proof you have of theft

Then, notify the police that your spouse has stolen your identity, and you would wish to file a report. Ask them to attach your FTC complaint to the report. You should also request for a copy of the police report. You need this to give it to creditors as well as credit bureaus even as you take other steps to recover from spousal identity theft.

How to Deal with Spousal Identity Theft Using DoNotPay

DoNotPay provides a fast, easy, and successful solution for many identity theft issues, including spousal identity theft.

How to deal with identity theft using DoNotPay:

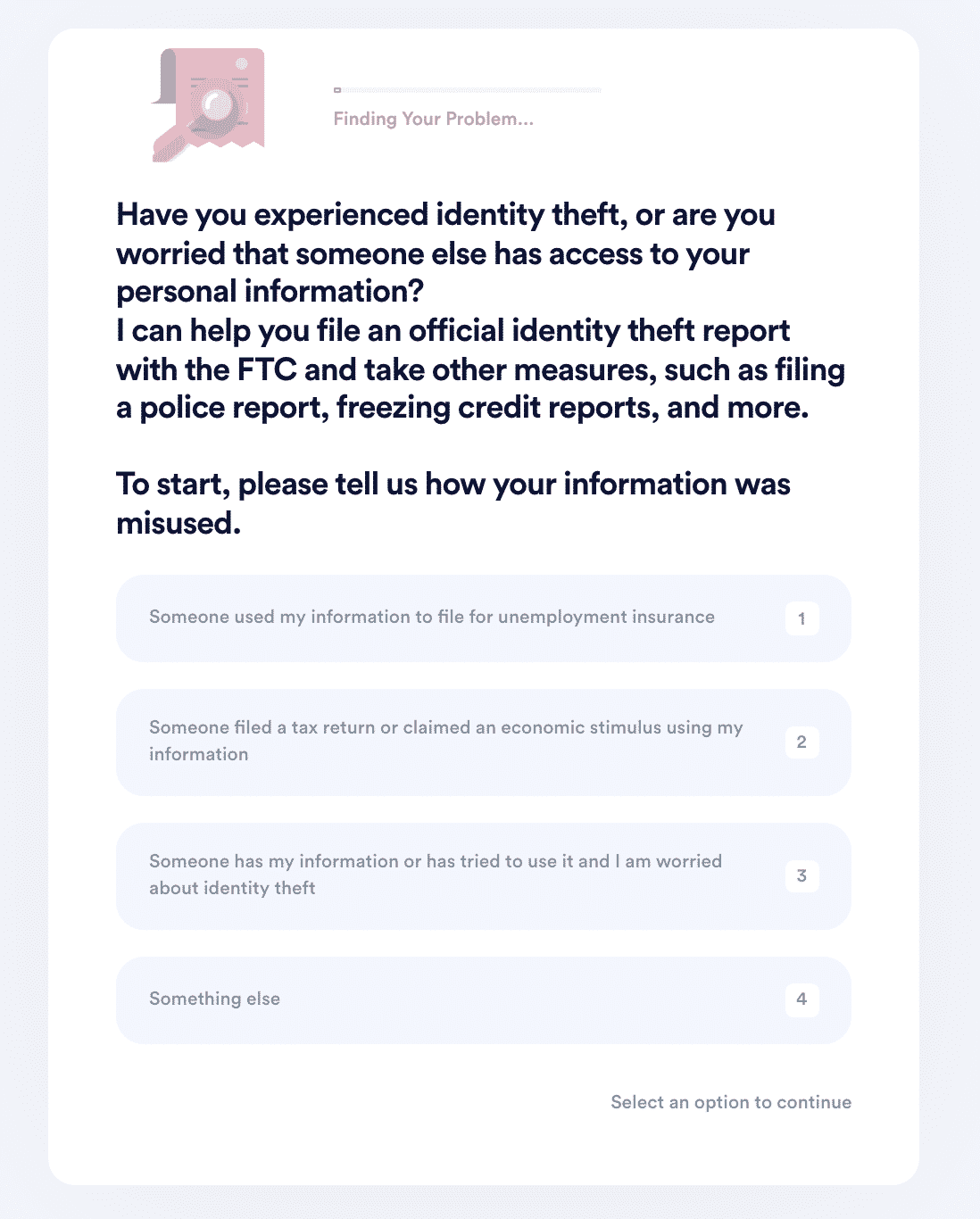

- Search "identity theft" on DoNotPay and select the type of incident you would like to report.

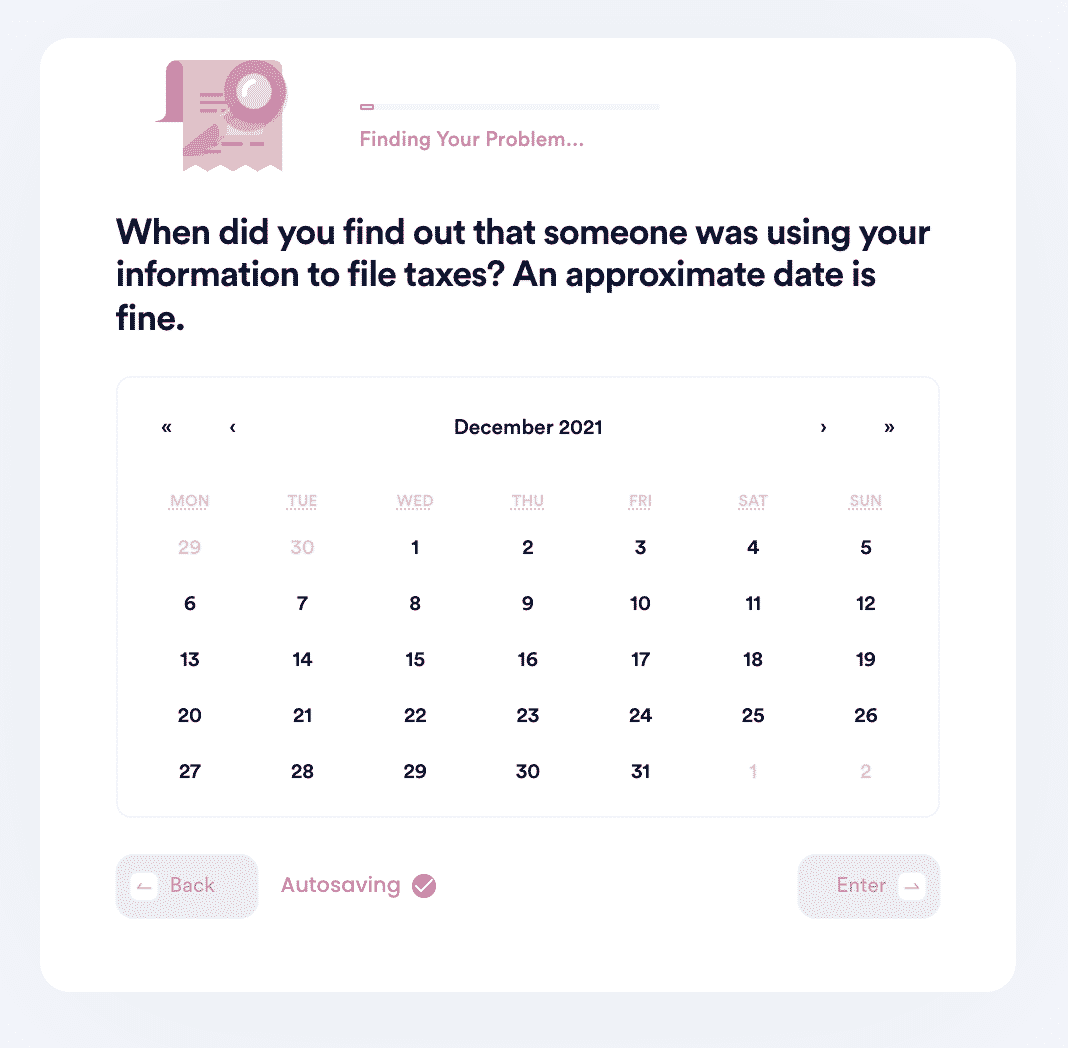

- Tell us more about the incident that occurred, including the location, date, time, financial loss, and any suspect information you may have.

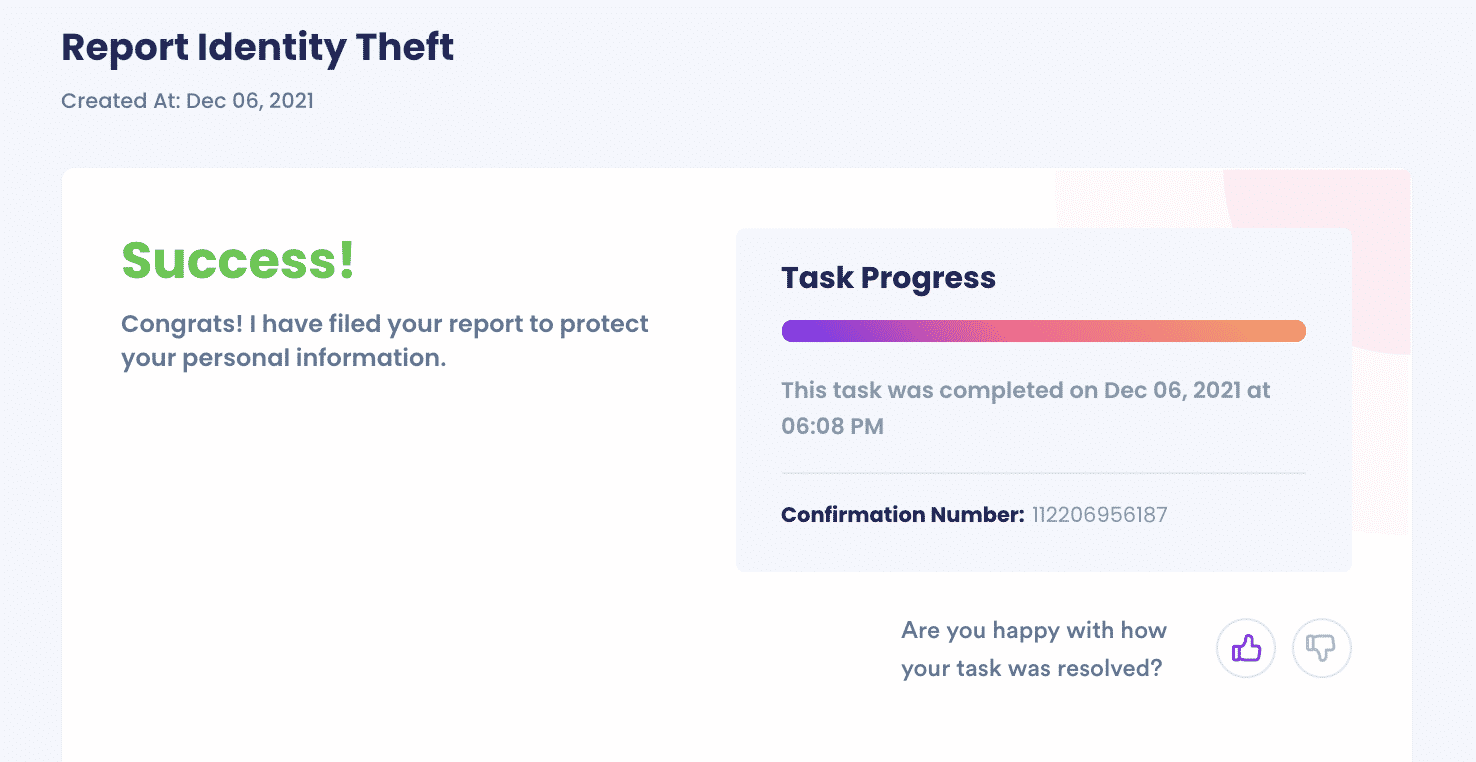

- We'll identify whether you should file an FTC report, contact the IRS, freeze your credit report, contact state agencies, or file a police report. Once we guide you through the best options, we'll automatically submit the reports on your behalf!

And that's it! DoNotPay will make sure your issue gets sent to the right place. We'll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

DoNotPay Works for Many Identity Theft Issues

At DoNotPay, we'll also help you:

- Discover if someone filed for unemployment in your name

- Report credit card fraud

- Know how much you can send demand letters to for identity theft

- Report stolen stimulus check

Solve More Problems With DoNotPay

DoNotPay can help with more than just identity theft. Here are a few other things we can help with:

| Schedule an appointment with the DMV | Solve small claims issues |

| Cancel any service or subscription | Get victims compensation |

Sign up for help solving your complicated problems!

By

By